Home Loan Interest Deduction Section Limit Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh You deduct 25 25 000 100 000 of the points 2 000 in 2023 Your deduction is 500 2 000 25 0 25 You also deduct the ratable part of the re maining 1 500 2 000 500 that must be spread over the life of the loan This is 50 1 500 180 months 6 payments in 2023

Home Loan Interest Deduction Section Limit

Home Loan Interest Deduction Section Limit

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Student Loan Interest Deduction Are You Eligible MoneyTips

https://moneytips.com/wp-content/uploads/Loans_TheStudentLoanInterestDeduction-800x535.jpg

Pin On Property Finance

https://i.pinimg.com/originals/5b/9c/f2/5b9cf2873744df5288180e2fd7e7be02.jpg

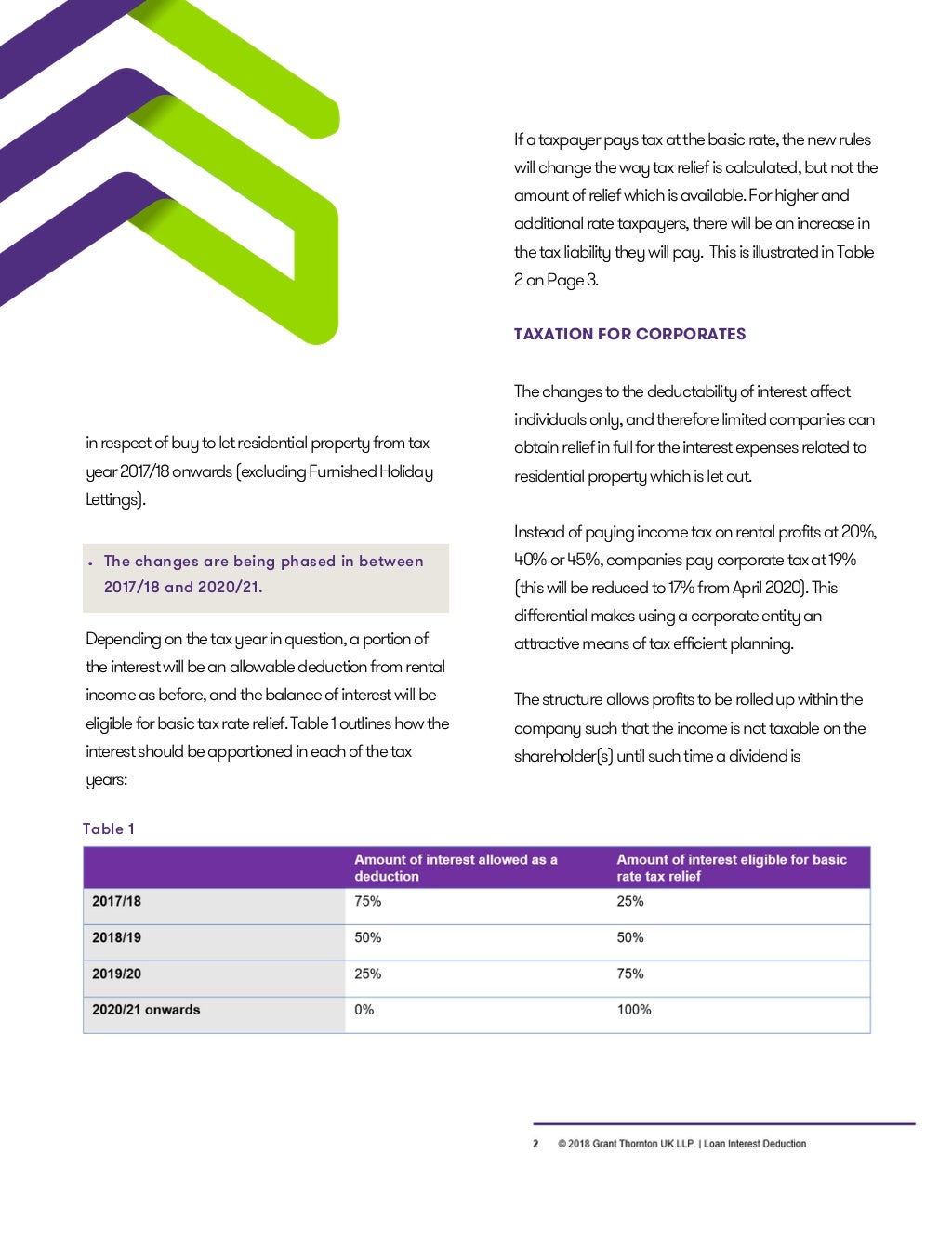

Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto 1 50 000 in section 80EEA provided specified conditions are fulfilled Under Section 80EE taxpayers can claim a deduction of up to Rs 50 000 on the interest paid on home loans This is in addition to the deduction available under Section 24 b which allows a maximum deduction of Rs 2 lakh per financial year

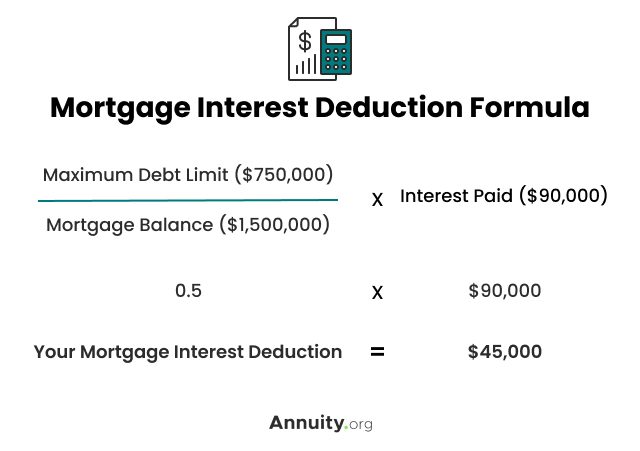

Mortgage interest deduction limit 2024 As stated earlier your mortgage interest deduction limit depends on when you purchased your home and your filing status If an individual happens to take out a home loan jointly each of the borrowers is eligible to claim a deduction for home loan interest up to the limit of Rs 2 00 000 under Section 24 b and also a deduction for principal repayment up to Rs 1 50 000 under Section 80C of the Income Tax Act

Download Home Loan Interest Deduction Section Limit

More picture related to Home Loan Interest Deduction Section Limit

Home Loan Lowest Interest Rate

https://marathikayda.com/wp-content/uploads/2022/12/home-loan-low-interest-rate-compressed.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180144/Section-80EE-Income-tax-deduction-for-interest-component-on-home-loan-FB-1200x700-compressed.jpg

Best Home Loan Rates

https://images.livemint.com/img/2021/12/26/original/loan_1640547127620.png

This provision allows first time homebuyers to avail an extra deduction on the interest paid for home loans taken between April 1 2016 and March 31 2017 amounting to a maximum of INR 50 000 provided they meet specific conditions Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under either under Section 80EE or 80EEA For your second home no deduction is available on the principal payment

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home If you are married filing separately the Under the objective Housing for all the government extended the interest deduction allowed for low cost housing loans taken during the period between 1 April 2019 and 31 March 2022 Accordingly a new Section 80EEA has been inserted to allow for an interest deduction from AY 2020 21 FY 2019 20

Student Loan Interest Deduction What You Need To Know

https://leveredge-application-public.s3.amazonaws.com/public/5G3A0er9wacZqRdQKQ8g3VlnR4RjHQhkTHJbSWvM.jpg

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

https://cleartax.in/s/deductions-under-section24...

Your deduction on interest is limited to Rs 30 000 if you fail to meet any of the conditions given below The home loan must be for the purchase and construction of a property The loan must be taken on or after 1 April 1999

https://cleartax.in/s/home-loan-tax-benefit

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Student Loan Interest Deduction A Tax Move You Must Make

Student Loan Interest Deduction What You Need To Know

Section 24 Home Loan Interest Deduction FinCalC Blog

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Home Loan Interest Rates Comparison Between SBI HDFC Bank Of Baroda

Compare Home Loan Interest Rates On ApnaPaisa Check Rates Of The Top

Compare Home Loan Interest Rates On ApnaPaisa Check Rates Of The Top

Home Loan Interest Deduction Procedure To Claim HomeCapital

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Loan Interest Deduction

Home Loan Interest Deduction Section Limit - If an individual happens to take out a home loan jointly each of the borrowers is eligible to claim a deduction for home loan interest up to the limit of Rs 2 00 000 under Section 24 b and also a deduction for principal repayment up to Rs 1 50 000 under Section 80C of the Income Tax Act