Housing Loan Tax Benefit Calculator India Web 18 Dez 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Web Home Loan Tax Benefit Nav Standard Deduction Interest Amount 4 90 000 1 47 000 15 000 3 28 000 So Nishant s Income From House Property is Rs 3 28 000 Housing Finance Income Tax Benefit Calculator helps you to calculate tax benefit eligible on your loan amp details on tax payable before amp after loan Web 4 Apr 2017 nbsp 0183 32 6 min read CONTENTS Show Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

Housing Loan Tax Benefit Calculator India

Housing Loan Tax Benefit Calculator India

https://i.ytimg.com/vi/Up8NvhUyMaw/maxresdefault.jpg

Maximizing Home Loan Tax Benefits In India 2023

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Home-Loan-Tax-Benefits-.jpg

Housing Loan Tax Benefit 21 22 Tax Saving Through Home Loan Tax

https://i.ytimg.com/vi/M9onZX59zZI/maxresdefault.jpg

Web This simple home loan tax benefit calculator will help you determine the tax saving opportunity that you can be eligible for on your home loan Select Financial Year Web Our Tax Savings calculator helps you understand the benefit on income tax before and after taking a home loan The type and amount of income tax deduction available against repayment of Home Loan is governed by applicable Income Tax Laws of Government of India Apply Now

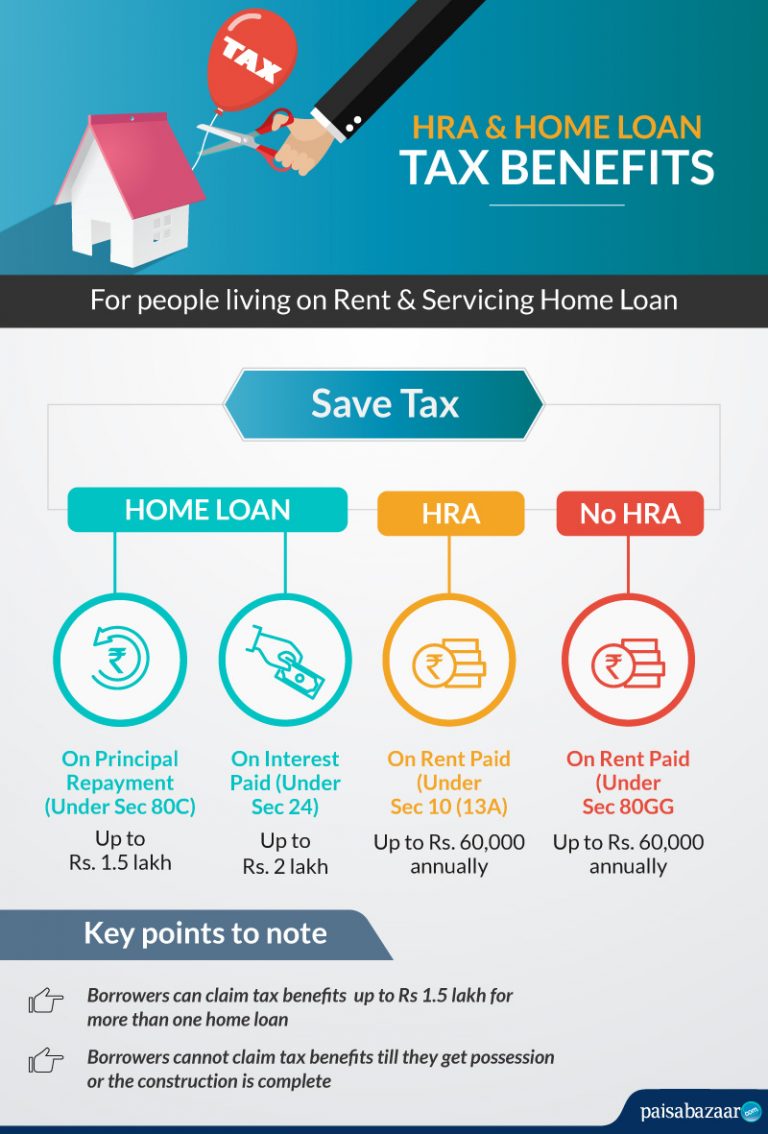

Web In the case of a home loan jointly every borrower can enjoy tax benefits on a joint home loan from his her taxable income individually Each applicant and co applicant can separately claim a maximum tax deduction of 1 50 lakh per annum for principal repayment under Sec 80C and 2 lakh per annum for interest payment under Sec 24 Web 31 Jan 2023 nbsp 0183 32 Let s begin 1 Section 24 of the Income Tax Act 1961 As we discussed earlier under this section you can claim deductions of up to Rs 2 Lakh based on the home loan interest payments But to avail of these the property concerned must complete its construction within five years 2 Section 80C of the Income Tax Act 1961

Download Housing Loan Tax Benefit Calculator India

More picture related to Housing Loan Tax Benefit Calculator India

Tax Benefits On Housing Loan Thdailymagazine

https://thdailymagazine.com/wp-content/uploads/2021/11/Tax-Benefits-on-Housing-Loan.jpg

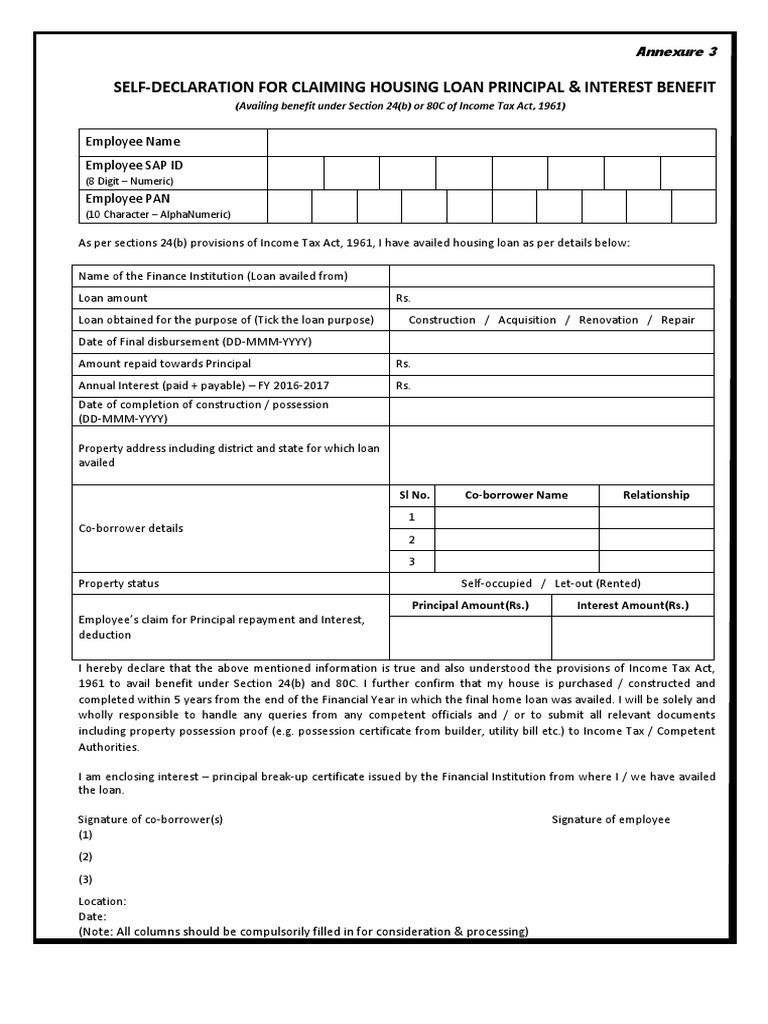

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

Web Check Eligibility By continuing I agree to Magicbricks T amp C Quick Look at Tax Benefits on Home Loan for FY 2022 23 The table below gives you a quick overview of how much you can save on tax with your home loan Home Loan Tax Benefit Under Section 80C Web 17 Sept 2021 nbsp 0183 32 How to calculate Income Tax Benefit Calculator for Home Loan Step1 Choose the financial year for which you want to calculate the Home loan Step2 Select your appropriate category which includes Male Female Senior Citizen Super Senior Citizen Step3 Next select the annual income Step4 Select the interest paid on your

Web 20 Okt 2023 nbsp 0183 32 The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Web Calculate how much you can save on taxes on availing a home loan Loan Amount Interest Rate per annum Loan Tenure years Annual Income in lakh Calculate tax savings Reset

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 18 Dez 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

http://incometax-calculator.com/Home-Loan-Tax-Benefit-Calculator

Web Home Loan Tax Benefit Nav Standard Deduction Interest Amount 4 90 000 1 47 000 15 000 3 28 000 So Nishant s Income From House Property is Rs 3 28 000 Housing Finance Income Tax Benefit Calculator helps you to calculate tax benefit eligible on your loan amp details on tax payable before amp after loan

Declaration For Housing Loan PDF Loans Government

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

Can I Claim Both Home Loan And HRA Tax Benefits

Tax Benefits On Home Loan Know More At Taxhelpdesk

Home Loan Tax Benefits As Per Union Budget 2020 IndiakaLoans

Home Loan Tax Benefits As Per Union Budget 2020 IndiakaLoans

Home Loan Tax Benefit 2021 22 YouTube

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Home Loan Tax Benefits MeidilighT

Housing Loan Tax Benefit Calculator India - Web This simple home loan tax benefit calculator will help you determine the tax saving opportunity that you can be eligible for on your home loan Select Financial Year