How Much Tax Benefit On Home Loan Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans under sections 24 80EE 80C

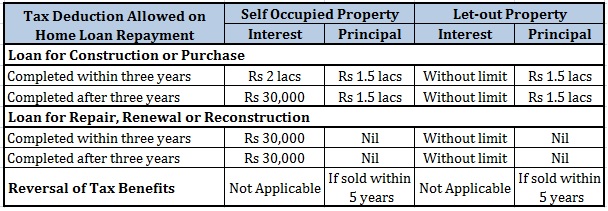

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or identical to the federal ones Here we ll discuss

How Much Tax Benefit On Home Loan

How Much Tax Benefit On Home Loan

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Home Loan Tax Benefit Home Loan Income Tax Benefit Income Tax

https://i.ytimg.com/vi/0ExGuGq5C0Q/maxresdefault.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

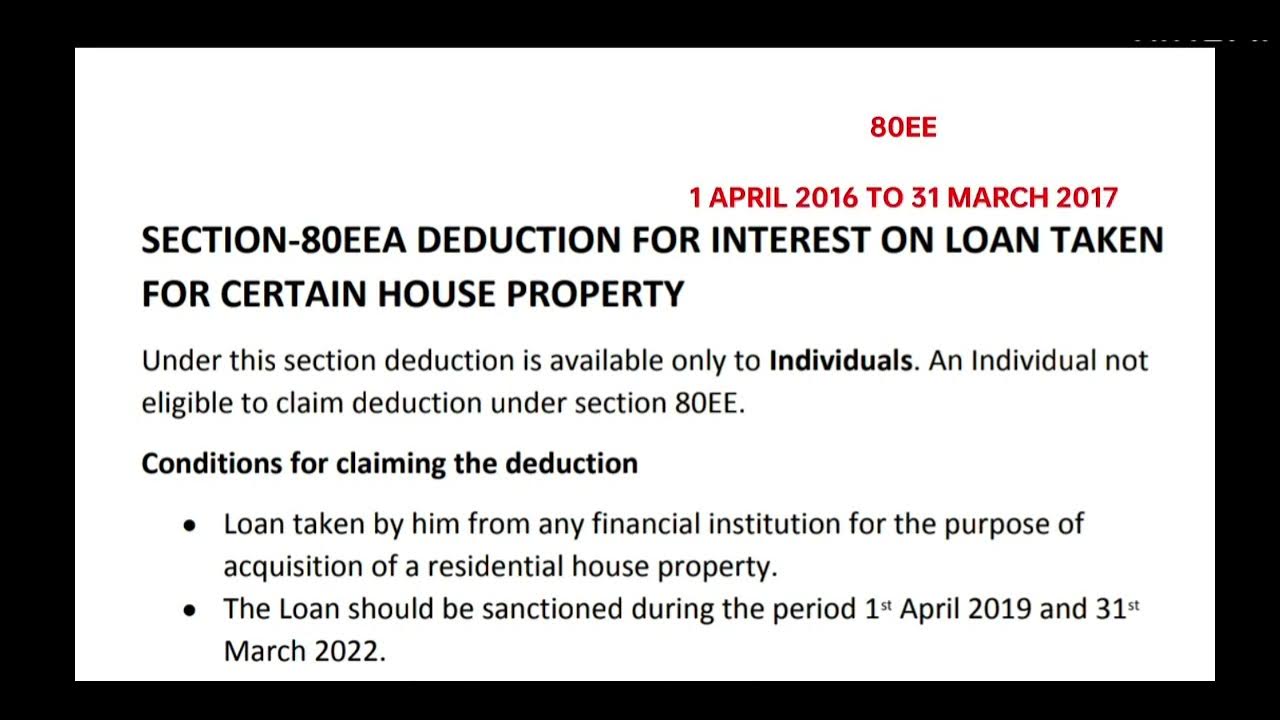

If you own your own home you might be able to save on your tax returns Get the most value from your home with these seven tax deductions Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March 2022 This is applicable for loans that

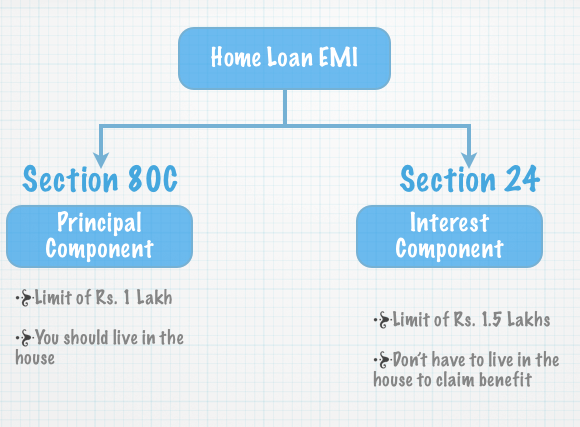

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest Check out the conditions to be fulfilled to claim the tax benefits on the jointly owned property Also find out the tax benefits on a joint home loan

Download How Much Tax Benefit On Home Loan

More picture related to How Much Tax Benefit On Home Loan

How To Claim Tax Benefits On Home Loan Bleu Finance

https://bleu-finance.com/wp-content/uploads/2021/05/Home-Loan0428.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

https://i.ytimg.com/vi/IEJqgz2FYNs/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYACggWKAgwIABABGGUgZShlMA8=&rs=AOn4CLAks-RAzi6owAVNxH58N3-sKJAQIw

Deductions include municipal tax standard deduction interest on home loan Individuals owning residential properties can claim deductions Pre construction interest and Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home Just plug in the amount of the loan What is the maximum tax benefit on a home loan You can deduct up to 2 lakh in taxes from your annual home loan interest payments under Section 24 b of the Income Tax

Home Loan Tax Benefits As Per Union Budget 2020

https://www.indiakaloan.com/blog/wp-content/uploads/2020/02/Home-Loan-Tax-Benefits_Blog-Creative.jpg

Homebuyers Can t Avail Tax Benefit On Home Loan From April 1 The Live

https://theliveahmedabad.com/wp-content/uploads/2022/03/Tips-and-tricks-to-save-on-your-home-purchase__280748251-1170x780.jpg

https://www.kotak.com/en/personal-bank…

Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans under sections 24 80EE 80C

https://housing.com/news/home-loans-…

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs

20151209 Tax Benefits On A Home Loan Personal Finance Plan

Home Loan Tax Benefits As Per Union Budget 2020

Tax Benefit On Home Loan And HRA Both

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

What Are The Tax Benefit On Home Loan FY 2020 2021

How To Claim Tax Benefit On Home Loan For Under Construction Property

How To Claim Tax Benefit On Home Loan For Under Construction Property

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

Tax Benefit How Much Tax Benefit Can You Claim On Donations

How Much Tax Benefit On Home Loan - Interest on up to 750 000 of first mortgage debt is tax deductible Not all interest paid toward a mortgage is tax deductable Typically as long as the amount of the mortgage