Housing Loan Tax Exemption Under Section Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this

Section 80EE Interest on Home Loan for first time home buyers If you are a first time home buyer you will be allowed an Home Loans Tax Benefits Exemptions Under Section 80C 24 b 80EE 80EEA One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce

Housing Loan Tax Exemption Under Section

Housing Loan Tax Exemption Under Section

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

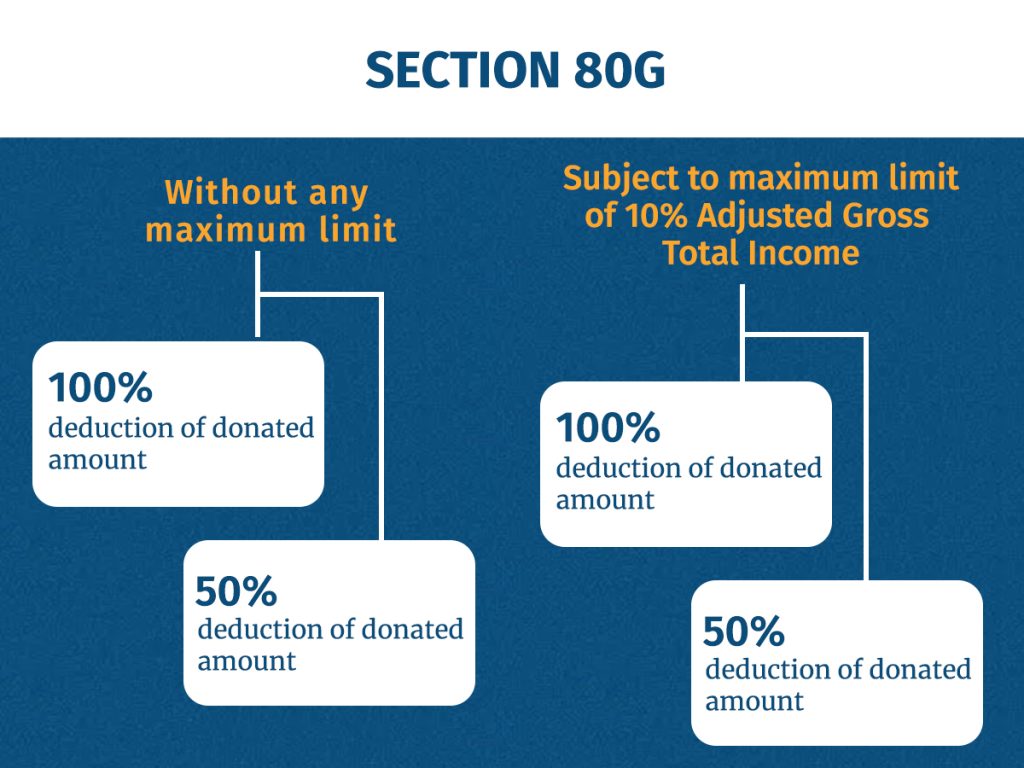

Tax Exemption Under Section 80g How To Claim Tax Exemption Under 80g

https://www.careindia.org/wp-content/uploads/2022/05/Secton80g-1024x768.jpg

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act Under section 80 c of the Income Tax Act tax deduction of a maximum amount of up to Rs 1 5 lakh can be availed per financial year on the principal repayment portion of the

If the required criteria are met the total amount of house loan related deductions Rs 2 lakh under Section 24 Rs 1 5 lakh under Sections 80C and The maximum housing loan tax exemption under Section 80C is Rs 1 5 lakhs in a financial year Note that there are several other investment options such as ELSS funds

Download Housing Loan Tax Exemption Under Section

More picture related to Housing Loan Tax Exemption Under Section

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Japan To Cut Housing Loan Tax Exemption Rate To 0 7 YouTube

https://i.ytimg.com/vi/QtukyP4xHCI/maxresdefault.jpg

Housing Loan Tax Exemption On Interest Paid On Housing Loan

http://drop.ndtv.com/albums/BUSINESS/budget-tax-changes/2013-08-19t215734z_1_cdee97i1p0700_rtroptp_3_markets-india-rupee.jpg

The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on principal repayment under Section 80C 1 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax

Home loan entitles Individuals to Deduction Under Section 80C of up to Rs 1 50 Lakh and Interest Deduction under section 24 of up to Rs 2 Lakh Articles deals Tax Benefits under Section 80EE Allows you to avail tax benefits of up to Rs 1 5 lakh on the interest component paid on a home loan The benefit can be availed over and above

5 Things You Must Know About Education Loan Tax Benefits In 2022 Tata

https://www.tatacapital.com/blog/wp-content/uploads/2022/04/4-education-loan-tax-benefits.jpg

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

https://imgk.timesnownews.com/media/1_2_7.jpg

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this

https://blog.bankbazaar.com/home-loan-tax-…

Section 80EE Interest on Home Loan for first time home buyers If you are a first time home buyer you will be allowed an

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

5 Things You Must Know About Education Loan Tax Benefits In 2022 Tata

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How Housing Loan Tax Benefit

Housing Loan Tax Exemption Under Section - Section 80EEA Deduction for interest paid on home loan for affordable housing Updated on Dec 11th 2023 9 min read CONTENTS Show Under the