How Do Health Insurance Tax Credits Work The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health

A tax credit for health insurance reduces your monthly health insurance costs To be eligible you need to buy your plan through What is a Premium Tax Credit for Health Insurance When you enroll in a Marketplace Health Insurance plan you may have the opportunity to save on your monthly premium with a Health Insurance Tax Credit also known as the

How Do Health Insurance Tax Credits Work

How Do Health Insurance Tax Credits Work

https://static01.nyt.com/images/2017/07/07/science/07HEALTHTAX1/07HEALTHTAX1-superJumbo.jpg?quality=75&auto=webp

Solo Business Owners How To Qualify For Health Insurance Tax Credits

http://manukafinancial.com/wp-content/uploads/2021/06/Health-Insurance-Tax-Credits-scaled.jpg

Full time Jobs Usually Offer Health Insurance List Foundation

https://lsitlcnd.listfoundation.org/1666070020128.png

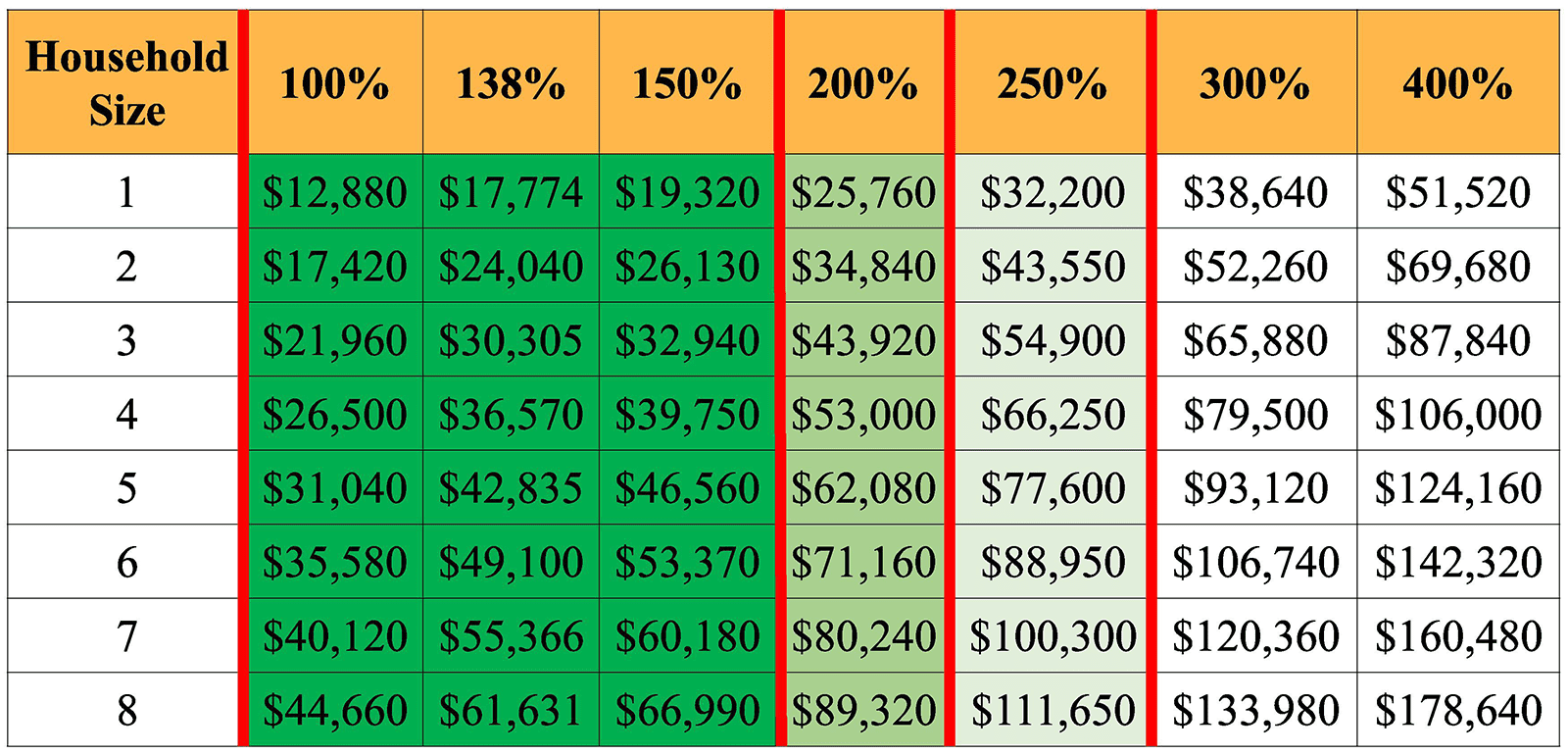

Understanding the ACA s Premium Tax Credit Health Insurance Subsidy How Much Will My Subsidy Be Cheaper Plan or Benchmark Do I What Is the Premium Tax Credit How It Works Calculator The premium tax credit is a refundable credit that helps some taxpayers afford health insurance premiums The advance PTC lowers

When it comes to health insurance tax credits can be applied towards monthly premiums and other out of pocket expenses This means that you could potentially pay less Health insurance tax credits officially known as Premium Tax Credits PTCs are subsidies the federal government provides to help lower the cost of health insurance

Download How Do Health Insurance Tax Credits Work

More picture related to How Do Health Insurance Tax Credits Work

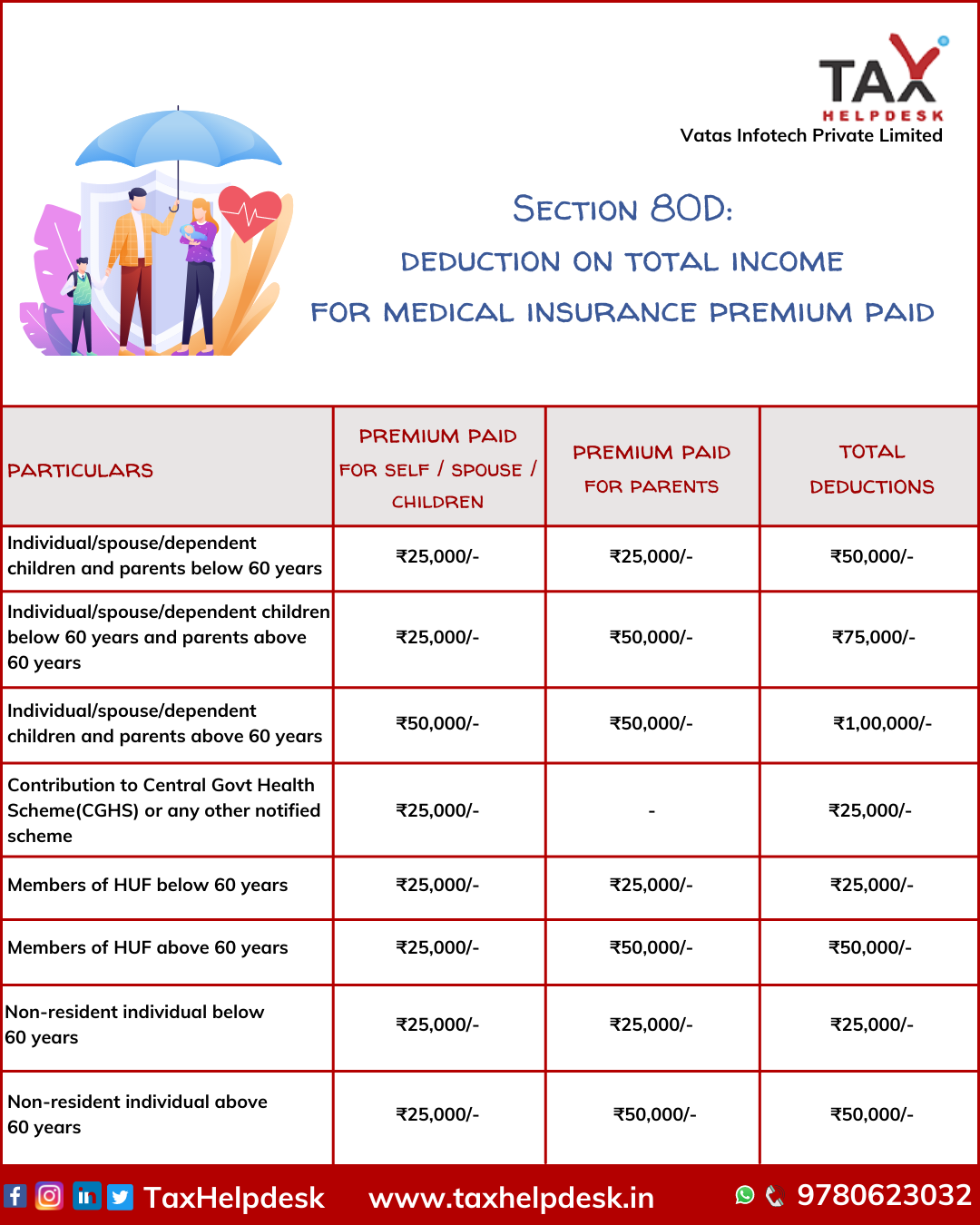

Health Insurance Tax Credits Deductions More

https://www.coveredca.com/marketing-blog/uploads/HealthInsuranceAndYourTaxes_RF_1144x630.jpg

Tax Credits To Help Cover The Costs Of Higher Education Lahrmer Company

https://lahrmercpa.files.wordpress.com/2022/04/tax-credits-to-help-cover-the-cost-of-higher-education.jpg

ACA Tax Credits To Help Pay Premiums White Insurance Agency

https://www.whiteinsuranceokc.com/wp-content/uploads/sites/4713/2021/11/2022-FPL-CHART_0001.png

Learn how health insurance tax credits work who qualifies and how they impact your tax filing and overall healthcare costs Health insurance can be expensive but tax credits Premium tax credits reduce your premium for most Marketplace policies The amount of the tax credit you may receive depends on your income and the cost of Marketplace health plans in

Understanding how subsidies and tax credits work is essential for making health insurance more affordable By knowing the eligibility requirements application process and How premium tax credits help reduce monthly health insurance costs How federal guidelines have changed and expanded tax credit eligibility criteria How to coordinate

Tax Credits And Health Insurance Affordable Healthcare Options For

https://enrichest.com/hubfs/Blog/0323031c-6edb-40d3-b4ba-e86f5c42a168.jpg

Guide To Premium Tax Credits For Health Insurance Guide To Premium

https://ecamping.com/4a209735/https/d4feb2/www.peoplekeep.com/hubfs/All Images/Featured Images/Everything you need to know about premium tax credits_fb.jpg#keepProtocol

https://www.irs.gov › affordable-care-act › individuals...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health

https://www.valuepenguin.com › health-in…

A tax credit for health insurance reduces your monthly health insurance costs To be eligible you need to buy your plan through

How Tax Credits Work YouTube

Tax Credits And Health Insurance Affordable Healthcare Options For

Why Are Health Insurance Tax Benefits Essential Todays Past

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

What Is Insurance And How It Works Jederr

Are You Eligible For A Health Insurance Subsidy And Tax Credit

Are You Eligible For A Health Insurance Subsidy And Tax Credit

Health Insurance Tax Credits How To Qualify And Maximize Savings The

Premium Tax Credit WhatTaxpayers Need To Know Tax Relief Center

Tips For Understanding Health Insurance Basics Health Wellness

How Do Health Insurance Tax Credits Work - Understanding the ACA s Premium Tax Credit Health Insurance Subsidy How Much Will My Subsidy Be Cheaper Plan or Benchmark Do I