How Do I File A Tax Return In Canada File your income taxes find filing and payment due dates what needs to be reported and can be claimed as deductions and how to check the status of your tax refund

NETFILE is an electronic tax filing service that lets you do your personal taxes online and send your income tax and benefit return directly to the Canada Revenue Agency CRA Filing Canadian taxes abroad There are several ways that you can file a Canadian tax return These are Electronically through software Using the paper forms that you need to send to your local tax office By phone using File My Return only available to those on low or fixed incomes

How Do I File A Tax Return In Canada

How Do I File A Tax Return In Canada

https://www.tpigroupinc.com/wp-content/uploads/2023/02/lettered-dice-spelling-“tax-season”-with-pencils-and-a-calculator-on-a-black-background-scaled.jpeg

File Tax Returns On Time Even If Unable To Pay What Is Owed Westside

https://westsidenewsny.com/wp-content/uploads/2022/04/6a00d8345157c669e201bb0a0357a6970d.jpg

How Long Does It Take To Get A Tax Return In Canada WealthRocket

https://www.wealthrocket.com/app/uploads/2022/10/AdobeStock_168496440.jpg

This guide will take you through the basics of how to file your first income tax return in Canada Are you a resident of Canada If you re a resident of Canada for income tax purposes you ll need to file tax returns for any tax Who should file a tax return in Canada What documentation do you need to file a tax return What steps should you take before filing your tax return What are the different tax forms

In future here s how to electronically file your taxes after the first year You can use TurboTax s Full Service package and hand off your taxes to a TurboTax expert to electronically file your return A certified tax preparer can use EFILE to submit your tax return online on your behalf How do I file a tax return in Canada To file a tax return in Canada you need to go to a tax preparer such as an accountant or use tax preparation software such as Wealthsimple Tax Tax preparation software makes it easy to file your return as long as you follow all the steps and have all of your documents ready to go

Download How Do I File A Tax Return In Canada

More picture related to How Do I File A Tax Return In Canada

Who Is Required To File A Tax Return And Who Isn t

https://images.inkl.com/s3/article/lead_image/18271345/FDfa94BNHboiF9hhoJdekU.jpg

T2209 Tax Form Federal Foreign Tax Credits In Canada 2023 TurboTax

https://turbotax.intuit.ca/tips/images/Untitled-design-32-1-720x370.jpg

What Is A Corporate Tax Return with Picture

https://images.wisegeek.com/tax-return-form.jpg

Most Canadians must file their tax returns and pay any taxes owed by April 30 for income earned the previous calendar year Before you can file a tax return in Canada you must have either a Social Insurance To file your taxes online you ll have to make sure that you are filing using a NETFILE certified or in Quebec Netfile certified tax software platform NETFILE is an electronic tax filing service that lets you file taxes online and send your income tax and benefit return directly to the CRA

Upon arrival Firstly your most important step is to get your Social Insurance Number SIN from Service Canada or get an individual Tax Number from the Canada Revenue Agency CRA This is required to get a job and to collect any benefits or credits you re entitled to If you are new to Canada you might be eligible for certain benefits and credits such as the federal child benefit the GST HST credit and related federal provincial or territorial programs but

How To File An Amended Tax Return WTOP News

https://wtop.com/wp-content/uploads/2020/07/GettyImages-897291366.jpg

How To File Tax Extension Self Employed

https://img.money.com/2023/02/News-2023-How-To-File-Taxes-Free.jpg

https://www.canada.ca/en/services/taxes/income-tax...

File your income taxes find filing and payment due dates what needs to be reported and can be claimed as deductions and how to check the status of your tax refund

https://www.canada.ca/en/revenue-agency/services/e...

NETFILE is an electronic tax filing service that lets you do your personal taxes online and send your income tax and benefit return directly to the Canada Revenue Agency CRA

Top 6 Tax Tips For Filing A Canadian Tax Return

How To File An Amended Tax Return WTOP News

How To File LLC Taxes Legalzoom

Tax Return Free Of Charge Creative Commons Clipboard Image

What Is Line 10100 On Tax Return Formerly Line 101

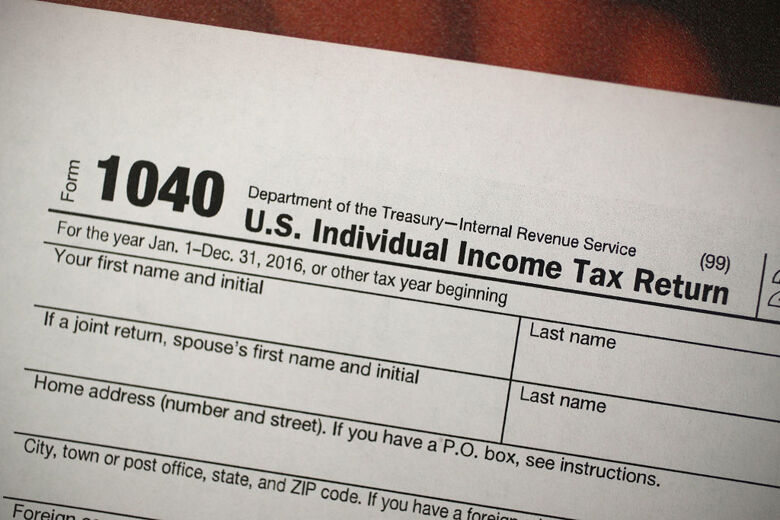

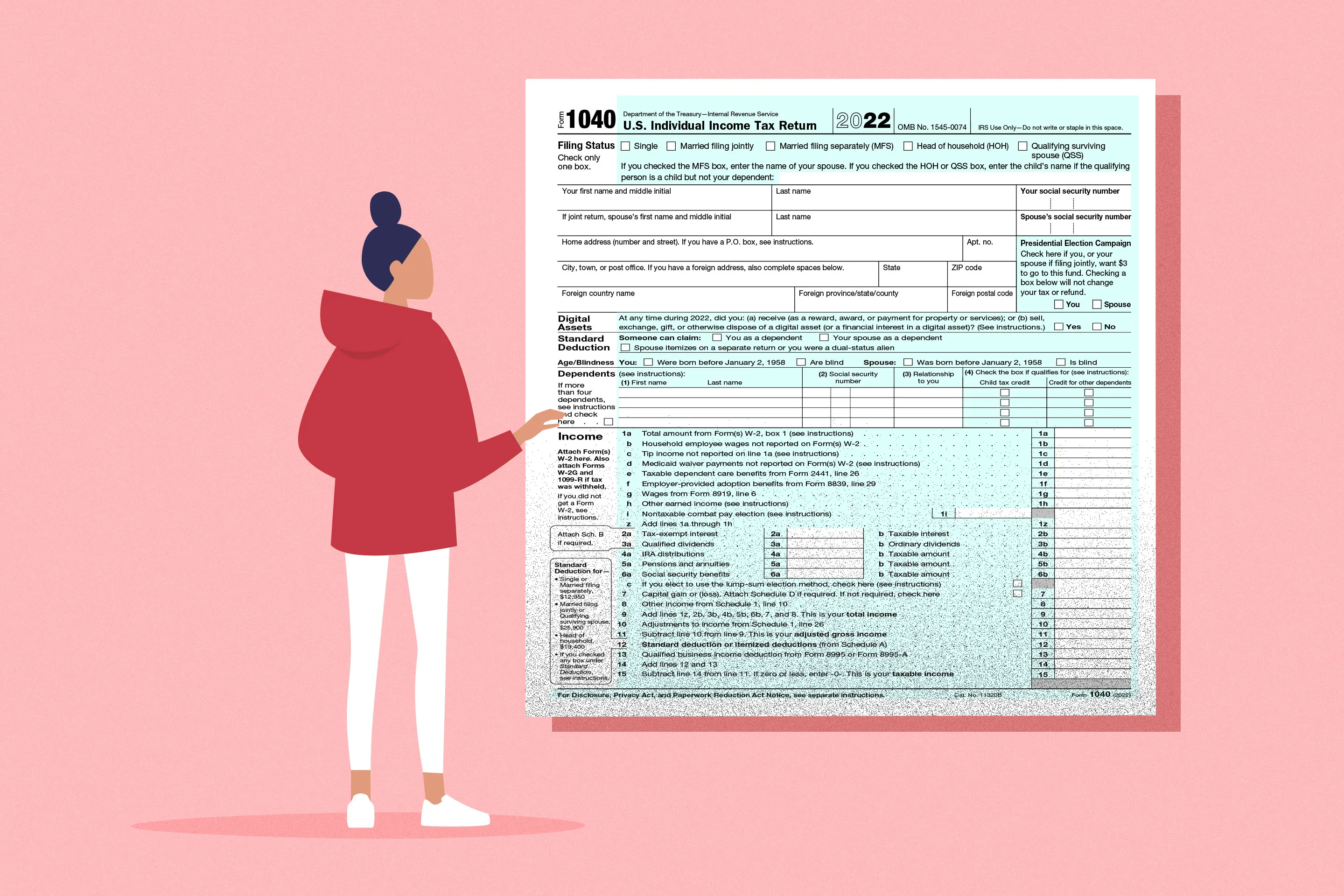

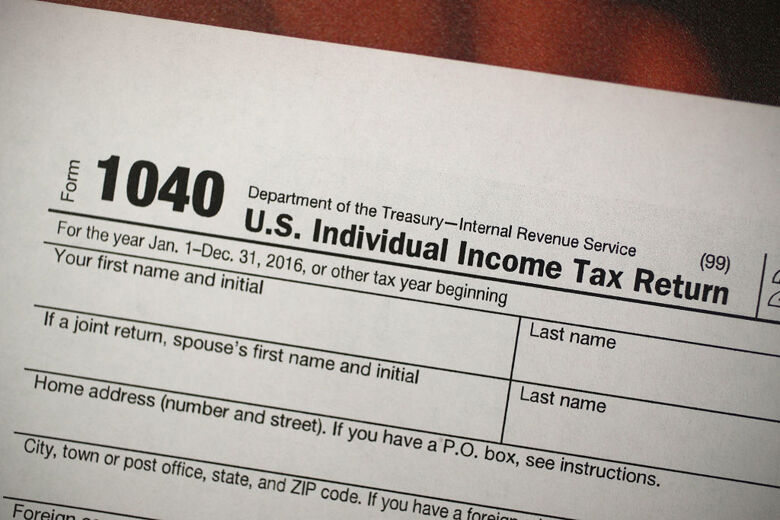

2023 Irs Tax Form 1040 Printable Forms Free Online

2023 Irs Tax Form 1040 Printable Forms Free Online

How To File Income Tax Return Online In Hindi YouTube

Filing Your Tax Return Intl Students In Canada

Federal Income Tax Filing Threshold 2023 Printable Forms Free Online

How Do I File A Tax Return In Canada - This guide will take you through the basics of how to file your first income tax return in Canada Are you a resident of Canada If you re a resident of Canada for income tax purposes you ll need to file tax returns for any tax