How Do I Get My Tax Return From 2021 Verkko 4 lokak 2023 nbsp 0183 32 Look at your payment history See your prior year adjusted gross income AGI View other tax records Visit or create your Online Account The method you used to file your tax return e file or paper and whether you had a balance due affects your current year transcript availability

Verkko For tax years 2022 2021 or 2020 To file a new prior year return you ll need to purchase and download that year s TurboTax software for PC or Mac as TurboTax Online and the mobile app are only available for the current tax year Note Returns for tax years 2019 and earlier are no longer eligible to be filed through TurboTax Verkko 11 jouluk 2023 nbsp 0183 32 Get a federal tax return transcript Transcripts are print outs of the most important highlights from a tax return In many cases you may only need a transcript and not a full copy of your tax return You can get transcripts of the last 10 tax years Transcripts are free

How Do I Get My Tax Return From 2021

How Do I Get My Tax Return From 2021

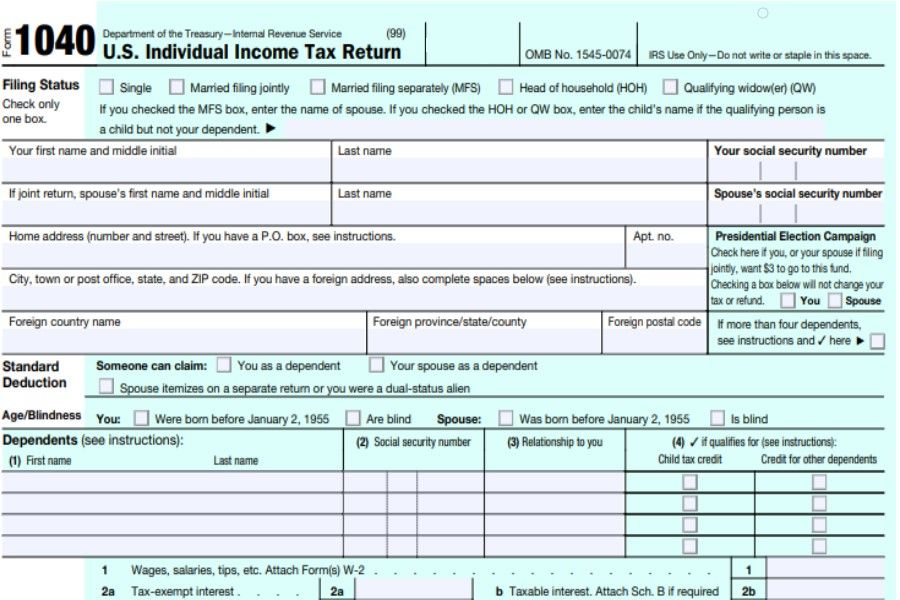

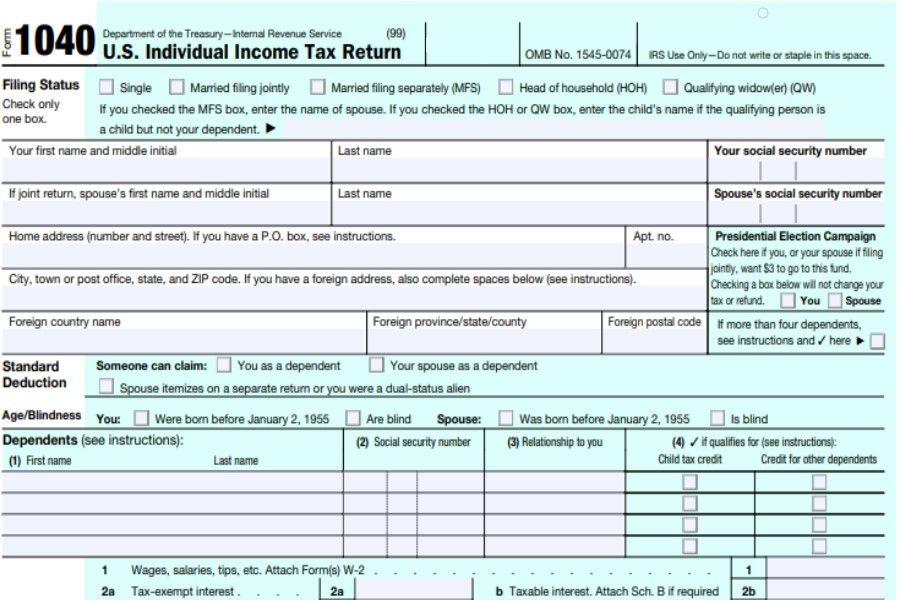

https://w4formsprintable.com/wp-content/uploads/2021/07/1040-form-2021-federal-income-tax-return.jpg

Top Five Reminders When Filing Income Tax Returns In 2022 Accounting

https://acgroupct.com/wp-content/uploads/2022/01/Income-Tax-Return.png

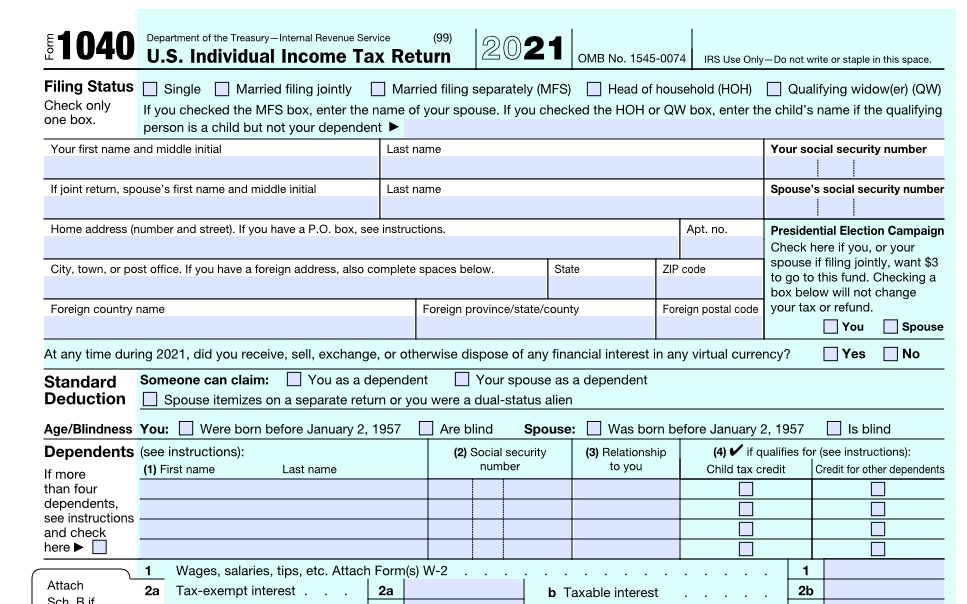

Taxpayers Should Take These Steps Before Filing Income Taxes CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/02/Form_1040_2021.62006f6875b45.png

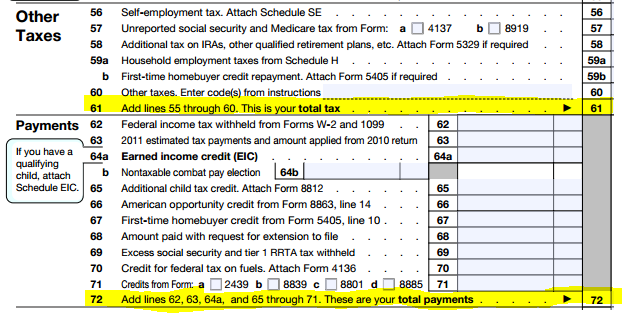

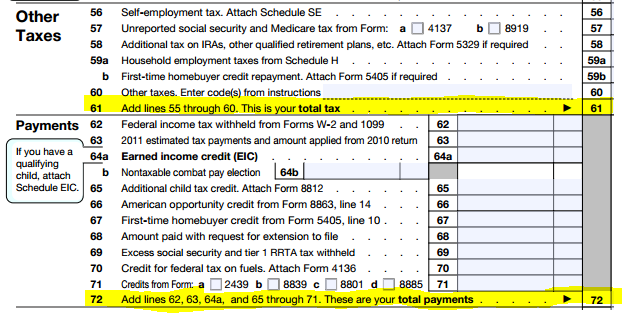

Verkko 29 jouluk 2023 nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns Verkko 6 jouluk 2023 nbsp 0183 32 Step 1 Download Form 4506 Step 2 Enter required data Click to expand Key Takeaways To obtain copies of your tax return from the IRS download file Form 4506 from the IRS website complete it sign it and mail it to the appropriate IRS address As of 2023 the IRS charges 43 for each return you request

Verkko To get a copy of your 2023 tax return that you filed this year TurboTax D To print a copy of your return complete the following steps You can also print directly from a saved PDF of your return by double clicking the PDF to open it and then following the instructions in step 4 iOS Chrome Verkko 18 helmik 2022 nbsp 0183 32 Follow these steps for tracking your 2021 federal income tax refund Gather the following information and have it handy Social security number SSN or Individual Taxpayer Identification Number ITIN Your filing status Your exact refund amount You will need this information to use the first two refund status tools below

Download How Do I Get My Tax Return From 2021

More picture related to How Do I Get My Tax Return From 2021

How Long Does It Take To Get Tax Returns Tax Return Tax Refund Irs

https://i.pinimg.com/736x/25/84/14/258414a9ba63687de99d431af3bce628.jpg

Income Tax Return Form

https://sp-uploads.s3.amazonaws.com/uploads/services/1990912/20210729221930_61032972c63ec_2020_taxreturn__6_page0.png

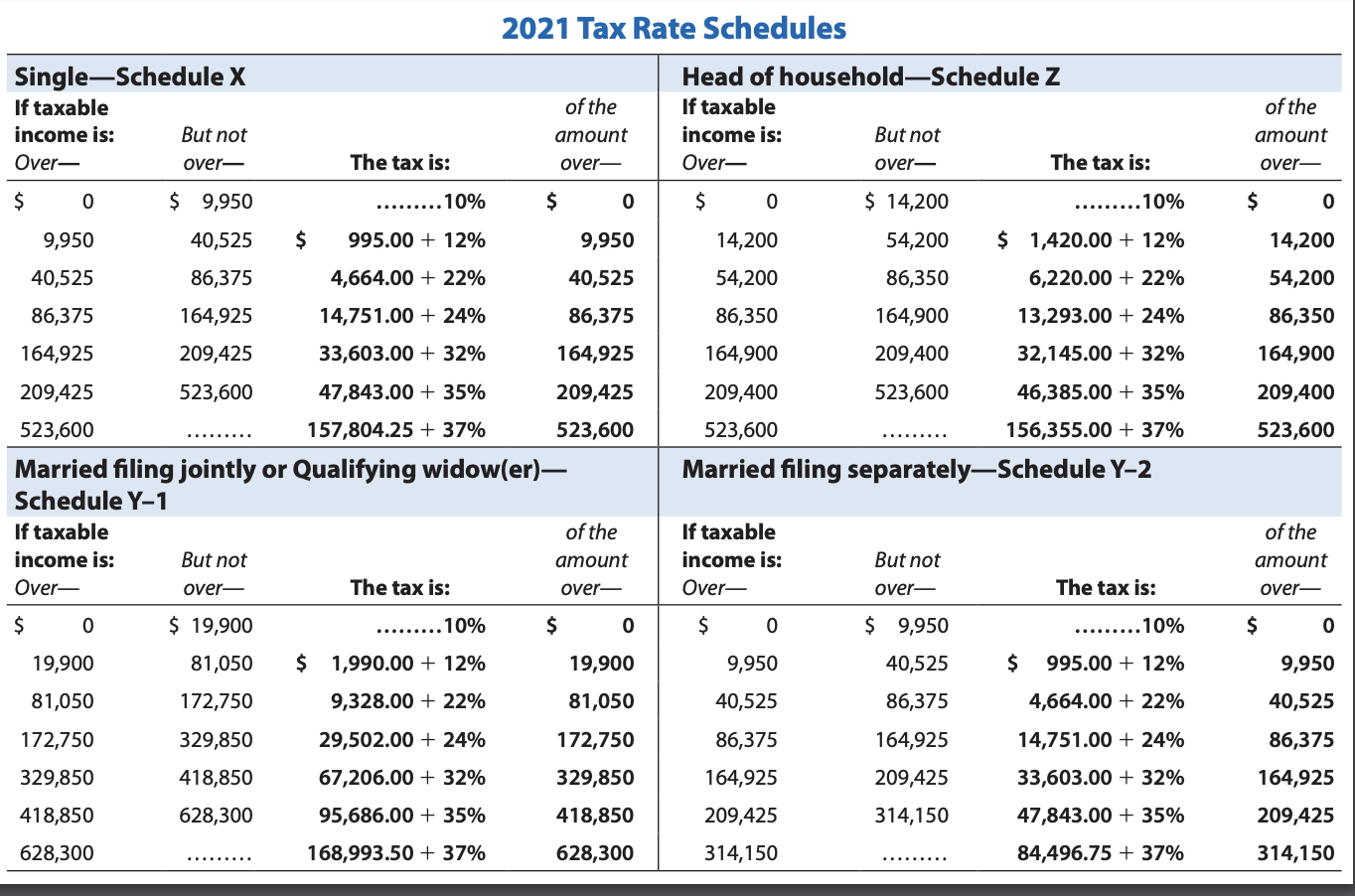

Solved Click Here To Access The 2021 Tax Rate Schedule If Chegg

https://media.cheggcdn.com/media/e59/e5933d55-8e0e-40de-a09a-3c6c78302bc1/phpQfeKQk

Verkko 31 tammik 2022 nbsp 0183 32 IRS Free File available only through IRS gov is now accepting 2021 tax returns IRS Free File is available to any person or family with adjusted gross income of 73 000 or less in 2021 The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit Verkko 13 marrask 2023 nbsp 0183 32 Individuals can call the IRS at 800 829 1040 between 7 a m and 7 p m your local time between Monday and Friday for assistance Business should call 800 829 5500 You might have to wait a while

Verkko To access your 2022 return Sign in at TurboTax Go to Tax Home and scroll down and select Your tax returns amp documents Here you ll see the years of taxes you ve filed with TurboTax If you don t see any returns when you sign in you might be using the wrong user ID Check to see if you have another account Verkko To get a copy of your H amp R Block online prior year return sign in to your account with the same username and password used to originally create the account Then just access the Prior years link in the Taxes section You ll then see all the years of tax returns available in your account

How To Calculate Your Federal Income Tax Refund Tax Rates

https://www.withholdingform.com/wp-content/uploads/2022/08/how-to-calculate-your-federal-income-tax-refund-tax-rates.png

WhatsCovered Understand Your Insurance

https://whatscovered-mmnkrhmhp-cishiv-dev.vercel.app/opengraph-image.png?49c2c3ea917a06c7

https://www.irs.gov/individuals/get-transcript

Verkko 4 lokak 2023 nbsp 0183 32 Look at your payment history See your prior year adjusted gross income AGI View other tax records Visit or create your Online Account The method you used to file your tax return e file or paper and whether you had a balance due affects your current year transcript availability

https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-return/...

Verkko For tax years 2022 2021 or 2020 To file a new prior year return you ll need to purchase and download that year s TurboTax software for PC or Mac as TurboTax Online and the mobile app are only available for the current tax year Note Returns for tax years 2019 and earlier are no longer eligible to be filed through TurboTax

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)

Income Tax Return Form

How To Calculate Your Federal Income Tax Refund Tax Rates

Tax Refund California 2024 Sile Yvonne

When I Get My Tax Return BreakBrunch

Do You Have To Pay Back The Child Tax Credit In 2023 Leia Aqui Will

Cara Mendapatkan Tax Identification Number

Cara Mendapatkan Tax Identification Number

Where S My Refund Calendar 2024 Hattie Christalle

Signing Tax Documents For Verification UCF Office Of Student

Tax Brackets 2024 For Couples Fiona Jessica

How Do I Get My Tax Return From 2021 - Verkko 29 jouluk 2023 nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns