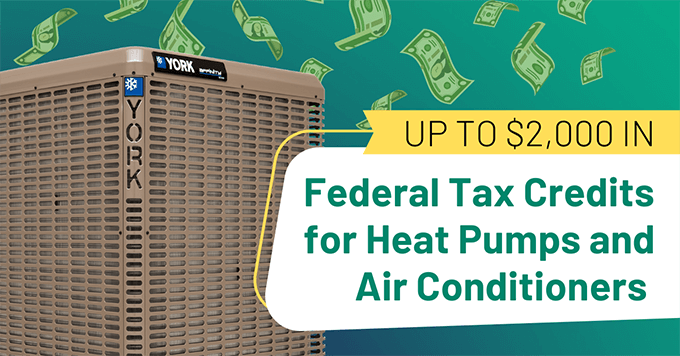

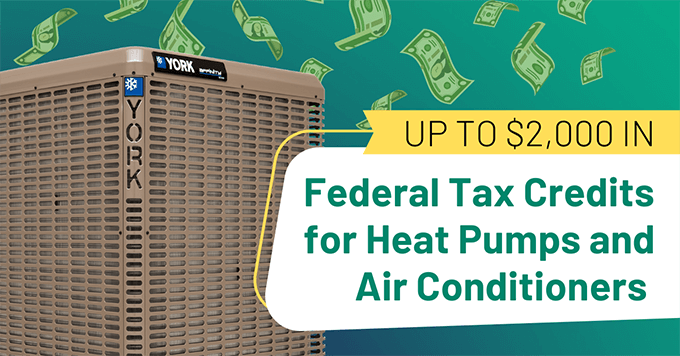

How Do I Know If My Heat Pump Qualifies For Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Yes There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000

How Do I Know If My Heat Pump Qualifies For Tax Credit

How Do I Know If My Heat Pump Qualifies For Tax Credit

https://media.marketrealist.com/brand-img/bjAd12-bt/1024x536/heat-pump-2-1660837533114.jpg

How To Check Your Heart Health The Washington Post

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/NTPLSYRLKVFL3MQRWZGOUMKN5M.gif&w=1440

Do You Need Ventilation When Using A Propane Heater

https://breathebetterair.org/wp-content/uploads/2022/09/Do-You-Need-Ventilation-When-Using-a-Propane-Heater.jpg

Thanks to the IRA if you made or are planning to make certain qualified energy efficient improvements to your home after January 1 2023 you may qualify for a tax credit from the IRS For heat Tax credits for heat pumps If you install an efficient heat pump between now and 2032 you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit is capped at 2 000 per year so if you are considering multiple energy upgrades you can maximize the incentives by spacing out

You purchase an air source heat pump that qualifies for the energy efficient home improvement credit In the same tax year you can claim 30 of the cost of that project for up to an additional 2 000 Heat pumps are rapidly gaining popularity as an energy efficient option for home heating and cooling With a 30 percent tax credit available for a range of heat pump solutions up to 2 000 per year it s a great time to investigate if this clean technology is right for your home

Download How Do I Know If My Heat Pump Qualifies For Tax Credit

More picture related to How Do I Know If My Heat Pump Qualifies For Tax Credit

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

How Do I Know If I Had Heat Exhaustion YouTube

https://i.ytimg.com/vi/x2sbs6wIPJA/maxresdefault.jpg

How Do I Know If I Have High Blood Pressure YouTube

https://i.ytimg.com/vi/KZznkb7v5pM/maxresdefault.jpg

Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to equipment installed on January 1 2023 or later A smaller tax credit of up Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Eligible models as listed above are qualified and dependent upon specific system combinations

The credit is allowed for qualifying property placed in service on or after January 1 2023 and before January 1 2033 General overview of the Residential Clean Energy Property Credit The residential clean energy property credit is a 30 percent credit for certain qualified expenditures made by a taxpayer for residential energy efficient In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000 applies to electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

What To Do If Auxiliary Heat Shown On Thermostat With Pictures

https://www.supertechhvac.com/wp-content/uploads/2022/01/Electric-Heating-Element-1.png

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

What Is A PSU Your PC s Power System Explained TechRadar

Federal Tax Credits For Air Conditioners Heat Pumps 2023

How Do I Know If My Pump Is Working Properly YouTube

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

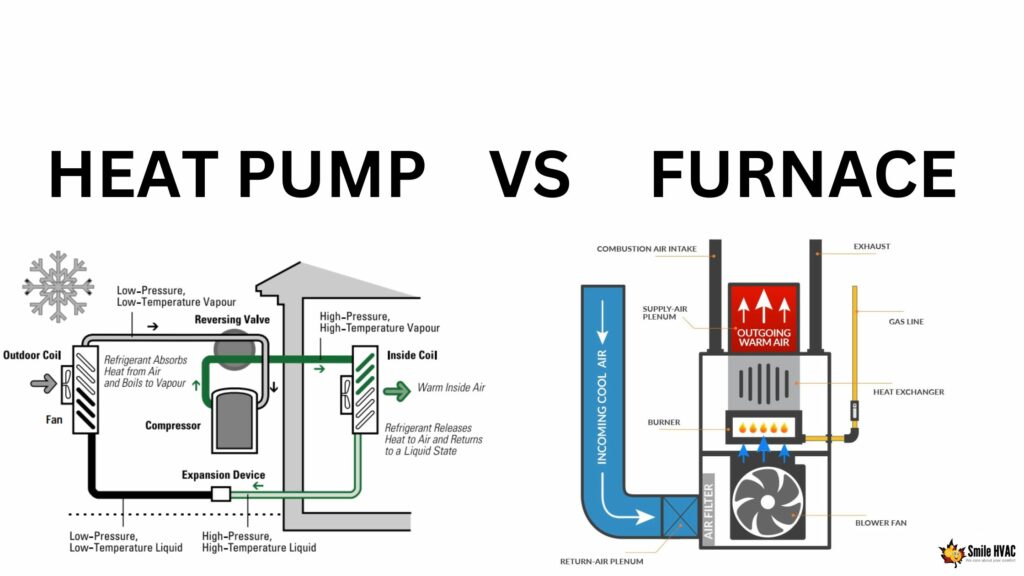

Heat Pump Vs Furnace Which Should You Choose

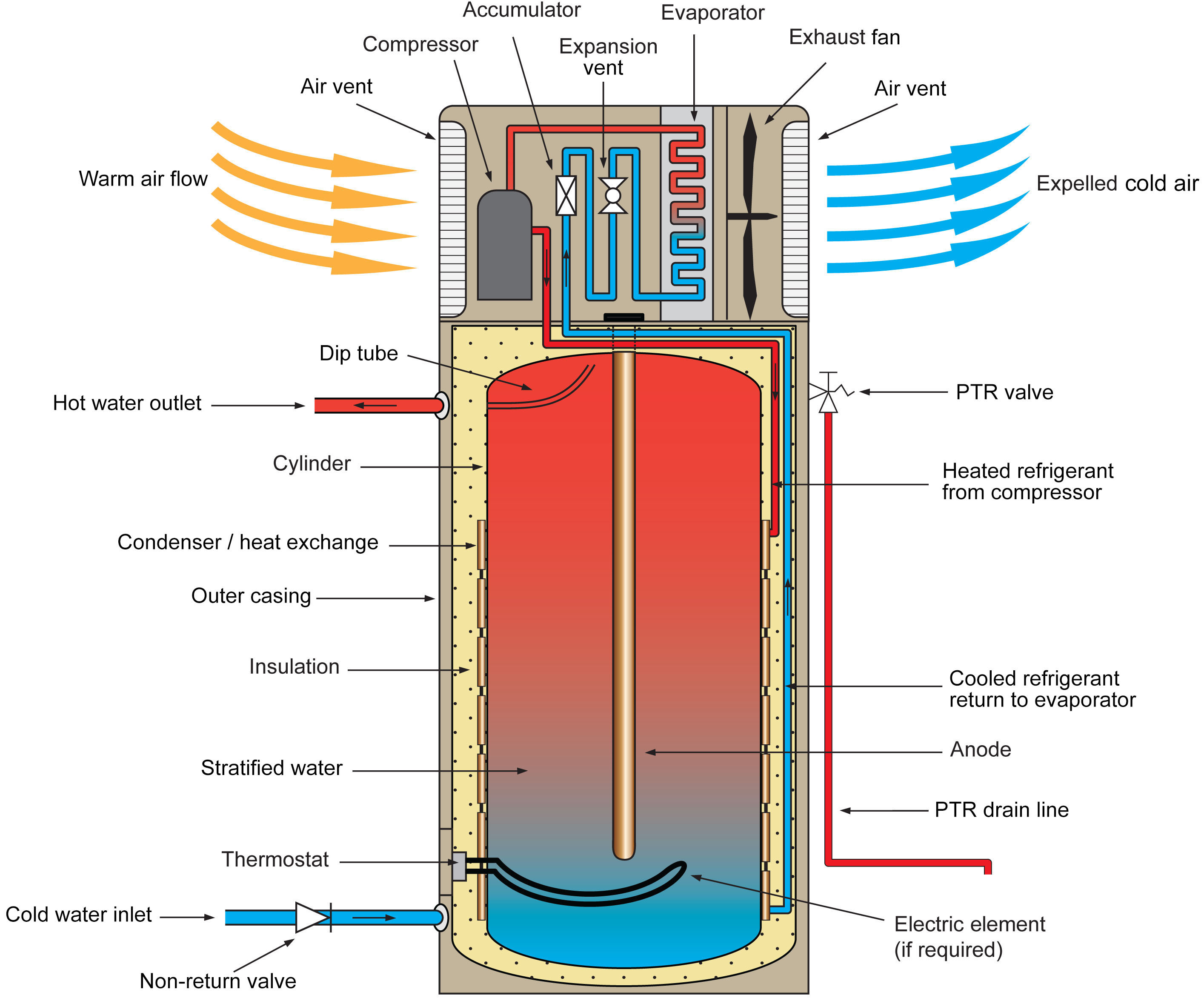

Hot Water System Prices Best Price Guaranteed Anytime Hot Water

Hot Water System Prices Best Price Guaranteed Anytime Hot Water

Solar Hot Water Booster Wiring Diagram Wiring Diagram

Install A Heat Pump This Winter Enjoy The Benefits

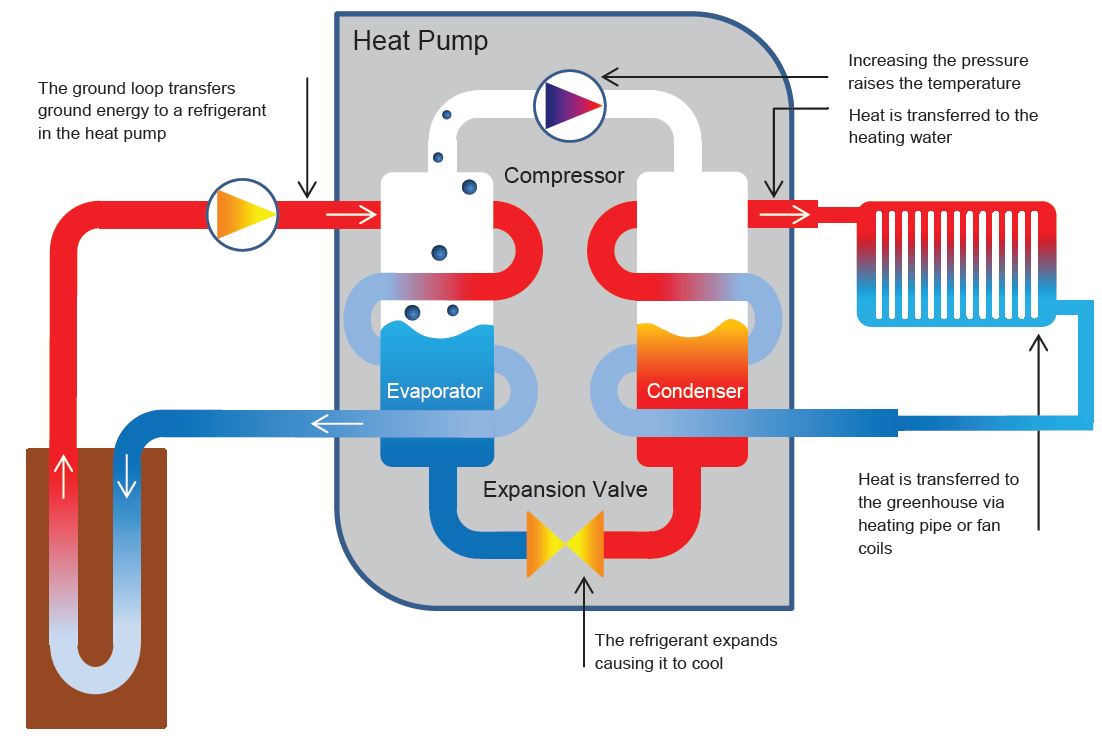

A Detailed Look At Heat Pumps And How They Work Growsave

How Do I Know If My Heat Pump Qualifies For Tax Credit - Heat pumps are rapidly gaining popularity as an energy efficient option for home heating and cooling With a 30 percent tax credit available for a range of heat pump solutions up to 2 000 per year it s a great time to investigate if this clean technology is right for your home