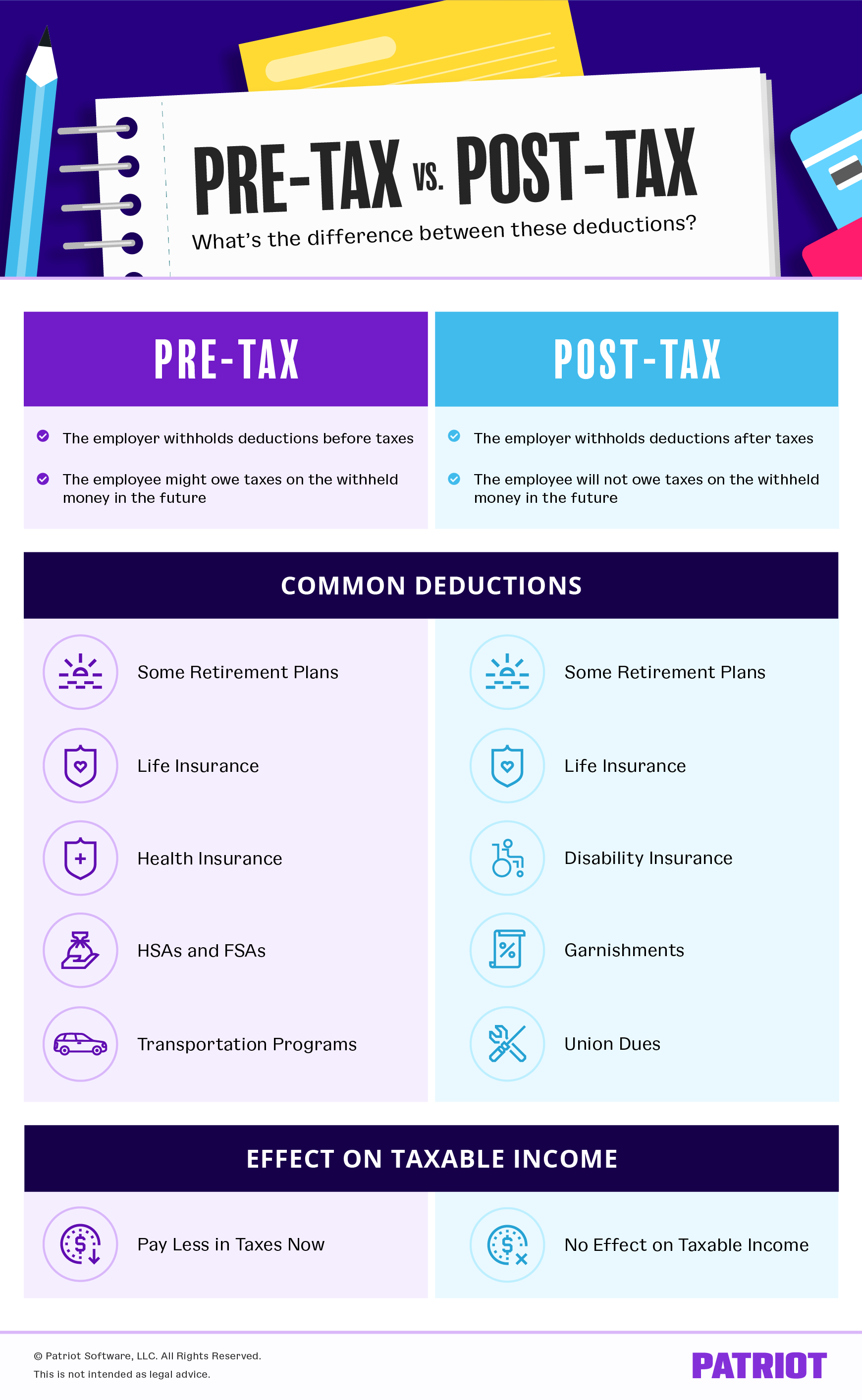

How Do Post Tax Deductions Work You take post tax deductions also called after tax deductions out of employee paychecks after taxes Post tax deductions have no effect on taxable wages and the amount of tax owed Both pre tax and post tax deductions from payroll are voluntary deductions

Post tax deductions Post tax deductions are taken from an employee s paycheck after all required taxes have been withheld Since post tax deductions reduce net pay rather than gross pay they don t lower the individual s overall tax burden Post tax deductions refer to deductions taken from an employee s paycheck after taxes have been withheld These deductions are typically voluntary and can include contributions to retirement plans health insurance premiums and charitable donations among others

How Do Post Tax Deductions Work

How Do Post Tax Deductions Work

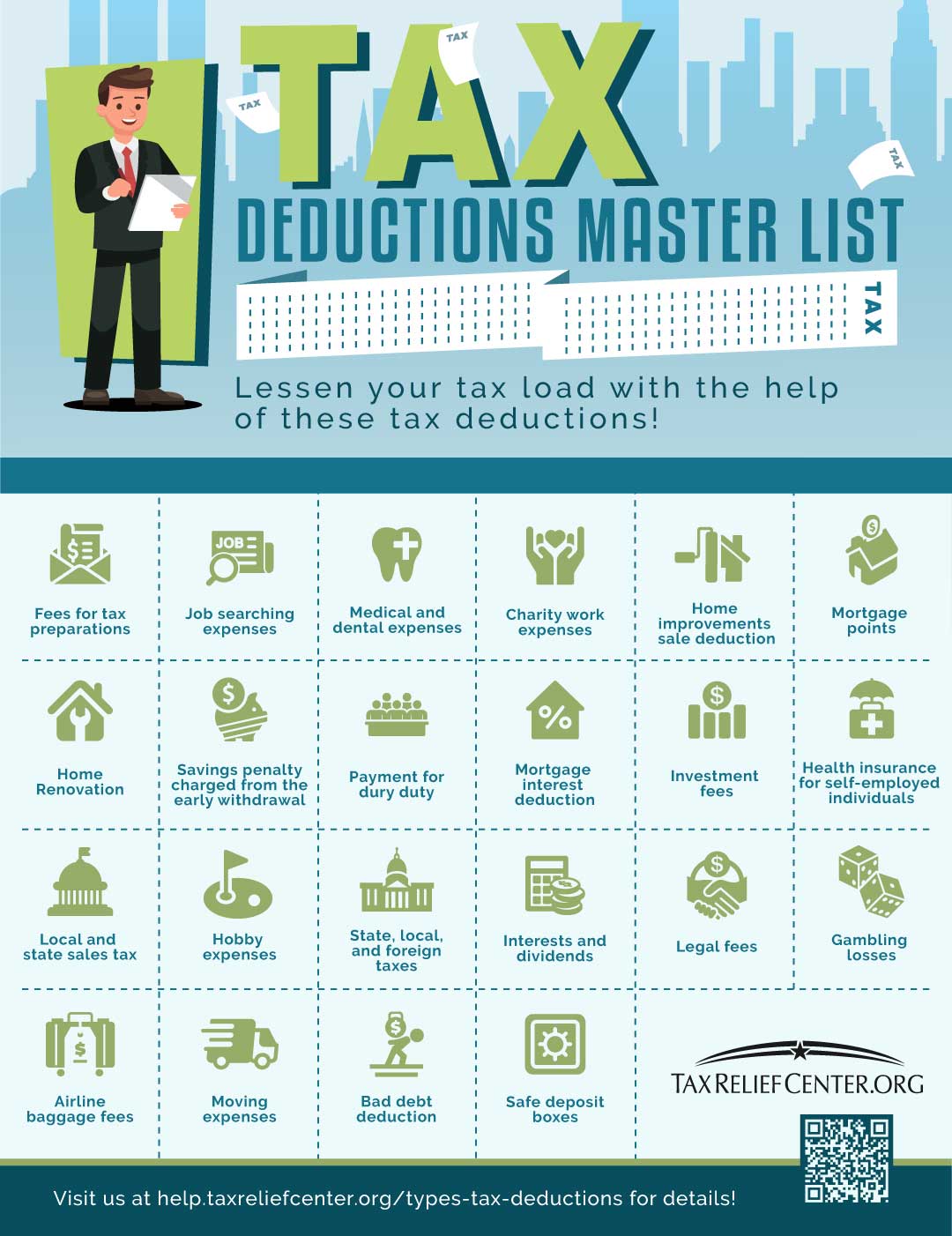

https://help.taxreliefcenter.org/wp-content/uploads/2018/06/Tax-Relief-Center-Types-of-Tax-Deductions.jpg

Small Business Tax Deductions Tax Deductible Business Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1.png

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/5f0cbe55b25f234fcd31d31d_hero-pretax vs post tax deduction_2.jpg

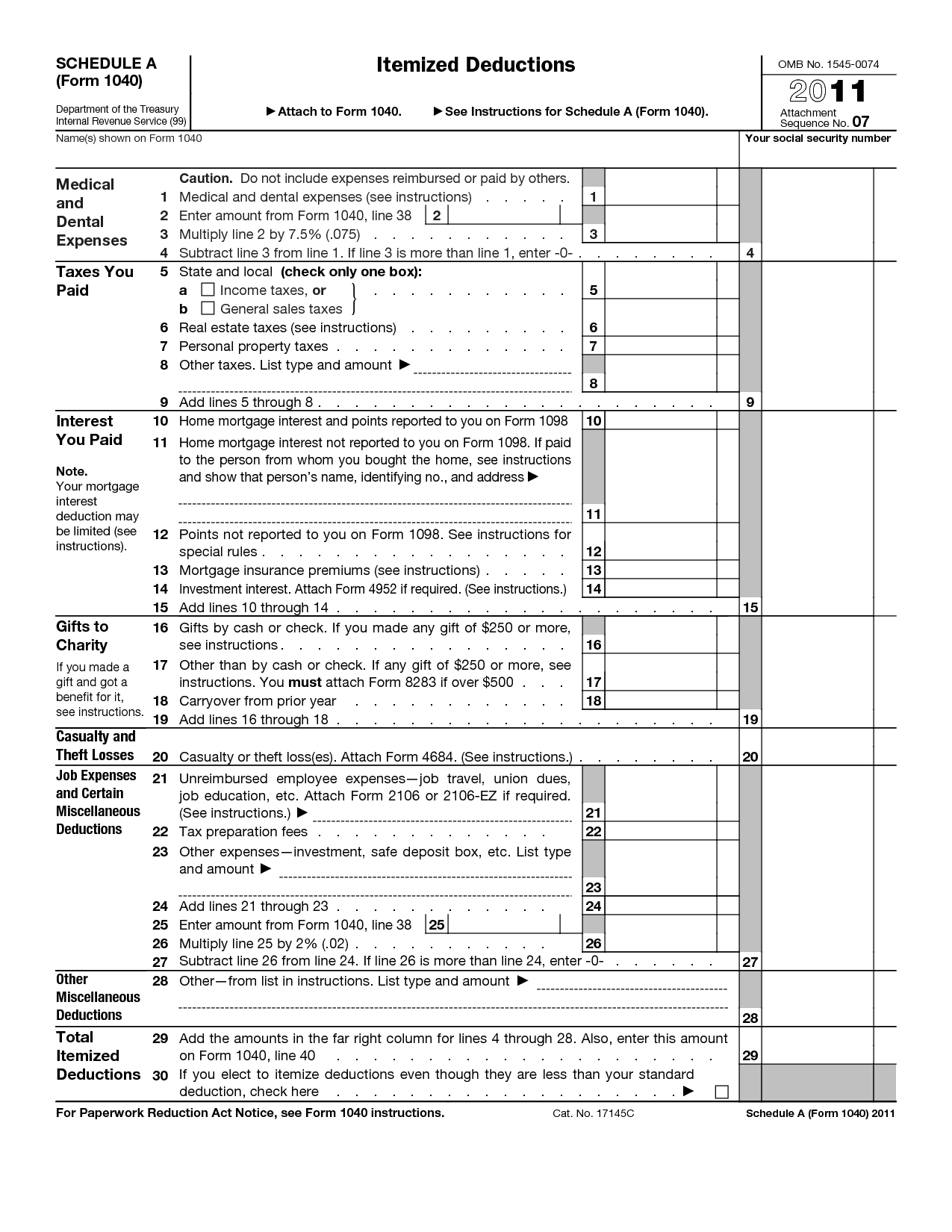

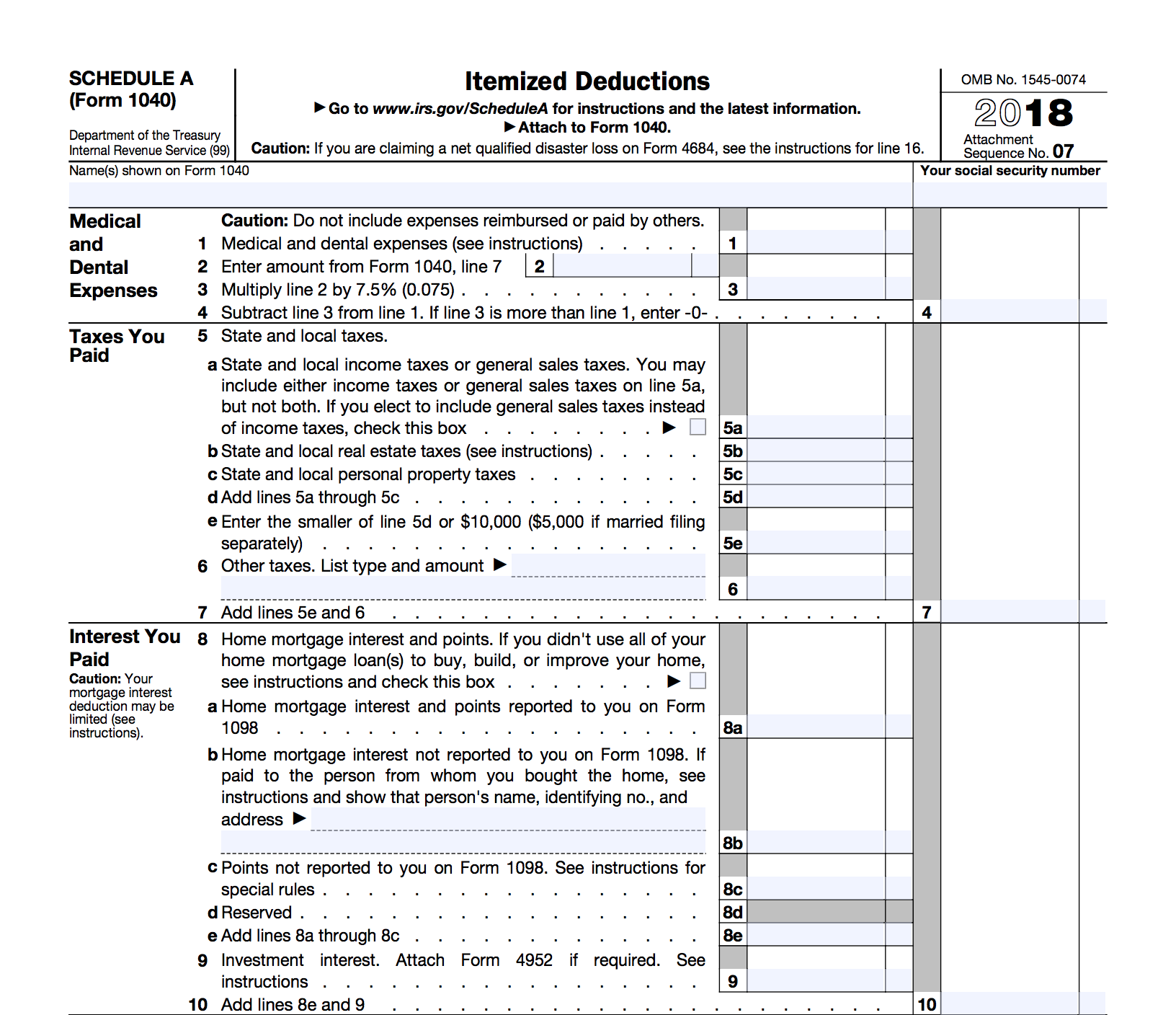

Pre tax deductions reduce an employee s taxable income which means they ll often see a decrease in the taxes withheld and an increase in their take home pay Post tax deductions do not affect an employee s taxable income so they will take home a little less pay compared to a pre tax deduction Post tax deductions also known as after tax deductions are amounts taken out of an employee s wages after applicable pre tax deductions and payroll taxes have been withheld These deductions may be voluntary such as Roth 401 k contributions or involuntary such as wage garnishments

Post tax deductions are withheld after you withhold taxes from your employee s wages and they ll have no impact on your employee s taxable income Common post tax deductions include Retirement plans Life and disability insurance Union wages Let s consider some of these deductions in more detail Union Or Professional Association Fees After tax deduction refers to the amount of money deducted from an employee s earnings after tax withholding These required taxes include federal income tax state tax social security and Medicare tax The amount will vary depending on the taxable income of each earning bracket

Download How Do Post Tax Deductions Work

More picture related to How Do Post Tax Deductions Work

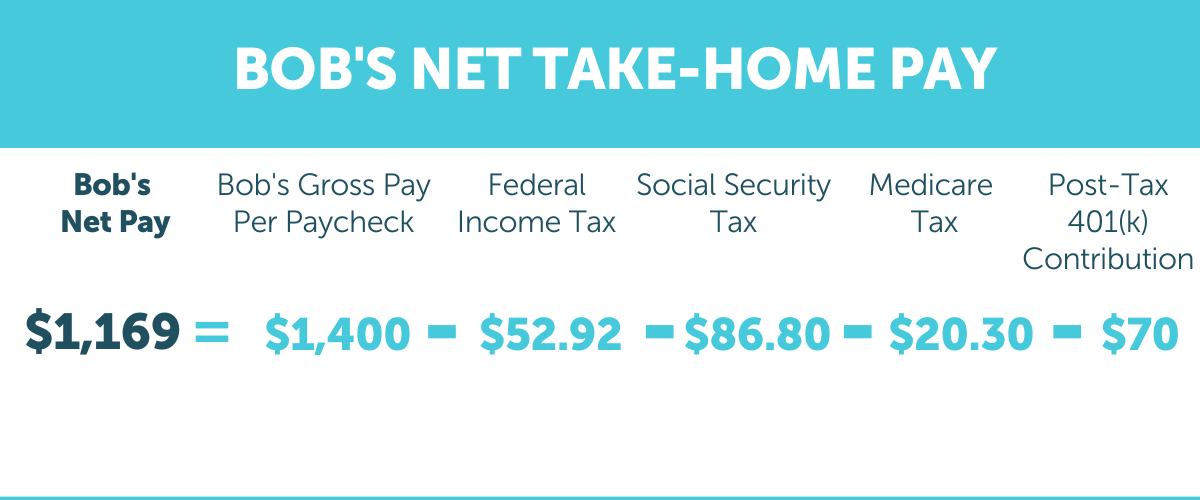

Is Wages Or Salary Before Or After Federal Tax Deductions Federal

https://apspayroll.com/wp-content/uploads/2021/07/Bobs-Net-Take-HomePay.png

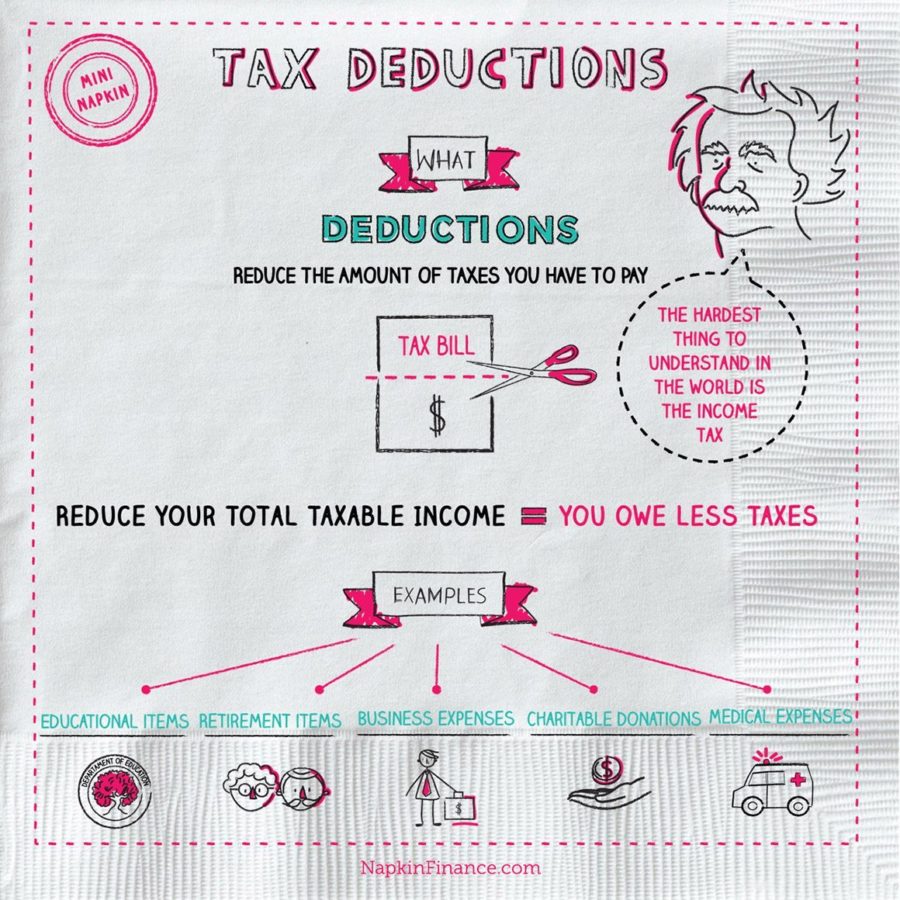

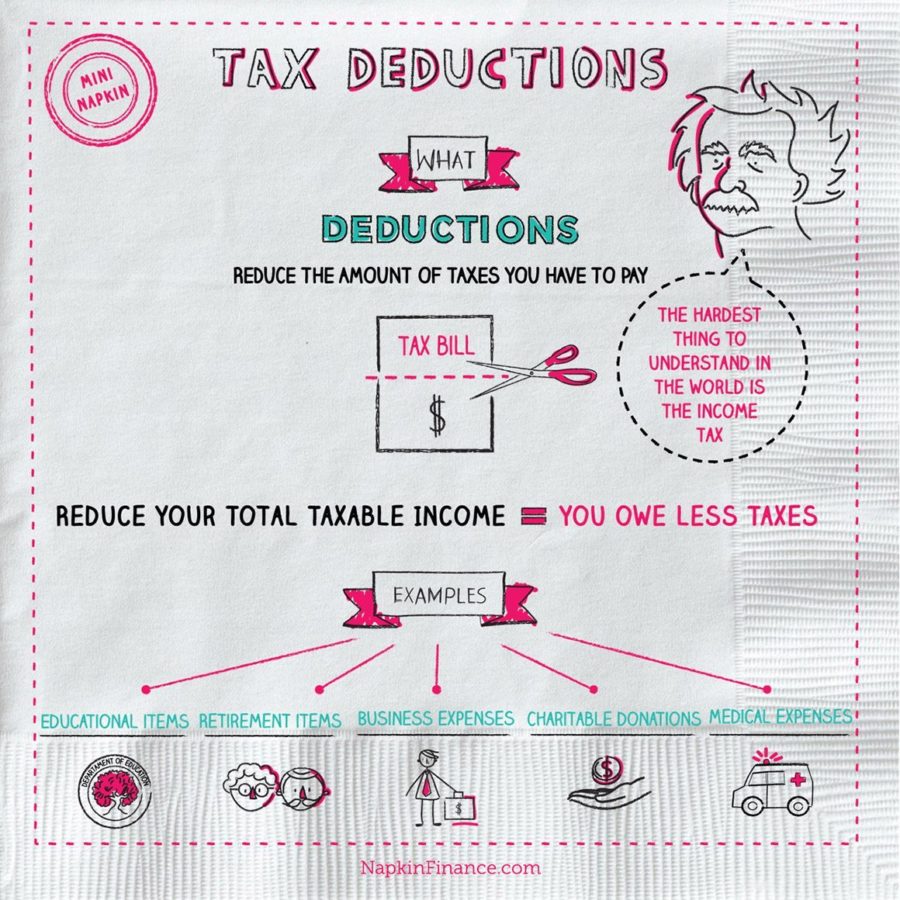

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Is Wages Or Salary Before Or After Federal Tax Deductions Federal

https://www.patriotsoftware.com/wp-content/uploads/2017/03/pre-tax-vs-post-tax.png

A post tax deduction is a payroll deduction taken out of an employee s paycheck after taxes get withheld As opposed to pre tax deductions post tax deductions don t lower tax burdens This difference in tax liability is because post tax deductions reduce after tax pay instead of pre tax pay A post tax deduction is an amount withheld from an employee s paycheck after deducting all applicable taxes These deductions do not reduce the employee s taxable income making them different from pre tax deductions which are subtracted from gross income before tax

Post tax deductions have no effect on an employee s taxable income Some benefits can be either pre tax or post tax such as a pre tax vs post tax 401 k types Often the type of deduction you need to make is predefined in the policy for the benefit Post tax deductions are specific expenses that are deducted from your income after taxes have already been deducted These deductions are typically subtracted from your paycheck reducing the amount of your take home pay

How Do Tax Deductions Work

https://lionessmagazine.com/wp-content/uploads/2018/07/napkin-finance-tax-deductions-e1506911042187.jpg

Time To Check Your Paycheck The Fancy Accountant

https://fancyaccountant.com/wp-content/uploads/2020/09/payroll-tax-deductions-1024x574.png

https://www.patriotsoftware.com › blog › payroll › a...

You take post tax deductions also called after tax deductions out of employee paychecks after taxes Post tax deductions have no effect on taxable wages and the amount of tax owed Both pre tax and post tax deductions from payroll are voluntary deductions

https://www.adp.com › ... › payroll-deductions.aspx

Post tax deductions Post tax deductions are taken from an employee s paycheck after all required taxes have been withheld Since post tax deductions reduce net pay rather than gross pay they don t lower the individual s overall tax burden

Tax Deduction Definition TaxEDU Tax Foundation

How Do Tax Deductions Work

Understanding Pre Vs Post tax Benefits

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable

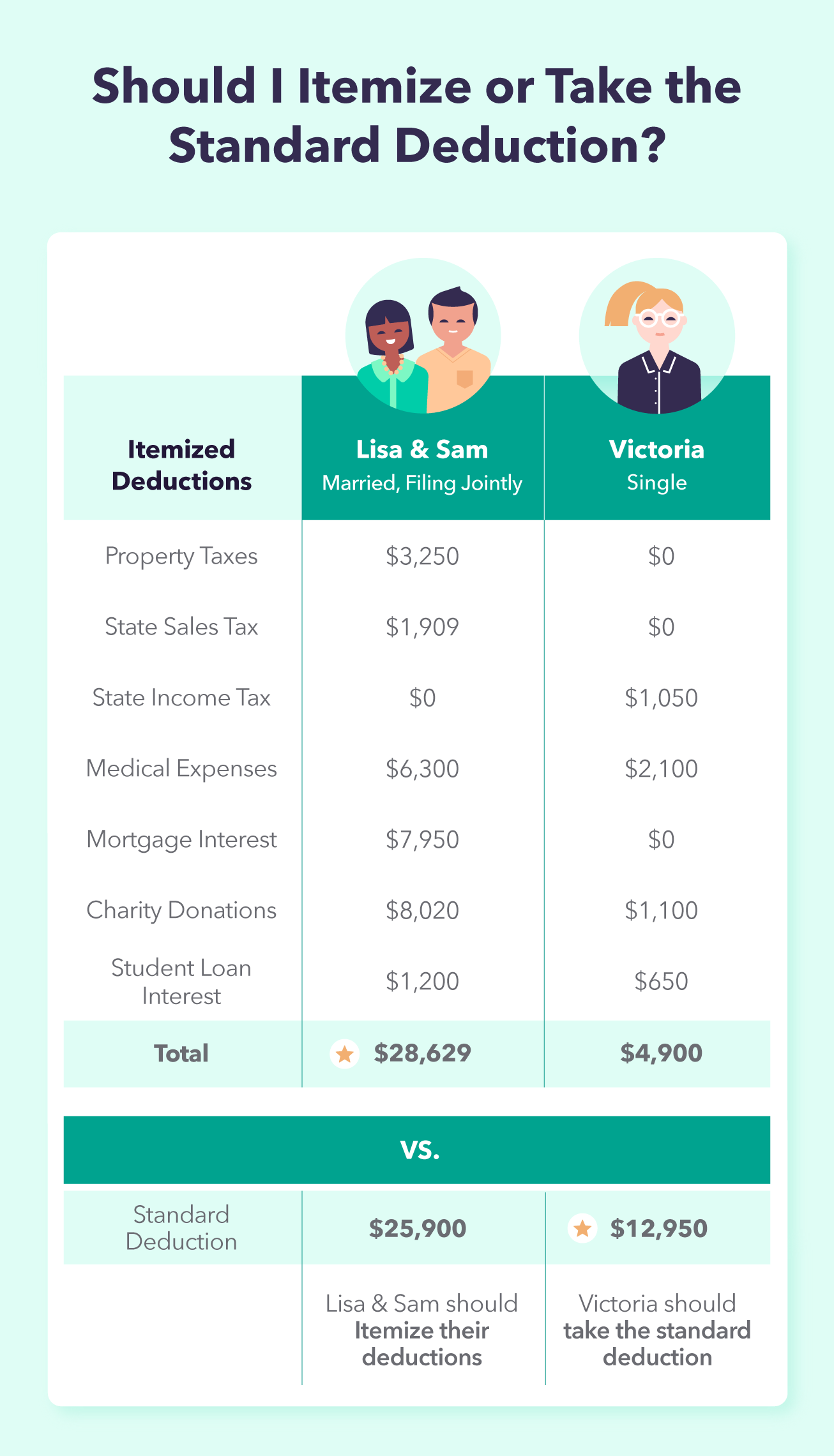

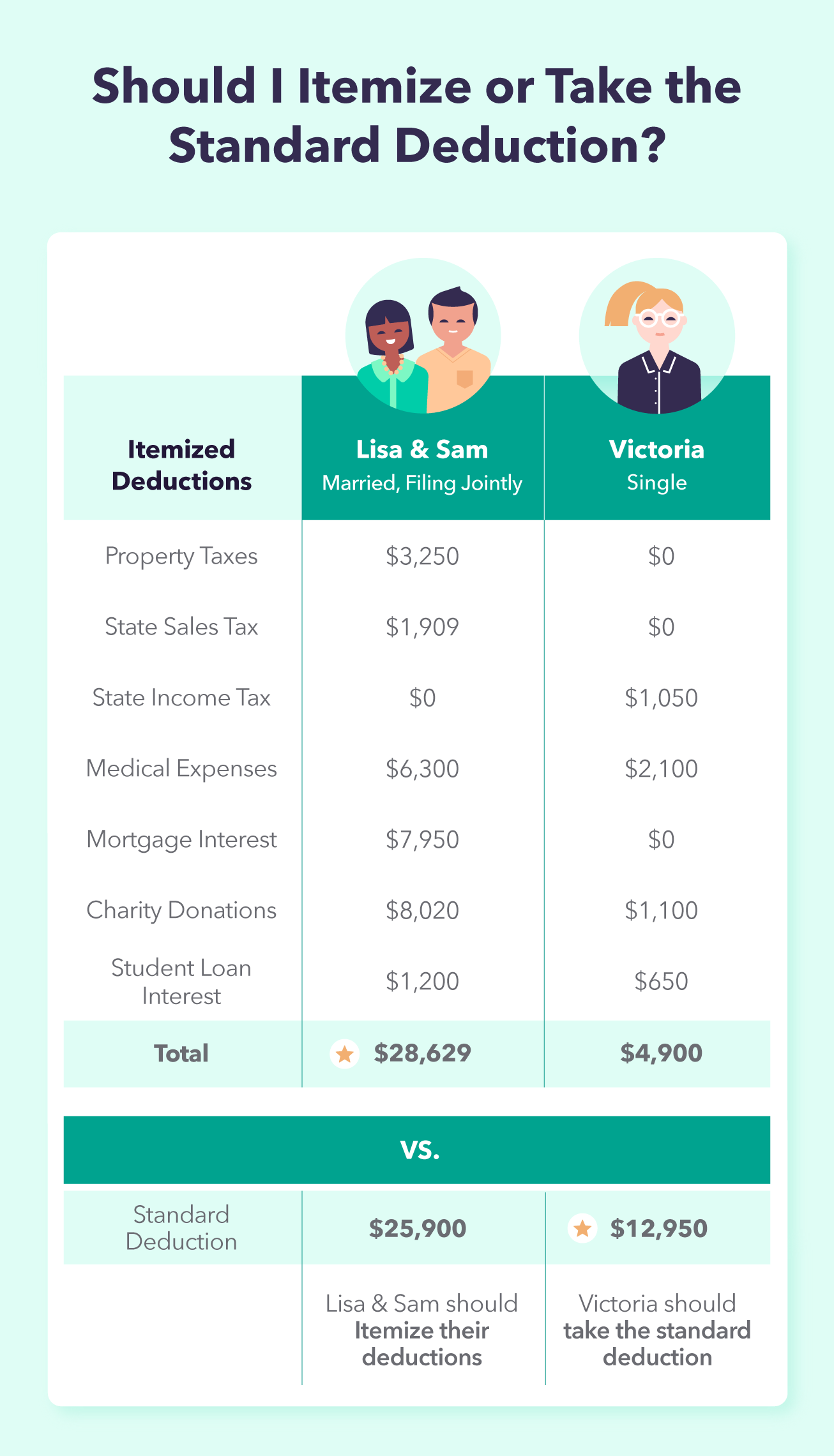

Standard Deduction 2020 Vs Itemized Standard Deduction 2021

What Are Tax Deductions And Credits 20 Ways To Save Blogginglass

What Are Tax Deductions And Credits 20 Ways To Save Blogginglass

5 Tax Deductions Small Business Owners Need To Know

8 Tax Itemized Deduction Worksheet Worksheeto

Pre tax Vs Post tax Contributions Personal Finance Series YouTube

How Do Post Tax Deductions Work - Payroll deductions are withheld from an employee s gross earnings for income taxes benefit payments or other permissible reasons Some payroll deductions are mandatory while other payroll deductions may be voluntary