How Do You Account For Lease Incentives Under Ifrs 16 Understanding of IFRS 16 s detailed guidance on lease modifications is currently essential and many lessees have taken advantage of the new practical expedient for

Accounting for lease incentives under IFRS 16 involves the following steps 1 Determine the total lease incentive At the commencement of the lease the lessee should assess Lease incentives part of Insights into IFRS 16 series provides further guidance and how to account for the following incentive examples Reimbursement of relocation costs Rent free period

How Do You Account For Lease Incentives Under Ifrs 16

How Do You Account For Lease Incentives Under Ifrs 16

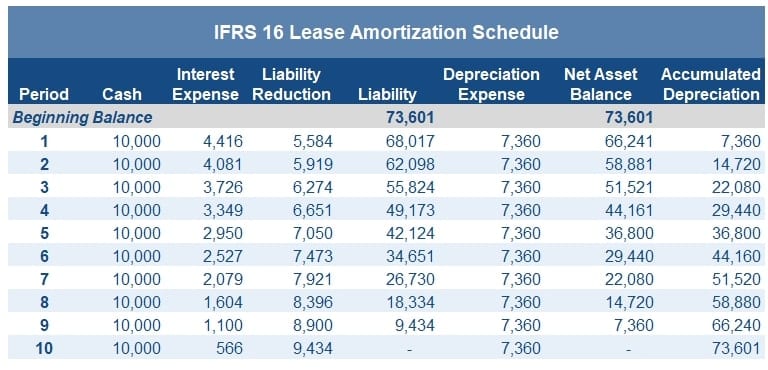

https://leasequery.com/wp-content/uploads/2021/02/ifrs16-amortization-schedule.jpg

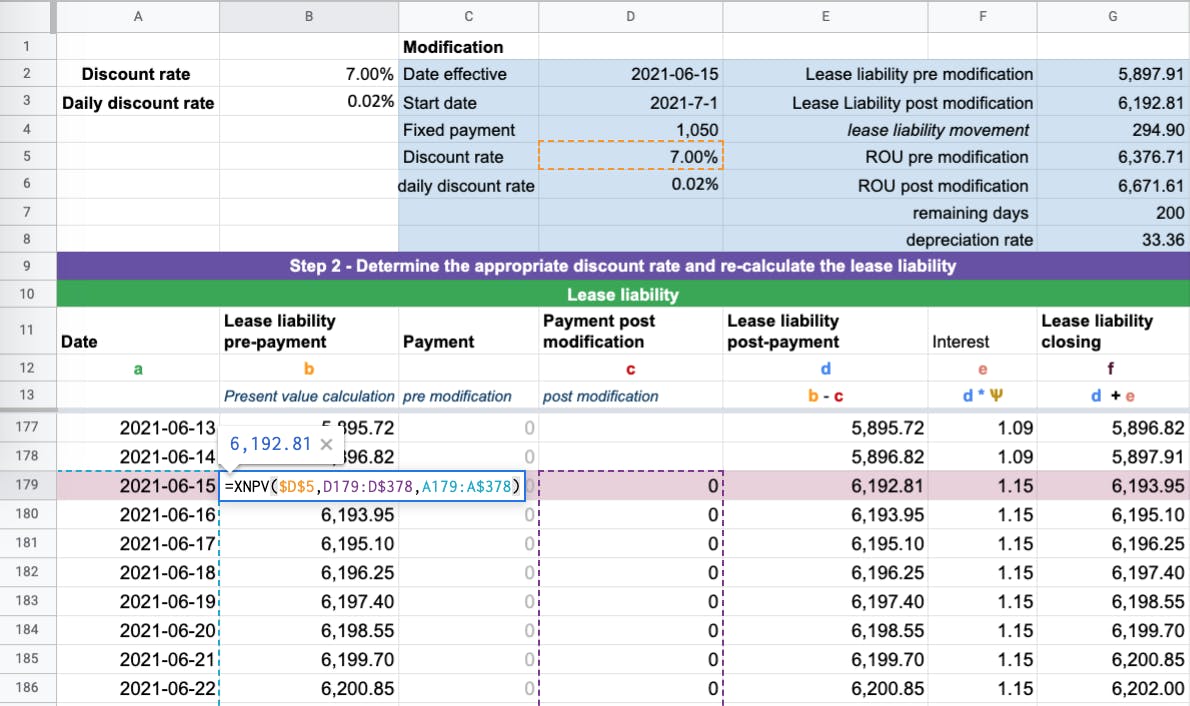

Dezv lui Screper Apos Ifrs 16 Present Value Calculation Salat Verde

https://www.evelyn.com/media/yezburwp/https-smithandwilliamsoncom-media-3675-ifrs-16-infographic-2.jpg

Awesome Ifrs 16 Rules Standard Profit And Loss Statement

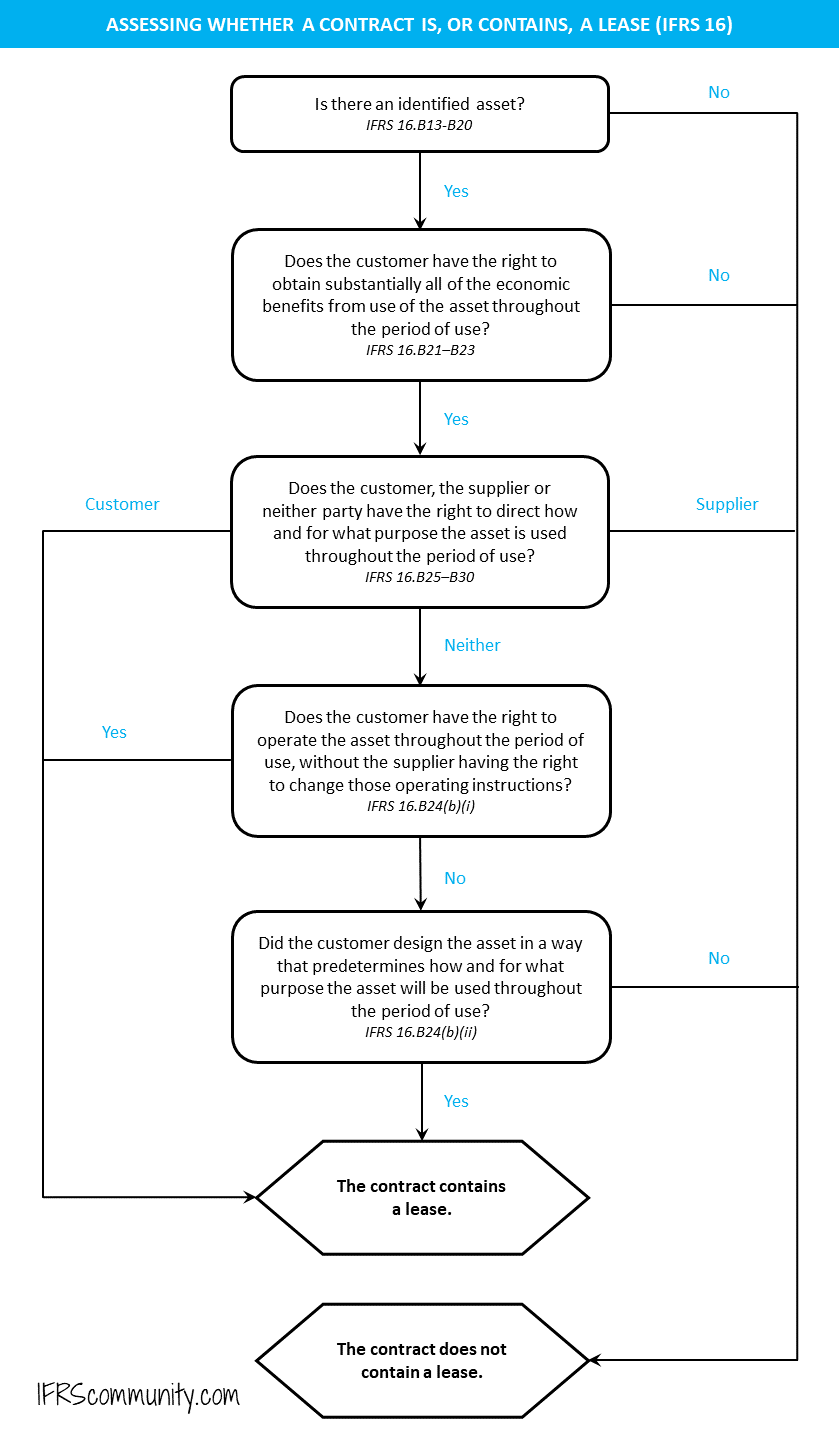

https://ifrscommunity.com/wp-content/uploads/ifrs-16-whether-contract-is-lease.png

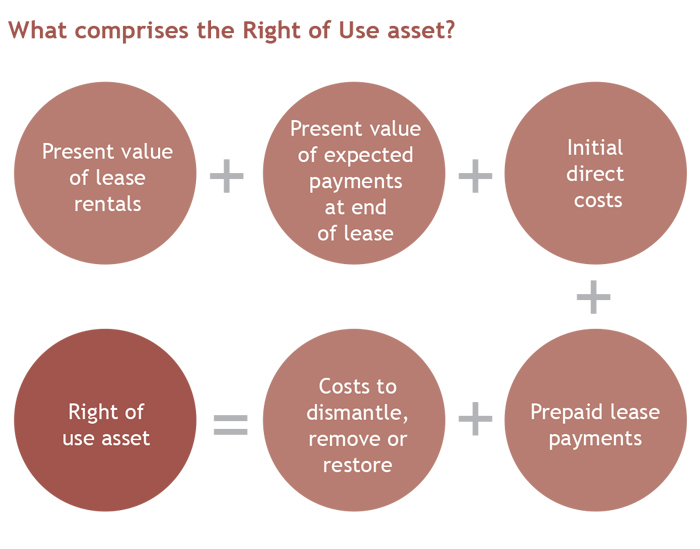

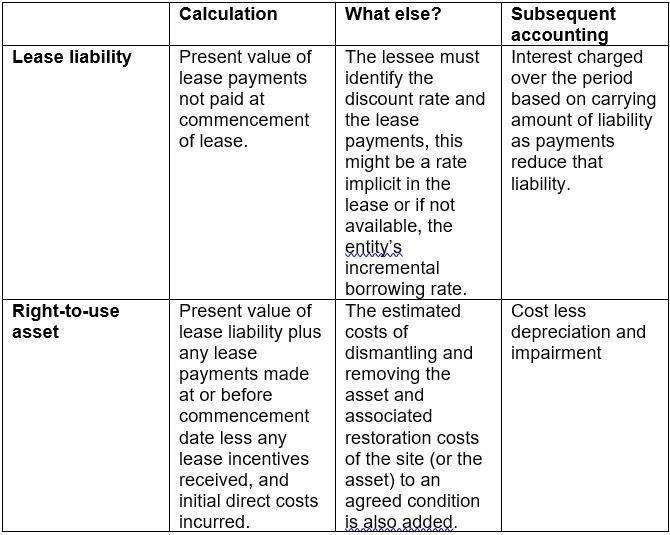

When accounting for lease incentives in accordance with IFRS 16 Leases from a lessee perspective questions may arise in how to identify a lease incentive and IFRS 16 requires a lessee to include lease incentives in the measurement of both the right of use asset and the lease liability Therefore all forms of lease incentive should be

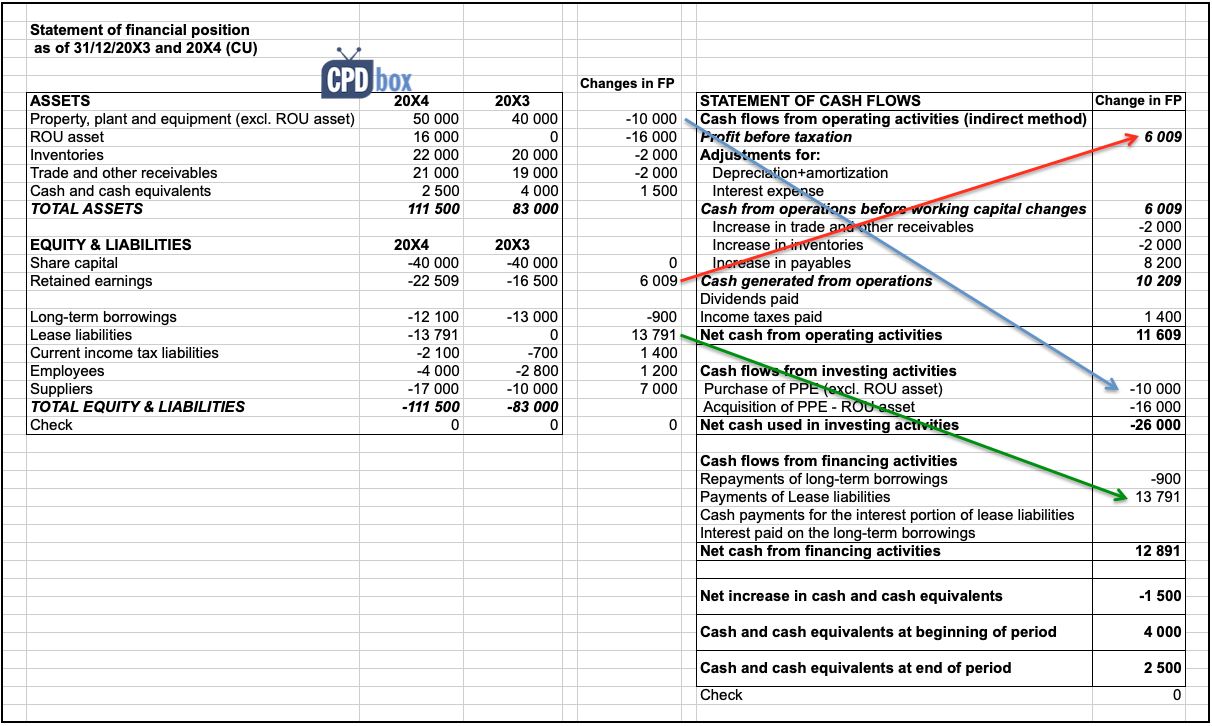

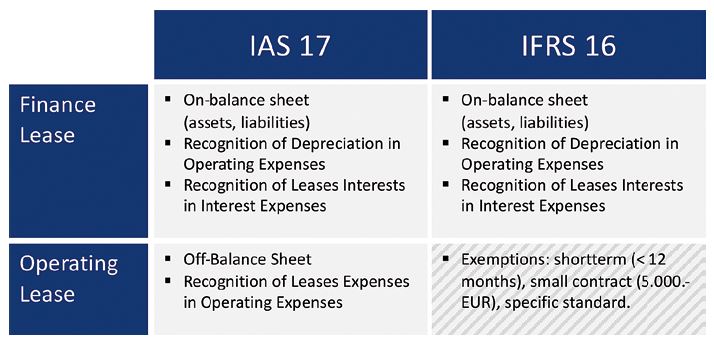

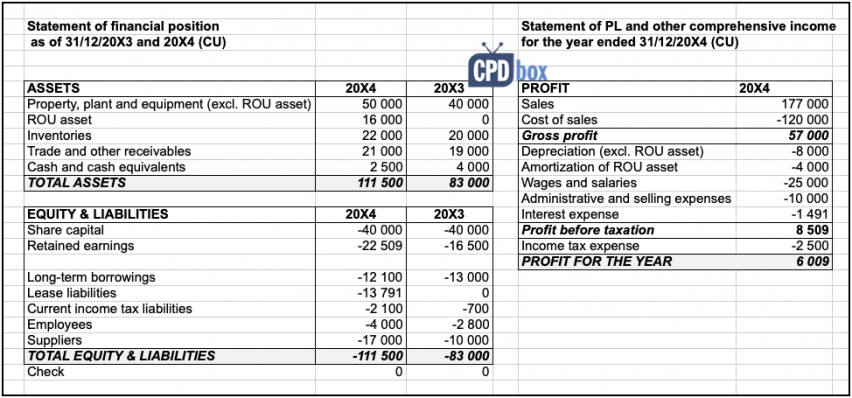

IFRS 16 sets out the principles for the recognition measurement presentation and disclosure of leases In May 2020 the Board issued Covid 19 Related Rent Under IFRS 16 leases are accounted for based on a right of use model The model reflects that at the commencement date a lessee has a financial obligation to make

Download How Do You Account For Lease Incentives Under Ifrs 16

More picture related to How Do You Account For Lease Incentives Under Ifrs 16

Right Of Use Asset Ifrs 16 ThomasqiKirk

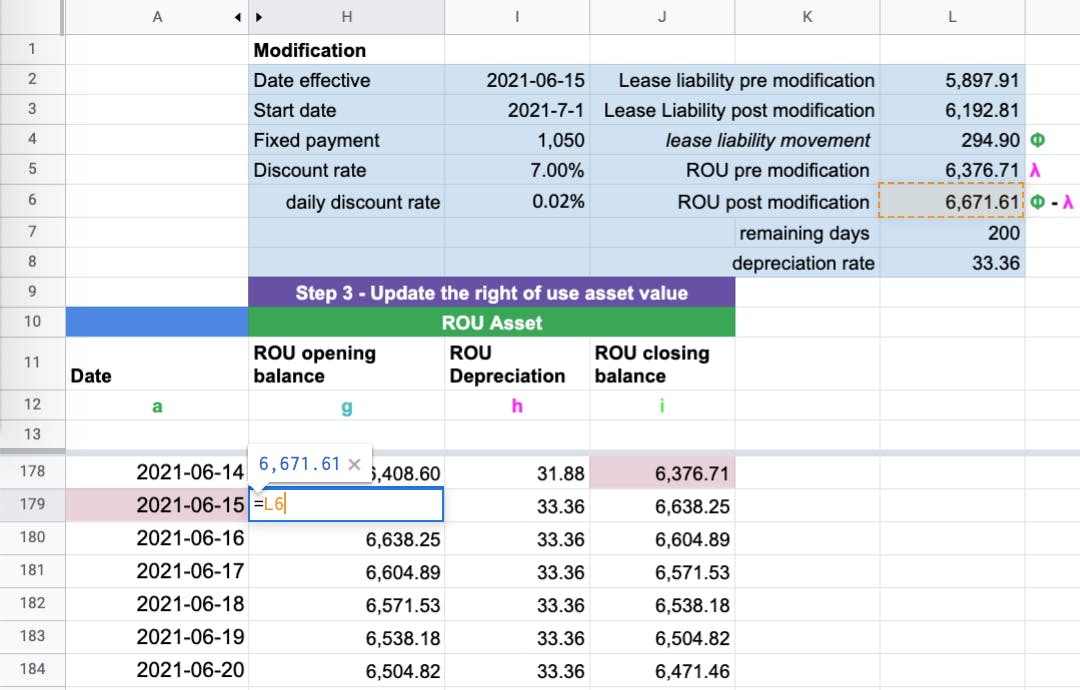

https://images.prismic.io/cradle/636ee59d-86cc-4490-985b-beae9925f8d2_step+3.png?auto=compress,format

Right Of Use Asset Ifrs 16 ThomasqiKirk

https://images.prismic.io/cradle/65d4c9ea-055a-46e8-ac2d-ab5b3a5d9488_Step+2.png?auto=compress,format

A Guide To IFRS 16 Leases The Journey To Compliance The CFO

https://the-cfo.io/wp-content/uploads/2017/10/Table-2.jpg

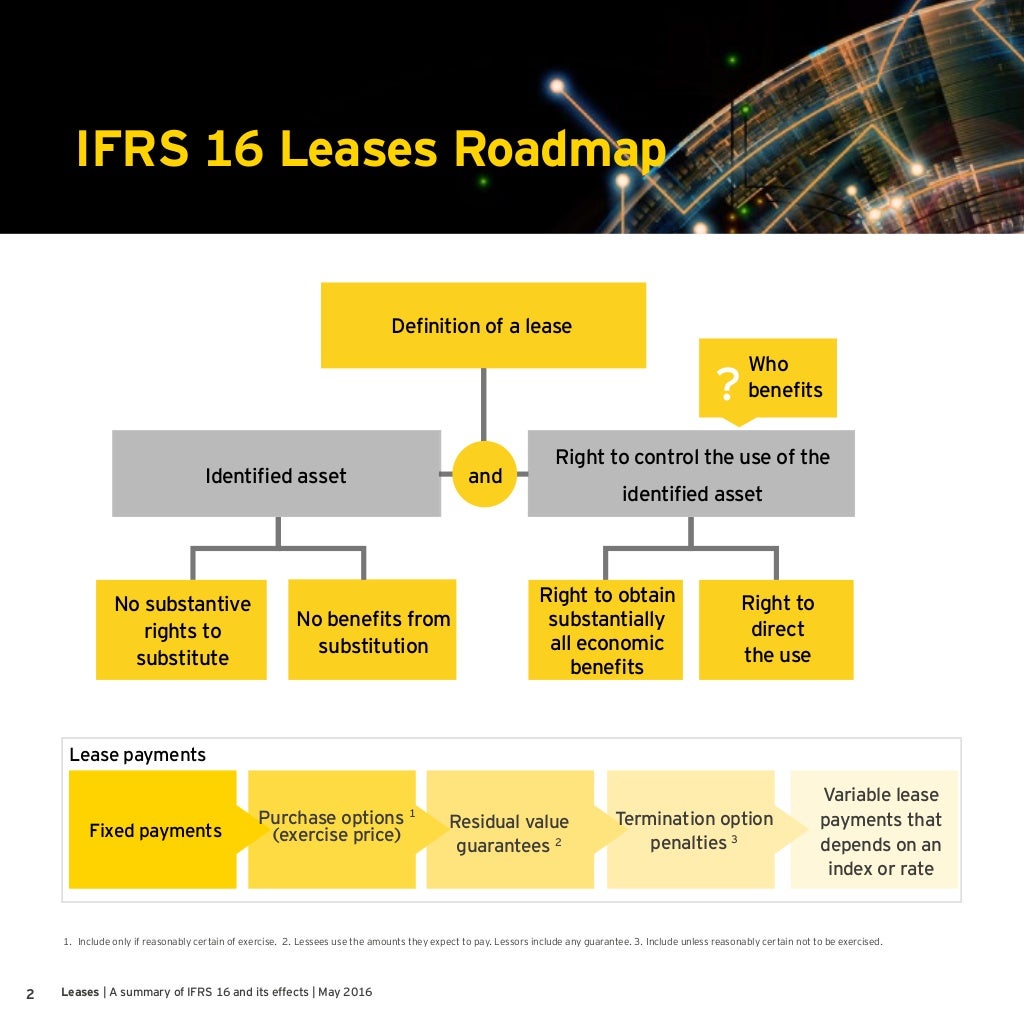

IFRS 16 specifies how an IFRS reporter will recognise measure present and disclose leases The standard provides a single lessee accounting model requiring Each one focuses on a particular aspect and includes explanations of the requirements and examples showing them in practice to help you apply the new standard We also have

How to calculate the right of use asset under IFRS 16 Under IFRS 16 the ROU asset is calculated based on the following The initial amount of the lease liability Payments made at or before the IFRS 16 27 The payments included comprise ed payments including in substance fixed payments less any lease fix incentives receivable ariable lease payments that

IFRS 16 Leases A Simplified Summary Of IFRS 16 With Practical

https://i.ytimg.com/vi/Gt2yG2akjxw/maxresdefault.jpg

Stunning Ifrs 16 Deferred Tax Example Payment Of Divident Financing

https://www.cpdbox.com/wp-content/uploads/02_IFRS16IAS7_Step2.png

https://assets.kpmg.com/.../2024/leases-overview.pdf

Understanding of IFRS 16 s detailed guidance on lease modifications is currently essential and many lessees have taken advantage of the new practical expedient for

https://blog.nomosone.com/news/accounting-for...

Accounting for lease incentives under IFRS 16 involves the following steps 1 Determine the total lease incentive At the commencement of the lease the lessee should assess

Impact Of New Lease Accounting Under IFRS 16

IFRS 16 Leases A Simplified Summary Of IFRS 16 With Practical

How To Present Leases Under IFRS 16 In The Statement Of Cash Flows IAS

Example Lease Accounting Under IFRS 16 YouTube

Leases A Summary Of IFRS 16 And Its Effects may 2016

Planet Jack Jumping Formal Right Of Use Asset Calculation Terorist

Planet Jack Jumping Formal Right Of Use Asset Calculation Terorist

Profit And Loss Account Under The IFRs Blog Antonio Alcocer

IFRS 16 Leases Updated Link In The Description YouTube

Determining The Lease Term For A Renewable Lease Under IFRS 16 GAAP

How Do You Account For Lease Incentives Under Ifrs 16 - Under IFRS 16 leases are accounted for based on a right of use model The model reflects that at the commencement date a lessee has a financial obligation to make