How Do You Claim Working From Home On Your Taxes In Canada Verkko A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked

Verkko The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual Each individual working from home who meets the Verkko 13 huhtik 2022 nbsp 0183 32 Canadians who were required to work from home as a direct result of the pandemic were able to claim 2 for every day they worked remotely to a

How Do You Claim Working From Home On Your Taxes In Canada

How Do You Claim Working From Home On Your Taxes In Canada

https://nrkaccounting.com/wp-content/uploads/2022/05/How-to-pay-your-taxes-img-scaled.jpg

How To Save Money On Taxes The Top Tips To Know Areas Of My Expertise

https://areasofmyexpertise.com/wp-content/uploads/2020/08/113254-1100x778.jpg

Changes To The Way You Claim Working From Home Tax Deductions WLF

https://wlf.com.au/wp-content/uploads/2023/03/telework-g2431970b1_1920-1536x1024.jpg

Verkko 11 tammik 2023 nbsp 0183 32 The first and most straight forward way to claim your working from home expenses is to use the temporary flat rate method This method allows you to claim 2 for each day you worked from Verkko 30 jouluk 2019 nbsp 0183 32 You cannot simply decide that you work from home your employer must require it Some employers put this in an employment agreement requiring a

Verkko 3 tammik 2023 nbsp 0183 32 If you re fully self employed and working from home or an employee who works from home at the request of your employer there are a number of credits Verkko 14 marrask 2022 nbsp 0183 32 You will need to fill the new T777 s Statement of Employment Expenses for Working at Home Due to COVID 19 form to claim the deduction What

Download How Do You Claim Working From Home On Your Taxes In Canada

More picture related to How Do You Claim Working From Home On Your Taxes In Canada

Can You Claim Your Elderly Parents On Your Taxes The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2011/07/can-you-claim-elderly-parent-on-taxes.jpg?resize=1200,630

BuzzCanada New Study Shows Canadians Spend More On Taxes Than Food And

http://1.bp.blogspot.com/-HaCPocuqiXg/U_KNdyDL0pI/AAAAAAAAEnY/5Y2wOFGzOwc/s1600/TaxBurden.jpg

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

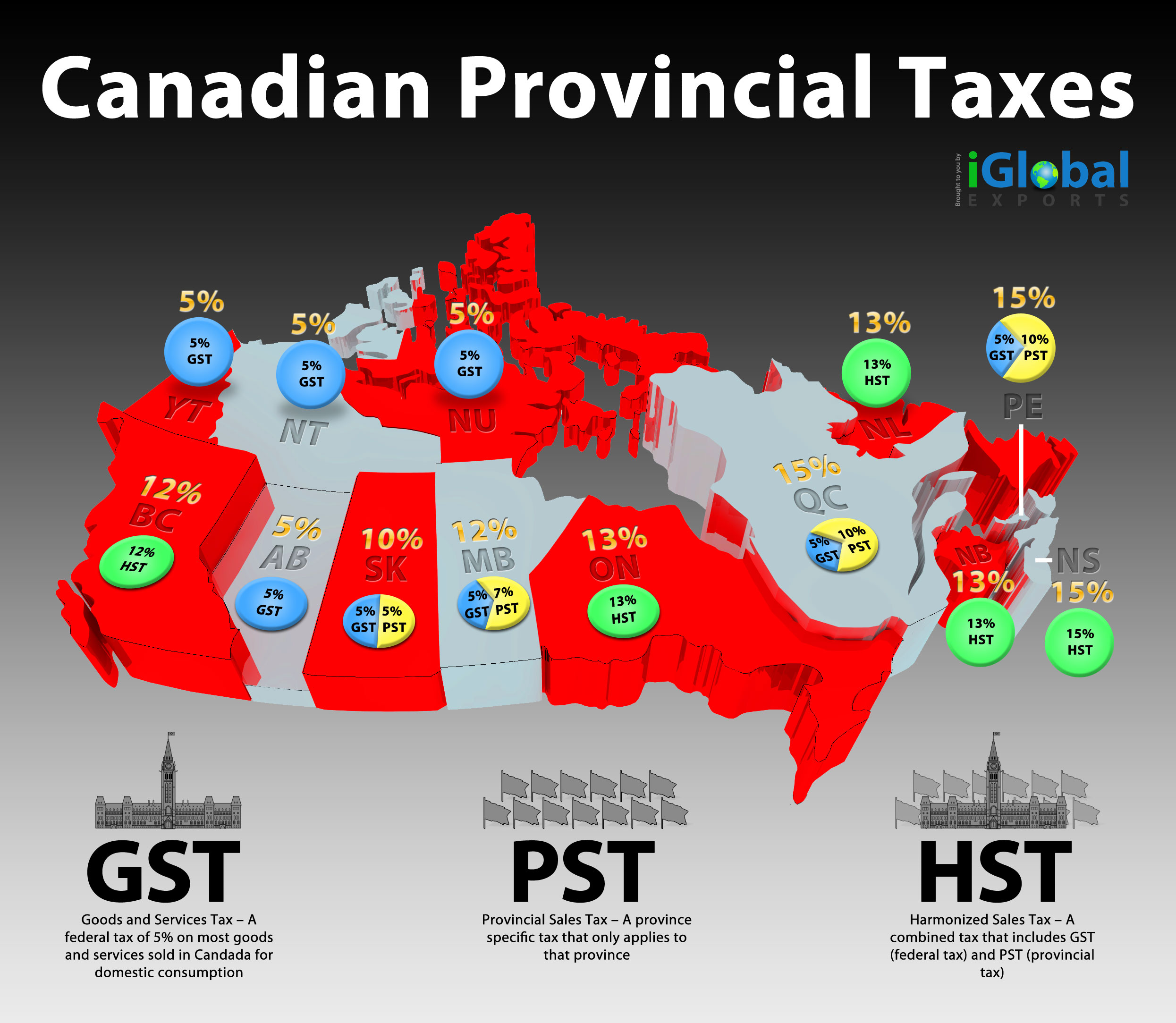

Verkko 25 huhtik 2022 nbsp 0183 32 If your home office qualifies for the tax deduction you can claim a portion of your household expenses For example if your home office takes up 10 Verkko 14 huhtik 2022 nbsp 0183 32 As a Canadian citizen foreign worker or visa holder if you work remotely in Canada you have to pay income taxes in Canada Your tax situation as

Verkko 19 tammik 2021 nbsp 0183 32 Here are the two ways to claim expenses Temporary flat rate method The T777S lets you make a claim without a signed form from your employer or even Verkko 29 maalisk 2022 nbsp 0183 32 Ideas How to Claim Work From Home Expenses on Your Taxes If you spent your time in a home office during 2021 you have two options for filing your

What Tax Deductions Can I Claim Working From Home Walker Financial

https://walkerfs.com.au/wp-content/uploads/2020/07/What-tax-deductions-can-I-claim-working-from-home.jpg

Claiming The Home Office Tax Deduction When Working Remotely Aloha

https://alohainternationalemployment.com/wp-content/uploads/2022/01/working-from-home-tax-relief-1024x682.jpg

https://www.canada.ca/en/revenue-agency/news/2020/12/introducing-a...

Verkko A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked

https://www.canada.ca/en/revenue-agency/news/2020/12/simplifying-the...

Verkko The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual Each individual working from home who meets the

How To Claim Working From Home On Tax Return 2024 Updated RECHARGUE

What Tax Deductions Can I Claim Working From Home Walker Financial

Provincial Taxation In The Ur III State Cuneiform Monographs

During This Time Even The The Smallest Changes In Our Daily Routine Can

WFH 5 Tips To Keep In Mind To Ensure Optimal Internet Connectivity

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

CI Post 2 Do Immigrants Pay Taxes

Canadians Now Paying Lower Income Taxes Than Americans OECD Data Shows

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes

How Do You Claim Working From Home On Your Taxes In Canada - Verkko 6 maalisk 2023 nbsp 0183 32 Working holidaymakers can claim tax relief on home office expenses such as electricity heat and water bills maintenance property taxes home