How Does A Federal Tax Credit Work A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000 A tax credit is the dollar for dollar amount of money that taxpayers subtract directly from the income taxes owed A federal tax credit is granted by the federal

How Does A Federal Tax Credit Work

How Does A Federal Tax Credit Work

https://greatertexassolar.com/wp-content/uploads/2022/11/The-Complete-Federal-Solar-Tax-Credit-Guide-Mason-Kerrville-Llano-Marble-Falls-Fredericksburg-TX-2.jpeg

Hybrid Vehicles 2014 Acetoneon

https://i.pinimg.com/736x/9b/9b/c8/9b9bc8ea7f0aa2d4649851d42a69130b--subaru-vehicles-hybrid-vehicle.jpg

Taxes And Solar How Does The Federal Tax Credit Work For Solar

https://i.ytimg.com/vi/LbH4Y8TQRJ4/maxresdefault.jpg

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the taxes you actually owe a tax credit is a benefit that directly reduces your tax burden 6 7 Individual Taxes Q What are tax credits and how do they differ from tax deductions A Credits reduce taxes directly and do not depend on tax rates Deductions reduce taxable income their value thus depends on the taxpayer s marginal tax rate which rises with income Tax Credits

A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software If you file a paper return you ll need to complete a form and attach it Tax deductions reduce the amount of taxable income you have which in turn reduces your tax bill On the other hand a tax credit decreases your tax bill dollar for dollar Types of tax credits Nonrefundable tax credits A nonrefundable tax credit can reduce your taxes to zero but not below that level

Download How Does A Federal Tax Credit Work

More picture related to How Does A Federal Tax Credit Work

Electric Vehicles That Are Eligible For US Federal Tax Credits

https://www.evehiclesmart.com/updates/wp-content/uploads/2023/02/US-Federal-Tax-Credits-1024x576.jpg

How Does The Federal Solar Tax Credit Work YouTube

https://i.ytimg.com/vi/HoPwzGYYsgM/maxresdefault.jpg

Can I Receive A Federal Tax Credit For Replacing My Windows

https://www.proreplacementwindows.com/wp-content/uploads/2022/02/fed-1030x345.jpg

Tax credits can reduce the amount you owe each year in federal state and sometimes even local income taxes Different from tax deductions which lower your taxable income tax credits can actually shave dollars off your tax bill Here s a breakdown of how they work Eligibility Each tax credit comes with specific requirements you need to meet to claim it These typically involve income levels qualifying expenses or specific actions taken Claiming the Credit When filing your tax return you identify the credits you re eligible for and the amount you re claiming

What is the EITC The EITC is a federal tax credit that offers American workers and families a financial boost The EITC has been benefitting low and moderate income workers for 46 years and many working families receive more money through EITC than they pay in federal income tax Claiming the Credit When filing your tax return you identify the credits you re eligible for and the amount you re claiming Reducing Your Tax Bill The claimed credit directly reduces the taxes you owe

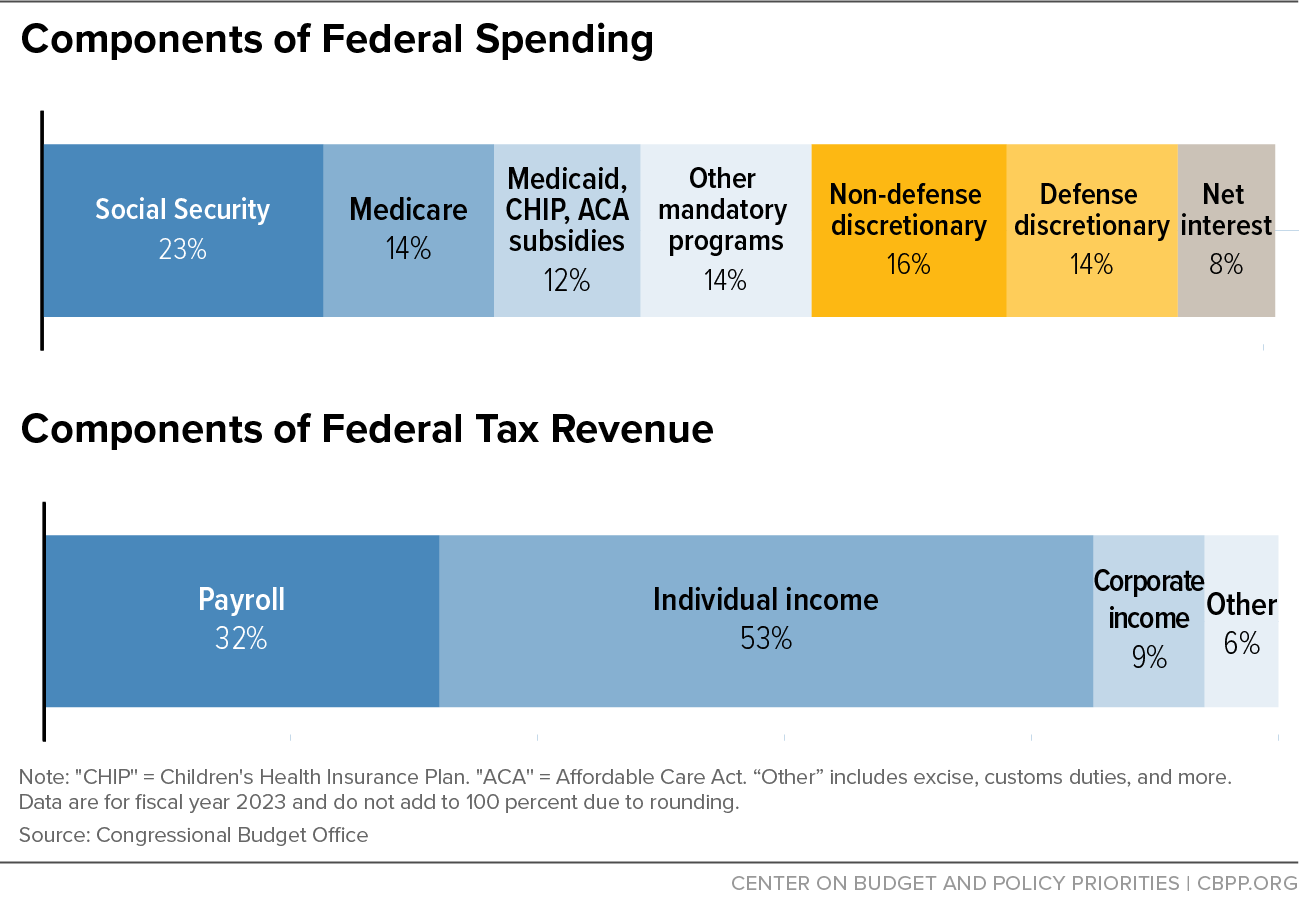

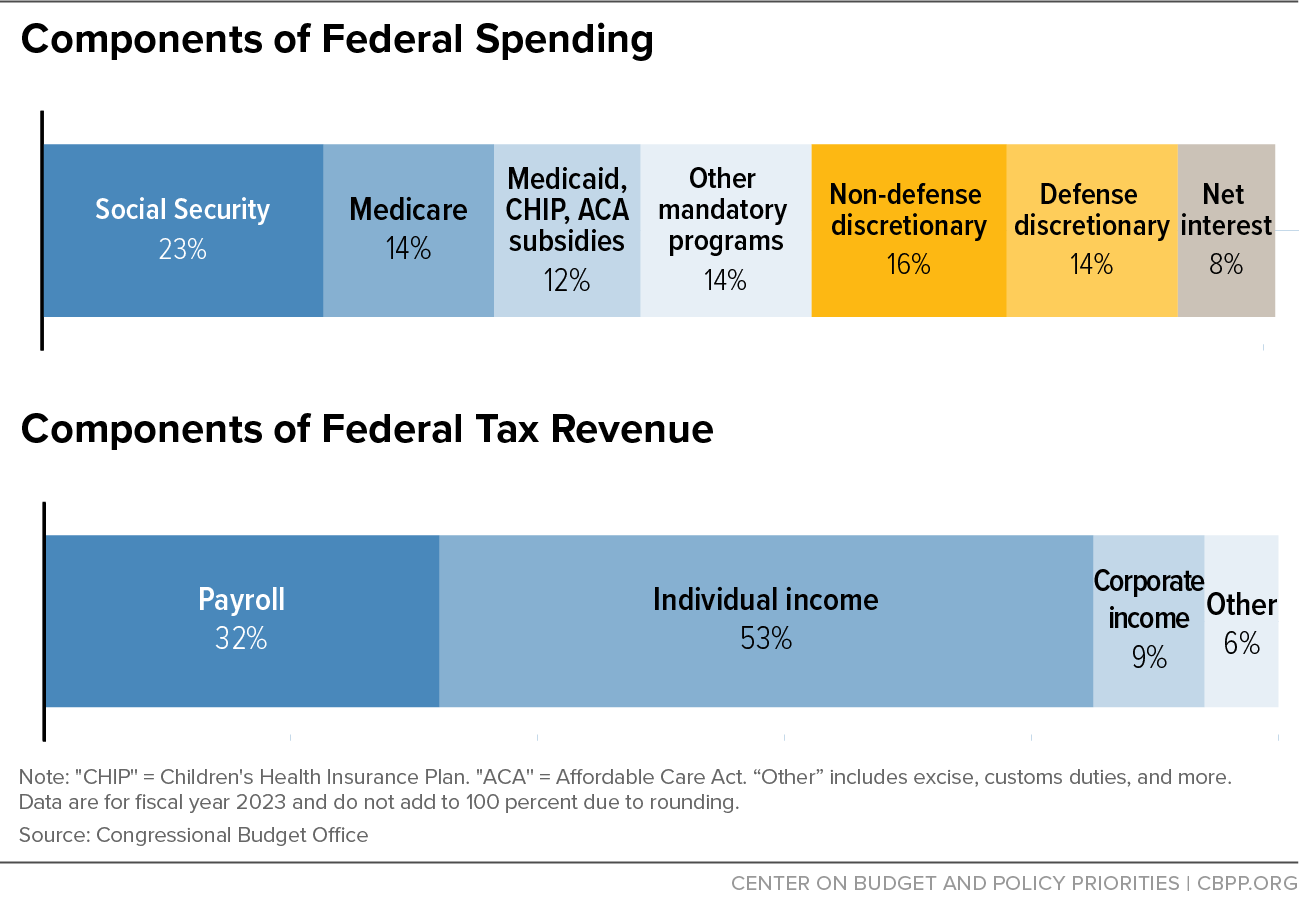

Components Of Federal Spending And Components Of Federal Tax Revenue

https://www.cbpp.org/sites/default/files/2022-10/3-7-03bud-rev10-24-22_f2.png

How Does The Federal Tax Credit Work Do I Get It Instantly Federal

https://i.pinimg.com/736x/be/7b/9c/be7b9c19a395fd159c59010377c832da.jpg

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

https://smartasset.com/taxes/tax-credits

A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000

How To Qualify For Employee Retention Tax Credit

Components Of Federal Spending And Components Of Federal Tax Revenue

Here s Every Electric Vehicle That Currently Qualifies For The US

How Tax Credits Work YouTube

How Does The Federal Solar Tax Credit Work

Act Fast The Solar Tax Credit Will Soon Expire

Act Fast The Solar Tax Credit Will Soon Expire

Child And Dependent Care Tax Credit Get Ahead Colorado

Understanding How Federal Tax Credits Work And Their Benefits The

Who Is Eligible For The Earned Income Tax Credit Medium

How Does A Federal Tax Credit Work - A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the taxes you actually owe a tax credit is a benefit that directly reduces your tax burden