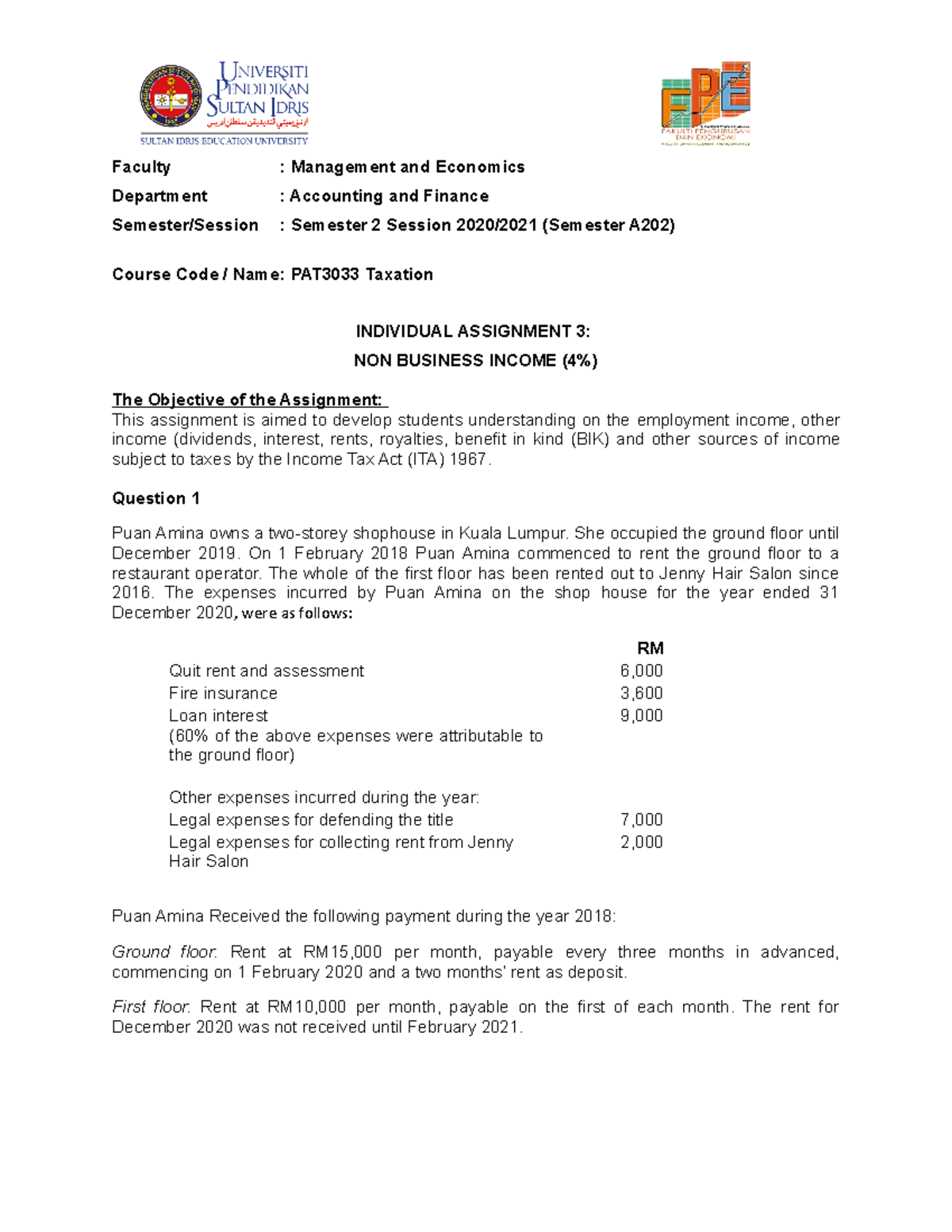

How Is Benefit In Kind Tax Calculated The benefit in kind tax rate also known as the BIK rate is determined by a variety of factors such as the driver s tax bracket the car s CO2 emissions and fuel

Benefit In Kind Tax Calculator How does having a benefit in kind affect your take home pay Taxable perks can reduce your take Broadly speaking benefits in kind are calculated at their cash equivalent value which is defined as the expense incurred in or in connection with provision of the benefit

How Is Benefit In Kind Tax Calculated

How Is Benefit In Kind Tax Calculated

https://images.expertmarket.co.uk/wp-content/uploads/2022/04/Benefit-in-Kind-Tax-1-1024x682.jpeg

Electric Car Tax Breaks Proactive Accounting

https://www.proactive-accounting.com/wp-content/uploads/2022/05/benefit-in-kind-rates-2402298.jpg

Benefit In Kind BIK Tax Rates Calculating Tax On Company Cars

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2021/05/Company-Car-Tax-Benefit-in-Kind-scaled.jpg

Here s a sample benefit in kind calculation Car P11D value 20 000 CO2 emissions 120g km Company car tax band 28 Taxable benefit in kind 5600 28 Benefit in Kind costs for a car are calculated by multiplying a car s P11D value which is closely related to its list price by its BiK rate and then by your income tax

Company car tax or benefit in kind BIK tax applies to anyone who has personal use of a company vehicle In most cases this is likely to be a company car or How do I calculate my BIK tax To calculate the company car or BIK tax multiply the P11D value by the BIK percentage banding then multiply that figure by your tax

Download How Is Benefit In Kind Tax Calculated

More picture related to How Is Benefit In Kind Tax Calculated

What Is Benefit in Kind Tax And How Is It Calculated Real Business

https://realbusiness.co.uk/wp-content/uploads/2022/08/What-Is-Benefit-in-Kind-Tax-And-How-Is-It-Calculated.jpg

CO2 Contribution And Benefit In Kind In 2022 LeasePlan Belgium

https://www.leaseplan.com/-/media/leaseplan-digital/be/business/images/vaa-page/website-header-large-st_20_69.jpg?rev=-1&mw=2600

Electric Cars And Benefit In Kind Tax FAQs GreenCarGuide

https://www.greencarguide.co.uk/wp-content/uploads/2019/05/gcg-confused-faq-header-2640x1040.jpg

There are special rules relating to certain kinds of benefit However in the absence of specific rules the methods cost to the employer and money s worth can be used to To get the amount your company car will cost you in tax per year you then multiply the BiK value by your income tax banding 20 45 In 2023 24 the BiK value

If the value exceeds 1 000 these benefits will be subject to tax Estimating benefits in kind In some cases the value of the benefit will be obvious if you pay an If you provide an employee with a BIK that HMRC considers taxable the employee will have to pay income tax on the financial value of the benefit the cash

Individual Assignment 3 NON Business Income Faculty Management And

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/56fb82a4cf36ac7aad6fe96ba0d6e97e/thumb_1200_1553.png

Car Tax Changes Benefit In Kind Rates Could Rise As Government May

https://cdn.images.express.co.uk/img/dynamic/24/590x/secondary/car-tax-rates-benefit-in-kind-3207059.jpg?r=1629379988599

https://www.moneyexpert.com/car-insurance/benefit...

The benefit in kind tax rate also known as the BIK rate is determined by a variety of factors such as the driver s tax bracket the car s CO2 emissions and fuel

https://www.uktaxcalculators.co.uk/tax-guides/...

Benefit In Kind Tax Calculator How does having a benefit in kind affect your take home pay Taxable perks can reduce your take

Write Off An Employee s Loan Tax Tips Galley And Tindle

Individual Assignment 3 NON Business Income Faculty Management And

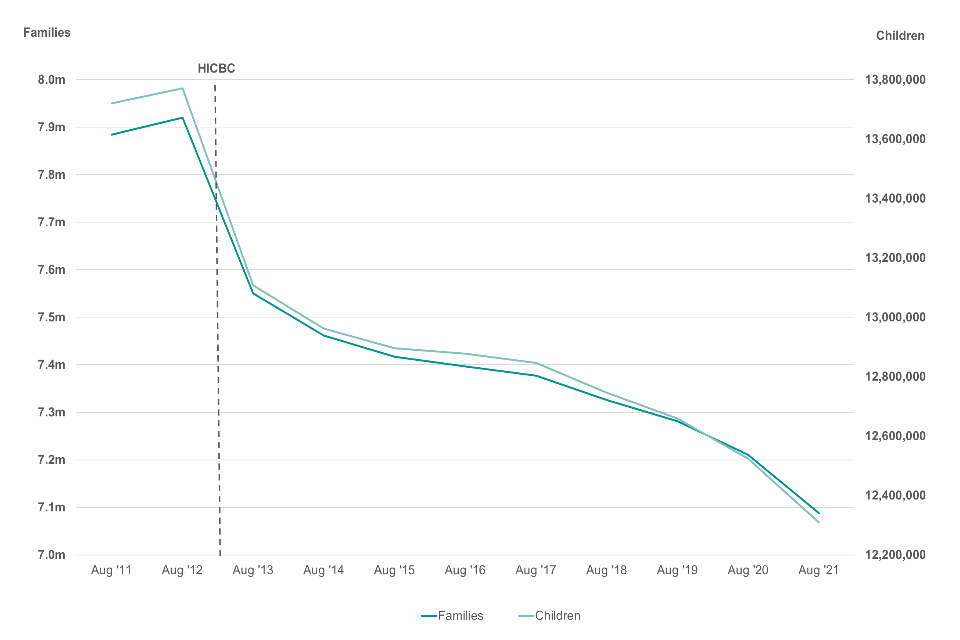

Child Benefit Statistics Annual Release Data As At August 2021 GOV UK

Benefit In Kind What Is It And Is It Taxable Cronin Co

:max_bytes(150000):strip_icc()/Cost-benefitanalysis-3be1b4befc724d8ca1e69760344ece2f.jpg)

What Is Cost Benefit Analysis How Is It Used What Are Its Pros And

Q A How Is Income Tax Calculated J P Accountants

Q A How Is Income Tax Calculated J P Accountants

How Is Agricultural Income Tax Calculated With Example Updated 2022

How Company Car Tax Is Calculated Benefit in kind And P11D Explained

What Is Benefit In Kind Tax mp4 On Vimeo

How Is Benefit In Kind Tax Calculated - How do I calculate my BIK tax To calculate the company car or BIK tax multiply the P11D value by the BIK percentage banding then multiply that figure by your tax