How Is Family Tax Benefit Calculated We pay Family Tax Benefit FTB Part A for each eligible child We work out your payment rate by doing both of the following looking at the ages and number of children in your

There are 2 methods used to calculate the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and

How Is Family Tax Benefit Calculated

How Is Family Tax Benefit Calculated

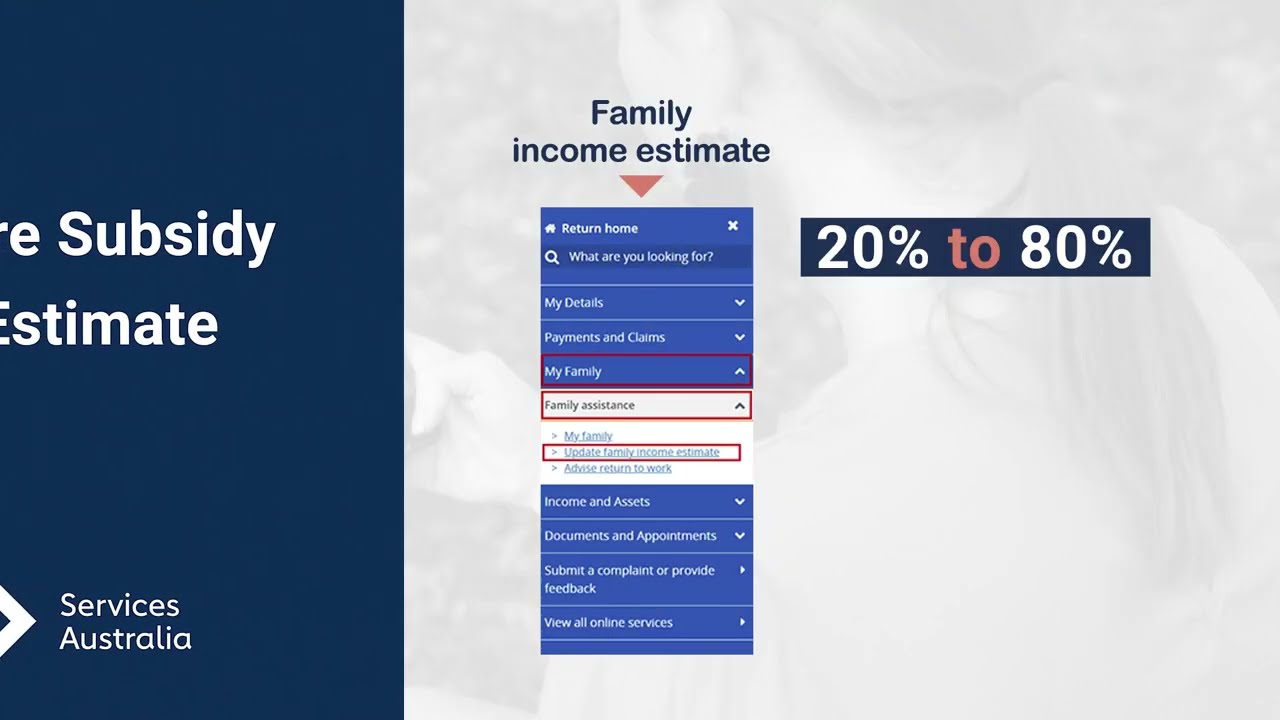

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

Retirement Social Security Benefits Calculator BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/10-free-or-cheap-social-security-calculators-to-help-you-plan.png

How Is Social Security Calculated SimplyWise

https://www.simplywise.com/blog/wp-content/uploads/2020/10/shutterstock_545282368.png

How much Family Tax Benefit Part A can I receive Your FTB A payment rate is calculated by Using your adjusted taxable income and an income test and Looking at the ages and number of children in your The standard rate of FTB Part B is the maximum annual amount payable for a child based on their age without including the supplement and without applying the

Family Tax Benefit FTB is a 2 part payment for eligible families to help with the cost of raising children The Family Tax Benefit is made up of 2 parts Part A a payment There are two methods used to work out the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the

Download How Is Family Tax Benefit Calculated

More picture related to How Is Family Tax Benefit Calculated

What Is Family Tax Benefit And Is It Taxable Income

https://www.bishopcollins.com.au/wp-content/webpc-passthru.php?src=https://www.bishopcollins.com.au/wp-content/uploads/2021/05/family-tax-benefit-part-A.png&nocache=1

What Is Family Tax Benefit And Is It Taxable Income

https://www.bishopcollins.com.au/wp-content/webpc-passthru.php?src=https://www.bishopcollins.com.au/wp-content/uploads/2021/05/family-tax-benefit.png&nocache=1

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

We pay Family Tax Benefit FTB Part B per family We work out your payment rate using your adjusted taxable income and an income test If you share caring responsibilities for Family Tax Benefit Family Tax Benefit is a payment to help families with the cost of raising child ren To be eligible for Family Tax Benefit you must be a parent

What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim FTB Part A is designed to help families with the cost of raising children Payment of FTB Part A is based on the combined income of a family and is paid in

How To Claim The Family Tax Benefit One Accountancy

https://oneaccountancy.com.au/wp-content/uploads/2022/09/Lodgment-Reminder-Family-Tax-Benefit-Recipients-e1663163157328.png

APSS Defined Benefit Calculated Newsroom

https://cdn.australianretirementtrust.com.au/library/media/images/web/newsroom/apss-db-calculation.png?rev=483df2118cfb43ecb4d8c12811771635

https://www.servicesaustralia.gov.au/family-tax...

We pay Family Tax Benefit FTB Part A for each eligible child We work out your payment rate by doing both of the following looking at the ages and number of children in your

http://operational.servicesaustralia.gov.au/.../families/...

There are 2 methods used to calculate the rate of Family Tax Benefit FTB Part A depending on whether the family s adjusted taxable income ATI is above or below the

How Is The Single Benefit Calculated Do All Families Have To Go

How To Claim The Family Tax Benefit One Accountancy

What Is Family Tax Recovery Canadian Tax Refunds

Lodge Your 2021 Tax Return Before June 30 To Avoid Losing Family Tax

Do I Qualify For Family Tax Benefit

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

How Is Social Security Benefit Calculated Mistersocialsecurity

How Is The Maximum Social Security Benefit Calculated

Card News What Is Family Tax Benefit SBS Korean

How Is Family Tax Benefit Calculated - The standard rate of FTB Part B is the maximum annual amount payable for a child based on their age without including the supplement and without applying the