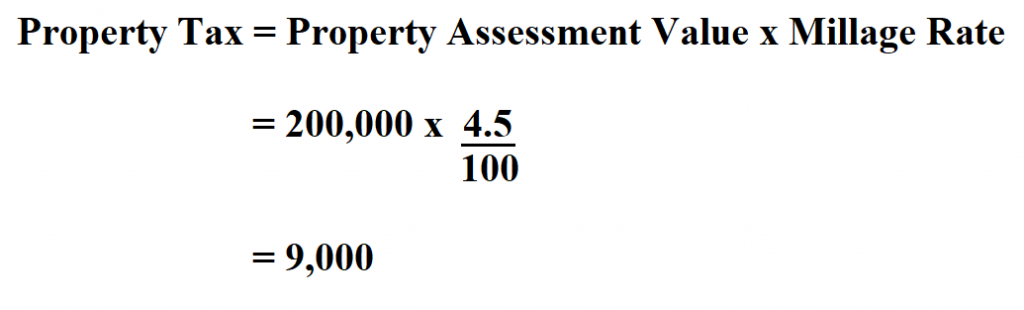

How Is Property Tax Calculated On A House In The Philippines In general the assessment of real property tax follows this formula Real Property Tax Rate x Assessed Value For instance if your property is in Metro Manila and the assessed value is 1 000 000 your real

A Remember that the RPT rate in Metro Manila is 2 and for provinces it is 1 To get the real property tax computation use this formula RPT RPT rate x assessed value To compute how much in total real property tax RPT needs to paid we multiply the RPT rate by the assessed value The RPT rate is 2 percent for properties located in the cities and municipality in Metro Manila and 1 percent for those in the provinces 1 Actual use of property House and lot 2 Location Metro Manila 3 Fair market value of property based on Tax Declaration Land Php500 000 Building and structures Php500 000 4

How Is Property Tax Calculated On A House In The Philippines

How Is Property Tax Calculated On A House In The Philippines

https://i.ytimg.com/vi/nrWry5i3TBU/maxresdefault.jpg

Estate Tax Loss Swan Wealth

https://swanwealth.com/wp-content/uploads/2020/02/State-Tax-Loss-dplic-207264826.jpg

/filters:quality(60)/2020-04-14-How-to-Calculate-Property-Tax-CDN.png)

How To Calculate Property Tax Ownerly

https://own-content.ownerly.com/fit-in/750x0/filters:format(jpeg)/filters:quality(60)/2020-04-14-How-to-Calculate-Property-Tax-CDN.png

Buying property in the Philippines involves navigating a complex landscape of taxes including but not limited to Capital Gains Tax CGT Real Property Tax RPT Transfer Tax Value Added Tax VAT Documentary Stamp Tax DST and property rental income tax Real estate tax can be computed using the formula Real Estate Income Tax Real Estate Rate X Assessed Value wherein the assessed value for a property is defined by the fair market price multiplied by the assessed value set in ordinances The appraised value is defined by its taxable value

The property consists of a parcel of land valued at Php 10 000 000 00 while the structure of the house itself also known as building or improvement is valued at Php 8 000 000 00 Learning how to compute the real property tax starts with determining the total assessed value of the property According to the Local Government Code of 1991 or Republic Act no 7160 property owners are required by the law to pay the Real Property Tax RPT every year Here are some of the FAQ about the Real Property Tax that you need to know What is Real Property Tax Revenues of the Local Government Units are earned from their local

Download How Is Property Tax Calculated On A House In The Philippines

More picture related to How Is Property Tax Calculated On A House In The Philippines

How Is Property Tax Calculated YouTube

https://i.ytimg.com/vi/YRmpytcoP1U/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGBcgPih_MA8=&rs=AOn4CLCAASccTJPZ8RyZoX3DzblnYEirBQ

How To Calculate Your Property Taxes YouTube

https://i.ytimg.com/vi/oLpqH7w8cS8/maxresdefault.jpg

How To Calculate Property Tax

https://www.learntocalculate.com/wp-content/uploads/2020/06/propertyy-tax-2-1024x310.png

How to compute real estate property taxes Here s the formula to calculate RPT in the Philippines Real Property Tax Rate x Assessed Property Value Real Property Tax Where Fair Market Value x Assessment Level Assessed Property Value The variables of the equation are defined as In the Philippines property taxes are primarily governed by the Local Government Code of 1991 Republic Act No 7160 which sets out the framework for the assessment and collection of real property taxes by local government units LGUs Calculation of Assessed Value The Assessed Value AV is calculated by multiplying

Assessed Value determined by ordinances x Tax Rate 1 or 2 Real Property Tax To Illustrate the computation Juan Dela Cruz is the owner of a residential property which consists of both house and lot in Pasig City The fair market value of the lot is at P5 000 000 while the house is at 8 000 000 To compute your Real Estate Tax simply multiply the Rate which varies depending on the type of property and the LGU by the Assessed Value of your property The formula looks like this Real Property Tax Rate x Assessed Value This calculation gives you the annual amount you re expected to pay in real property taxes

Property Tax Calculator And Complete Guide

https://rethority.com/wp-content/uploads/2020/12/910459_Property-Tax-Calculator_1_120720.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

https://www.moneymax.ph/.../articles/real-property-tax

In general the assessment of real property tax follows this formula Real Property Tax Rate x Assessed Value For instance if your property is in Metro Manila and the assessed value is 1 000 000 your real

https://www.lamudi.com.ph/journal/real-property-tax-in-the-philippines

A Remember that the RPT rate in Metro Manila is 2 and for provinces it is 1 To get the real property tax computation use this formula RPT RPT rate x assessed value To compute how much in total real property tax RPT needs to paid we multiply the RPT rate by the assessed value

Property Tax Receipt November 30 1896 UNT Digital Library

Property Tax Calculator And Complete Guide

How To Calculate Income Tax On Salary With Example

How High Are Property Taxes In Your State Tax Foundation

How Is Property Tax Calculated In California The Tech Edvocate

Property Tax Hello

Property Tax Hello

Top 14 La County Property Tax Payment Inquiry 2022

My Property Taxes Are What Understanding New Hampshire s Property

Understanding California s Property Taxes

How Is Property Tax Calculated On A House In The Philippines - Real estate tax can be computed using the formula Real Estate Income Tax Real Estate Rate X Assessed Value wherein the assessed value for a property is defined by the fair market price multiplied by the assessed value set in ordinances The appraised value is defined by its taxable value