How Many Times Can You Claim Solar Tax Credit Eligibility for claiming the solar tax credit multiple times depends on specific IRS criteria Officially called the Investment Tax Credit ITC this credit allows taxpayers to deduct

How many times can I claim the solar tax credit Homeowners can claim the solar tax credit once per solar and or battery system installed on an eligible property and the credit You can claim solar credit for each project if you have multiple solar projects Additionally the solar credit can be carried forward to future tax years if the credit exceeds

How Many Times Can You Claim Solar Tax Credit

How Many Times Can You Claim Solar Tax Credit

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Solar Tax Credit What You Need To Know NRG Clean Power

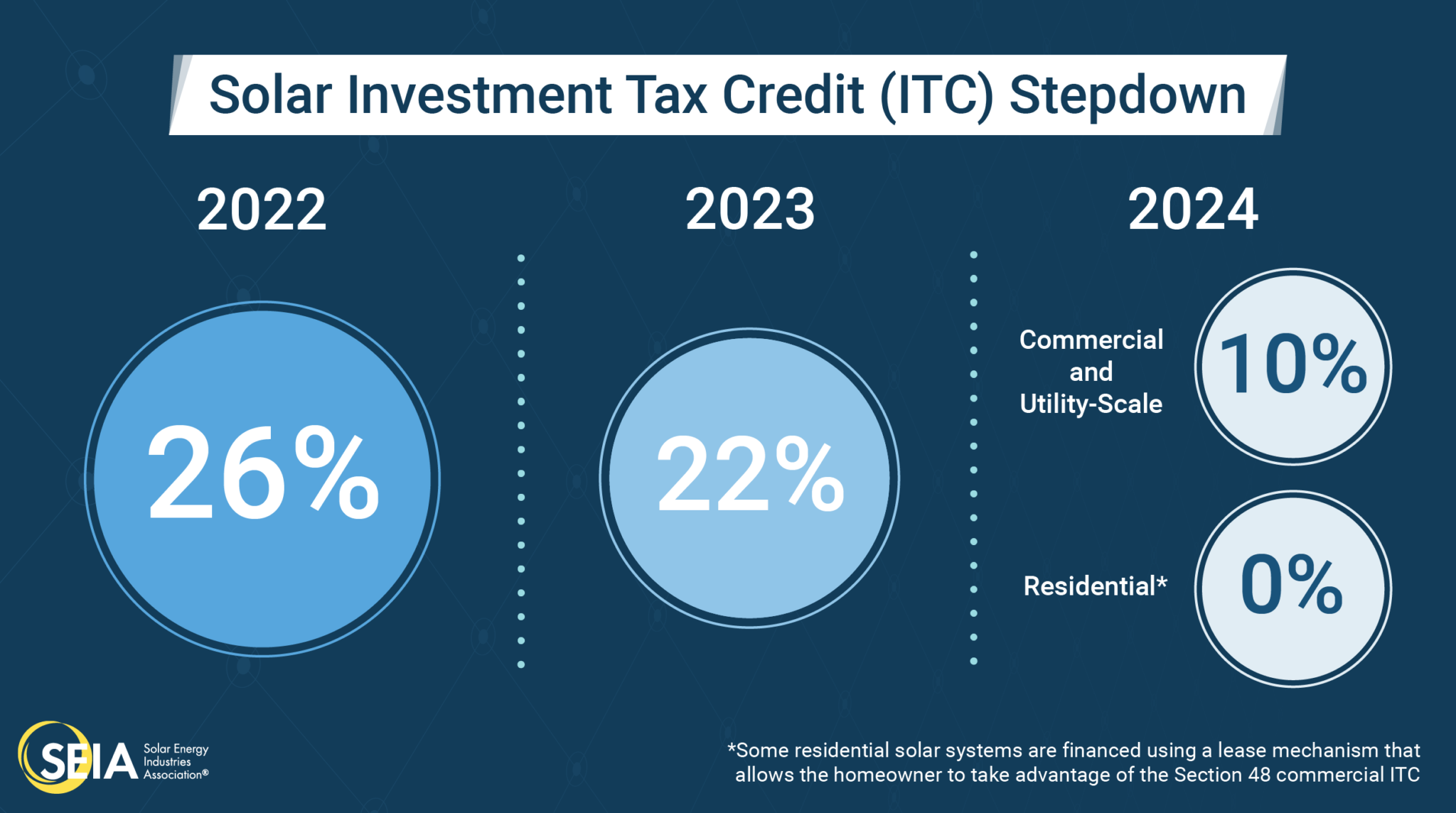

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

How Many Years Can I Claim Solar Tax Credit YouTube

https://i.ytimg.com/vi/NWOSYlRLgc4/maxresdefault.jpg

No you cannot claim the solar tax credit twice The credit is designed to encourage people to install solar panels by offering a tax break and claiming it twice would defeat the In this article we ll explore the ins and outs of the Solar Tax Credit in 2024 and 2025 including eligibility limitations and how often you can claim it

The answer is that you can claim the tax credit every time you install a new solar system As long as the homeowner owns the system they are eligible to claim the ITC This You can claim the solar tax credit only once However you may be able to claim it more times in case you have more than one solar powered property

Download How Many Times Can You Claim Solar Tax Credit

More picture related to How Many Times Can You Claim Solar Tax Credit

Understanding How Solar Tax Credits Work Credit

https://www.credit.com/blog/wp-content/uploads/2019/02/solar-tax-credit1.jpg

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

The credit for solar upgrades has been extended through 2034 empowering more homeowners to switch to solar Find out if you qualify and learn how to claim the solar tax credit to recoup the cost of your solar installation Technically you cannot claim the tax credit more than once in case you have one home or business But if you have more than one property with solar projects installed then one can claim the tax credits for multiple

Assuming the Inflation Reduction Act gets signed yes 26 USC 25D a 1 allows a taxpayer to take a tax credit for qualified solar electric property expenditures Yes you can claim the solar credit in more than one year as long as it reflects payments made in each of those years As for timing the costs can t be deferred and costs

How To Claim Solar Tax Credit Wheelhouse Credit Union

https://www.wheelhousecu.com/files/iStock-985363900-1114x530-1.png

Your Guide To Solar Federal Tax Credit

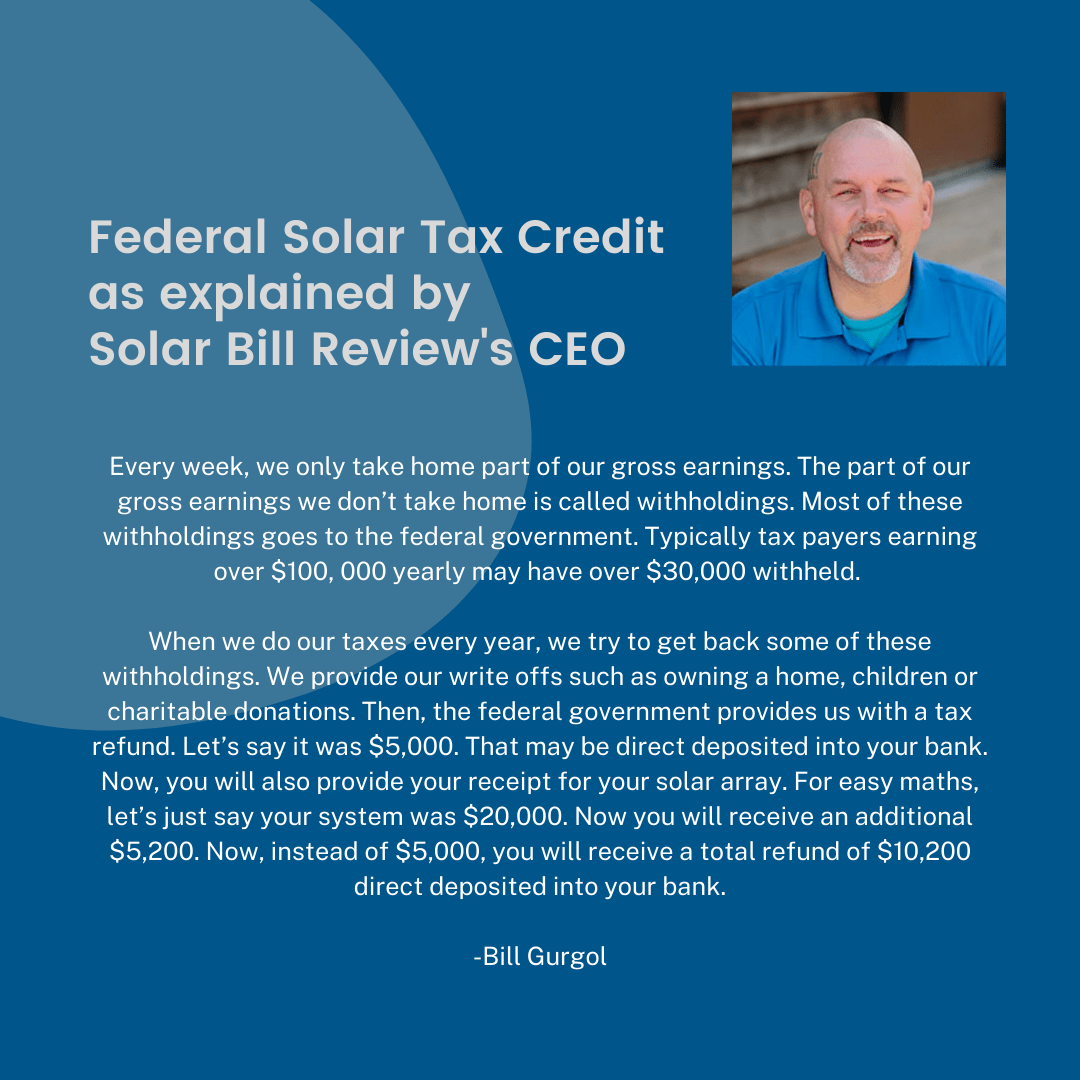

https://solarbillreview.com/wp-content/uploads/2021/10/ITC-Explanation-v3.png

https://accountinginsights.org › can-you-claim-the...

Eligibility for claiming the solar tax credit multiple times depends on specific IRS criteria Officially called the Investment Tax Credit ITC this credit allows taxpayers to deduct

https://www.solar.com › learn › frequently-asked...

How many times can I claim the solar tax credit Homeowners can claim the solar tax credit once per solar and or battery system installed on an eligible property and the credit

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

How To Claim Solar Tax Credit Wheelhouse Credit Union

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

The 30 Solar Tax Credit Has Been Extended Through 2032

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

The Federal Solar Tax Credit What You Need To Know 2022

8 Incredible Tips How To Claim Solar Tax Credit Outbackvoices

Federal Solar Tax Credit Guide Atlantic Key Energy

How Many Times Can You Claim Solar Tax Credit - No you cannot claim the solar tax credit twice The credit is designed to encourage people to install solar panels by offering a tax break and claiming it twice would defeat the