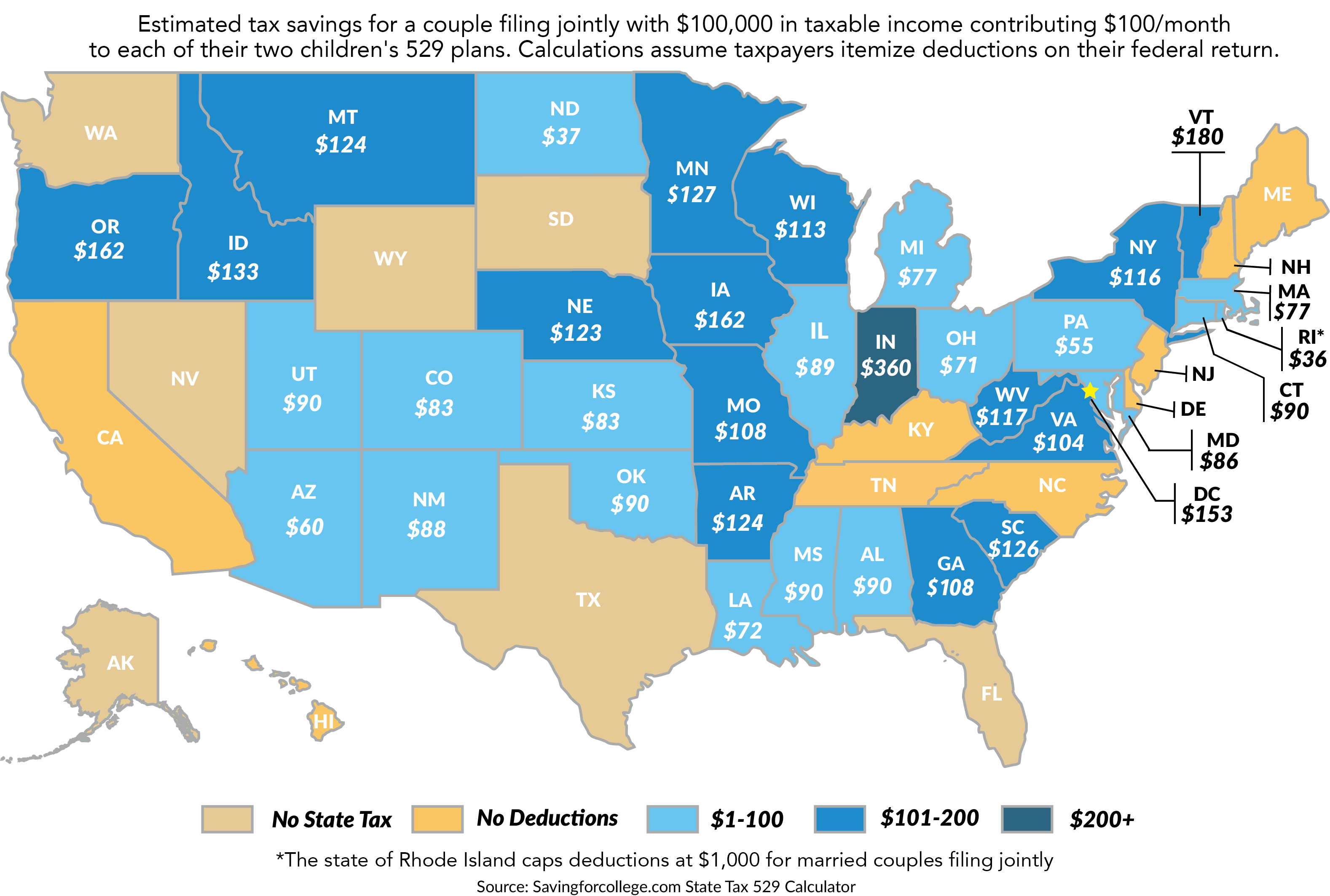

How Much 529 Is Tax Deductible Contributions to a 529 plan aren t tax deductible for federal income tax purposes However more than 30 states provide tax deductions or credits of varying amounts for these

In most states the total amount or a portion of a taxpayer s 529 plan contribution is deductible in computing state income tax But Indiana Oregon Utah and Vermont offer a state income tax credit for In short 529 contributions are not tax deductible on the federal level However some states consider contributions tax deductible Defer to your state treasurer for more info Plus 529 plans offer other tax benefits

How Much 529 Is Tax Deductible

How Much 529 Is Tax Deductible

https://webresources-savingforcollege.s3.amazonaws.com/images/original-state-map-2017-12.png

529 Plan Contribution Limits Rise In 2023 YouTube

https://i.ytimg.com/vi/zPe0mzYuoC8/maxresdefault.jpg

Everything You Need To Know About 529 Tax Deductions

https://tate.cmacmillanmarin-admin.com/wp-content/uploads/2022/05/529-taxes-student-loans-og.jpg

The main tax benefit of a 529 plan is that you can grow your contributions tax free and any withdrawals are tax free as long as you use them for qualifying 529 State Tax Calculator Answer a few simple questions to see whether your state offers a tax benefit for 529 plan contributions and if so how much it might be

Unlike an IRA contributions to a 529 plan are not deductible and do not have to be reported on federal income tax returns What s more the investment earnings in your account are not reportable until the year Even better withdrawals are tax free as long as you use the money to pay for qualified education expenses which typically include tuition books school supplies and room and board Because

Download How Much 529 Is Tax Deductible

More picture related to How Much 529 Is Tax Deductible

Is A 529 Tax Deductible Diversified Tax

https://diversifiedllctax.com/wp-content/uploads/2023/09/featured-image-for-blogs-1160x665-2023-09-07T084431.040-1024x587-1024x585.jpg

Are 529 Plans Tax Deductible In New Jersey Simon Quick Advisors

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Everything You Need To Know About 529 College Savings Plans In 2023

https://529-planning.com/wp-content/uploads/2020/12/GettyImages-182175346-5c4e721dc9e77c0001d7bb0f.jpg

As the cost of college tuition skyrockets parents and grandparents can take advantage of tax efficient 529 plans and higher limits on gift and estate taxes How much of a 529 plan is tax deductible Tax deductions differ from state to state and some are a lot more generous than the rest For instance if you contribute 5 000 to a 529 plan in Indiana you ll get

A 529 plan can be a tax advantaged way to save for college Learn whether you can get a 529 tax deduction and how to use it to save on taxes Contributions to a 529 plan are not eligible for federal income tax deductions However the earnings in a 529 plan grow tax deferred and are not taxed

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

https://www.investopedia.com/terms/1/52…

Contributions to a 529 plan aren t tax deductible for federal income tax purposes However more than 30 states provide tax deductions or credits of varying amounts for these

https://www.savingforcollege.com/article/…

In most states the total amount or a portion of a taxpayer s 529 plan contribution is deductible in computing state income tax But Indiana Oregon Utah and Vermont offer a state income tax credit for

How Much Should You Have In A 529 Plan By Age

Is The NC 529 Plan Tax Deductible CFNC

Are 529 Plans Tax Deductible Edelman Financial Engines

What Are The 529 Contribution Limits For 2023

Overfunded 529 Plan These Are Tax Efficient Solutions

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert

Are Mission Trips Tax Deductible

Is Oregon 529 College Savings Plan Tax Deductible EverythingCollege info

Contributions To College Savings Plans Pick Up As Inflation Eases The

How Much 529 Is Tax Deductible - Even better withdrawals are tax free as long as you use the money to pay for qualified education expenses which typically include tuition books school supplies and room and board Because