How Much Can I Claim For Travel Expenses Markku can claim commuting expenses based on the use of a private car Markku s annual holiday is 1 month so the deduction is calculated for a period of 11 months The average number of working days per month is 22

There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim deductions for any commuting and travel expenses in 2025 Submit the expenses for tax card File travel expenses in MyTax How much is the tax deduction for commuting in my tax return for 2024 HAR s 2023 business travel expense list guides you on what travel expenses you can write off Check our free PDF a travel expense calculator expert advice

How Much Can I Claim For Travel Expenses

How Much Can I Claim For Travel Expenses

https://cdn.cocodoc.com/cocodoc-form/png/57571426--expenses-claim-form--x-01.png

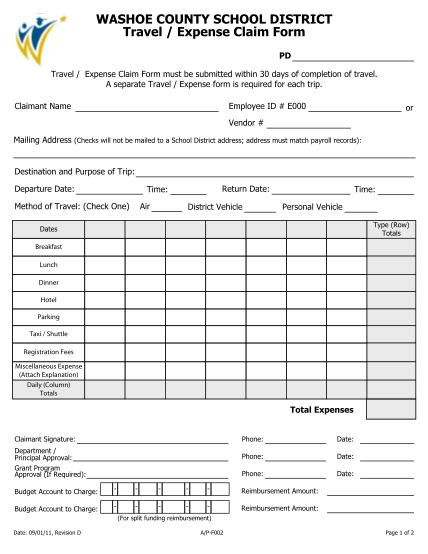

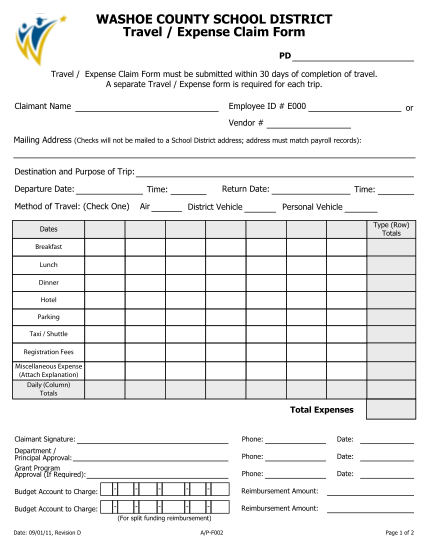

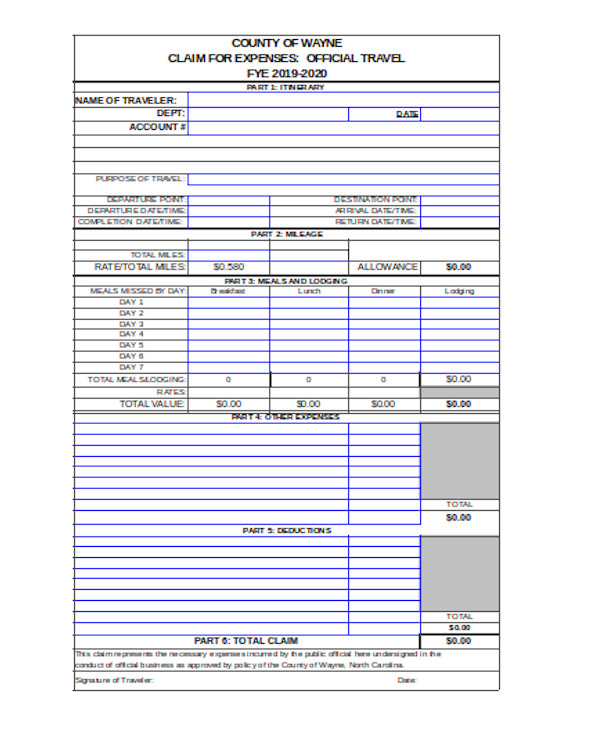

Stunning Travel Expenses Claim Form In Excel Account Tracking Spreadsheet

https://i.pinimg.com/originals/86/de/84/86de846193af9ac19563aafa3c39cfd2.jpg

Travel Expenses Claim Letter Template

https://writolay.com/wp-content/uploads/2021/08/86-letter-to-claim-travel-expenses.png

The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances If you re self employed or a 1099 contractor you can claim the business travel tax deduction You don t have to be flying first class or staying at a fancy hotel Here s everything you can and can t write off and how to take this deduction

Whether someone travels for work once a year or once a month figuring out travel expense tax write offs might seem confusing The IRS has information to help all business travelers properly claim these valuable deductions As an employer paying your employees travel costs you have certain tax National Insurance and reporting obligations This includes costs for Subsistence includes meals and any other necessary

Download How Much Can I Claim For Travel Expenses

More picture related to How Much Can I Claim For Travel Expenses

What Travel Costs Can I Claim As A Business Expense When I Travel Full

https://images.squarespace-cdn.com/content/v1/5510bad9e4b0ce924f0445c5/1591045269227-VP84B76ENM22TGRFB25R/Can+I+claim+my+travel+expenses+as+business+expenses+when+I+travel+full+time+as+a+digital+nomad+or+full-time+RVer.+NuventureCPA.com

Blank Expense Claim Form Hot Sex Picture

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Expenses Form Template Free In With Images My XXX Hot Girl

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

Expenses you can claim Your business can claim a deduction for travel expenses related to your business whether the travel is taken within a day overnight or for many nights Expenses you can claim include airfares train tram bus taxi or ride sourcing fares If you have to travel for your work you may be able to claim tax relief on the cost or money you ve spent on food or overnight expenses

You can only claim the total amount you spent on work related travel For example if you received 1500 worth of travel allowances from your employer during the year but the cost of your travel was 1 000 you can only claim 1 000 worth of travel deductions on your return Deductibility of travel costs mainly airfares are dependent on the purpose of the travel The current view of the ATO is that if the travel was predominantly for work related purposes then the airfares are claimable

Can Small Business Owners Claim Meals And Travel Expenses Pandle

https://www.pandle.com/wp-content/uploads/2017/11/Travel-Expenses.jpg

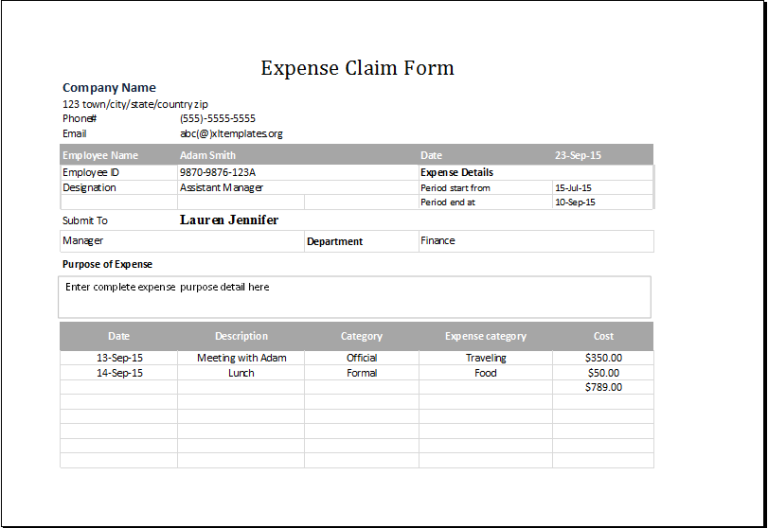

EXCEL Of Expense Claim Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190822/468eb21a039146b7a06c76a652c95c70.jpg

https://www.vero.fi › ... › commuting-expenses

Markku can claim commuting expenses based on the use of a private car Markku s annual holiday is 1 month so the deduction is calculated for a period of 11 months The average number of working days per month is 22

https://www.vero.fi › en › individuals › deductions › travel-expenses

There are many different travel expenses that qualify for tax deductions on the condition that they relate to your work You can already now claim deductions for any commuting and travel expenses in 2025 Submit the expenses for tax card File travel expenses in MyTax How much is the tax deduction for commuting in my tax return for 2024

Letter To Claim Travel Expenses 10 Samples

Can Small Business Owners Claim Meals And Travel Expenses Pandle

Sample Travel Expense Report How To Create A Travel Expense Report

How Much Travel Expenses Can I Claim

EXCEL Of Expenses Claim Sheet xlsx WPS Free Templates

Travel Expense Claim Form Template Expense Reimbursement Form Free

Travel Expense Claim Form Template Expense Reimbursement Form Free

Businesses Receiving A Compulsory Purchase Order What Can I Claim For

The Ultimate List Of Self Employed Expenses You Can Claim

PDF T l charger 2014 Travel Claim Form Gratuit PDF PDFprof

How Much Can I Claim For Travel Expenses - As an employer paying your employees travel costs you have certain tax National Insurance and reporting obligations This includes costs for Subsistence includes meals and any other necessary