How Much Can You Claim For Meals On Taxes 2023 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27 2020 the deductibility of meals is changing Food and beverages were 100 deductible if

Meals are still tax deductible 50 of their cost can be deducted Business Meal Tax Deduction How to Write Off Food The standard meal allowance which is the federal meals and incidental expense M IE per diem rate The GSA website lists these rates by location Note that

How Much Can You Claim For Meals On Taxes

How Much Can You Claim For Meals On Taxes

https://www.visory.com.au/wp-content/uploads/2022/08/how-much-can-you-claim-for-laundry-845x321.jpg

How Much Can You Claim For Medical Negligence

https://www.mesotheliomahope.com/wp-content/uploads/2018/07/bigstock-142733894-780x400.jpg

Can You Claim For Asbestosis

https://europepmc.org/articles/PMC7840719/bin/ajcr0011-0043-f1.jpg

IR 2020 225 September 30 2020 WASHINGTON The Internal Revenue Service issued final regulations on the business expense deduction for meals and entertainment The deduction for business meals is generally limited to 50 of the unreimbursed cost If you re self employed you can deduct travel expenses on

The IRS released guidance on Thursday explaining when the temporary 100 deduction for restaurant meals is available and when the 50 limitation on the deduction for food and beverages continues to Deductions you can claim Meals entertainment and functions Deductions for meals snacks overtime meals entertainment and functions Meals and snacks With limited

Download How Much Can You Claim For Meals On Taxes

More picture related to How Much Can You Claim For Meals On Taxes

RAF Loss Of Support Claims When And How Much Can You Claim

https://abrbuzz.co.za/images/2022/RAFLogo.jpg

Can You Claim For Asbestos Exposure

https://img.yumpu.com/52484920/1/500x640/rheumatoid-arthritis.jpg

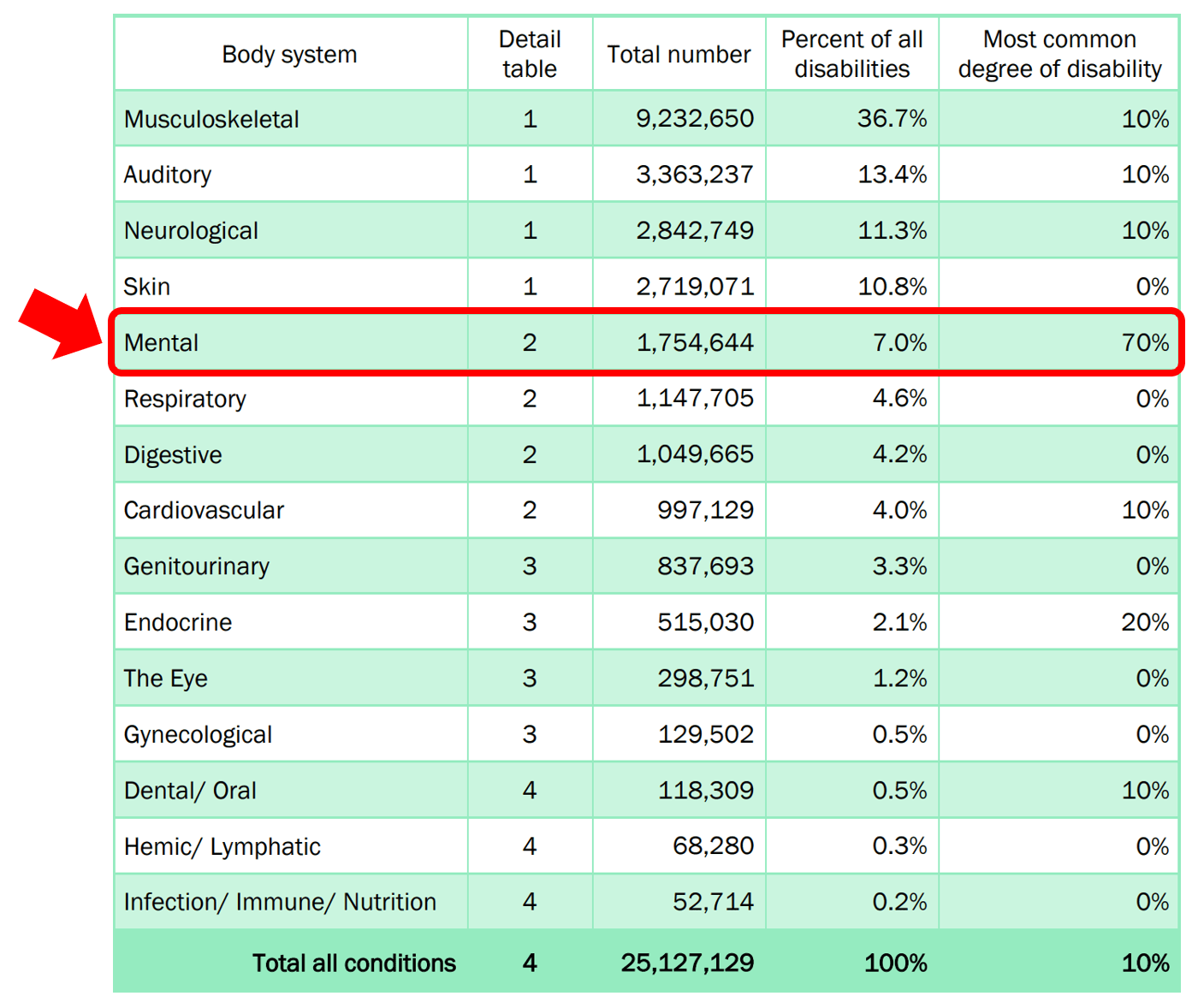

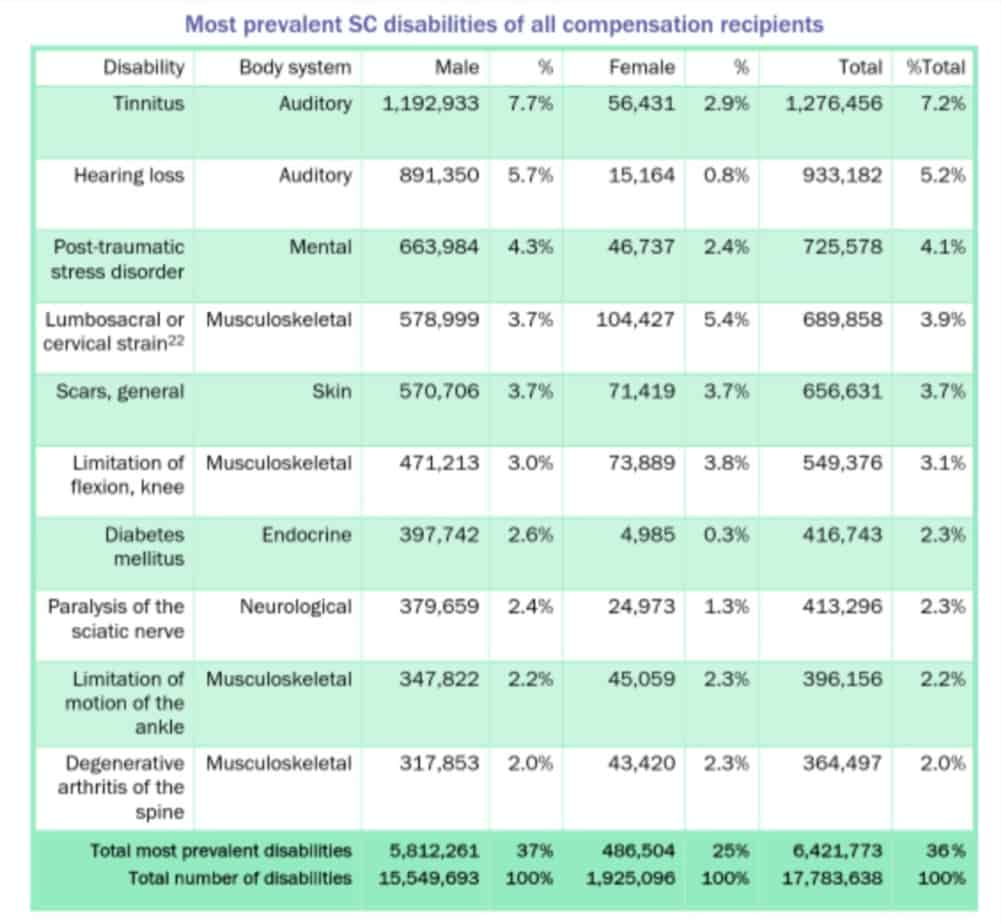

VA List Of Disabilities VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/va-disability-hearing-loss-chart-best-picture-of-chart.png

Claiming food and beverage expenses The maximum amount you can claim for food beverages and entertainment expenses is 50 of the lesser of the following amounts Meal expenses If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent If you choose the

Using Form 2106 EZ you can deduct up to 50 percent of the actual cost of the meal If your employer reimburses you for your travel expenses you can only claim up to 50 percent TL2 is a Claim for Meals and Lodging Expenses form Use this form if you are working as a transport employee and were required to pay for your own meals and

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-hanfincal.jpg

Can You Claim Doctor Copayments On Your Taxes AnchorAndHopeSF

https://cdn.anchorandhopesf.com/can_i_clame_dr_copay_on_taxes.jpg

https://www.bench.co/blog/tax-tips/deduct-m…

2023 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27 2020 the deductibility of meals is changing Food and beverages were 100 deductible if

https://www.keepertax.com/posts/freelancers …

Meals are still tax deductible 50 of their cost can be deducted Business Meal Tax Deduction How to Write Off Food

How Much Can You Claim For A Broken Leg Beacon Law

How Many Kids Can You Claim On Taxes Hanfincal

Is A Collapsed Drain An Insurance Claim Interior Magazine Leading

How Does The Medical Expense Tax Credit Work In Canada

VA Non Service Connected Disability Pay Chart VA Disability Rates 2021

Standard Deduction How Much Can You Claim On Your 2022 And 2023

Standard Deduction How Much Can You Claim On Your 2022 And 2023

How Much Can You Claim For Asbestosis

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

What Benefits Can You Claim If You Have Dementia

How Much Can You Claim For Meals On Taxes - The CRA has also increased the rate at which transport employees and other individuals can claim meal expenses using the simplified method a flat rate per