How Much Can You Deduct For Gambling Losses On Schedule A If you itemize you can claim your gambling losses up to the amount of your winnings on Schedule A Itemized Deductions under Other Miscellaneous Deductions You cannot reduce your

For gambling losses this requires compliance with IRS guidelines Deductions such as medical expenses mortgage interest and charitable contributions are reported on The short answer is yes You can absolutely deduct those gambling losses However you can only do so based off of how much you ve won in cold hard gambling cash This means in order to write off your losses you

How Much Can You Deduct For Gambling Losses On Schedule A

How Much Can You Deduct For Gambling Losses On Schedule A

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

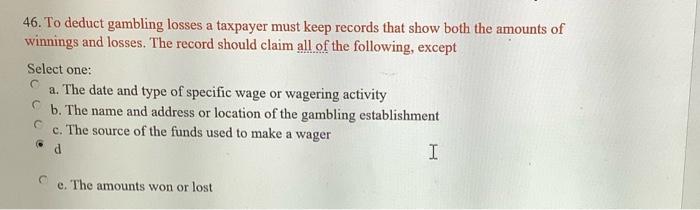

How To Document Gambling Losses For Irs Cleverph

http://cleverph.weebly.com/uploads/1/2/5/2/125262053/419924241.jpg

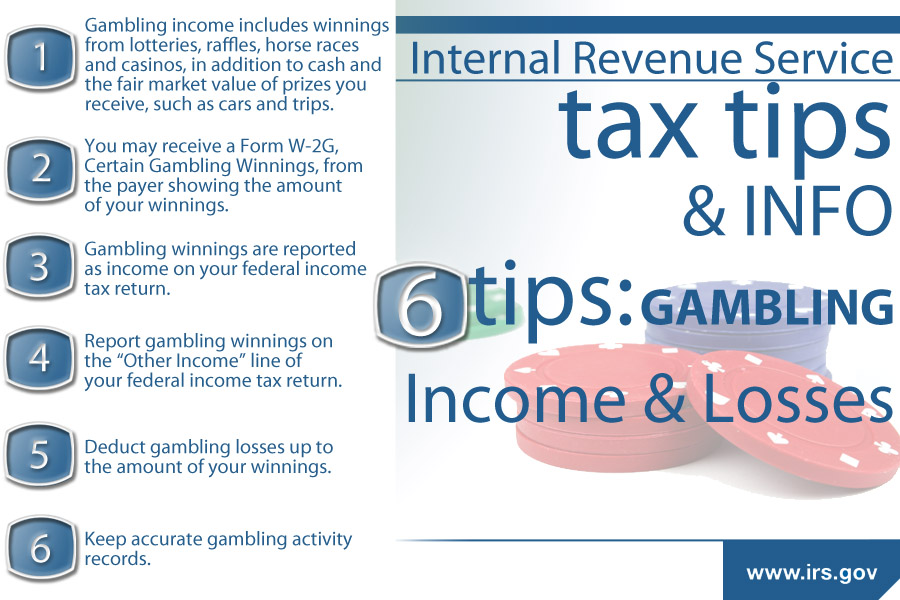

6 Tips On Gambling And Income Taxes Don t Play The IRS For A Sucker

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/17834/tumblr_mquwjxyxX21roj7sjo1_1280_1_.54c2a4e28d5a1.png

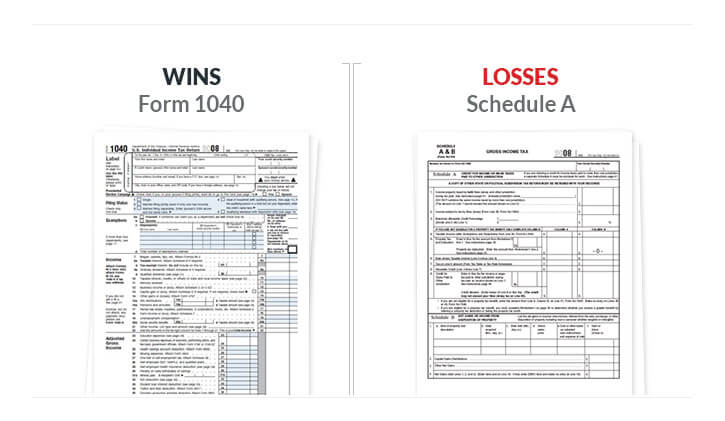

If you itemize deductions you can deduct your gambling losses for the year on line 27 Schedule A Form 1040 Your gambling loss deduction cannot be more than the amount of gambling You are allowed to list your annual gambling losses as a miscellaneous itemized deduction on Schedule A of your tax return If you lost as much as or more than you won

You are allowed to list your annual gambling losses as an itemized deduction on Schedule A of your tax return If you lost as much as or more than you won during the year you won t have Schedule A Form 1040 If you choose to itemize your deductions you ll report your gambling losses as a miscellaneous deduction on Schedule A Form 1040 Due date Schedule A Form 1040 is due by the tax filing deadline which is

Download How Much Can You Deduct For Gambling Losses On Schedule A

More picture related to How Much Can You Deduct For Gambling Losses On Schedule A

Can You Deduct Gambling Losses From Your Taxes Geek4news

https://i.kinja-img.com/gawker-media/image/upload/s--M84RvSgs--/c_fit,fl_progressive,q_80,w_636/sgvujornxx2oqkiildtz.jpg

/157564580-56a9392d5f9b58b7d0f961e8.jpg)

Can Gambling Losses Deducted Your Tax Return Managementever

https://fthmb.tqn.com/HtDDxsQa7Zj2oJOQPMgyYED38f8=/768x0/filters:no_upscale()/157564580-56a9392d5f9b58b7d0f961e8.jpg

Gambling Losses 2018 Tax Law Renewlu

http://renewlu897.weebly.com/uploads/1/2/5/2/125247245/937637877.jpg

How much can I deduct in gambling losses You can report as much as you lost in 2023 but you cannot deduct more than you won Remember you can only do this if you re itemizing your Gambling losses including those from losing lottery tickets can be deducted but only up to the amount of your gambling winnings For example if you won 5 000 and lost

How much can I deduct in gambling losses You can report as much as you lost in 2023 but you cannot deduct more than you won Remember you can only do this if you re If you are not a professional gambler your winnings are taxable and reported on schedule 1 line 8 losses are limited to the income and are reported on schedule A as an

Form 1040 Gambling Winnings And Losses YouTube

https://i.ytimg.com/vi/uwfODJPn6dU/maxresdefault.jpg

Lots Of NFL Football Betting This First Sunday Of The Season Don t

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e202a2eed56c7a200d-600wi

https://www.irs.gov › pub › irs-utl › OC-Knowthefive...

If you itemize you can claim your gambling losses up to the amount of your winnings on Schedule A Itemized Deductions under Other Miscellaneous Deductions You cannot reduce your

https://accountinginsights.org › can-you-offset...

For gambling losses this requires compliance with IRS guidelines Deductions such as medical expenses mortgage interest and charitable contributions are reported on

How Much Can You Deduct For Business Mileage In 2023

Form 1040 Gambling Winnings And Losses YouTube

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)

2023 Form 1040 Sr Printable Forms Free Online

Michigan Residents Can Now Deduct Gambling Losses On Tax Returns

Where To Report Gambling Losses On Tax Return

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Solved How Much Can She Deduct Were You Being A Tax Professional

Solved 46 To Deduct Gambling Losses A Taxpayer Must Keep Chegg

What Is A Casino Win Loss Statement And What Does It Do For A Player

How Much Can You Deduct For Gambling Losses On Schedule A - To deduct gambling losses you must itemize your deductions on Schedule A Form 1040 Here s how it works Itemize Your Deductions You must choose to itemize your deductions rather