How Much Cpp Is Deducted From My Paycheck Ontario The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

Date modified 2023 11 30 Determine which method you can use to calculate deductions get the Canada Pension Plan CPP contributions tables the Employment The Cpp deduction calculator takes into account your income age and other factors to determine the amount of Cpp deductions you need to pay The calculator uses

How Much Cpp Is Deducted From My Paycheck Ontario

How Much Cpp Is Deducted From My Paycheck Ontario

https://allmancpa.com/wp-content/uploads/2020/08/pexels-karolina-grabowska-4386367.jpg

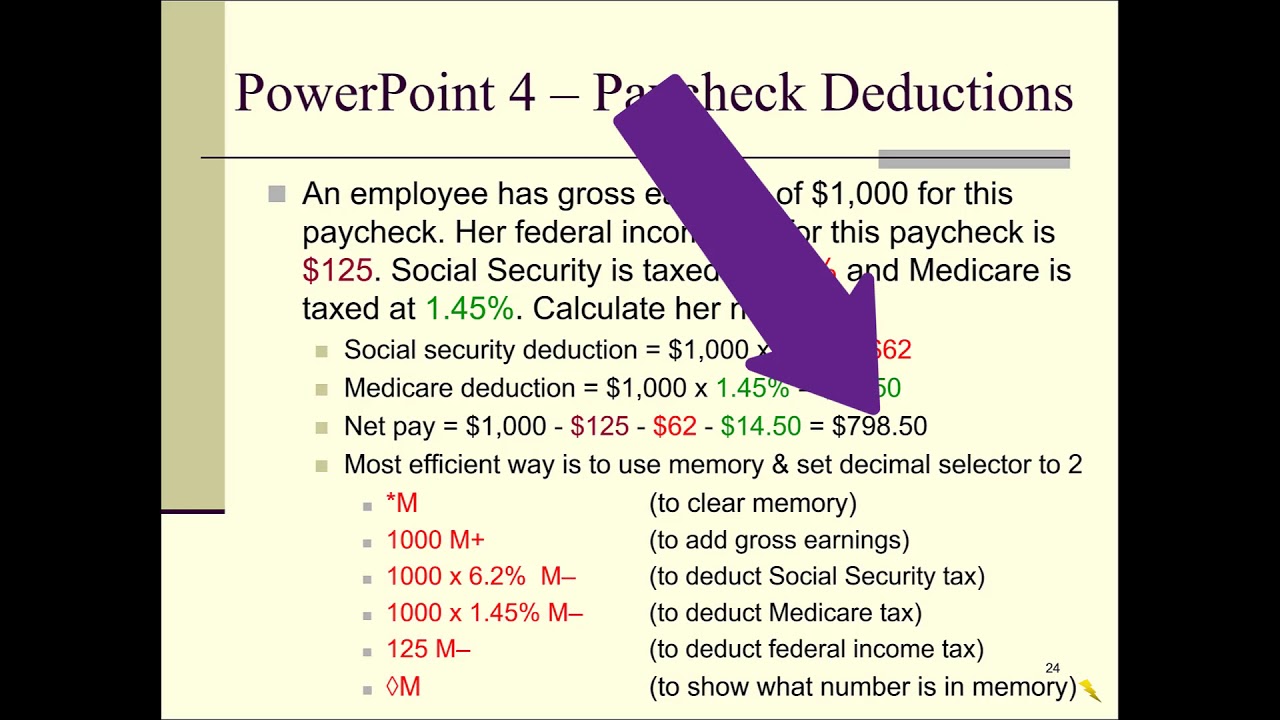

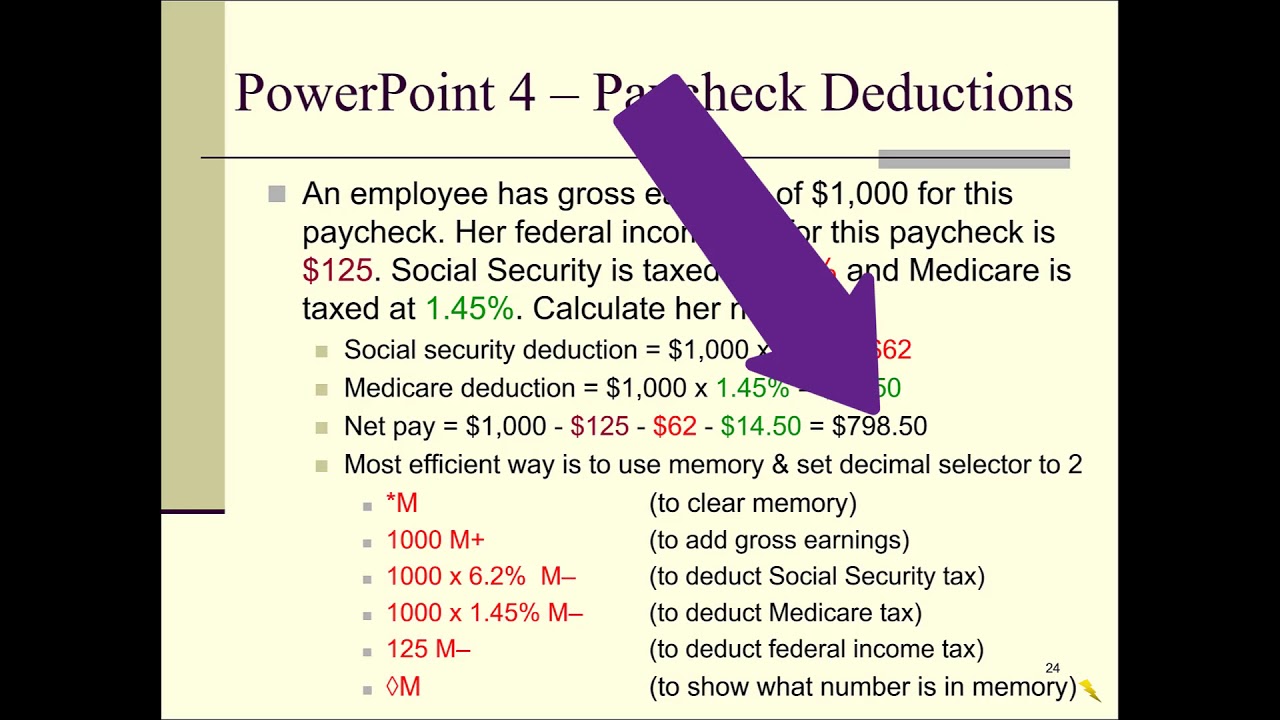

How Much Taxes Deducted From Paycheck In Ga Georgia

https://www.allaboutcareers.com/wp-content/uploads/2022/05/Taxes-Deducted-From-Paycheck-in-Ga.jpg

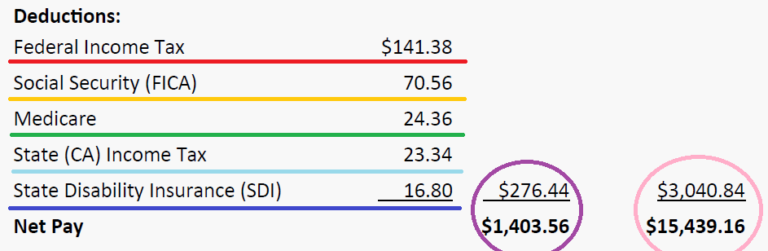

Anatomy Of A Paycheck Understanding Your Deductions Fidelity

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/LC/infographic/Anatomy_of_a_paycheck_Desktop_Image_Module_1_Hero_Image.png

Calculate payroll deductions and contributions Learn about CPP contributions EI premiums and income tax deductions how to calculate the deductions on the Your employee notifies you that they have reached the maximum CPP contribution for the year They tell you that they had 1 700 in CPP contributions deducted by a previous

The tax calculation in Ontario is simple All you have to do is take your total earnings add the exempted amounts and then deduct the tax deductions and credits that you are How much do you contribute to CPP QPP Calculating your employee s CPP QPP contribution isn t as tricky as it might sound You can determine the amount manually or use one of the following tools

Download How Much Cpp Is Deducted From My Paycheck Ontario

More picture related to How Much Cpp Is Deducted From My Paycheck Ontario

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax

https://i.ytimg.com/vi/Q8AqcgJTp5Y/maxresdefault.jpg

Visualizing Taxes Deducted From Your Paycheck In Every State

https://cdn.howmuch.net/articles/how-much-money-gets-taken-out-paychecks-1542.jpg

How Much Does Government Take From My Paycheck Federal Paycheck

https://www.surepayroll.com/contentassets/2b05e761f6c24fcb8150cb0efd6aa690/how-much-federal-taxes-is-taken-out-of-my-paycheck.jpg

How much and for how long you contributed to the CPP your average earnings throughout your working life For 2024 the maximum monthly amount you could receive if you Contributions to CPP are compulsory for all working Canadians aged 18 70 and for 2022 the contribution amount is 5 7 for both employees and employers When you retire you can apply to

Summary If you make 52 000 a year living in the region of Ontario Canada you will be taxed 14 043 That means that your net pay will be 37 957 per year or 3 163 per ON basic personal amount 11 865

How To Calculate Net Income California Haiper

https://i.ytimg.com/vi/Omxh157P-8U/maxresdefault.jpg

Understanding Your Paycheck Deduction Codes Lifestyle Mirror

https://www.lifestylemirror.com/wp-content/uploads/2020/03/thehoth76924-1360x460.jpg

https://www.canada.ca/en/revenue-agency/services/e...

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

https://www.canada.ca/en/revenue-agency/services/...

Date modified 2023 11 30 Determine which method you can use to calculate deductions get the Canada Pension Plan CPP contributions tables the Employment

Indiana Paycheck Taxes

How To Calculate Net Income California Haiper

Janice Plut Minor Ontario Tax Calculator Cobor i In Fiecare Zi Te

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The Truth About Your Paycheck Finance Free Life

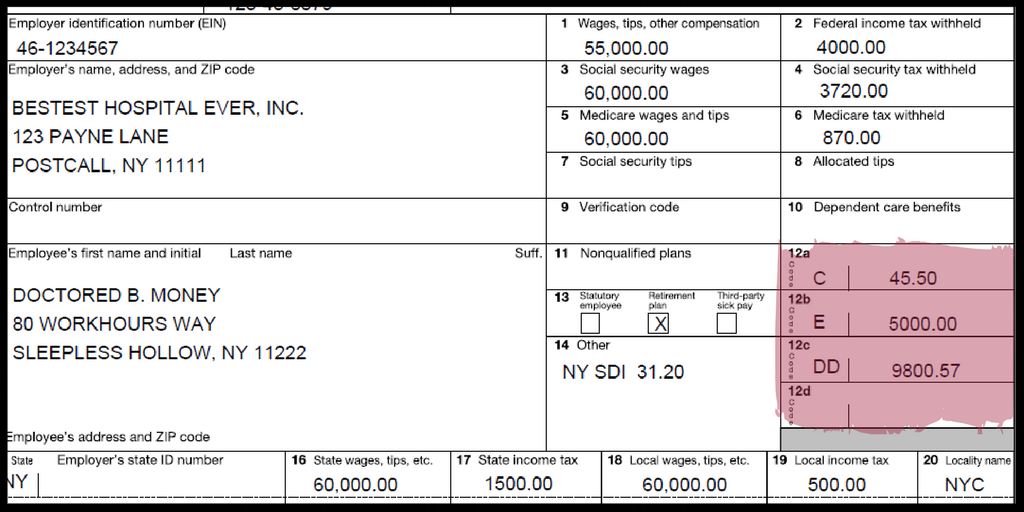

W 2 Doctored Money

W 2 Doctored Money

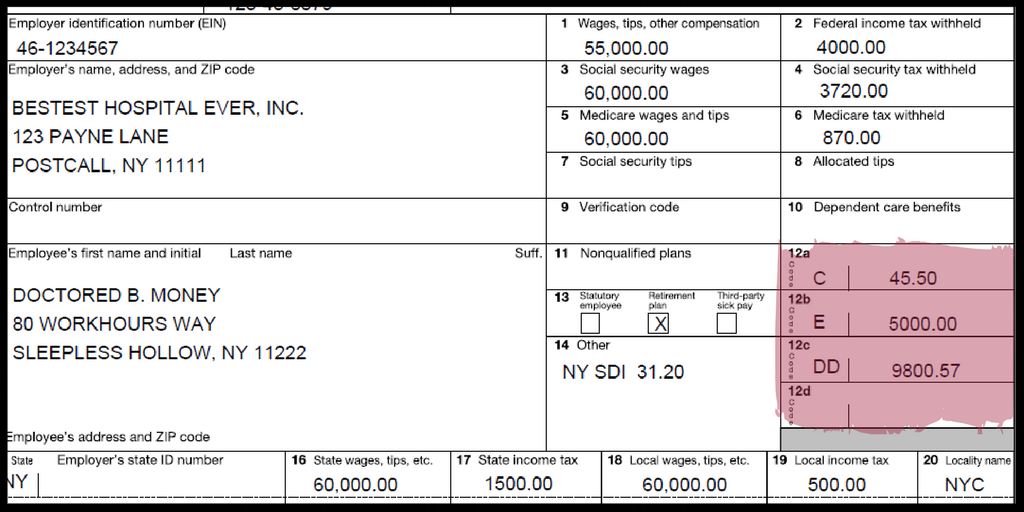

Understand Paycheck Deductions Talkin Money Minutes

Explaining Paychecks To Your Employees

EzPaycheck How To Add A New Payroll Deduction And Withhold It From

How Much Cpp Is Deducted From My Paycheck Ontario - The tax calculation in Ontario is simple All you have to do is take your total earnings add the exempted amounts and then deduct the tax deductions and credits that you are