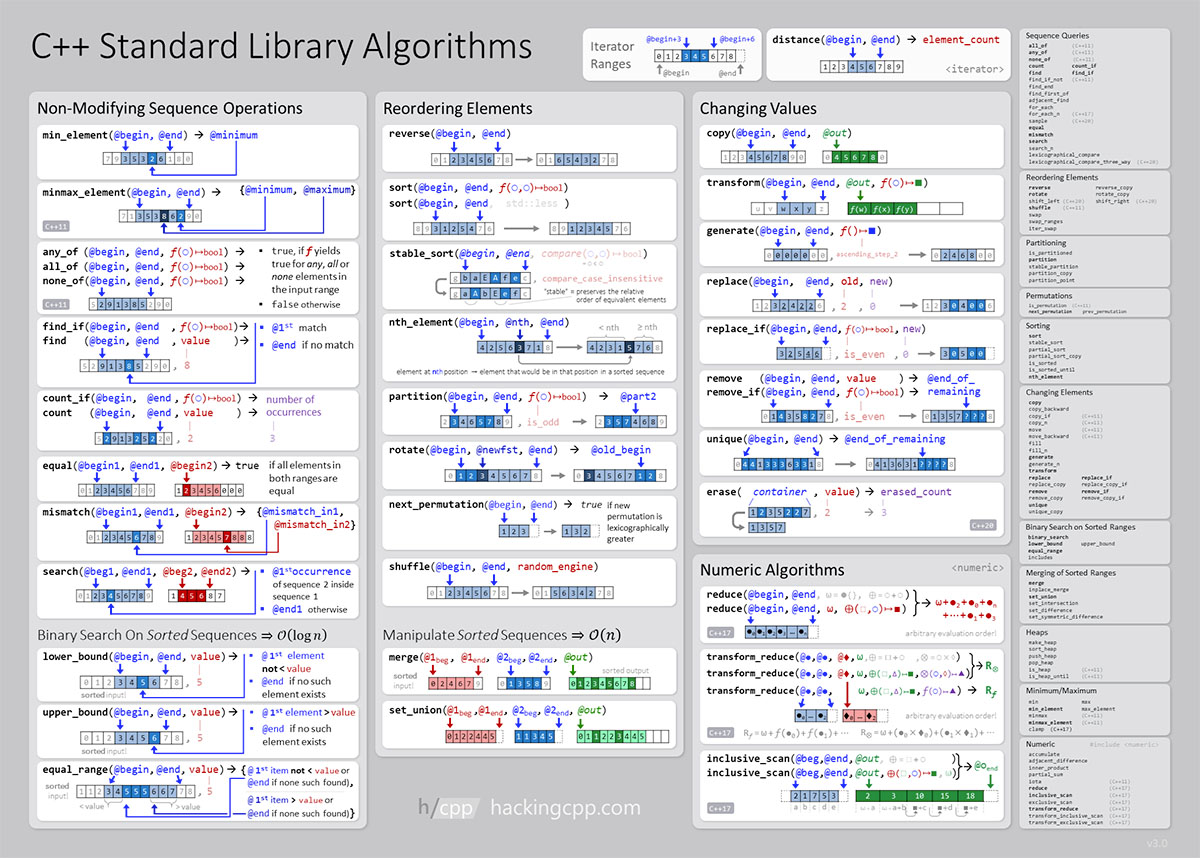

How Much Cpp Is Deducted Web It contains tables for federal and provincial tax deductions CPP contributions and EI premiums It will help you determine the payroll deductions for your employees or

Web 2 Zeilen nbsp 0183 32 6 Dez 2023 nbsp 0183 32 The Cpp deduction calculator takes into account your income age and other factors to determine Web The average monthly amount paid for a new retirement pension at age 65 in October 2023 was 758 32 Your situation will determine how much you ll receive up to the maximum

How Much Cpp Is Deducted

How Much Cpp Is Deducted

https://www.fool.ca/wp-content/uploads/2021/12/CPP-Contribution-Rates-Maximums-Exemptions-768x315.png

Understanding CPP How Much CPP Will You Get HomeEquity Bank

https://www.chip.ca/wp-content/uploads/Understanding-CPP.jpg

Will CPP Benefits Be Deducted From Long Term Disability Benefits

https://www.yglaw.ca/wp-content/uploads/2022/02/Will_CPP_Benefits_Be_Deducted_From_Long-Term_Disability_Benefits.jpeg

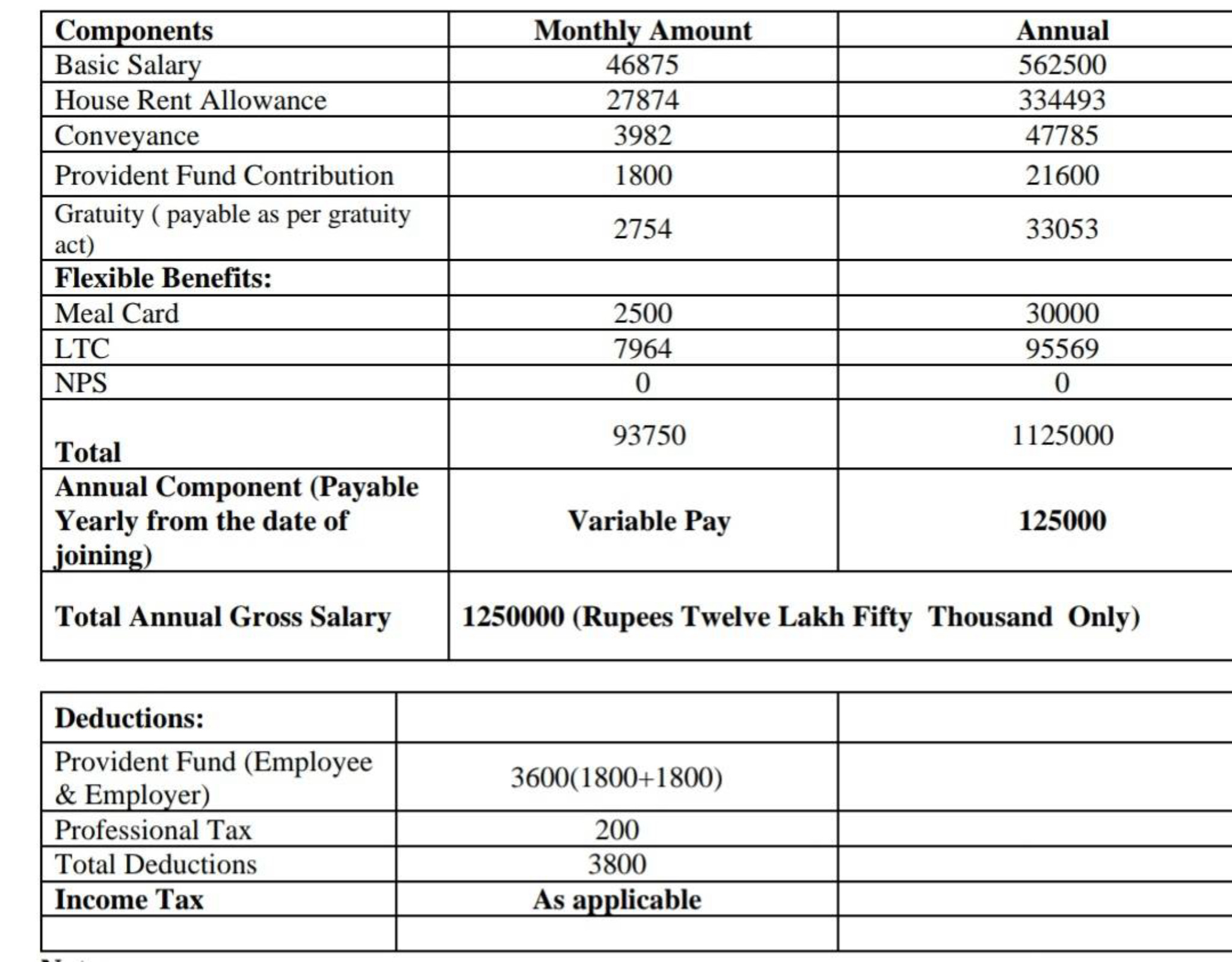

Web 1 Jan 2024 nbsp 0183 32 For each year the CRA provides the Maximum pensionable earnings Year s basic exemption amount Rate you use to calculate the amount of CPP contributions to Web Generally you must deduct CPP contributions from Salary wages or other remuneration Commissions Bonuses Most taxable benefits Honorariums Certain tips and gratuities To

Web You can ask that federal income tax be deducted from your monthly payments by signing into your My Service Canada Account or completing the Request for voluntary Federal Web 6 Dez 2023 nbsp 0183 32 Under the CPP contributions are deducted from your salary or wages on every pay period These contributions are mandatory and the amount you are required

Download How Much Cpp Is Deducted

More picture related to How Much Cpp Is Deducted

Canada Pension Plan Enhancement Taxes Budgeting And Investments

https://www.saskatchewan.ca/-/media/images/finance/table-3---after-tax-cost-of-additional-cpp-contributions-for-wage-earners-of-various-levels.png?la=en&hash=8CCF6CA36A52D7E3DE3DE8FF1415E642

Everything You Need To Know About The Enhanced CPP From How Much You

https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2019/01/cpp-1.jpg

How Much Tax Is Deducted From My Monthly Salary Fishbowl

https://dslntlv9vhjr4.cloudfront.net/posts_images/fIUjzl6VNs2HG.jpg

Web 2 Jan 2024 nbsp 0183 32 The first tier works similarly to the old system just like before workers contribute a set portion of their earnings to CPP up to a government set threshold for Web How to calculate Determine which method you can use to calculate deductions get the CPP contributions tables the EI premiums tables the claim codes and the income tax

Web Deduct CPP contributions up to and including the last pay dated in the month in which the employee turns 70 When you prorate use the number of months up to and including the Web 6 Dez 2023 nbsp 0183 32 If your earnings are 50 000 and the contribution rate is 5 25 your CPP deduction for the year is calculated as 50 000 5 25 2 625 Why are CPP

Solved Please Explain Thank You Chapter 10 Compensation Income 3

https://www.coursehero.com/qa/attachment/18920165/

How Much PF Will Be Deducted From Your Salary Clearclaim

https://clearclaim.in/blogs/wp-content/uploads/2023/01/PF-min.jpg

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web It contains tables for federal and provincial tax deductions CPP contributions and EI premiums It will help you determine the payroll deductions for your employees or

https://canpension.ca/articles/cpp-deduction-calculator-simplify-your...

Web 2 Zeilen nbsp 0183 32 6 Dez 2023 nbsp 0183 32 The Cpp deduction calculator takes into account your income age and other factors to determine

Learn Cpp How To Create Cpp Source File Example And Solution For

Solved Please Explain Thank You Chapter 10 Compensation Income 3

50 M mos Et Infographies Pour Les D veloppeurs C

CPP Announces Distinguished Visiting Professorship

How To Claim Refund Of TDS Deducted From You TDS Refund SimBizz

Learn OpenCV cpp in 4 Hours Chapter5 cpp At Main Murtazahassan Learn

Learn OpenCV cpp in 4 Hours Chapter5 cpp At Main Murtazahassan Learn

CPP Rates For 2020 Professional Touch Accounting

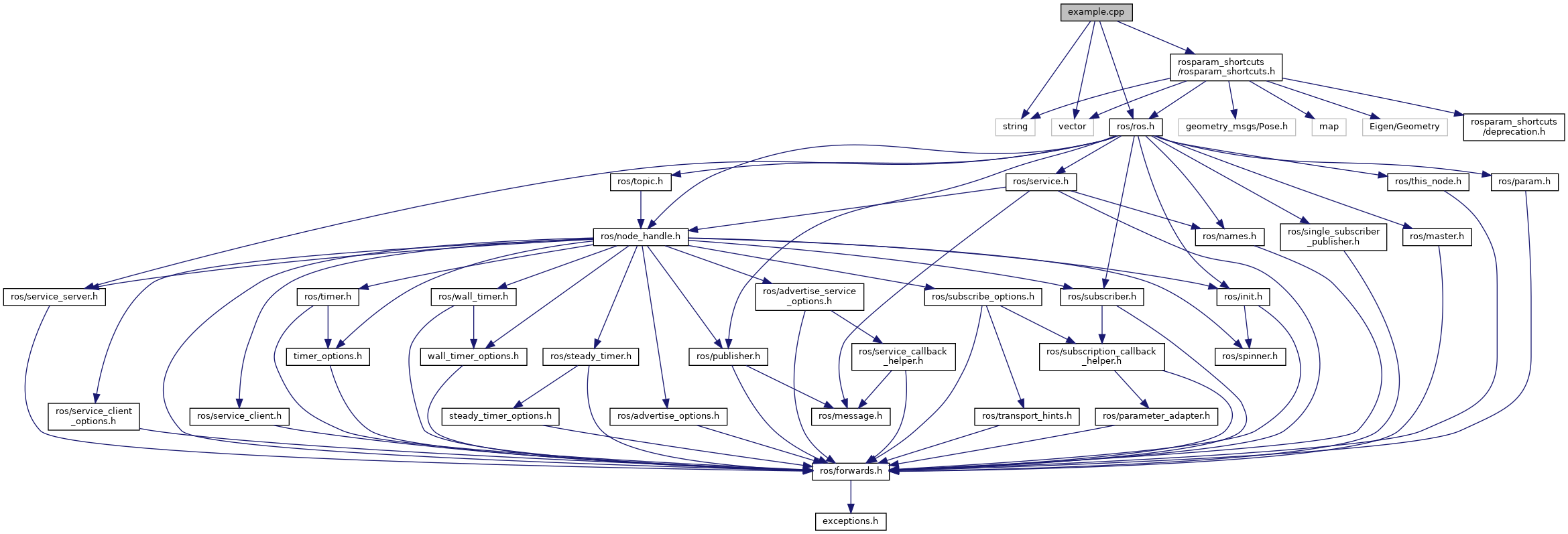

Rosparam shortcuts Example cpp File Reference

In A Competitive Examination 1 Mark Is Awarded For Each Correct Answer

How Much Cpp Is Deducted - Web CPP is not withheld on the business income earned so the person is required to make the contribution by April 30th or if required as quarterly instalments They would have to pay