How Much Do Companies Reimburse For Mileage Use our mileage reimbursement calculator to compute your employee s mileage reimbursement and the total taxable amount if you reimburse more than the IRS standard rate Calculate your employee mileage reimbursement and taxable mileage reimbursement here

Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile The IRS provides an optional standard mileage rate Not just any expense or mile driven for work qualifies for reimbursement How is mileage reimbursement calculated The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like gas insurance depreciation and standard maintenance

How Much Do Companies Reimburse For Mileage

How Much Do Companies Reimburse For Mileage

https://hrwatchdog.calchamber.com/wp-content/uploads/EmployeeMileageReimburse.jpg

Do I Have To Reimburse My Employees For That Reasonable Not

https://organicremedies.com/e0348c3b/https/e7167b/sbshrs.adpinfo.com/hubfs/Jaime/iStock-1042650228.jpg

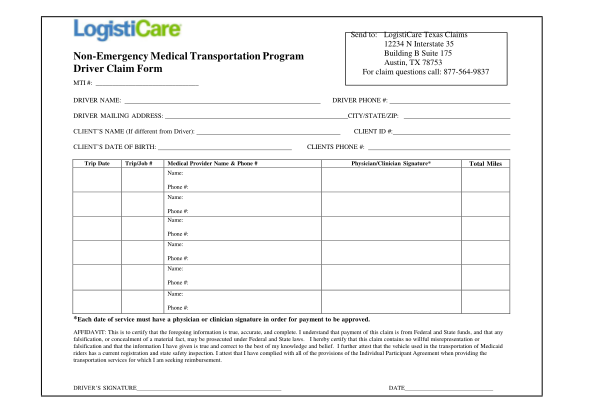

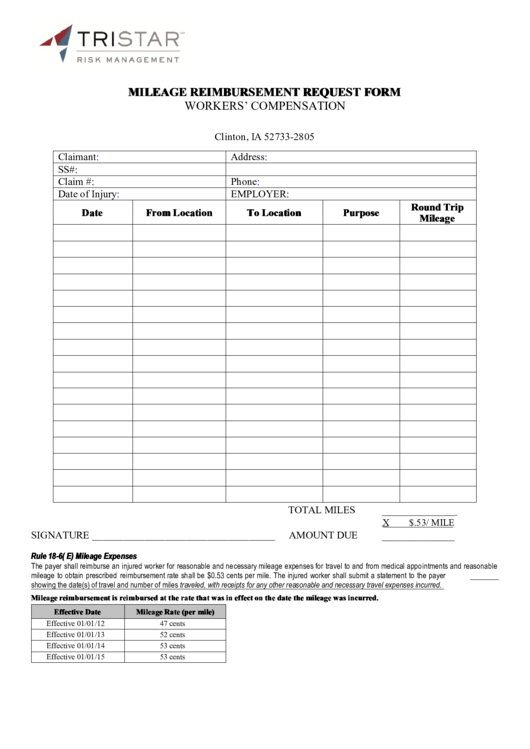

27 Gas Mileage Reimbursement Form Page 2 Free To Edit Download

https://cdn.cocodoc.com/cocodoc-form/png/129591925-fillable-logisticare-itp-reimburse-claims-form-x-01.png

As of July 2022 the standard mileage rate is 0 625 per mile For trips in 2022 that occurred from January to July the rate was 0 585 per mile Many employers reimburse employees at this While the IRS rate serves as a guideline actual reimbursement rates can vary significantly across businesses In the end most businesses take the simplest approach using the IRS standard

The standard mileage reimbursement rate for 2023 is 65 5 cents per mile What does that mean for employers Here s a breakdown of the 2023 mileage rate Understanding what most businesses pay for mileage can help companies ensure they re offering competitive and fair reimbursement rates This article will explore current trends in mileage reimbursement and factors that influence these rates

Download How Much Do Companies Reimburse For Mileage

More picture related to How Much Do Companies Reimburse For Mileage

Fillable Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/fillable-mileage-reimbursement-request-form-printable-pdf.png

How Much To Reimburse For Employee Mileage Timesheets

https://blog.timesheets.com/wp-content/uploads/2011/06/51261875_m.jpg

Car Allowance Vs Mileage Reimbursement

https://falconexpenses.com/blog/wp-content/uploads/2020/03/HowToReimburseEmployeesForMileageExpenses-768x510.jpg

The standard mileage rate for 2025 is 70 cents per mile set by the IRS To calculate a mileage reimbursement multiply the rate by the miles you drive For reimbursements to be tax free companies need to use standard mileage rates provided by the IRS In 2025 it means that companies can issue tax free reimbursements at the maximum rate of 70 cents per mile Any vehicle reimbursement higher

You can reimburse them based on their mileage which is simpler to administer and manage or the gas and other expenses incurred proof provided How much should I be paid per mile According to the IRS in 2025 the standard mileage rate for businesses is 0 70 per mile 0 21 per mile for medical and 0 14 per mile for charities As of January 2025 the IRS has determined that the federal mileage reimbursement rate is 70 cents per mile This is up 3 cents from 2024 when it was 67 cents per mile Here is the full breakdown As we mentioned every year the IRS sets the standard mileage rate for the business use of a car van pickup or panel truck

Reimburse For Health Insurance With HRA Reimbursement

https://www.takecommandhealth.com/hubfs/reimburse-for-health-insurance.jpg#keepProtocol

Top 5 Reasons To Reimburse The Full IRS Mileage Rate

https://www.timesheets.com/blog/wp-content/uploads/2016/02/19606090_m.jpg

https://fitsmallbusiness.com › employee-mileage-reimbursement

Use our mileage reimbursement calculator to compute your employee s mileage reimbursement and the total taxable amount if you reimburse more than the IRS standard rate Calculate your employee mileage reimbursement and taxable mileage reimbursement here

https://www.paylocity.com › resources › resource...

Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile The IRS provides an optional standard mileage rate Not just any expense or mile driven for work qualifies for reimbursement

New Guide Helps Fleets To Reimburse Business Mileage In EVs And Hybrids

Reimburse For Health Insurance With HRA Reimbursement

Mileage Reimbursement A Complete Guide TravelPerk

How Much Should I Reimburse Employees For Home Office Equipment

How To Get Your Employer To Reimburse Remote Work Expenses Wrkfrce

How Much To Reimburse For Mileage REVOLUTION REPORTS

How Much To Reimburse For Mileage REVOLUTION REPORTS

What Do Most Companies Pay For Mileage Reimbursement

How Do I Reimburse Myself From The Business aka Accountable Plan

Employee Mileage Reimbursement Rules For Companies Everlance

How Much Do Companies Reimburse For Mileage - The standard mileage reimbursement rate for 2023 is 65 5 cents per mile What does that mean for employers Here s a breakdown of the 2023 mileage rate