How Much Donations Can You Claim On Taxes Without Receipts Australia You should keep records of all tax deductible gifts donations and contributions you make However if you made one or more small cash donations each of 2 or more to bucket collections you can claim a total tax deduction of up to 10 for those donations for the income year without a receipt

Tax Deductions on Donations Donation is another deduction you can claim on the what can I claim on tax without receipts list if you donated 2 or more to bucket collections by an approved charity organisation you can claim 10 max without a receipt Taxpayers can claim up to 300 for work related expenses without a receipt as income tax deductions

How Much Donations Can You Claim On Taxes Without Receipts Australia

How Much Donations Can You Claim On Taxes Without Receipts Australia

https://i.ytimg.com/vi/PHpv_CO-_7k/maxresdefault.jpg

Give A Donation Craigieburn Trails

https://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

How Much Can You Claim In Charitable Donations Without Receipts Help

https://irs-taxes.org/wp-content/uploads/2021/06/Signing-charitable-donation-check-768x481.jpg

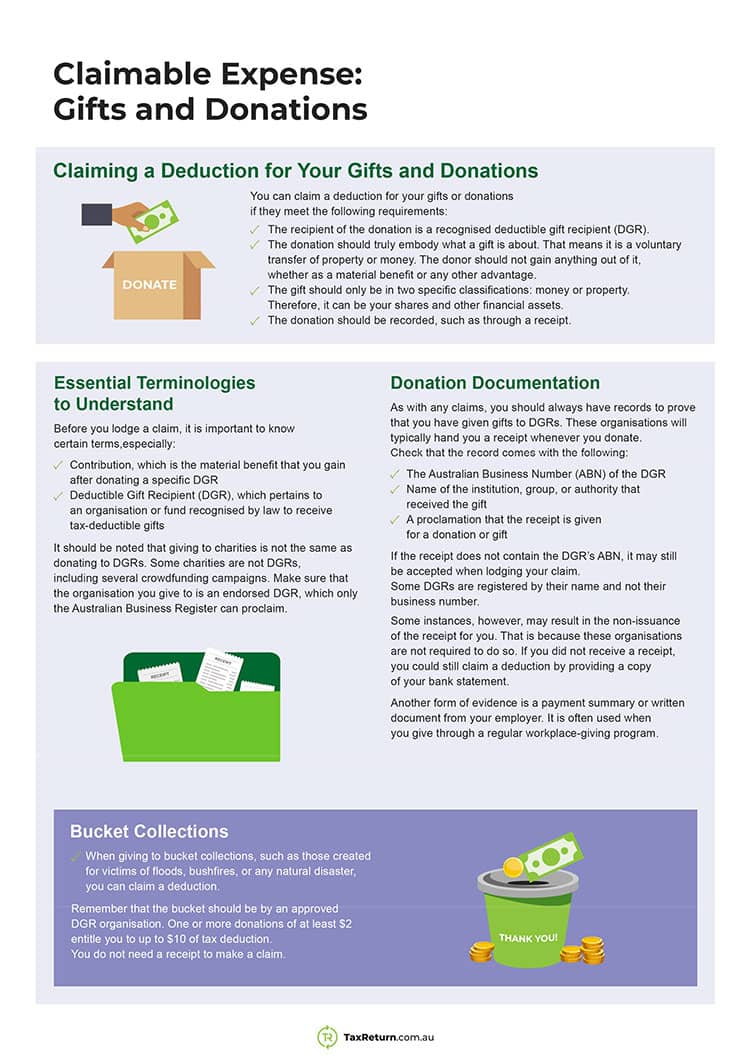

Tax Rules on Claiming Donations and Gifts By H R Block 4 min read You can only claim a tax deduction for gifts or donations to organisations which are deductible gift recipients DGRs When you make a gift you do not receive a Learn about the rules and regulations regarding tax deductible donations in Australia including whether donations can be claimed as tax deductions without a receipt Read this guide to know more

Tax deductible donations are simply donations you can claim a portion of at tax time For example if you donate 2 or more to a charity your donation may be considered tax deductible by the Australian Taxation Office ATO Learn how to claim tax deductions without receipts in Australia Understand allowable expenses record keeping methods and ATO compliance

Download How Much Donations Can You Claim On Taxes Without Receipts Australia

More picture related to How Much Donations Can You Claim On Taxes Without Receipts Australia

Looking Good Ngo Donation Request Letter How To Write Your Work

https://i.pinimg.com/originals/8d/b2/c2/8db2c2f5aed510beeab3764a8eed00a8.jpg

What Can You Claim On Tax Without Receipts In Australia

https://creditte.com.au/wp-content/uploads/2023/02/blog-what-can-you-claim-on-tax-without-receipts.jpg

Sponsorship Letter For Donation Gotilo

https://gotilo.org/wp-content/uploads/2020/08/how_to_write_a_letter_asking_for_donations_or_sponsorship_9.png

If your gift fits the above criteria you and the gift giver don t pay tax on it There s no limit on how much money you can give or receive as a gift However there are some occasions where tax may be payable or capital gains tax CGT may apply Here are some key points to consider Minimum Donation Amount To claim a tax deduction the minimum donation amount must be 2 or more Deductible Gift Recipients DGRs Donations must be made to organisations that are endorsed as Deductible Gift Recipients by the ATO

Is my donation tax deductible For a donation to be tax deductible it must be made to an organisation endorsed as a deductible gift recipient DGR It must also be a genuine gift you cannot receive any benefit from the donation As long as your donation is 2 or more and you make it to a deductible gift recipient charity you can claim the full amount of money that you donated on your tax return

Donation Receipts Are They Tax Deductible Full Guide WellyBox

https://directskins.com/a06babbc/https/20925c/www.wellybox.com/wp-content/uploads/2021/07/Depositphotos_68349399_l-2015.jpg

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-01-768x432.jpg

https://www.ato.gov.au/.../gifts-or-donations

You should keep records of all tax deductible gifts donations and contributions you make However if you made one or more small cash donations each of 2 or more to bucket collections you can claim a total tax deduction of up to 10 for those donations for the income year without a receipt

https://taxaccountinghouse.com.au/individual-tax...

Tax Deductions on Donations Donation is another deduction you can claim on the what can I claim on tax without receipts list if you donated 2 or more to bucket collections by an approved charity organisation you can claim 10 max without a receipt

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Donation Receipts Are They Tax Deductible Full Guide WellyBox

Claimable Expenses What You Can Claim On Your Tax Return

Fillable Online What Receipts Can You Claim On Taxes Fax Email Print

The Importance Of Paying Your Taxes University Herald

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

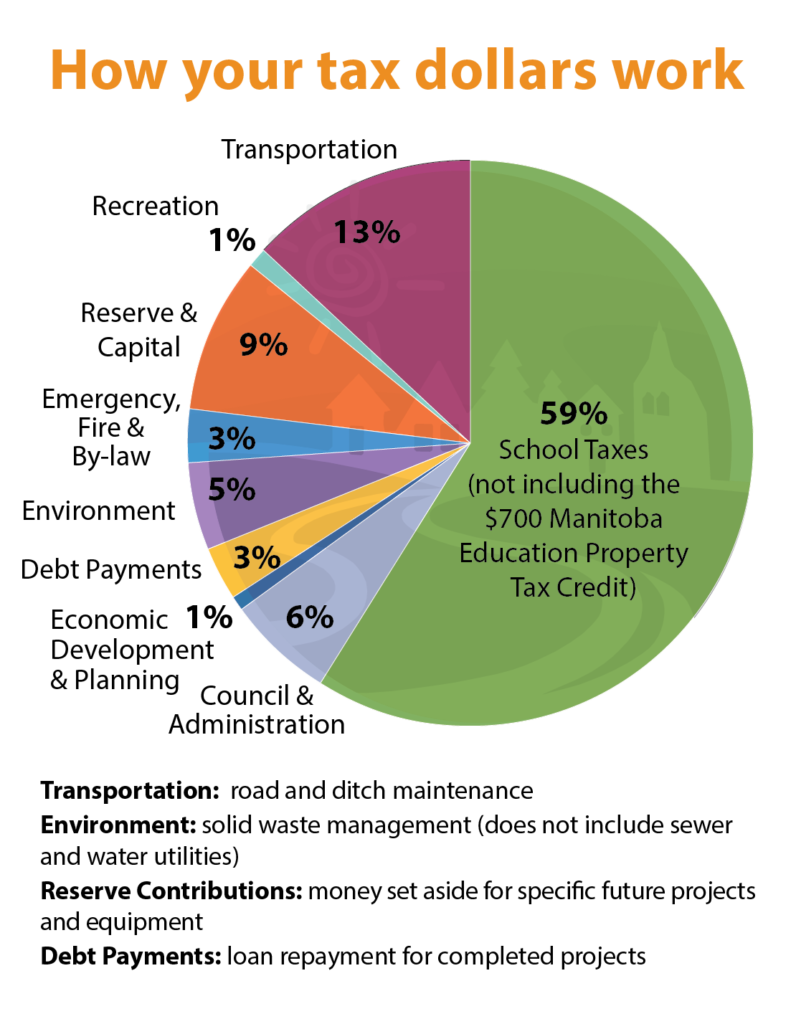

Tax Dollars Pie Chart 2x Rural Municipality Of St Clements

Tax Deductions Write Offs To Save You Money Financial Gym

Non Profit Letter For Donations Database Letter Template Collection

How Much Donations Can You Claim On Taxes Without Receipts Australia - Tax deductible donations are simply donations you can claim a portion of at tax time For example if you donate 2 or more to a charity your donation may be considered tax deductible by the Australian Taxation Office ATO