How Much Exemption For Fd Interest Is Tax Free For senior citizens the basic exemption limit is Rs 50 000 You should remember that a bank will deduct the TDS on interest on FD only when it credits the

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can You may also get up to 1 000 of interest and not have to pay tax on it depending on which Income Tax band you re in This is your Personal Savings Allowance To work out your

How Much Exemption For Fd Interest Is Tax Free

How Much Exemption For Fd Interest Is Tax Free

https://navi.com/blog/wp-content/uploads/2023/04/SBI-FD-Interest-Rate.jpg

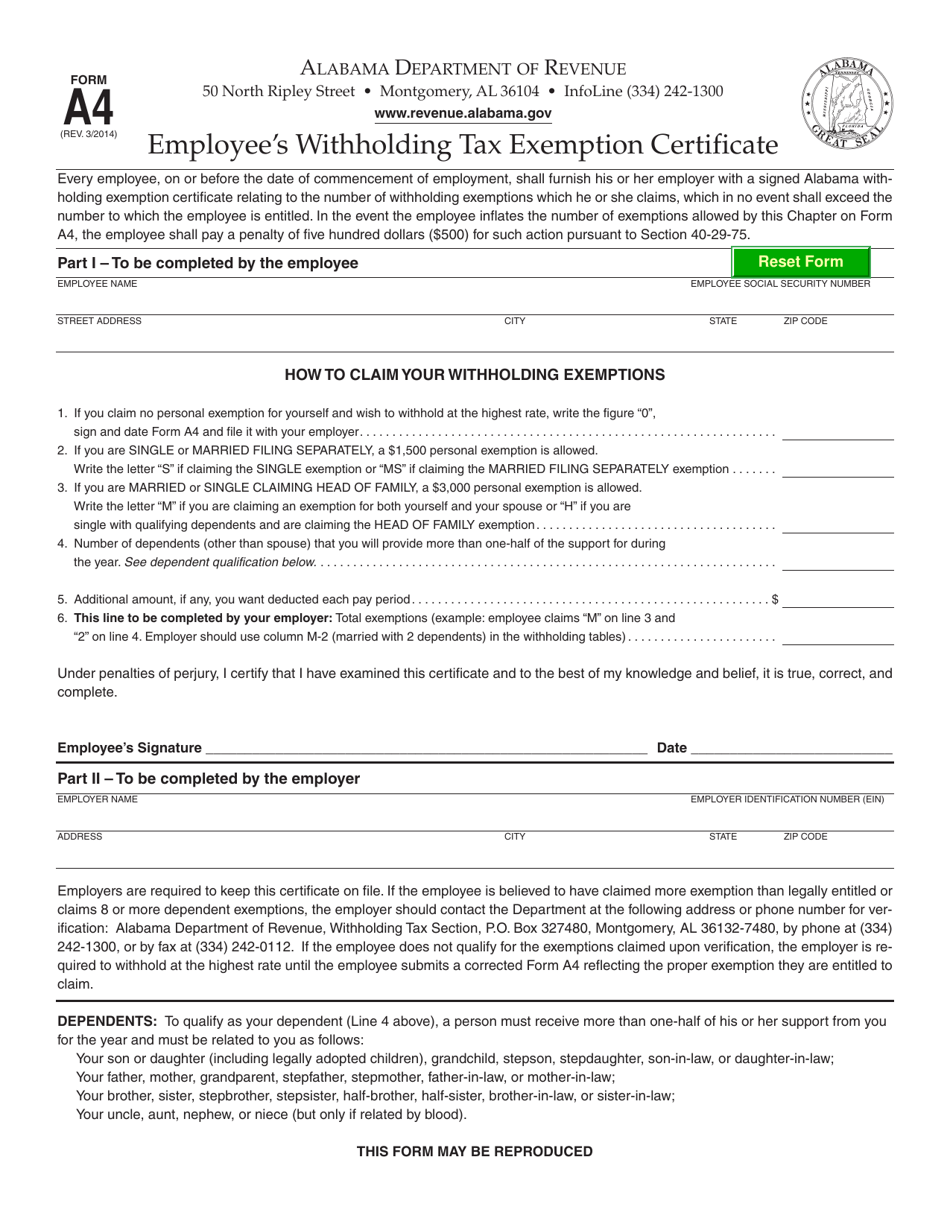

Certificate Of Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/50/825/50825271/large.png

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

An investor can claim income tax exemption on investments up to Rs 1 5 lakh when investing in Fixed Deposits As part of a Tax Saving Fixed Deposit interest earned is It also makes income tax on FD interest chargeable Banks deduct tax at source TDS when crediting interest to your account if the amount of interest exceeds 40 000 It applies to all investors except senior citizens

This will mean that the bank or the post office will not deduct tax on interest income of up to Rs 50 000 on FDs RDs Post office Schemes like MIS Senior Citizen Savings Scheme KVP NSC etc The Do remember that individuals cannot invest more than Rs 1 5 lakh in a tax saving FD So senior citizens can invest a smaller amount of money in tax saving fixed

Download How Much Exemption For Fd Interest Is Tax Free

More picture related to How Much Exemption For Fd Interest Is Tax Free

FD RD PPF Tax Hello Maharashtra

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

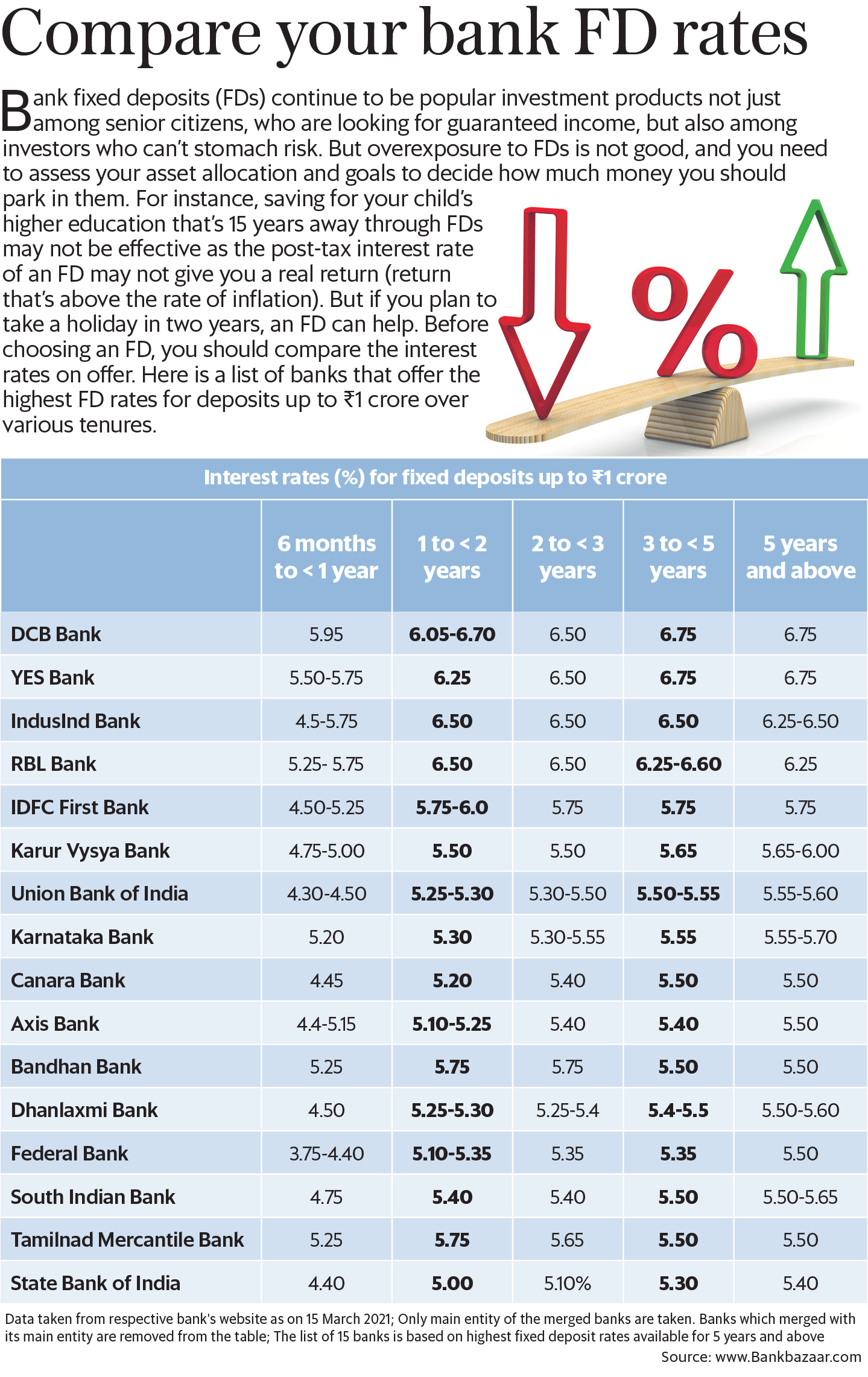

Compare Your Bank FD Rates Mint

https://images.livemint.com/img/2021/03/18/original/IYHYAB2Z_1616090593916.png

What Can You Buy During Tax free Weekend Here s A Complete List The

https://www.thestate.com/news/business/5eqzyg/picture162700938/alternates/LANDSCAPE_1140/TaxFree2

Form if you earn interest from a financial institution This form will have all the information you need to add the income to your tax return Once you hit the 1 500 of earned interest income for the year you can Lastly returns on tax saving FDs attract TDS whereas PPF is tax free Further PPF falls under the EEE Exempt Exempt Exempt tax treatment Meaning

The tax deduction rate at source is 10 if the income from interest for each year exceeds Rs 40 000 or in the case of Senior citizens threshold limit is Rs 50 000 If your interest income from all FDs is less than Rs 40 000 in a year the income is TDS exempt On the other hand if your interest income is over Rs 40 000 the TDS would be

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/03/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-April-2020_Featured.png?fit=1239%2C891&ssl=1

Printable Exemption Form From Garnishment Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1999/19996/1999660/form-a4-employee-s-withholding-tax-exemption-certificate-alabama_print_big.png

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

For senior citizens the basic exemption limit is Rs 50 000 You should remember that a bank will deduct the TDS on interest on FD only when it credits the

https://cleartax.in/s/tax-saving-fd-fixed-deposits

A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

Bharat Bank

Pin On Cgt And Tax And Others

Flag Sales Tax Exemptions Pledge Project

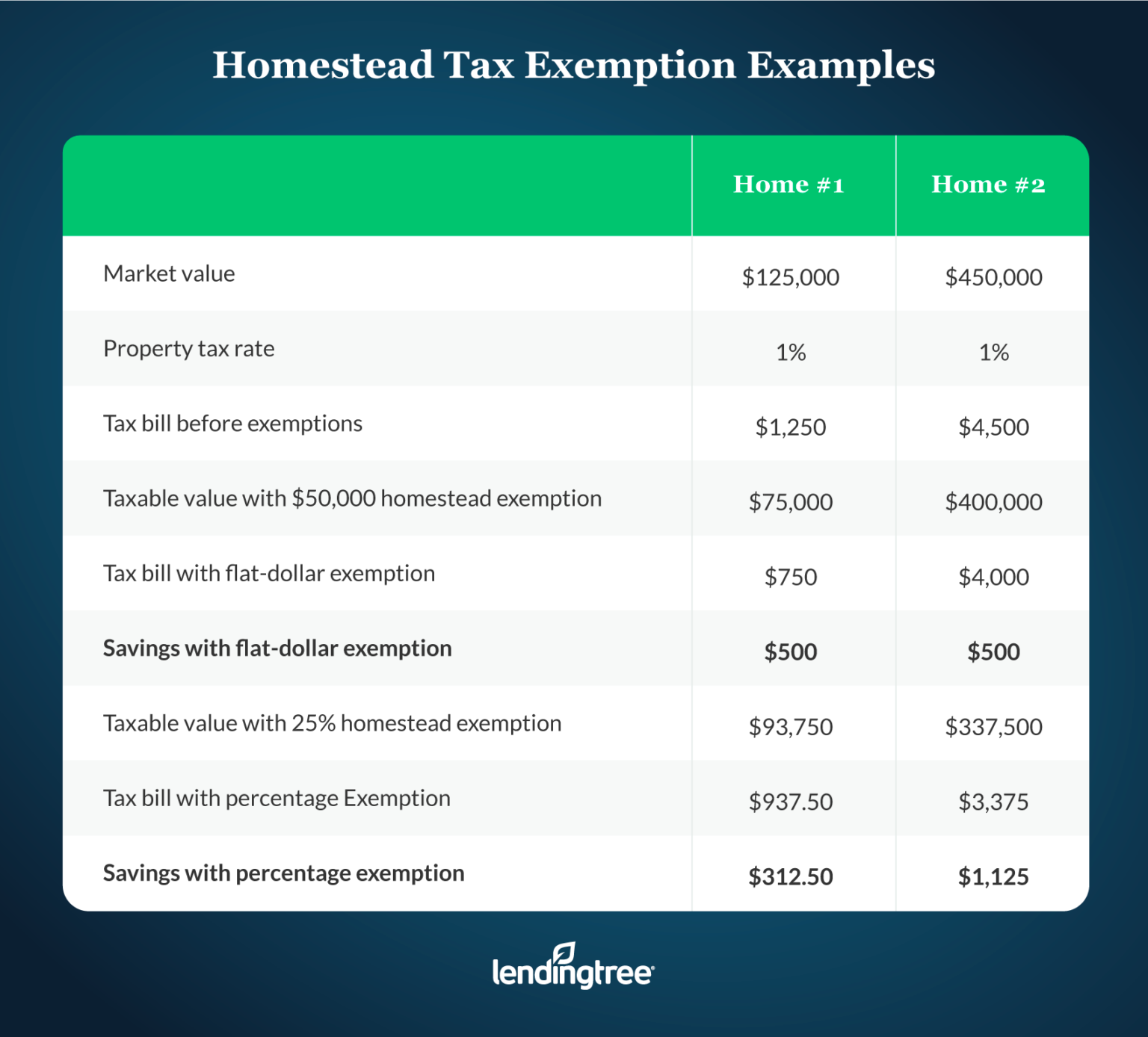

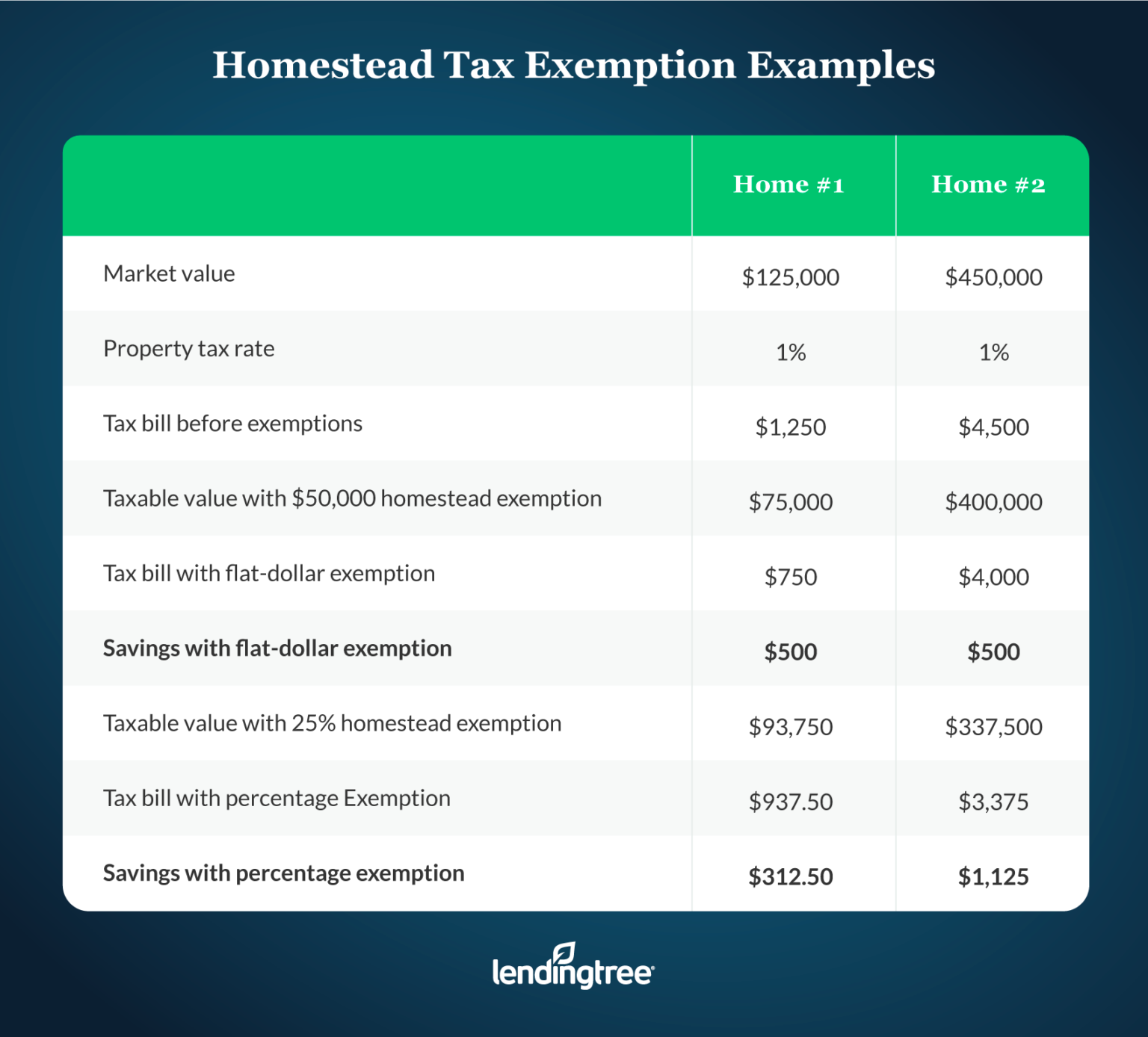

What Is A Homestead Exemption And How Does It Work LendingTree

What Is A Homestead Exemption And How Does It Work LendingTree

Sales Exemption Certificate TUTORE ORG Master Of Documents

Tax Saver FD 5 Year Fixed Deposit For Tax Saving Scheme Explained

501c3 Determination Letter Sample

How Much Exemption For Fd Interest Is Tax Free - It also makes income tax on FD interest chargeable Banks deduct tax at source TDS when crediting interest to your account if the amount of interest exceeds 40 000 It applies to all investors except senior citizens