How Much Income Is Tax Free In Netherlands Web In 2023 the median gross salary in the Netherlands sits at 40 000 based on the latest macroeconomic report from CPB Centraal Planbureau This equates to an after tax pay

Web Income tax in the Netherlands in 2021 Annual income EUR Rate Up to 35 129 9 45 35 129 to 68 507 37 10 More than 68 507 49 50 Personal tax credit for people with low Web About 30 Ruling The salary criteria for the 30 ruling as per January 2024 are as follows The salary amount does not matter if working with scientific research The annual taxable

How Much Income Is Tax Free In Netherlands

How Much Income Is Tax Free In Netherlands

https://i.ytimg.com/vi/x1ag5I8srTE/maxresdefault.jpg

Income Tax On Gift Money How Much Money Is Tax Free In Gift Section

https://i.ytimg.com/vi/mO036He-RM4/maxresdefault.jpg

Centre Plans Sharper Income Tax Scrutiny On Rich Farmers Latest News

https://images.hindustantimes.com/img/2022/04/07/1600x900/5266dadc-b6a4-11ec-a307-d7d8f6d974aa_1649357859066_1649373456337.jpg

The 30 Percent Rule is a personal income tax reduction for select employees in the Netherlands It applies to specialized foreign employees who are brought to the Netherlands because their skills are scarce in the Dutch marketplace The scarcity of work force with particular skills is reviewed annually The 30 Percent Rule allows an employer to exempt from income tax up to 30 of the employee s annual remuneration the quot Basis quot and used to be applicable for the first 10 y Web When you live in the Netherlands you pay tax in the Netherlands on your income on your financial interests in a company and on your savings and investments The Tax and

Web Personal allowances Personal allowances are expenditures which you may deduct from your taxable income subject to certain conditions Examples are maintenance Web Grandchildren A tax free allowance of 22 918 is available After this tax is charged at 18 below 138 642 or 36 above Others In most other cases a tax free allowance of 2 418 is available Tax is charged at

Download How Much Income Is Tax Free In Netherlands

More picture related to How Much Income Is Tax Free In Netherlands

How Much Income Is Tax Free In BC Genesa CPA Corp

https://genesacpa.com/wp-content/uploads/2023/03/Untitled-design-89-846x709.png

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

What Is Income Tax And How Are Different Types Calculated 50 OFF

https://www.investopedia.com/thmb/5gk30VTd3T-tJlqMprcY4lsSMJk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png

How To Find Out If You Owe Irs Informationwave17

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

Web Different kinds of tax in the Netherlands Whether you re a Dutch citizen or an expat you are required to pay taxes if you earn money while living in the Netherlands The Belastingdienst Dutch tax office collects taxes Web 30 Juni 2023 nbsp 0183 32 Individual Income determination Last reviewed 30 June 2023 In the Taxes on personal income section we explained that in the Netherlands personal

Web Country amp region guides Netherlands Tax in the Netherlands Moving Living Working Money Tax The content in this tax guide is provided by EY Going to or leaving the Web Ministry of Finance If you live in the Netherlands or receive income from the Netherlands you are required to pay income tax Find out more on government nl

How Much Income Is Tax Free Ultimate Guide Accotax

https://cruseburke.co.uk/wp-content/uploads/2022/10/how-much-income-is-tax-free-768x509.png

Here s How Much Income Is Taxed Around The World

http://static.businessinsider.com/image/5541367f6bb3f72b57e17bde/image.jpg

https://salaryaftertax.com/salary-calculator/netherlands

Web In 2023 the median gross salary in the Netherlands sits at 40 000 based on the latest macroeconomic report from CPB Centraal Planbureau This equates to an after tax pay

https://www.dutch-tax.nl

Web Income tax in the Netherlands in 2021 Annual income EUR Rate Up to 35 129 9 45 35 129 to 68 507 37 10 More than 68 507 49 50 Personal tax credit for people with low

How Much Foreign Income Is Tax free In U K Expat US Tax

How Much Income Is Tax Free Ultimate Guide Accotax

2020 Key Tax Numbers For Individuals Eclectic Associates Inc

2024 25 Tax Rates Natty Charita

Income Tax Refunds Of Rs 1 71 Lakh Crore Released Till 14th Feb Daily

Tips To Reduce Your Income Tax Liability Roberts Nathan Roberts Nathan

Tips To Reduce Your Income Tax Liability Roberts Nathan Roberts Nathan

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

Form 1040 U S Individual Income Tax Return 2015 MbcVirtual Income

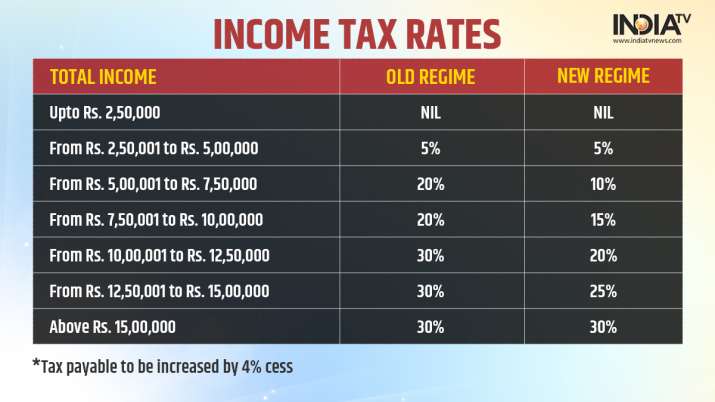

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

How Much Income Is Tax Free In Netherlands - Web Box 3 Box 3 covers income from assets such as savings and investments The value of your assets minus debts is calculated once annually on 1 January to determine your