How Much Is Property Tax In Dallas Texas This notice concerns the 2022 property tax rates for City of Dallas This notice provides information about two tax rates used in adopting the current tax year s tax rate The no new revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years

Select applicable exemptions General Homestead Over 65 or Surviving Spouse Disabled Person Neither Disabled Veterans 10 29 Disabled Veterans 50 69 Disabled Veterans 30 49 Disabled Veterans 70 100 None Dallas has highest 5 year property tax increase of any major U S city study says Residents of Dallas had an average property tax bill of 2 851 in 2016 and that jumped to 4 671 in 2021

How Much Is Property Tax In Dallas Texas

How Much Is Property Tax In Dallas Texas

http://klauerlaw.com/wp-content/uploads/2015/10/tax-increase.jpg

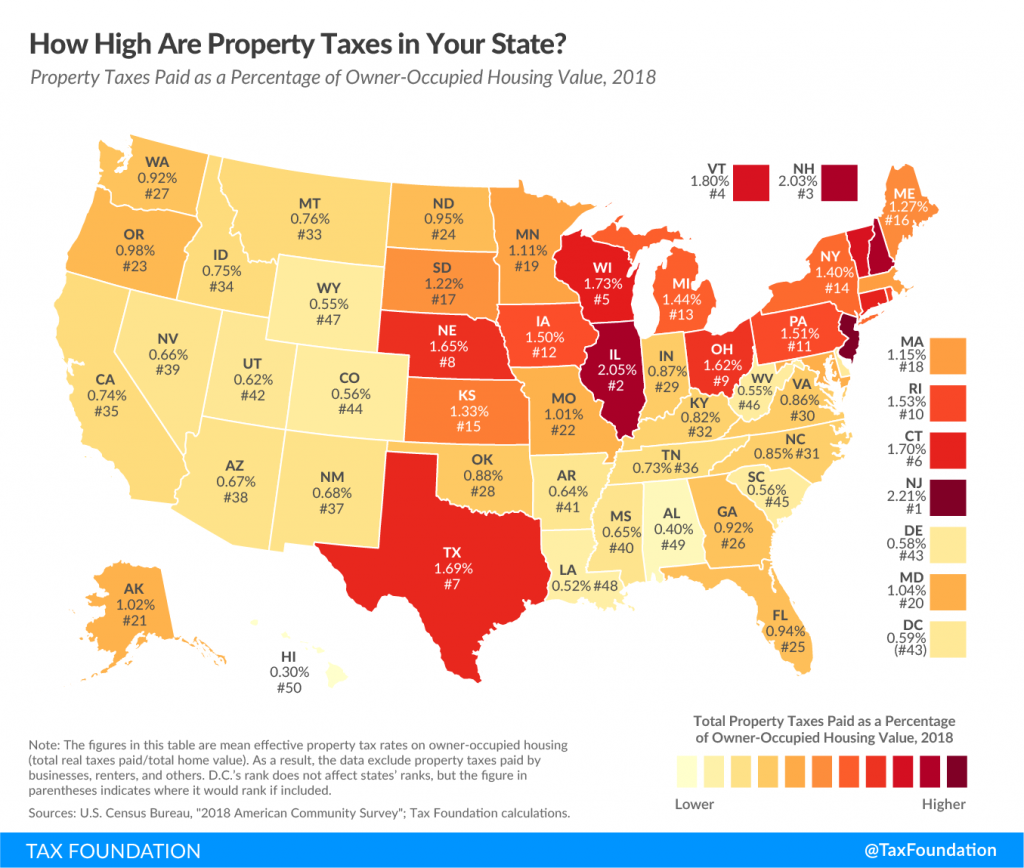

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

KY State Legislature Makes Changes To Property Tax In House Bill 6

https://deandorton.com/wp-content/uploads/2022/05/Property-Tax-1.jpg

As of the most recent data the average property tax rate in Dallas County is approximately 2 22 However this can vary significantly based on the specific location within the county For example in the city of Dallas itself the property tax rate is 0 7357 per 100 in valuation Property tax If you own your home you pay a percent of what your home is worth in property taxes based on a rate set by City Council If you rent your home the landlord probably includes that amount in your rent payment In Dallas only about 30 of all money from property taxes is used to pay for City services

The below rates are provided as information only please confirm current rates with the appropriate jurisdiction Rates are applicable to real property and business personal property For projects located within the City of Dallas and Dallas County the total combined local tax rate is 2 294781 per 100 in valuation Dallas residents are officially under a new property tax rate of 0 7393 While technically a one cent reduction in rate this measure increased the tax burden on Dallas homeowners by a collective 120 million as previously reported by The Dallas Express

Download How Much Is Property Tax In Dallas Texas

More picture related to How Much Is Property Tax In Dallas Texas

How High Are Property Taxes In Your State Tax Foundation

https://files.taxfoundation.org/20170110101027/PropertyTax.png

These States Have The Highest Property Tax Rates

https://www.thestreet.com/.image/c_limit%2Ccs_srgb%2Cq_auto:good%2Cw_700/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

Which States Have The Highest Property Tax In The USA

https://www.tododisca.com/en/wp-content/uploads/2023/01/The-highest-property-tax-rates-in-the-USA.jpg

LISTEN Dallas proposed 4 97 billion budget offers the largest property tax rate decrease in at least four decades but the typical homeowner may not feel it The upcoming budget proposes a Dallas wants to lower the property tax rate and spend more money on its police and fire departments in the upcoming fiscal year The big picture The proposed city budget would reduce the property tax rate by 3 1 cents per 100 valuation from 73 57 cents to 70 47 cents It would be the largest single year tax rate reduction in Dallas

DALLAS The City of Dallas announced plans for the largest single year property tax reduction in modern history as part of its 2024 2025 proposed budget The nearly 5 billion plan makes up for This program is designed to help you access property tax information and pay your property taxes online If you have questions about Dallas County Property Taxes please contact propertytax dallascounty see our Frequently Asked Questions or call our Customer Care Center at 214 653 7811

In depth Look At The Property Tax Reform Delano News

https://assets.paperjam.lu/images/articles/understanding-the-property-tax/0.5/0.5/600/400/531510.jpg

Property Tax Dallas 2023

https://propertytaxgov.com/wp-content/uploads/2021/11/PROPERTY-TAX-DALLAS.jpg

https://dallascityhall.com/departments/budget/DCH...

This notice concerns the 2022 property tax rates for City of Dallas This notice provides information about two tax rates used in adopting the current tax year s tax rate The no new revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years

https://www.dallascad.org/TaxRateCalculator.aspx

Select applicable exemptions General Homestead Over 65 or Surviving Spouse Disabled Person Neither Disabled Veterans 10 29 Disabled Veterans 50 69 Disabled Veterans 30 49 Disabled Veterans 70 100 None

Property Taxes By State County Median Property Tax Bills

In depth Look At The Property Tax Reform Delano News

What To Know About Dallas Property Tax Increases Guiding Wealth

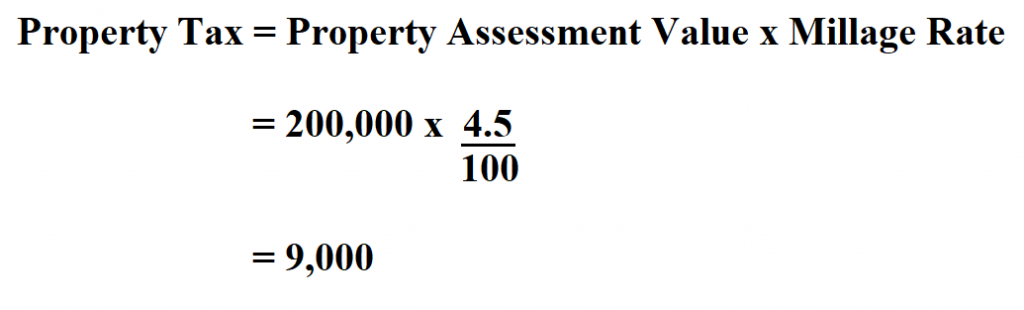

How To Calculate Property Tax

Where Are Lowest Property Taxes In North Texas

What If I Do Not Pay My Texas Property Taxes Property Tax Loan Pros

What If I Do Not Pay My Texas Property Taxes Property Tax Loan Pros

25 Things To Do In Dallas Texas With Photos

What Is The Property Tax Rate In Dallas Texas There Was A Huge Weblog

What Is The Property Tax Rate In Dallas Texas There Was A Huge Weblog

How Much Is Property Tax In Dallas Texas - As of the most recent data the average property tax rate in Dallas County is approximately 2 22 However this can vary significantly based on the specific location within the county For example in the city of Dallas itself the property tax rate is 0 7357 per 100 in valuation