How Much Is The Carbon Tax In Canada On Gasoline As of April 1 2021 the carbon tax on gasoline is 8 8 cents per litre based on the application of the 40 per tonne carbon tax and is estimated to reach 39 6 cents per litre by 2030 based on the application of the 170 per tonne carbon tax see Figure 1a Global News 2020

Starting April 1 the carbon tax will tack an extra 2 2 cents onto the cost of a litre of gas With that change the carbon tax will account for 11 cents of the litre Rebates meant to offset The fuel charge rates reflect a carbon pollution price of 65 per tonne of carbon dioxide equivalent CO2e in 2023 the price currently reaches 50 per tonne in 2022 which will rise by 15 per tonne annually to reach 170 per tonne in 2030

How Much Is The Carbon Tax In Canada On Gasoline

How Much Is The Carbon Tax In Canada On Gasoline

https://cepr.org/sites/default/files/styles/og_image/public/voxeu-cover-image/AdobeStock_265590709.jpeg?itok=pCPMCahI

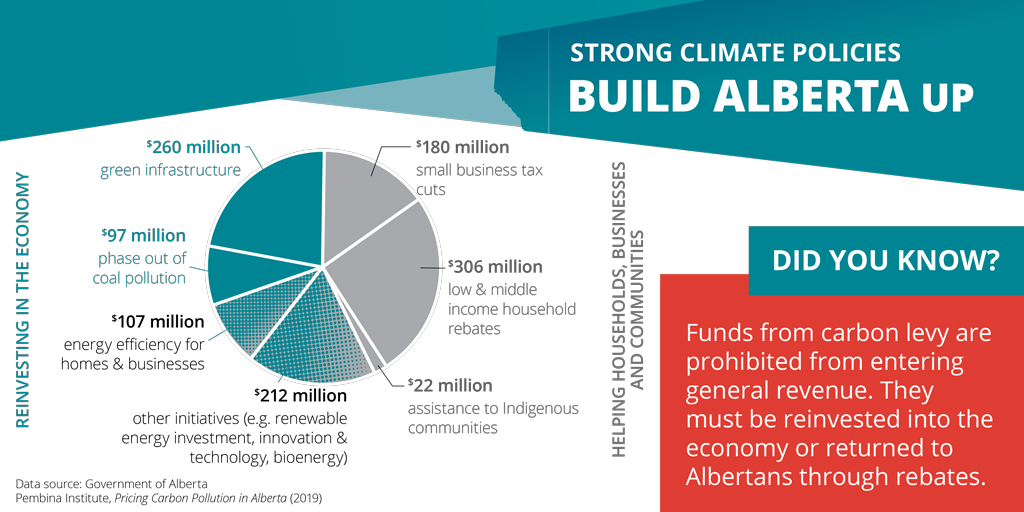

Carbon Tax Canada 2019

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/federal-government-s-carbon-tax-and-rebate-plan.png

Canadians Set To Receive First Carbon Pricing Rebate Of 2024 What You

https://culturemagazin.com/wp-content/uploads/2024/01/carbon-canada-1024x1024.jpg

The carbon tax increased to 80 per tonne on April 1 We explain what the carbon tax is and how the carbon tax rebate can help keep more money in your bank account The Canada Carbon Rebate In provinces where the federal fuel charge applies a family of four will receive up to 1 800 under the base Canada Carbon Rebate in 2024 25 In April 2024 residents of these provinces will receive their first of four quarterly Canada Carbon Rebate payments with additional payments in July 2024 October 2024

Gasoline Going from 65 per tonne to 80 means the carbon tax on a litre of gasoline will now be 17 6 cents per litre up 3 3 cents per litre from before That means filling a 50 litre The Canadian Taxpayers Federation estimates the federal carbon price now adds a total of 11 cents per litre for gasoline 13 cents per litre of diesel and 10 cents per cubic metre of

Download How Much Is The Carbon Tax In Canada On Gasoline

More picture related to How Much Is The Carbon Tax In Canada On Gasoline

Newsroom

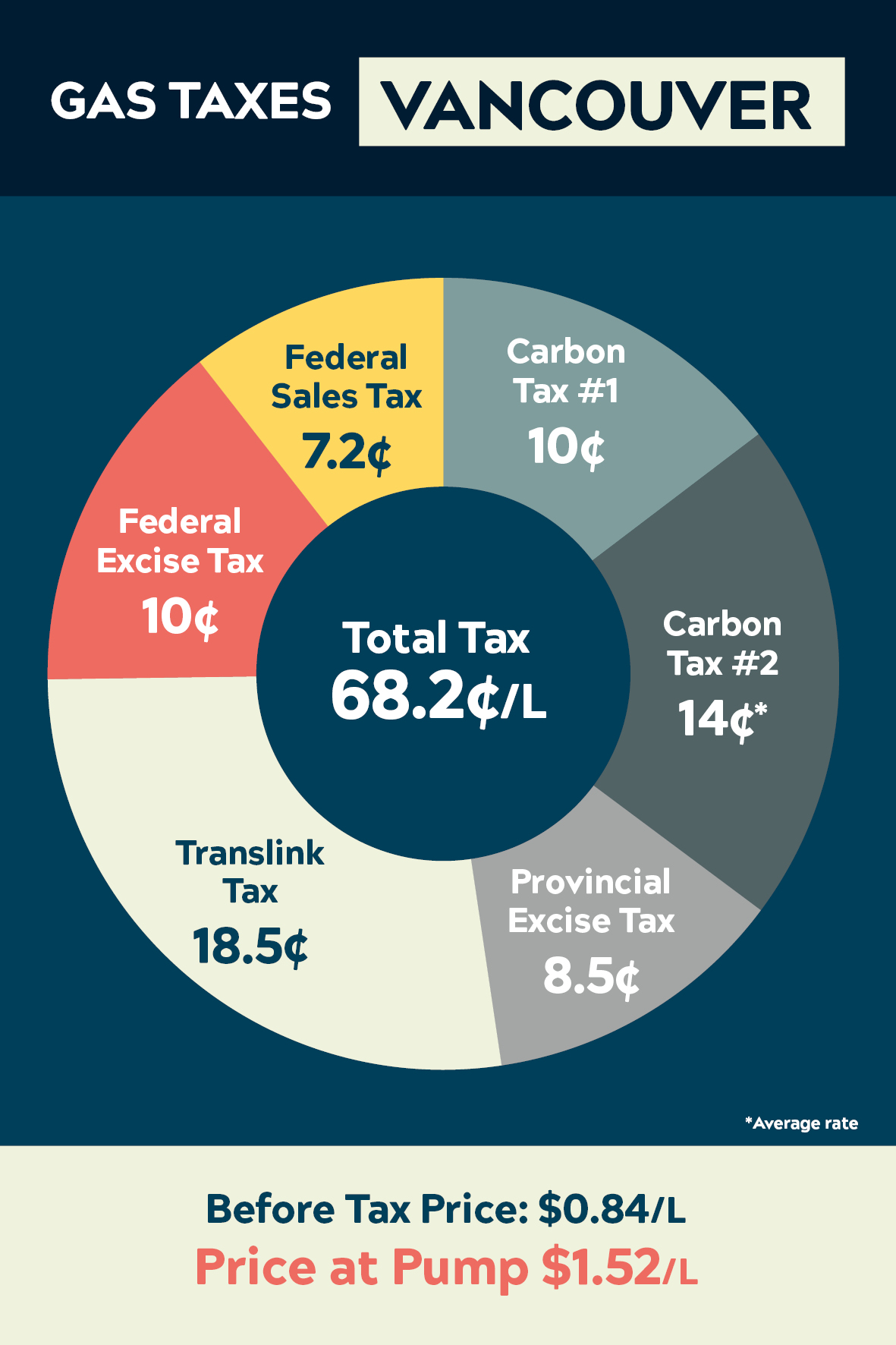

https://www.taxpayer.com/media/Vancouver Gas Tax Chart Media 2021.jpg

Carbon Tax Emissions Reduction And Employment Some Evidence From

https://oecdecoscope.blog/wp-content/uploads/2020/01/image-2.png

How To Build A Trusted Voluntary Carbon Market RMI

https://rmi.org/wp-content/uploads/2022/09/carbon-credit-lifecycle-infographic-scaled.jpg

In places where the federal carbon pricing system applies Canadians will see an increase to the fuel charge what s known as the carbon tax while heavy emitters will see increases The tax rose from 65 per tonne to 80 per tonne of emissions on April 1 That comes out to 17 cents per litre on gasoline 21 cents per litre on diesel and 15 cents per cubic metre on natural

The federal carbon tax and rebates in a nutshell The amount you pay in carbon tax varies from fuel to fuel More emissions intensive fuels are subject to higher tax rates Gasoline Going from 65 per tonne to 80 means the carbon price on a litre of gasoline will now be 17 6 cents per litre up 3 3 cents per litre from before That means filling a 50

Clarifying The Carbon Tax In The Case Of Canada UAlberta Sustain SU

https://sustainsu.files.wordpress.com/2021/10/carbon-pricing-canada-map-1024x606-1.png

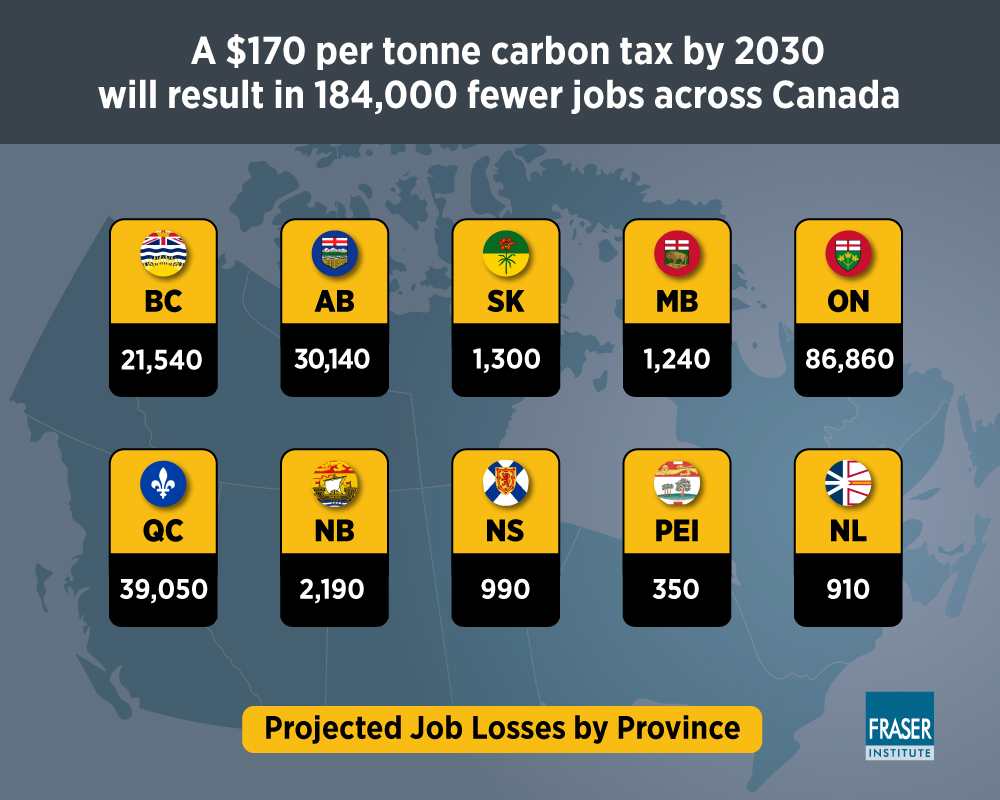

Estimated impacts of a 170 dollar carbon tax in canada infographic jpg

https://www.fraserinstitute.org/sites/default/files/estimated-impacts-of-a-170-dollar-carbon-tax-in-canada-infographic.jpg

https://energynow.ca/2021/08/trudeaus-carbon-tax...

As of April 1 2021 the carbon tax on gasoline is 8 8 cents per litre based on the application of the 40 per tonne carbon tax and is estimated to reach 39 6 cents per litre by 2030 based on the application of the 170 per tonne carbon tax see Figure 1a Global News 2020

https://toronto.ctvnews.ca/this-is-how-the-april-1...

Starting April 1 the carbon tax will tack an extra 2 2 cents onto the cost of a litre of gas With that change the carbon tax will account for 11 cents of the litre Rebates meant to offset

No Joke Trudeau s Carbon Tax Starts Today Huddle Today

Clarifying The Carbon Tax In The Case Of Canada UAlberta Sustain SU

New Carbon Price Agreements Announced For 2023 2030 Atlantica Centre

Carbon Tax

February 2013 Link To The World

Memahami Skema 3 Jenis Perdagangan Karbon Di Hari Konvensi Bonn

Memahami Skema 3 Jenis Perdagangan Karbon Di Hari Konvensi Bonn

Where The Money Goes How Revenue From Carbon Taxes Drives Change

Carbon Pricing And Carbon Tax In Canada Earth Org

/cdn.vox-cdn.com/uploads/chorus_image/image/60431081/shutterstock_586114652.0.jpg)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

How Much Is The Carbon Tax In Canada On Gasoline - Currently the price is set at 65 per tonne which means consumers pay a carbon levy of about 14 cents per litre of gasoline It adds 5 60 to a 40 litre fill Natural gas is charged at 12 4