How Much Is The Child Tax Credit For 2022 What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child For tax year 2022 the child tax credit pays up to 2 000 per eligible child That s a drop from 2021 levels That year the credit paid 3 600 per child for kids under age 6 For

How Much Is The Child Tax Credit For 2022

How Much Is The Child Tax Credit For 2022

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

Child Tax Credit 2022 How Much Can You Get Shared Economy Tax

https://sharedeconomycpa.com/wp-content/uploads/2022/04/child-tax-credit-2022.png

Child Tax Credit 2023 What Are The Changes YouTube

https://i.ytimg.com/vi/jZkTfYSsaw8/maxresdefault.jpg

The maximum refundable amount per child currently capped at 1 600 would increase to 1 800 in tax year 2023 1 900 in tax year 2024 and 2 000 in tax year 2025 Some lawmakers are The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of

For 2022 the child tax credit is 2 000 per kid under the age of 17 claimed as a dependent on your return The child has to be related to you and generally live with you for at least How has the Child Tax Credit changed over the years The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3 600 per child for qualifying children under the age of 6 and to 3 000 per child for

Download How Much Is The Child Tax Credit For 2022

More picture related to How Much Is The Child Tax Credit For 2022

Are You Eligible For Monthly Child Tax Credit Payments Check IRS

https://www.al.com/resizer/pc0fe2ASg7gqF95M0g5gW9VCFkI=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/X4QF7BYSU5DRXPZWDOD4P564SQ.jpg

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

Advancements In The Child Tax Credits Quality Back Office

https://goqbo.com/app/uploads/2021/07/Advancements-In-Child-Tax-Credits-1024x683.png

The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable Jan 7 2022 This year s tax filing season is likely to be another challenging one because of pandemic related tax changes But the first step for many taxpayers is simple Check the mail The

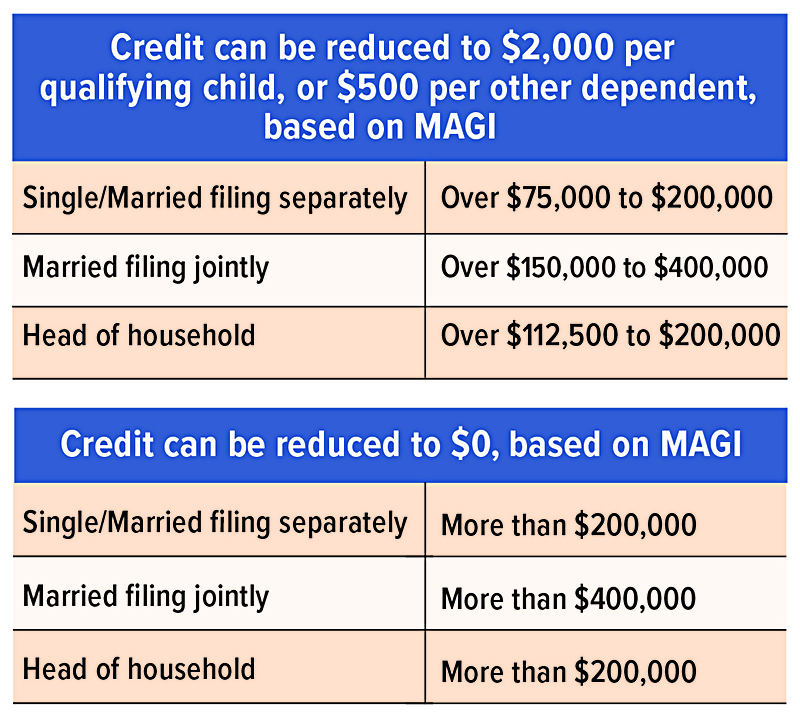

Original Child Tax Credit Payment You ll receive 2 000 the original child tax credit amount if your MAGI is between 107 000 and 200 000 for a child age under 6 and 95 000 and 200 000 In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18 However these tax credits begin to phase out at certain income levels depending on your filing status The annual income thresholds for different filing status are

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Child Tax Credit 2022 Age Limit Latest News Update

https://i2.wp.com/www.cpabr.com/assets/htmlimages/Articles/child tax credit payments chart.JPG

https://www.irs.gov/credits-deductions/tax-year...

What is the amount of the Child Tax Credit for 2021 added January 31 2022 Q A3 How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5

https://theweek.com/finance/1021293/a-guide-to-the-2022-child-tax-credit

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

2022 Education Tax Credits Are You Eligible

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

What Families Need To Know About The CTC In 2022 CLASP

FAQ WA Tax Credit

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

How Much Is The Child Tax Credit For 2023 Leia Aqui What Will The

Child Tax Credit For 2021 Will You Get More Velocity Retirement

How Much Is The Child Tax Credit For 2022 - The maximum refundable amount per child currently capped at 1 600 would increase to 1 800 in tax year 2023 1 900 in tax year 2024 and 2 000 in tax year 2025 Some lawmakers are