Income Tax Rebate On Home Loan Principal Amount Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This Web 15 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Income Tax Rebate On Home Loan Principal Amount

Income Tax Rebate On Home Loan Principal Amount

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

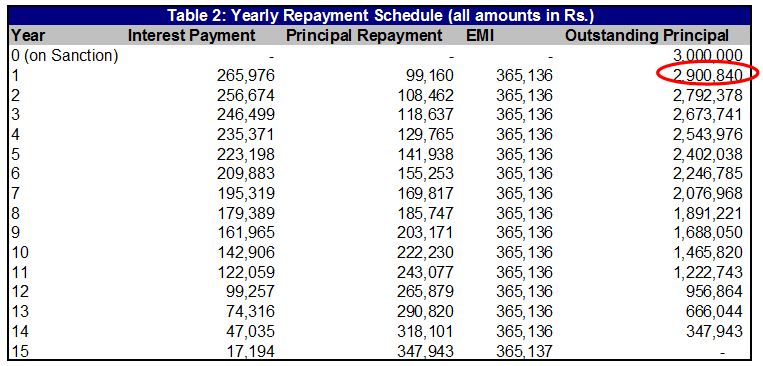

Home Loan Repayment Schedule

http://www.wisdomtimes.com/wp-content/uploads/2013/08/Home-loan_21.jpg

Web 25 mars 2016 nbsp 0183 32 What should be the Principle amount that I show on Housing Loan Is it Rs 1 12 422 81 Full FY 2017 18 Or is it for the Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Web 31 mai 2022 nbsp 0183 32 The following are the various tax exemptions on home loans available in India 1 Section 80C Tax Deduction On Principal Amount It allows you to claim a Web Tax saving on home loan increases the affordability of your home loan With the help of a home loan tax benefit calculator you can find out your exact tax exemption My Annual

Download Income Tax Rebate On Home Loan Principal Amount

More picture related to Income Tax Rebate On Home Loan Principal Amount

Loan Principal Definition Deltapart

https://s3.amazonaws.com/earnest-static-assets/blog/How-a-loan-works-4-how-later-payments-include-less-interest.jpg

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

https://i0.wp.com/stableinvestor.com/wp-content/uploads/2020/11/Home-loan-EMI-interest-principal.png?resize=496%2C500&ssl=1

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

Web 20 f 233 vr 2020 nbsp 0183 32 Section 80C Tax benefit on Principal amount on Home Loan The maximum tax deduction allowed under Section 80C is Rs 1 50 000 This tax deduction under Section 80C is available on payment Web 28 janv 2014 nbsp 0183 32 As per the law I can get tax benefits on principle up to 1L rs and interest 2 5L for first 2 years then 1 5L if first loan and loan amount lt 25L I am starting my

Web 20 mars 2023 nbsp 0183 32 Repayment of the principal amount The repayment of the principal amount of a home loan is eligible for a deduction of up to Rs 1 5 lakh per annum under Section 80C Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Home Loan Repayment Template Home Loan Calculator Home Etsy

https://i.etsystatic.com/23166515/r/il/cbde10/2436978805/il_794xN.2436978805_8wai.jpg

https://blog.bankbazaar.com/home-loan-tax-…

Web 9 f 233 vr 2018 nbsp 0183 32 For an individual or Hindu Undivided Family HUF the amount that goes towards the repayment of the principal on a Home

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Web 24 ao 251 t 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Home Loan Tax Benefits How Much Do You Really Get Stable Investor

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

What Does Rebate Lost Mean On Student Loans

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Principal Amount - Web 25 mars 2016 nbsp 0183 32 What should be the Principle amount that I show on Housing Loan Is it Rs 1 12 422 81 Full FY 2017 18 Or is it for the