Income Tax Rebate On Home Loan Rules The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair The year s interest expenses are still shown on your pre completed tax return

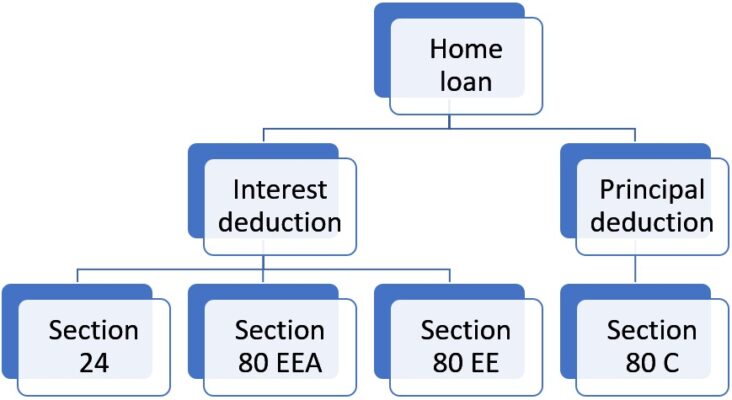

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax rebate for senior citizens Rs 2 lakhs per annum Tax deductions allowed on home loan interest Relevant Section s in the

Income Tax Rebate On Home Loan Rules

Income Tax Rebate On Home Loan Rules

https://images.thewest.com.au/publication/C-4161332/6742d4847f6fdaa41b56597d25c6eca594e60e92.jpg?imwidth=810&impolicy=wan_v3

ANOTHER Update To Home Loan Rules Blog BetterSaver

https://bettersaver.co.nz/images/blog/_1200x630_crop_bottom-right_90_none/5182/2022-03-home-loan-updates-1200x600.jpg

SBS Language What Are The New Changes To Home Loan Rules

https://sl.sbs.com.au/public/image/file/121f53e8-1bee-4bc0-8dcd-fbe0bcc5f65d/crop/16x9

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017 1 Home loan borrowers are entitled to tax benefits under Section 80C and Section 24 of the Income Tax Act These can be claimed by the property s owner 2 In the case of co owners all are entitled to tax benefits provided they are co borrowers for the home loan too The limit applies to each co owner 3

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Note that home loan borrowers opting for new tax regime cannot claim deductions under Sections 80C or 24 b An income tax rebate is allowed on both the principal and the interest throughout the repayment tenure of your home loan under the following sections Section 80C Section 80C Conditions Section 24 Section 24 Conditions Section 80EEA Section 80EE Section 80EE Conditions FAQs

Download Income Tax Rebate On Home Loan Rules

More picture related to Income Tax Rebate On Home Loan Rules

Budget 2023 India May Allow Income Tax Rebate On Electric Vehicles

https://images.cnbctv18.com/wp-content/uploads/2022/09/391310908-e1663242150789-1019x573.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/FeatureImage_Income-tax-rebate-on-home-loan-768x524.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the Income Tax Act for tax rebate on home loan Here are some key sections of the Income Tax Act in India that provide tax benefits on home loans The Union Minister of India announced in 2020 21 that all previous regimes of income tax rebates on home loans would be extended until 2024 The following are the advantages of a home loan Interest Deduction on Principal Repayment The principal amount and interest amount are two components of the EMI that you pay

The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Principal repayment of home loans can net annual tax deductions Raising the tax rebate on home loan interest rates from Rs 2 lakh to a minimum of Rs 5 lakh under Section 24 of the Income Tax Act is imperative This adjustment has the potential to invigorate the housing market especially in the affordable homes category which has witnessed a dip in demand post the pandemic

Home Loan Rules Have Been Relaxed Here s What You Need To Know

https://myspringwood.com.au/wp-content/uploads/2019/07/home-loan-rules-you-need.jpg

The Less Known Rules For The First Home Loan Scheme

https://smarterstart.co.nz/wp-content/uploads/2022/07/The-Less-Known-Rules-For-The-First-Home-Loan-Scheme.png

https://www. vero.fi /en/individuals/tax-cards-and...

The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair The year s interest expenses are still shown on your pre completed tax return

https:// cleartax.in /s/home-loan-tax-benefit

From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is no upper limit for claiming interest However the overall loss one can claim under the head House Property is restricted to Rs 2 lakh only

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Home Loan Rules Have Been Relaxed Here s What You Need To Know

Know About The Changes In Home Loan Rules SBS Malayalam

5 Home Loan Tax Exemptions Businesszag

Income Tax Rebate On Home Loan Tmdl edu vn

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Latest Income Tax Rebate On Home Loan 2023

Home Loan Rules 2017 GoI Latest Order

Latest Income Tax Rebate On Home Loan 2023

Income Tax Rebate On Home Loan Rules - These include a deduction of up to Rs 1 5 lakh on the principal repayment under section 80C of the income tax Act and up to Rs 2 lakh on the interest paid under section 24 in a single financial year Now other than this did you know there is way you can claim tax benefit on a home loan