How Much Is The Disabled Veterans Property Tax Exemption 6 Georgia In Georgia veterans with a 100 service connected disability might be entirely exempted from property tax Learn more about Georgia s Disabled

Disabled Veteran Exemption Disability Rating Exemption Amount Up To 10 to 29 5 000 from the property s value 30 to 49 7 500 from the property s value 50 A veteran with at least a 10 service related disability may get a 5 000 property tax exemption Meanwhile a 100 service

How Much Is The Disabled Veterans Property Tax Exemption

How Much Is The Disabled Veterans Property Tax Exemption

https://texasveteranloan.com/wp-content/uploads/2020/01/va-loans-texas-social-share.jpg

Do 100 Disabled Veterans Qualify For Property Tax Exemptions YouTube

https://i.ytimg.com/vi/jG-waEDZwro/maxresdefault.jpg

Disabled Veterans Property Tax Exemptions By State Tax Exemption

https://i.pinimg.com/originals/72/de/b0/72deb08487ef56182fd2f5060ab36198.jpg

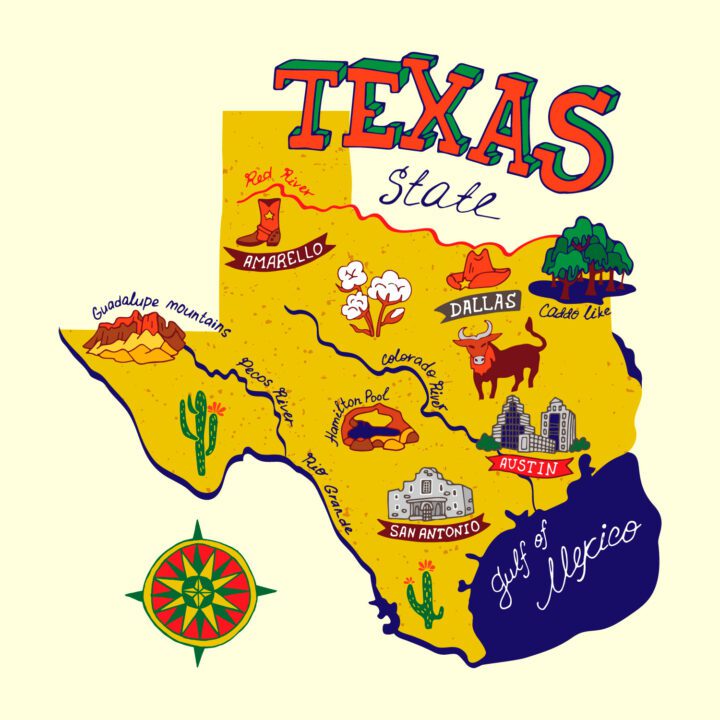

Veterans who have a 100 percent disability rating or are deemed unemployable may qualify for a full property tax exemption on their primary residence Tax Code Section 11 131 provides an exemption of the total appraised value of the residence homestead of Texas veterans awarded 100 percent compensation from the

Some types of properties are exempt from real estate taxes These include qualifying nonprofit religious and government properties Senior citizens veterans and those eligible for STAR the School Tax 50 to 69 receive a 10 000 property tax exemption 30 to 49 receive a 7 500 property tax exemption 10 to 29 receive a 5 000 property tax exemption The Tax Office

Download How Much Is The Disabled Veterans Property Tax Exemption

More picture related to How Much Is The Disabled Veterans Property Tax Exemption

Saving On Property Taxes PA Disabled Veterans Property Tax Exemption

https://www.americanveteran.org/wp-content/uploads/2023/07/PADisabledVeteransPropertyTaxExemptionSavingOnPropertyTaxesForEligibleVeterans.jpg

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

https://www.esperaiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

100 Percent Disabled Veterans Qualify For The Veterans Property Tax

https://i.ytimg.com/vi/I6ctvDSp2Ck/maxresdefault.jpg

The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service connected injury or disease 70 to 100 12 000 from the property s value A disabled veteran may also qualify for an exemption of 12 000 of the assessed value of the property if the veteran is age 65

An increase in the veteran s percentage of disability from the Department of Veterans Affairs which may include a retroactive determination or the combat While disabled veteran property tax exemptions can significantly reduce or even eliminate a homeowner s property taxes veterans may qualify for other

How The Disabled Veterans Property Tax Benefit Works YouTube

https://i.ytimg.com/vi/O8LAZJyQYbo/maxresdefault.jpg

ALL COLORADO TOTALLY DISABLED VETS NEED THE DISABLED VETERAN PROPERTY

https://1.bp.blogspot.com/-48dxsMUG4IM/Vt-QNIrYw-I/AAAAAAAARS4/WzZDruXxI3cjdFdObdxDOPeywWVfiVZRgCPcBGAYYCw/s900/photo.jpg

https://www.military.net/which-states-offer...

6 Georgia In Georgia veterans with a 100 service connected disability might be entirely exempted from property tax Learn more about Georgia s Disabled

https://comptroller.texas.gov/taxes/property-tax/...

Disabled Veteran Exemption Disability Rating Exemption Amount Up To 10 to 29 5 000 from the property s value 30 to 49 7 500 from the property s value 50

What States Are Tax Free For Disabled Veterans Finance Zacks

How The Disabled Veterans Property Tax Benefit Works YouTube

Missouri Lawmakers Propose Property Tax Exemption For Disabled Veterans

Hecht Group Disabled Veterans In Arkansas May Be Eligible For

Fl Property Tax Exemption For Disabled Veterans PRORFETY

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Tax Exemption Form For Veterans ExemptForm

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Property Tax Exemption For Illinois Disabled Veterans

How Much Is The Disabled Veterans Property Tax Exemption - Tax Code Section 11 131 provides an exemption of the total appraised value of the residence homestead of Texas veterans awarded 100 percent compensation from the