How Much Revenue Does The Gas Tax Generate The United States federal excise tax on gasoline is 18 4 cents per gallon and 24 4 cents per gallon for diesel fuel Proceeds from the tax partly support the Highway Trust Fund The federal tax was last raised on October 1 1993 and is not indexed to inflation which increased 111 from Oct 1993 until Dec 2023 On average as of April 2019 state and local taxes and fees add 34 24 cents to g

Fuel duties are levied on purchases of petrol diesel and a variety of other fuels They represent a significant source of revenue for government In 2023 24 we Gas taxes thus accounted on average for about 15 of the average retail gasoline price of 3 50 per gallon of regular unleaded as of November 2023 Here s a rundown of the gas taxes

How Much Revenue Does The Gas Tax Generate

How Much Revenue Does The Gas Tax Generate

https://tnjn.com/wp-content/uploads/2017/02/14991242791_cc91074a2d_o.jpg

Two States Suspend Gas Tax To Help Drivers As Prices Soar Will Yours

https://www.the-sun.com/wp-content/uploads/sites/6/2022/03/lv-comp-gas-tax-suspensions-1.jpg?w=1500

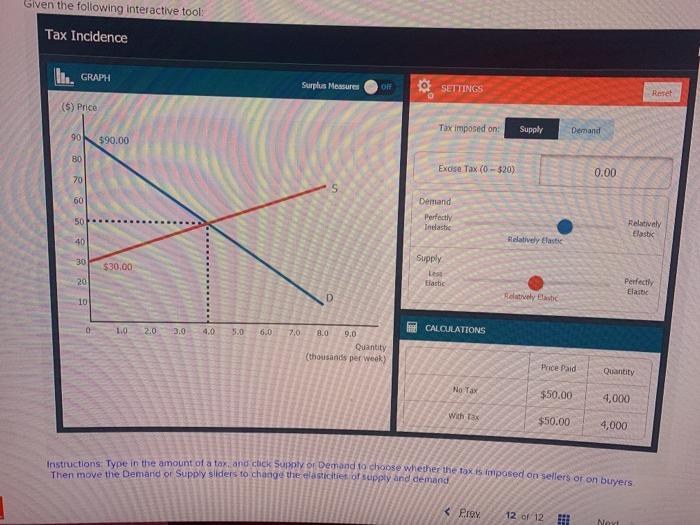

Solved Instructions Type In The Amount Of A Tax And Click Chegg

https://media.cheggcdn.com/study/525/52549f32-1670-4310-aa22-83fd5e6c200e/image

Because the gas tax is not pegged to inflation its purchasing power has eroded significantly over the past 28 years and the tax is now worth 45 percent less than in 1993 if the tax had been Consumers in the United States had to pay state and federal gasoline motor fuel taxes of 57 09 U S dollar cents per gallon In 2021 the average annual retail price of gasoline in

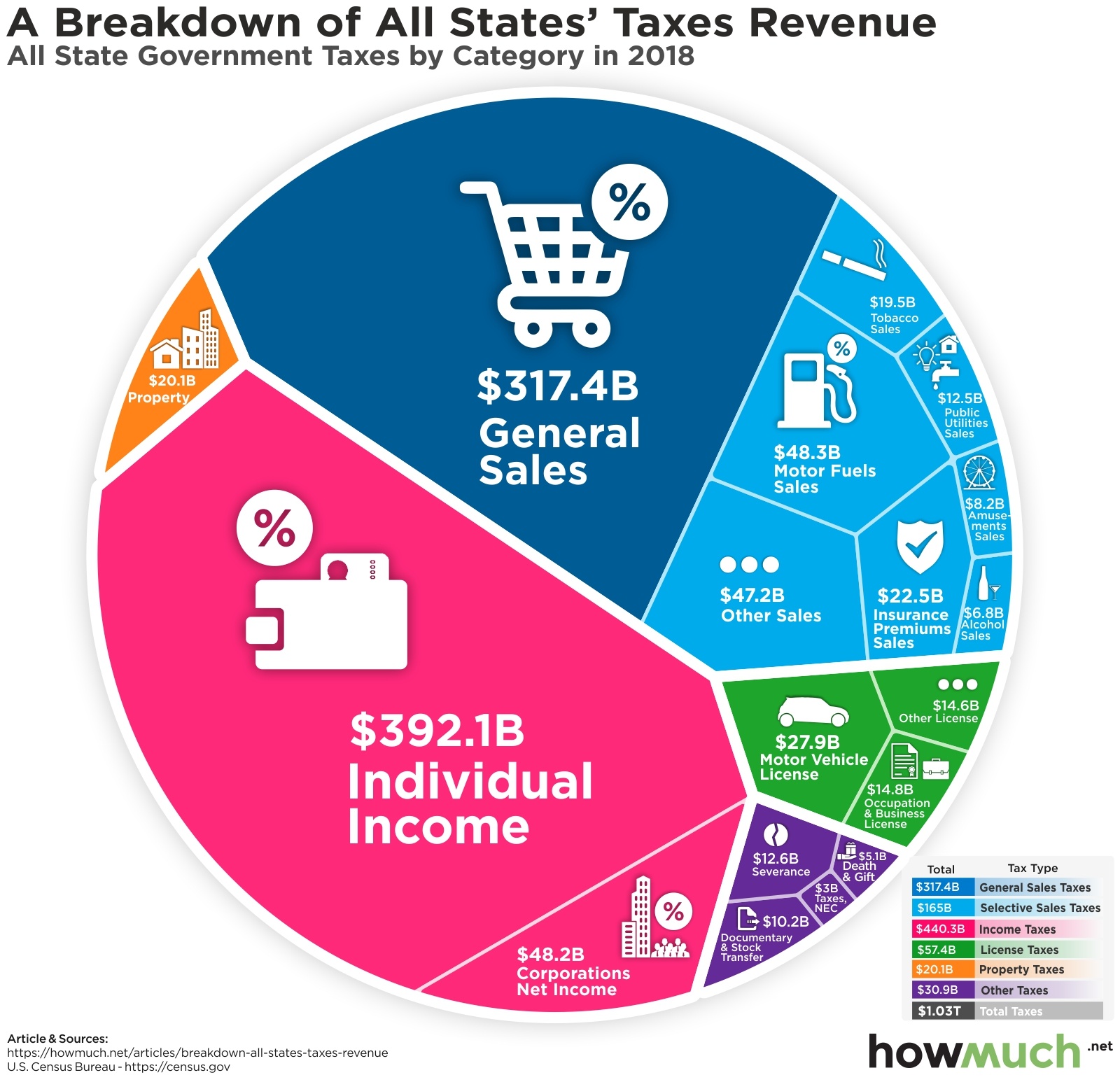

In 2021 state and local governments in the United States collected about 53 05 billion U S dollars through motor fuels tax This is a significant increase from Gas Tax The excise tax on fuel is the only specific tax on energy use in the United States Currently federal tax rates are at 0 18 per gallon of gasoline and 0 24 per gallon of diesel

Download How Much Revenue Does The Gas Tax Generate

More picture related to How Much Revenue Does The Gas Tax Generate

In One Chart State Tax Revenue By Source

https://cdn.howmuch.net/articles/breakdown-americas-taxes-revenue-2dc5.jpg

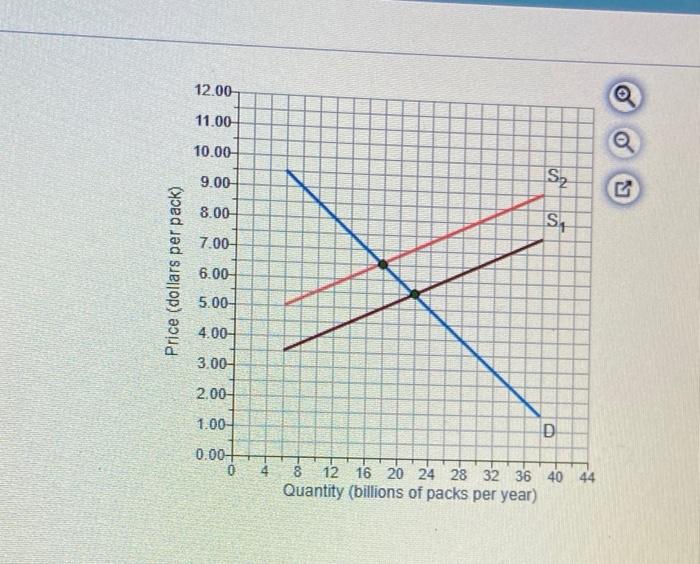

Solved Use The Graph To The Right Of The Market For Chegg

https://media.cheggcdn.com/study/ec9/ec980ab9-c238-4061-90a3-0a74c3319816/image

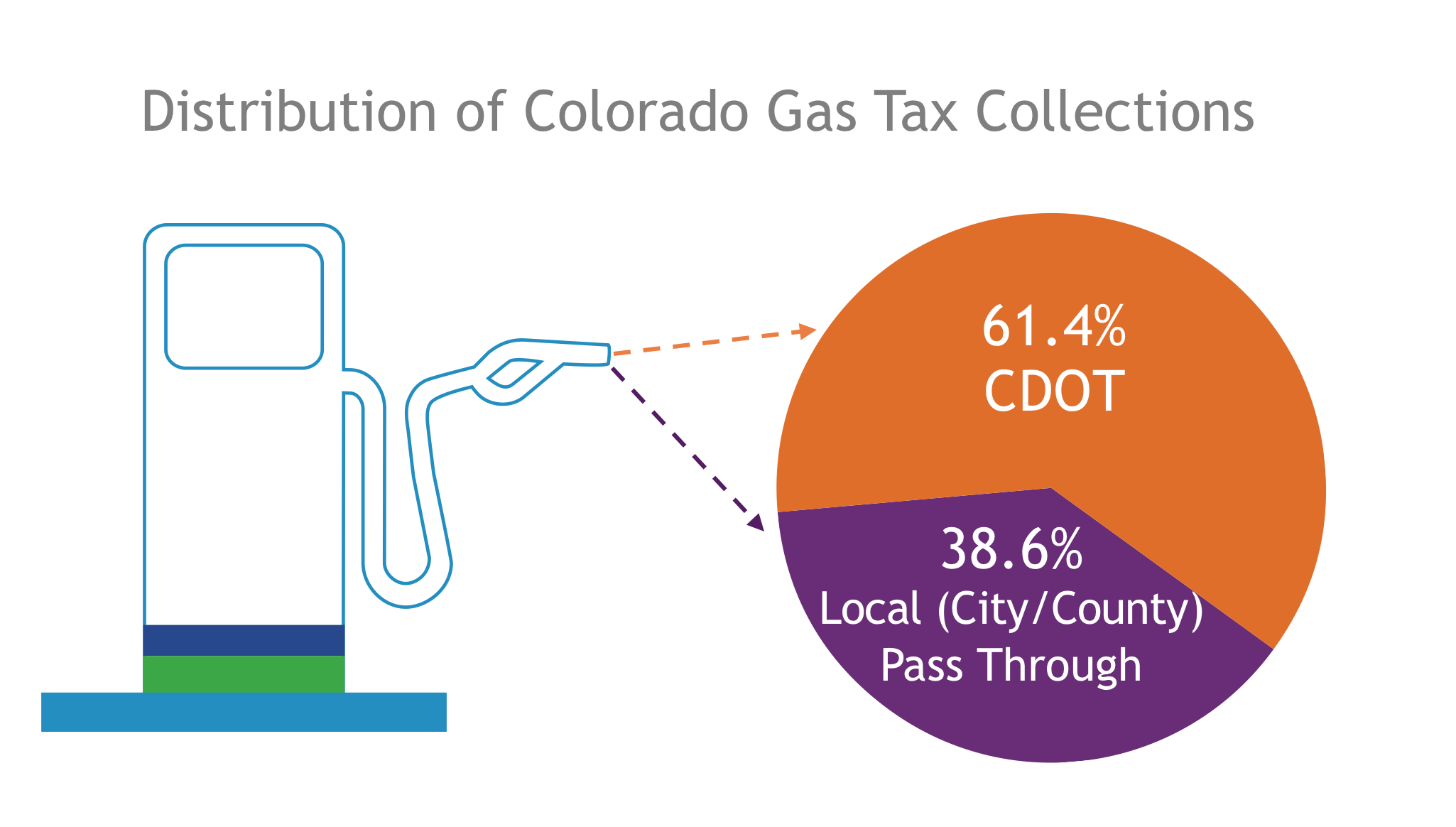

Transportation Funding Colorado Department Of Transportation

https://www.codot.gov/programs/yourtransportationpriorities/your-transportation-plan/assets/gas-tax-collections.png

Our analysis shows that through 2050 a 0 25 gas tax would generate 840 billion in revenue for the federal government add 1 2 million additional electric The UK government receives tax revenue from drivers of petrol and diesel cars via two key methods fuel duty which brings 28 billion a year into government

Currently 0 18 of every gallon that Americans pump goes to federal taxes 31 on average goes to state taxes EVs might provide solution to surging gas prices Under the Chamber of Commerce proposal the tax increase would have phased in at 0 05 per year until it reaches 0 25 per gallon Assuming a similar proposal starting in 2021

Governor Defends Gas Tax Proposal

https://x-default-stgec.uplynk.com/ausw/slices/51c/ea660b0be0634bafb4e6d8a0650cafd3/51c3e822fc864e9b9d6ab29fed7a11f3/poster_72f2141461624d1b8e0758c3e981f8d8.jpg

60 Revenues Page 11

https://stories.opengov.com/livermoreca/uploads/4024db0ab1cc-Subterranean.JPG

https://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

The United States federal excise tax on gasoline is 18 4 cents per gallon and 24 4 cents per gallon for diesel fuel Proceeds from the tax partly support the Highway Trust Fund The federal tax was last raised on October 1 1993 and is not indexed to inflation which increased 111 from Oct 1993 until Dec 2023 On average as of April 2019 state and local taxes and fees add 34 24 cents to g

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/fuel-duties

Fuel duties are levied on purchases of petrol diesel and a variety of other fuels They represent a significant source of revenue for government In 2023 24 we

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Governor Defends Gas Tax Proposal

Raise The Gas Tax Rather Than Relying On clean Fuels Letters To The

Stop The Gas Tax Food Tax Connecticut Senate Republicans

What Is A Gas Tax Holiday Federal Proposal s Meaning How It Affects

Notes On The Gas Tax School Choice Inflation Paul Curtman

Notes On The Gas Tax School Choice Inflation Paul Curtman

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

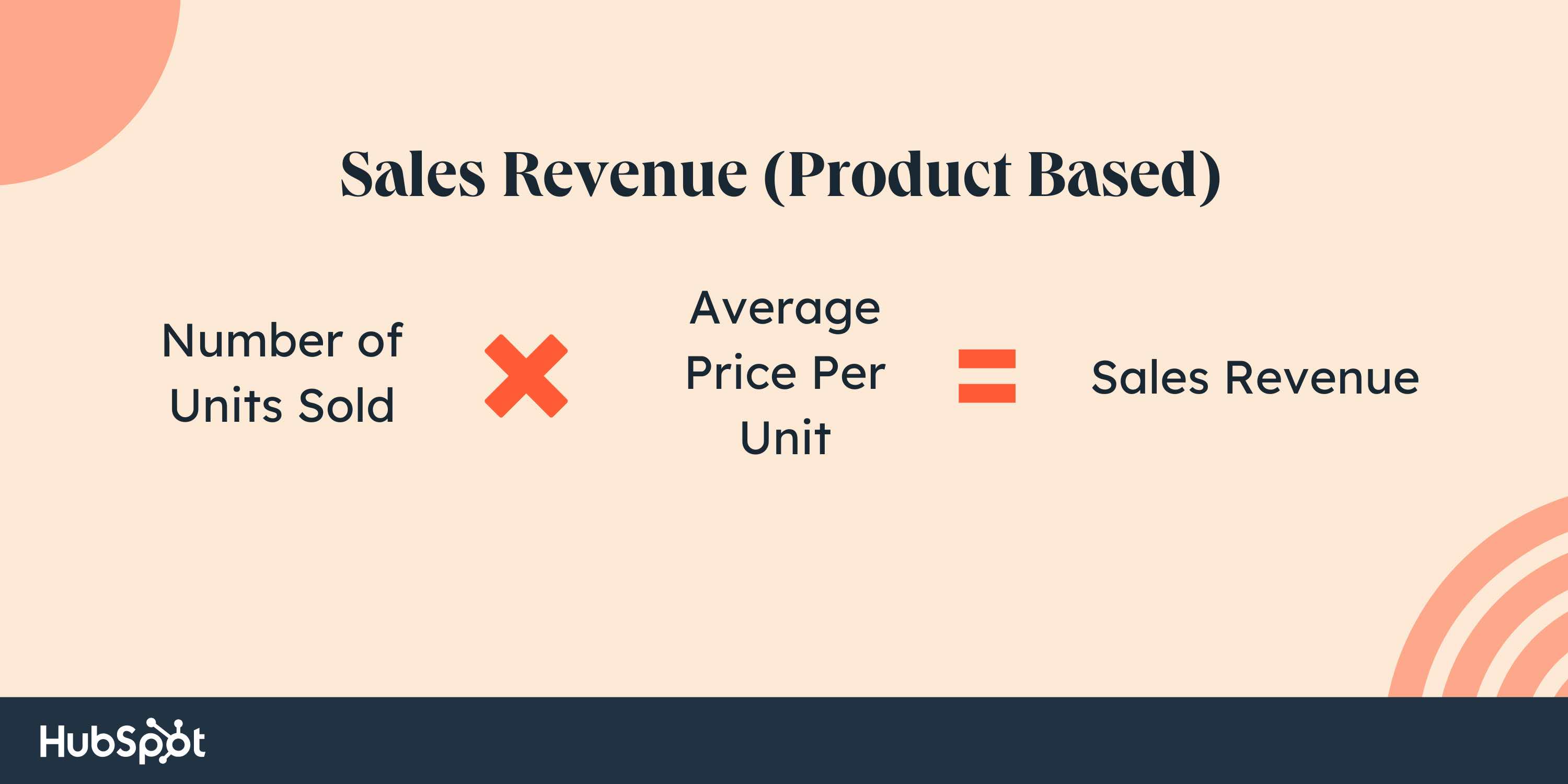

The Sales Revenue Formula How To Use It And Why It Matters Scribebee

Raise The Gas Tax Reform The Federal Highway Trust Fund

How Much Revenue Does The Gas Tax Generate - Because the gas tax is not pegged to inflation its purchasing power has eroded significantly over the past 28 years and the tax is now worth 45 percent less than in 1993 if the tax had been