How Much Savings Interest Is Tax Free Your personal savings allowance PSA is a tax free allowance that lets you earn interest on your savings without

Helen Saxon Updated 4 May 2023 If you earn less than 18 570 a year from income and savings interest then all your savings interest will be tax free Depending on how much money you make you can expect to pay between 10 to 37 on savings account interest in taxes These are the

How Much Savings Interest Is Tax Free

How Much Savings Interest Is Tax Free

https://www.advantageccs.org/wp-content/uploads/high-interest-savings-account-2020-1536x1024.jpg

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

How Much Interest Is Your Savings Account Earning Savings Account

https://i.pinimg.com/originals/7d/3c/61/7d3c61b3028155c1d427037a46533517.png

The starting rate for savings is a tax break on interest worth up to 5 000 aimed at those on a lower income If you have used up your personal allowance then it can help reduce the tax bill on your If tax is payable on savings interest it s charged at your usual rate of income tax 0 20 40 or 45 What types of savings interest are taxed Interest

Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned In most cases interest paid in savings accounts is taxed Certain tax advantaged retirement accounts education savings accounts and other

Download How Much Savings Interest Is Tax Free

More picture related to How Much Savings Interest Is Tax Free

Deposits With A 5 Annual Interest Rate Are Once Again Available

https://images.surferseo.art/f6cd9970-d9d0-4840-8721-7398d41ca238.png

Tax On Savings Interest KNNLLP

http://www.knnllp.co.uk/wp-content/uploads/2018/11/2017-03-23-391386.jpg

How To Get Highest Savings Account Interest Rate Investdunia Free

https://investdunia.com/wp-content/uploads/2017/11/Savings-account-interest-rate-Dec-2020.png

The interest you earn from the money in a savings account is taxable In the U S the principal balance in your savings account is not taxable The IRS taxes interest from high yield savings accounts and traditional interest bearing savings accounts at the same rate they tax other income e g from your job Any money

You earn 1 500 in savings interest This would make your net income excluding any deductibles like pension contributions for the sake of argument 44 000 Direct ISA 3 00 tax free AER variable Tax free AER VARIABLE Invest from 1 to 20 000 in the tax year 2023 24 Find out more Junior ISA 4 00 tax

3 Ways To Calculate Bank Interest On Savings WikiHow

http://www.wikihow.com/images/5/5a/Calculate-Bank-Interest-on-Savings-Step-14-Version-2.jpg

How Much Savings Should I Have Accumulated By Age Personal Wealth

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2022/11/financial-freedom-saving-rate-retire-early-chart.png?fit=1456,9999

https://www.moneysavingexpert.com/sa…

Your personal savings allowance PSA is a tax free allowance that lets you earn interest on your savings without

https://www.moneysavingexpert.com/savings/tax-free-savings

Helen Saxon Updated 4 May 2023 If you earn less than 18 570 a year from income and savings interest then all your savings interest will be tax free

SBI Tax Savings Scheme Eligibility Investment Limits Interest Rates

3 Ways To Calculate Bank Interest On Savings WikiHow

How I m Getting 5 Interest On FDIC Insured Savings Accounts Poorer

What Can You Buy During Tax free Weekend Here s A Complete List The

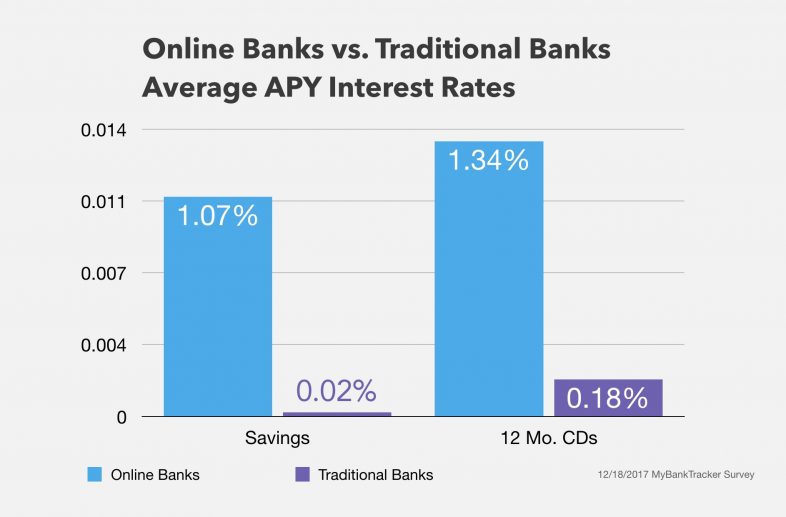

What Banks Do With The Money In Your Savings Account MyBankTracker

Coming To Terms With The Interest Rate Rise Finance Advice Centre

Coming To Terms With The Interest Rate Rise Finance Advice Centre

How Interest Works On Savings Accounts Discover

Income Tax Rates In The UK

THOUGHTSKOTO

How Much Savings Interest Is Tax Free - If tax is payable on savings interest it s charged at your usual rate of income tax 0 20 40 or 45 What types of savings interest are taxed Interest