How Much Should You Get Paid For Mileage Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys You re allowed to pay your employee a certain amount of MAPs each year

How much can you get reimbursed if you drive your own car for work It depends on your employer and the law in your state Federal law doesn t require employers to pay for an employee s mileage and travel expenses unless the expense would drop the employee s pay rate below minimum wage Learn the ins and outs of employee mileage reimbursement IRS tax deduction rates and how an organization can adopt its own mileage policies

How Much Should You Get Paid For Mileage

How Much Should You Get Paid For Mileage

https://knowbetterplanbetter.com/static/087ed8b0e4baf1db10727b7429b22b3c/48efe/how-much-should-i-have-in-savings.jpg

How Do You Know How Much You Should Be Paid Study Work Grow

https://studyworkgrow.com.au/wp-content/uploads/2023/02/pay.jpg

How Much Should You Tip A Delivery Driver Elite EXTRA

https://eliteextra.com/wp-content/uploads/2022/07/AdobeStock_434928489.jpeg

The standard mileage rate for 2025 is 70 cents per mile set by the IRS To calculate a mileage reimbursement multiply the rate by the miles you drive How is mileage reimbursement calculated The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like gas insurance depreciation and standard maintenance

Mileage reimbursement is employer set compensation for work related use of your personal vehicle Some companies pay monthly car allowances while others might require you to track mileage for specific travel The Internal Revenue Service IRS has standard mileage rates if you list mileage deduction on your income tax You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can calculate mileage reimbursement in three simple steps Select your tax year Input the number of miles driven for business charitable medical and or moving purposes

Download How Much Should You Get Paid For Mileage

More picture related to How Much Should You Get Paid For Mileage

Photography Pricing Guide How Much Should You Charge Run N Gun

https://therunngun.com/wp-content/uploads/2021/01/Thumbnail-Pricing-Guide-RunNGun-2.jpg

Make Sure You Get Paid On Time Here s Why

https://fatstacksblog.com/wp-content/uploads/2020/01/get-paid-image-jan9.jpg

How Much Should You Spend On Your Online Marketing Strategy Mind

https://hello.mindandmetrics.com/hubfs/Blog-Post-Headers-2019/how-much-to-spend-marketing.jpg

Now you can quickly calculate how much your employees can get back with our easy to use mileage reimbursement calculator Enter the miles driven to see how much money you can get back Each country has its own standard mileage allowance Throughout this article we will walk you through the different scenarios so you know what to expect whether you are using your personal car or you have access to a company As an employer you don t have to pay an employee 45p

If you ve received a payment recently and wondered How much should I be reimbursed for mileage the answer depends on the vehicle program your company uses the miles you drive and the geographic expenses of vehicle ownership Now you can quickly calculate how much your employees can get back with our easy to use mileage reimbursement calculator Select the tax year you want to calculate for and enter the miles driven to see how much money you can get back Each country has its own standard mileage allowance

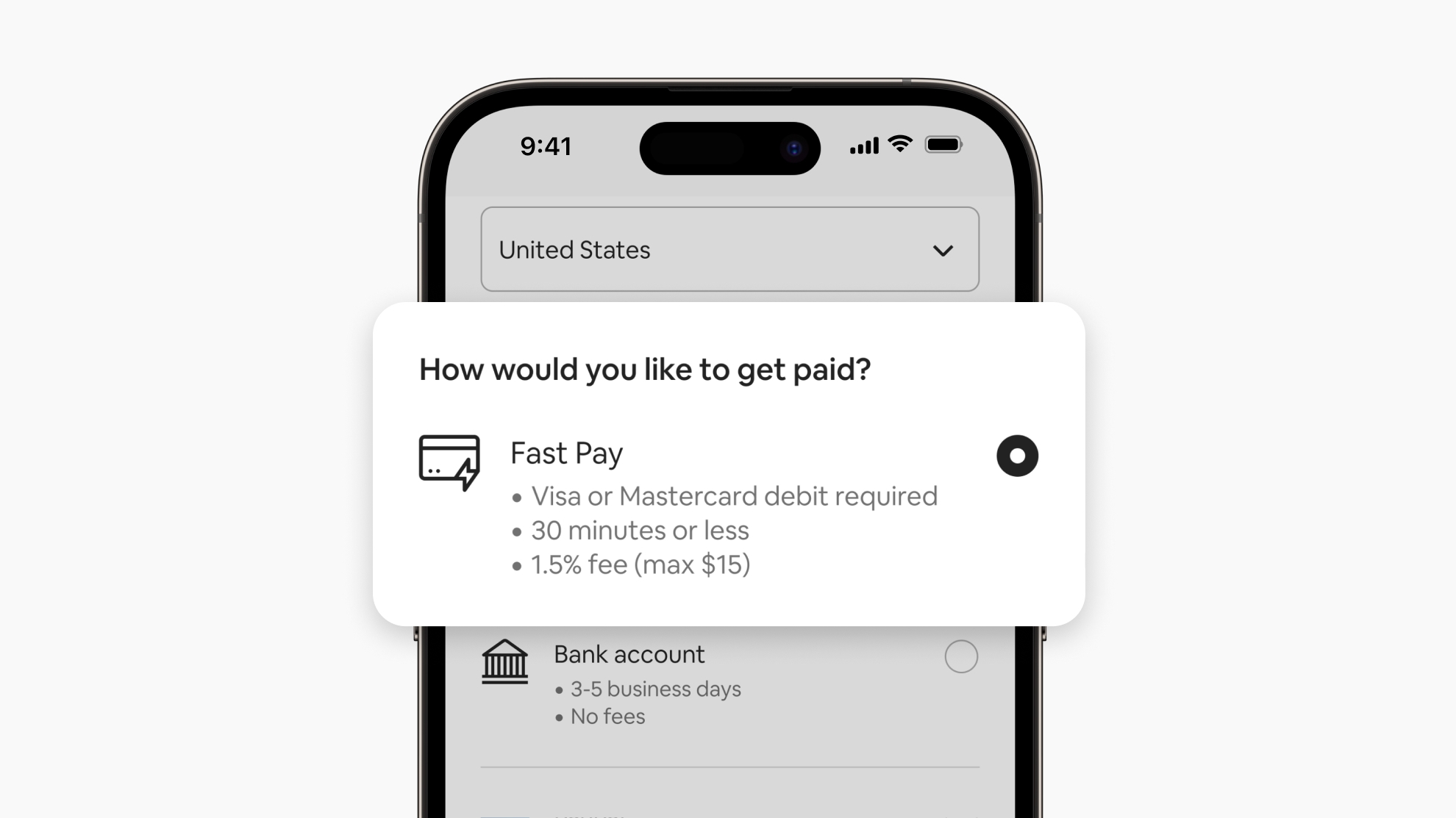

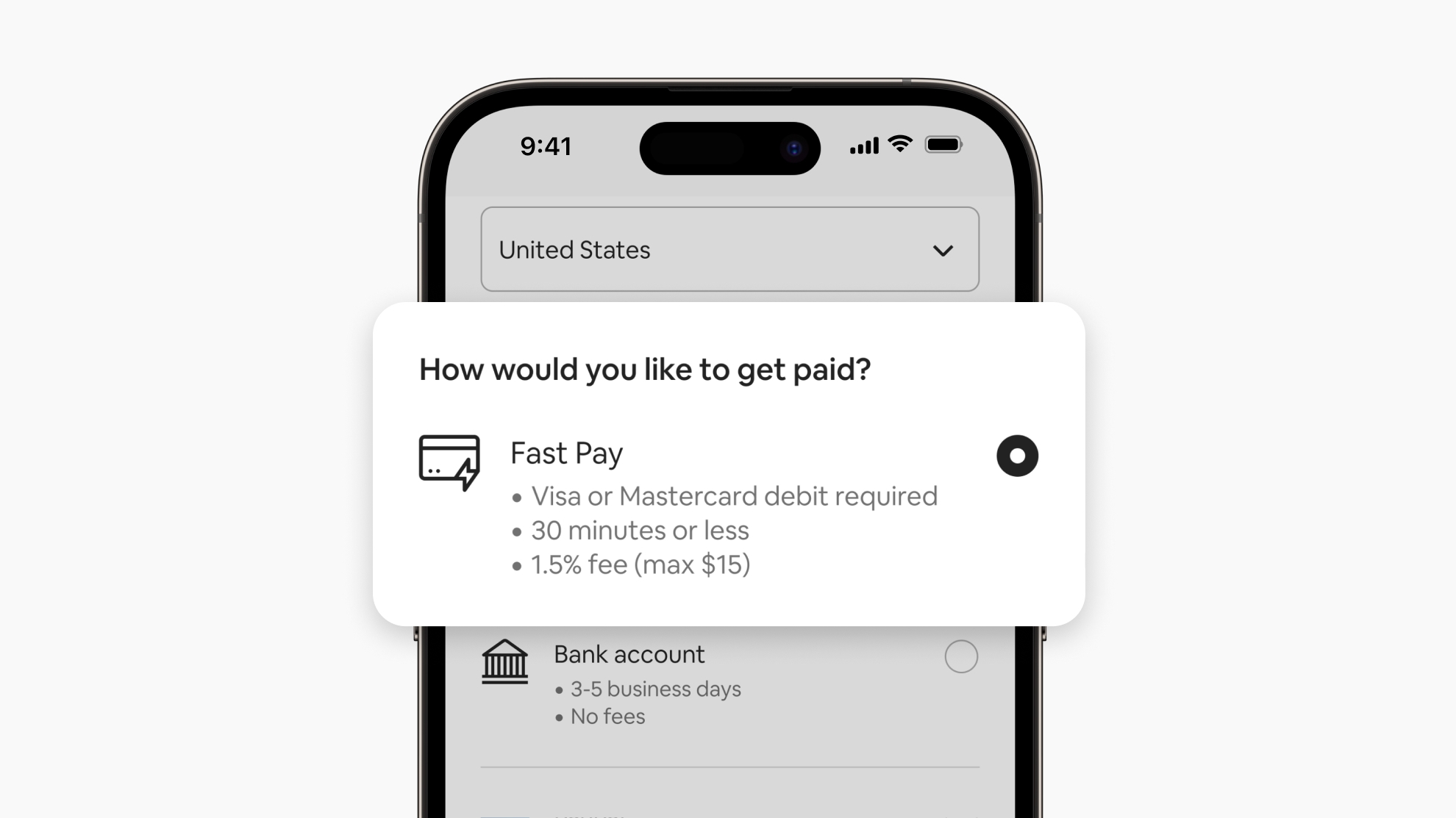

Get Paid Faster With Fast Pay Resource Center Airbnb

https://images.contentstack.io/v3/assets/bltb428ce5d46f8efd8/blt9e21d9169f68cec3/6362ad40e59c1746b737d2a8/tools-get-paid-XL.jpg

How Much Exercise Is Enough

https://nutritionfacts.org/app/uploads/2017/08/38-exercise-1024x1024.png

https://www.gov.uk › expenses-and-benefits-business...

Mileage Allowance Payments MAPs are what you pay your employee for using their own vehicle for business journeys You re allowed to pay your employee a certain amount of MAPs each year

https://www.thebalancemoney.com › how-much-are...

How much can you get reimbursed if you drive your own car for work It depends on your employer and the law in your state Federal law doesn t require employers to pay for an employee s mileage and travel expenses unless the expense would drop the employee s pay rate below minimum wage

The Best And Easiest Ways To Make Money Overseas

Get Paid Faster With Fast Pay Resource Center Airbnb

How Much You Get Paid For Homeschooling In California Varies Greatly

Jim Rohn Quote You Don t Get Paid For The Hour You Get Paid

How To Get Paid To Sext In 2023 Vicetemple

How Much Should You Get Paid Creative Training Techniques The Bob

How Much Should You Get Paid Creative Training Techniques The Bob

How To Make Sure You Get Paid For The Work You Do

How Much Should You Spend On A House

How To Monetize Your Blog IAC

How Much Should You Get Paid For Mileage - You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can calculate mileage reimbursement in three simple steps Select your tax year Input the number of miles driven for business charitable medical and or moving purposes