How Much Student Loan Interest Can I Deduct On My Taxes Web The court decided that all costs in the context of initial education such as a Bachelor s degree or an apprenticeship without any prior qualification cannot be deducted as income related expenses Werbungskosten but as special expenses Sonderausgaben Werbungskosten amp Sonderausgaben What s the difference

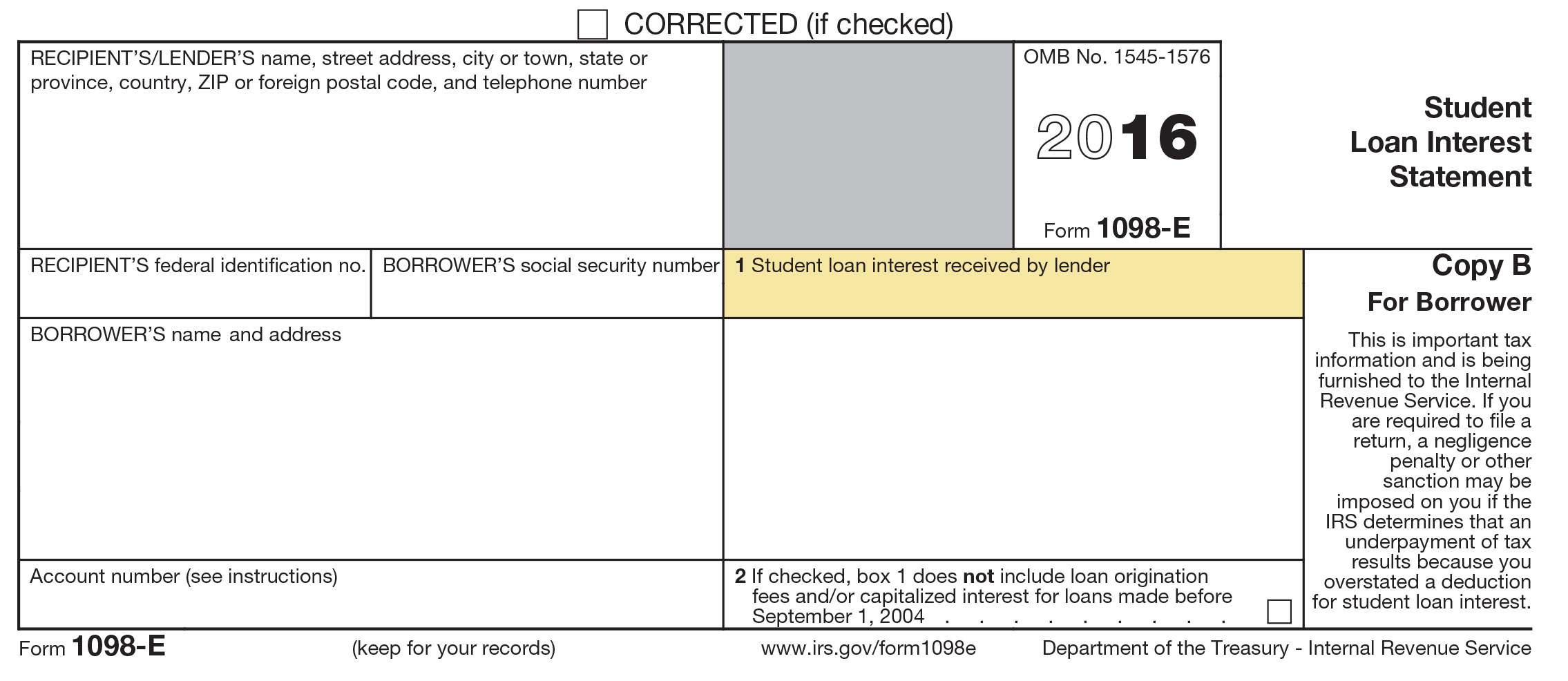

Web 21 Nov 2023 nbsp 0183 32 You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status Web 25 Jan 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

How Much Student Loan Interest Can I Deduct On My Taxes

How Much Student Loan Interest Can I Deduct On My Taxes

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2FvqH5qaLkkguQwCJxW4ty7%2F20273a18cf0dceae91b420dd3ed349be%2FThe_D_List_.png&w=3840&q=100

Can I Deduct My Student Loan Interest NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2018/03/Screenshot_12.jpg

Student Loan Interest Can You Deduct It On Your Tax Return Kelly CPA

https://kelly.cpa/wp-content/uploads/2020/05/Screen-Shot-2020-05-27-at-10.02.59-AM.png

Web 16 Feb 2021 nbsp 0183 32 The student loan interest deduction reduces your taxable income based on how much interest you paid on top of your student loan principal payments As an example If you re single and make 40 000 a year all of it is subject to taxes Web 6 Dez 2020 nbsp 0183 32 The short answer is that you can deduct 2 500 in student loan interest in both the 2020 and 2021 tax years But there s a little more to the story First off the student loan

Web Reporting the amount of student loan interest you paid in 2022 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject to tax which may benefit you by reducing the amount of tax you may have to pay Web 3 Apr 2023 nbsp 0183 32 You may be able to deduct up to 2 500 of student loan interest from your taxes You may be limited or prevented from claiming the deduction entirely depending on your income level and a few other factors The deduction only applies to the portion of your payment dedicated to interest

Download How Much Student Loan Interest Can I Deduct On My Taxes

More picture related to How Much Student Loan Interest Can I Deduct On My Taxes

How Much Student Loan Interest Can I Deduct UnderstandLoans

https://www.understandloans.net/wp-content/uploads/can-i-deduct-my-student-loan-interest.png

Can I Deduct My Child s Student Loan Interest

http://taxaudit.com/getmedia/4021edce-e7b8-4021-88a8-32ea41fc3d04/StudentLoanInterestDeduction.jpg;?width=800&height=452&ext=.jpg

When Filing Your Taxes Don t Forget To Deduct Up To 2500 In Interest

https://i.pinimg.com/736x/ac/ea/c6/aceac6c109a0d1839ad43e44c64f3c15--student-loan-interest-student-loans.jpg

Web 26 Okt 2023 nbsp 0183 32 The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable Web 28 Aug 2020 nbsp 0183 32 The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your taxable income

Web 6 Okt 2021 nbsp 0183 32 If you qualify you can deduct up to 2 500 of student loan interest per year When your modified adjusted gross income MAGI reaches the yearly limit for your tax filing status the Web 2 Okt 2023 nbsp 0183 32 ITA Home This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information You ll Need Filing status Basic income information Your adjusted gross income Educational expenses paid with nontaxable funds

What Types Of Interest Can I Deduct For Taxes

https://blog.bakerave.com/hubfs/What Interest Can You Deduct for Taxes.jpg#keepProtocol

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

https://taxfix.de/en/guide-german-taxes/save-money/deducting-stud…

Web The court decided that all costs in the context of initial education such as a Bachelor s degree or an apprenticeship without any prior qualification cannot be deducted as income related expenses Werbungskosten but as special expenses Sonderausgaben Werbungskosten amp Sonderausgaben What s the difference

https://www.irs.gov/taxtopics/tc456

Web 21 Nov 2023 nbsp 0183 32 You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income MAGI amount reaches the annual limit for your filing status

How Much Mortgage Interest Can I Deduct On My Taxes Nj

What Types Of Interest Can I Deduct For Taxes

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

Can I Deduct Dental Implants On My Taxes Dental News Network

Can I Deduct My Student Loan Interest Student Loan Interest Student

What Can I Deduct On My Business Taxes Due Business Tax Online

What Can I Deduct On My Business Taxes Due Business Tax Online

What Can I Deduct On My Taxes 2021

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

Student Loan Interest Can You Deduct It On Your Tax Return N K CPAs

How Much Student Loan Interest Can I Deduct On My Taxes - Web Assuming you meet all the requirements to receive the student loan interest tax deduction you can deduct up to 2 500 in qualifying interest payments within the tax year Can student loan interest be deducted for tax year 2023