How Much Student Loan Interest Can I Write Off Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the year whichever is less How Much Interest Paid on a Student Loan Can I Deduct The IRS allows borrowers to deduct up to 2 500 of the interest that s paid on a student loan What Is a Tax Deduction

How Much Student Loan Interest Can I Write Off

How Much Student Loan Interest Can I Write Off

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

How Much Student Loan Interest Can I Deduct UnderstandLoans

https://www.understandloans.net/wp-content/uploads/can-i-deduct-my-student-loan-interest.png

How Much Interest Is On Student Loans INFOLEARNERS

https://infolearners.com/wp-content/uploads/2022/05/how-much-interest-is-on-student-loans.png

Student loan interest is deductible if your modified adjusted gross income or MAGI is less than 70 000 145 000 if filing jointly If your MAGI was between 70 000 and 85 000 175 000 if The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your taxable income which

Key takeaways You may be able to deduct up to 2 500 of student loan interest from your taxes You may be limited or prevented from claiming the deduction entirely depending on your income level and a few other factors The deduction only applies to the portion of your payment dedicated to interest While it s possible to deduct up to 2 500 in student loan interest payments there are several other rules and limitations Note that this deduction at most will save you a few hundred dollars It s still worthwhile if you qualify but it won t change your life like a significantly lower IBR payment could

Download How Much Student Loan Interest Can I Write Off

More picture related to How Much Student Loan Interest Can I Write Off

How Does Student Loan Interest Work CreditAssociates

https://i6z5s7q8.rocketcdn.me/wp-content/uploads/2020/12/201203_5_StudentLoanInterest.jpg

College Student Statistics

https://lh6.googleusercontent.com/proxy/0r6iN8RacbDbTK8FoGgQpdCaO-Tm-cKse_4oGqX10hfrm8LZIc1QXuW3ztj7CFsQqRVefEwzaj4r9l1HaF9f-rNchxw4e9m4pCSzvcMtQwJ4oDVSOhoATdAQdmf_cmfg0b0=s0-d

Student Debt And Moral Luck Lawyers Guns Money

http://cdn.statcdn.com/Infographic/images/normal/24477.jpeg

IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service IRS and to you Will I receive a 1098 E If you paid 600 or more in interest to a federal loan servicer during the tax year you ll receive at least one 1098 E The short answer is that you can deduct 2 500 in student loan interest in both the 2020 and 2021 tax years But there s a little more to the story First off the student loan interest you

[desc-10] [desc-11]

Claiming The Student Loan Interest Deduction

https://www.taxdefensenetwork.com/wp-content/uploads/2022/04/student-loan-interest-deduction-worksheet-1-2048x1352.jpg

How Much Money Can You Get In Student Loans INFOLEARNERS

https://infolearners.com/wp-content/uploads/2022/05/how-much-money-can-you-get-in-student-loans-1024x877.png

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

https://www.forbes.com/advisor/taxes/student-loan-interest-tax...

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the year whichever is less

How Do I Get A Increase On My Student Loan

Claiming The Student Loan Interest Deduction

Student Loan Plan 1 2 Thresholds Confirmed For April 2023 PAYadvice UK

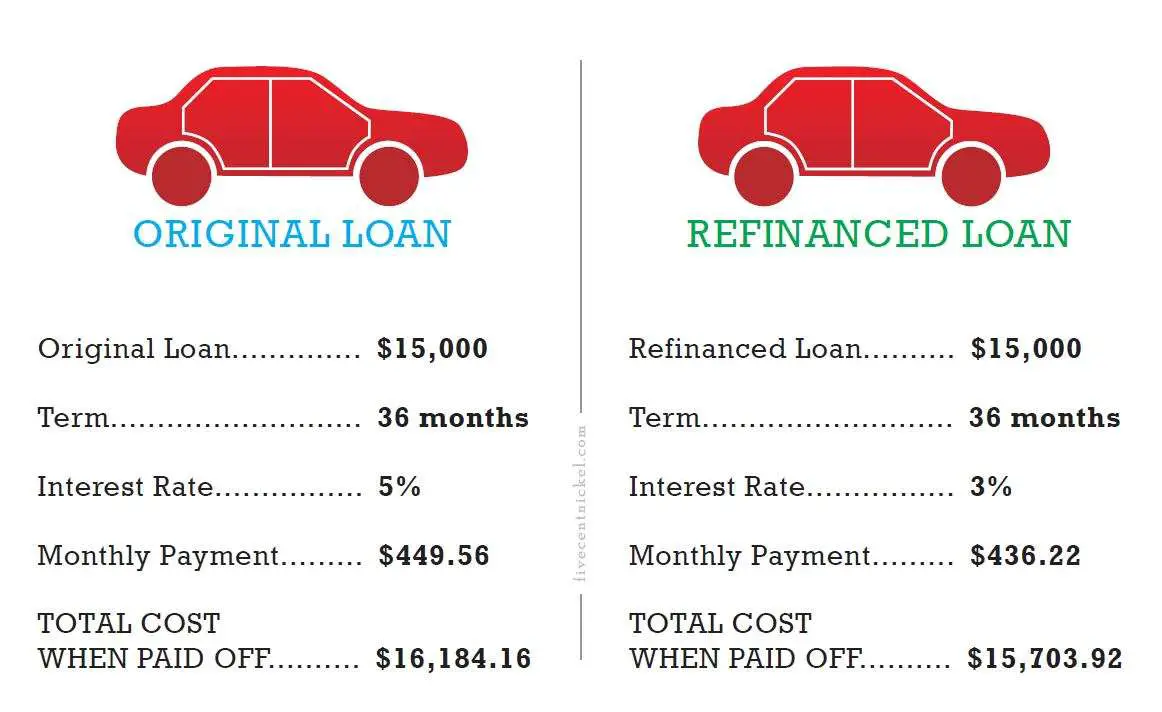

Can You Refinance Your Auto Loan With The Same Bank UnderstandLoans

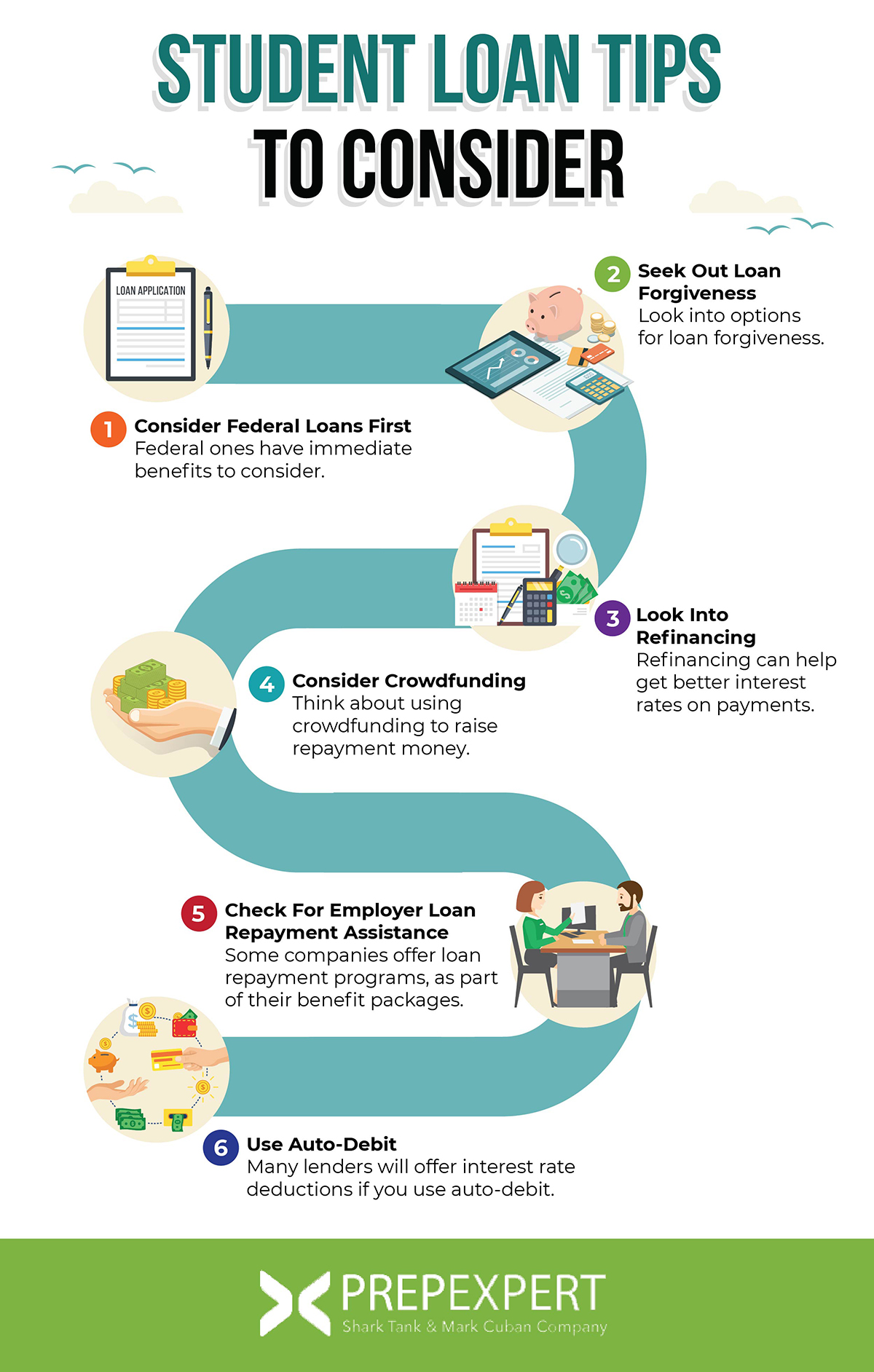

Student Loan Tips To Use When Applying Repaying Prep Expert

Why You Shouldn t Co sign On A College Loan CBS News

Why You Shouldn t Co sign On A College Loan CBS News

How Much Student Loan Debt Is Normal Personal Finance Gold

Average Student Loan Debt 2023 By Year Age More

Awesome Loan Calculator Education References Educations And Learning

How Much Student Loan Interest Can I Write Off - Key takeaways You may be able to deduct up to 2 500 of student loan interest from your taxes You may be limited or prevented from claiming the deduction entirely depending on your income level and a few other factors The deduction only applies to the portion of your payment dedicated to interest