How Much Tax Credit For A Car Donation If you are looking for a car donation tax credit of over 500 but less than 5 000 you ll have to fill out a 1098 c form or a 8283 IRS Form for a non cash charitable contribution A tax deduction for a donated car is a simple step within the

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill Contributions including vehicle donations may be claimed as deductions on your federal tax return if you itemize How much can I deduct Once your vehicle is sold the selling price determines the amount of your donation

How Much Tax Credit For A Car Donation

How Much Tax Credit For A Car Donation

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Your Guide To Car Donation Driving Guide Donate Charity Car

https://i.pinimg.com/originals/23/64/5f/23645f8bd144aae7045d74f1470a16f5.jpg

How To Make A Car Donation

https://funender.com/wp-content/uploads/2020/08/car-donation-1.jpg

To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI The amount of your charitable contribution to charity X is reduced by 700 70 of 1 000 The result is your charitable contribution deduction to charity X can t exceed 300 1 000 donation 700 state tax credit The reduction applies

The IRS has specific rules regarding car donations For any vehicle donation worth more than 500 you must complete Section A of IRS Form 8283 and attach it to your tax return If the claimed value exceeds 5 000 an To donate a car to RMHC call 855 227 7435 or visit the group s car donation website Charitable Adult Rides Services CARS a nonprofit that partners with RMHC for vehicle donations will

Download How Much Tax Credit For A Car Donation

More picture related to How Much Tax Credit For A Car Donation

2021 A Record Year In Car Donation Car Donation Wizard

https://www.cardonationwizard.com/blog/wp-content/uploads/2022/01/imageLikeEmbed-1.png

Finding The Best Car Donation Program Car Charity Charity Work

https://i.pinimg.com/originals/6e/dd/40/6edd401b012f41126e0a769a553fed32.jpg

Tips For Donating A Car For Tax Credit Goodwill Car Donation

https://www.goodwillcardonation.org/wp-content/uploads/2016/01/checklist-goodwill-car-donation.jpg

This article generally explains the rules covering income tax deductions for charitable contributions by individuals You can find a more comprehensive discussion of Typically you ll receive a written receipt that tells you how much the car sold for and this is the amount you should use as a tax deduction On the other hand there are a few

If you are eligible to deduct charitable contributions for federal income tax purposes see Qualifying for a Tax Deduction below and you want to claim a deduction for donating your For contributions of qualified vehicles with a claimed fair market value FMV of more than 500 the charitable deduction amount will be determined by one of the following two situations

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

What Is My Car Donation s Value Tax Deduction

https://www.cars2charities.org/media/k2/items/cache/cb9c495b17bc28a44ffb50c55572ed63_XL.jpg

https://www.wheelsforwishes.org/irs-car …

If you are looking for a car donation tax credit of over 500 but less than 5 000 you ll have to fill out a 1098 c form or a 8283 IRS Form for a non cash charitable contribution A tax deduction for a donated car is a simple step within the

https://www.aarp.org/money/taxes/info …

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill

Gatelink

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Car Donation For Tax Deduction Finance News Daily

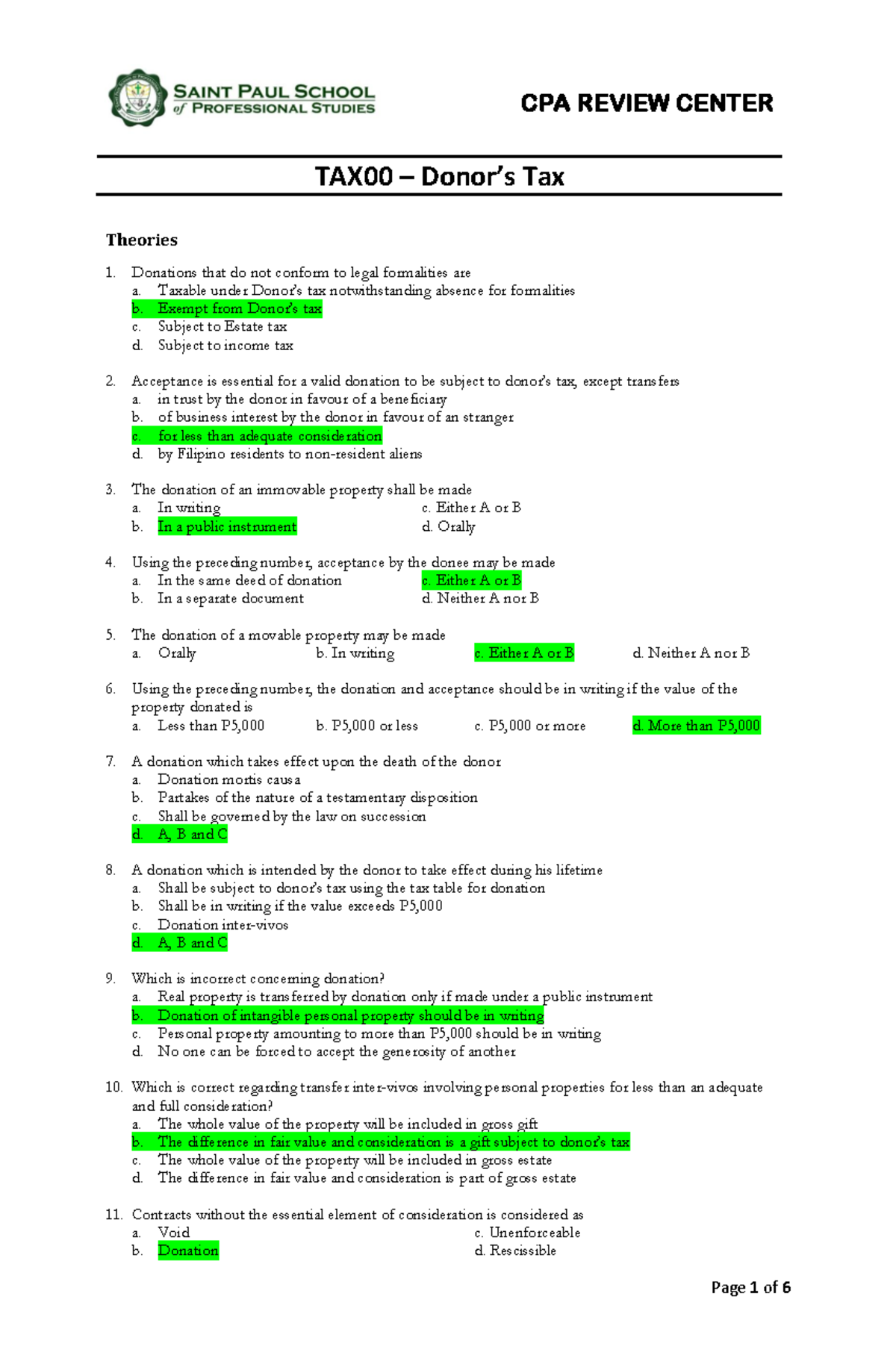

Donors TAX TEST BANK CPA REVIEW CENTER TAX00 Donor s Tax Theories

Is An Electric Car 100 Tax Deductible Leia Aqui Can You Write Off

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

2023 How To Donate Your Car For Tax Credit

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

How Much Tax Credit For Donating A Car Tax Walls

How Much Tax Credit For A Car Donation - Plus you may qualify for a tax deduction if you can itemize on your return Key Points Donating a vehicle to charity can be simple rewarding and may even reap a tax benefit Understanding