How Much Tax Deduction Home Mortgage In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

Most home buyers take out a mortgage to buy their home and then make monthly payments to the mortgage holder This payment may bundle other costs of owning a home Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up

How Much Tax Deduction Home Mortgage

How Much Tax Deduction Home Mortgage

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Income Tax Returns How Much Tax Must Be Paid If We Sell Our Gold And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhQ2W6UKlptiT7wCww6Tmwe47jeGJvM0G8yNSz5NQGoODBSL6UbB3C2pJZ2ZMFwDRhcqHMy0TT4Ok7jpE0kjyws2Ed0zX8QC_4zBlNyYzBIEZhuCgrX1WVveQV3jyIHHyraNvZ1-XqwgQcQypfkME5HgI6PC_kGSTyqZOMGi2HrYBg9SknzaO81FujENA/w1200-h630-p-k-no-nu/IMG_20221012_125158.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income This can help homeowners lower tax bills by reducing their The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one

Lisa Greene Lewis certified public accountant and tax expert at TurboTax notes that under the Tax Cuts and Jobs Act tax filers can deduct interest based on up to 750 000 With the mortgage interest deduction MID you can write off a portion of the interest on your home loan lowering your taxable income and potentially moving you into a lower tax bracket

Download How Much Tax Deduction Home Mortgage

More picture related to How Much Tax Deduction Home Mortgage

What Is The Different Between Tax Credits And Deductions Wester Law

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2017/11/GettyImages-1222021860.jpg

Tax Deduction Concept Of Tax Return optimization Duty Financial

https://static.vecteezy.com/system/resources/previews/013/259/623/large_2x/tax-deduction-concept-of-tax-return-optimization-duty-financial-accounting-vector.jpg

/cloudfront-us-east-1.images.arcpublishing.com/tgam/CUMB66YN7VA2RMPYCIVUDVPGKU.jpg)

Tax Tips For Families Going Through Life Transitions The Globe And Mail

https://www.theglobeandmail.com/resizer/FwJhFsE2WdlynoF8NZkqMobcUPk=/1200x800/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/CUMB66YN7VA2RMPYCIVUDVPGKU.jpg

Single filers can deduct interest on mortgage debt up to 375 000 covering both primary and secondary residences To claim this deduction taxpayers must itemize Calculate your mortgage tax deduction with our easy to use calculator to determine annual interest and tax savings maximizing your financial benefits

To calculate your mortgage tax deduction divide your maximum debt limit by the remaining balance on your mortgage Then multiply that result by the interest paid to find your When purchasing a home several tax deductions may be available These can significantly reduce your taxable income One major benefit is the mortgage interest deduction

Deferred Sales Trust When And How Much Tax Do You Pay YouTube

https://i.ytimg.com/vi/tVE8m-3Qn6k/maxresdefault.jpg

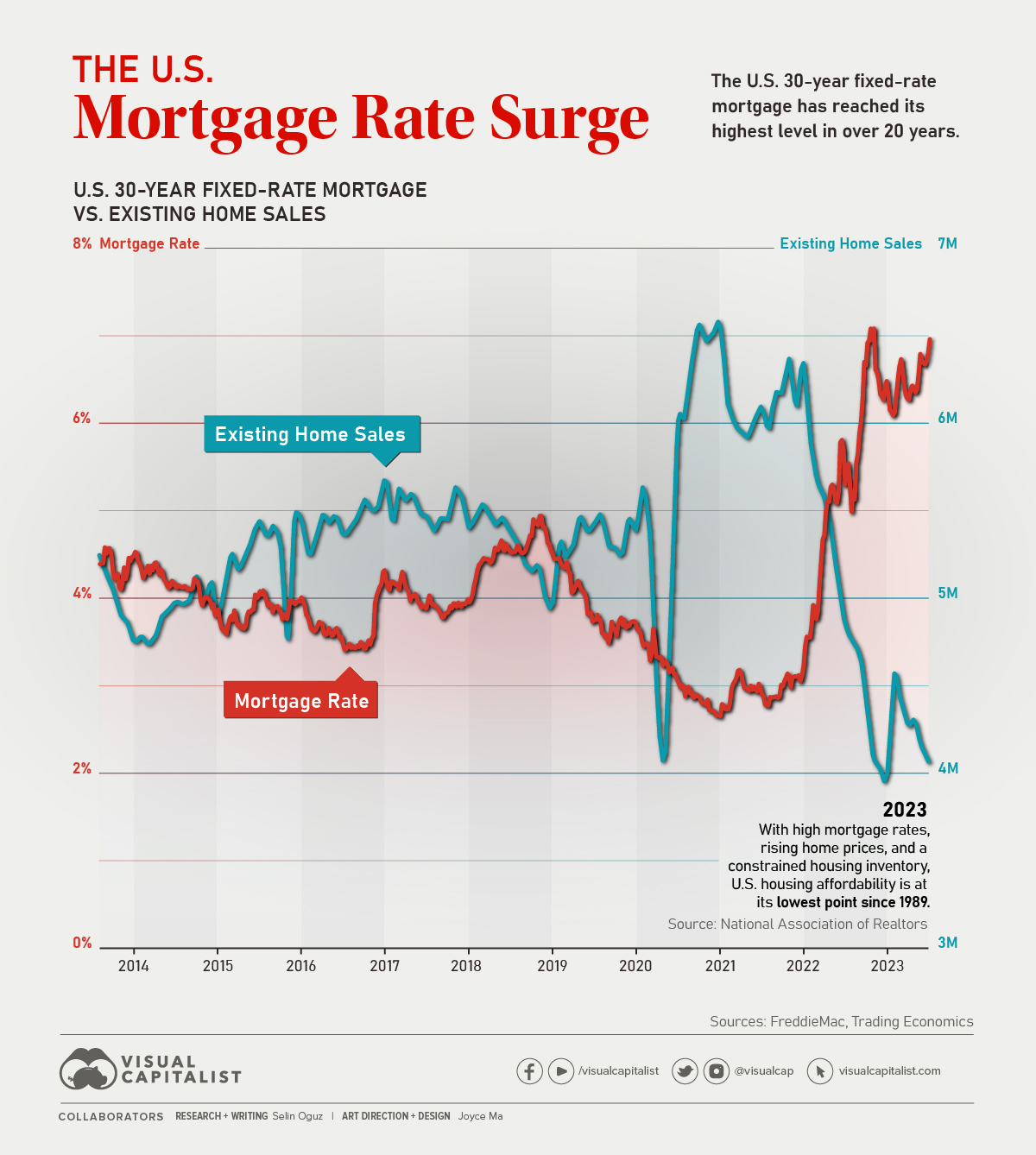

Charted The U S Mortgage Rate Vs Existing Home Sales Telegraph

https://www.visualcapitalist.com/wp-content/uploads/2023/10/US_Mortgage_Rate_Surge-Sept-11-1.jpg

https://www.irs.gov › publications

In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

https://www.irs.gov › newsroom › tax-benefits-for-homeowners

Most home buyers take out a mortgage to buy their home and then make monthly payments to the mortgage holder This payment may bundle other costs of owning a home

Bookkeeping Spreadsheet Anita Forrest Goselfemployed co

Deferred Sales Trust When And How Much Tax Do You Pay YouTube

Tax Calculator How Much You Will Pay On Savings and Easy Ways To Cut It

A Lifetime Of Tax How Much Tax Will The Average Canadian Pay Over

How Much Do Tax Consultants Charge In The UK

Employer Monthly Schedule Payroll Tax Deposit Due February 15 2023

Employer Monthly Schedule Payroll Tax Deposit Due February 15 2023

Tax Deduction Big News Taxpayers Can Avail The Benefit Of Tax

Property Tax Deduction Mortgage ProfitBooks

How To Save Tax In Canada And Maximize Your Tax Return

How Much Tax Deduction Home Mortgage - Mortgage Tax Benefits Calculator One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing