How Much Tax Do You Pay On A Retirement Annuity Verkko 25 huhtik 2022 nbsp 0183 32 Dividing the basis 90 000 by the expected return 120 000 gives you 75 Then by multiplying 75 by the amount of each payment you ll see how much of the payment will not incur taxes So if your 120 000 annuity assumes your life expectancy is 20 years your monthly payments would be 400

Verkko 31 lokak 2023 nbsp 0183 32 How much tax do you pay on annuity withdrawals The amount of tax you ll owe on an annuity withdrawal depends on the type of annuity you have A withdrawal from a qualified annuity will be taxed as normal income at your current tax rate while non qualified annuity withdrawals are only partially taxable Verkko 27 toukok 2014 nbsp 0183 32 Dear Allen If you were born before Jan 2 1936 and the lump sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of calculating your tax

How Much Tax Do You Pay On A Retirement Annuity

How Much Tax Do You Pay On A Retirement Annuity

https://i.imgur.com/BIfFzW9.jpg

Free Calculator How Much Tax Do You Pay On Rental Income

https://resources.wiseadvice.co.nz/hubfs/Rental Income Tax Calculator.png#keepProtocol

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01-923x1024.png

Verkko 25 hein 228 k 2017 nbsp 0183 32 Say you cash in the entire annuity for a lump sum You ll have to pay income taxes on all of the earnings in one year in your case 60 000 of the 210 000 But if you withdraw some of the Verkko 12 helmik 2021 nbsp 0183 32 The exclusion ratio depends on how long you ve held the annuity how much interest you ve earned and how long the payments will last but for example 75 of each payment might be

Verkko 22 elok 2023 nbsp 0183 32 Annuities are taxed favorably for retirement purposes Much like taxes annuities just aren t very popular No one likes paying taxes to Uncle Sam and a mere 17 of American Verkko How Much Tax Do You Pay on Annuity Income Income from an annuity is taxed as ordinary income which means that you will pay the same tax rate on your withdrawals as you would on any other type of income such as wages from a job However the amount of tax you will pay will depend on your marginal tax bracket

Download How Much Tax Do You Pay On A Retirement Annuity

More picture related to How Much Tax Do You Pay On A Retirement Annuity

How Much Tax Do You Pay On A Buy To Let Property Property Investing

https://i.ytimg.com/vi/oP7qdDk0etU/maxresdefault.jpg

How Much Tax Do You Pay On Your Equity Investment Mint

https://images.livemint.com/img/2019/10/29/original/taxchart_1572375655046.png

Your Income Tax Calculator 2020 Tax Return Australia

https://www.taxreturn.com.au/wp-content/uploads/2020/10/tax-return-calculator-help.jpg

Verkko 12 huhtik 2021 nbsp 0183 32 Period Certain Annuitization With this option the value of your annuity is paid out over a defined period of time of your choosing such as 10 15 or 20 years Should you elect a 15 year period Verkko 31 hein 228 k 2022 nbsp 0183 32 Whether you will pay taxes and how much after you retire depends on your sources of retirement dividends IRA 401 k distributions pensions and annuities Common adjustments to gross

Verkko 10 hein 228 k 2009 nbsp 0183 32 You can buy an annuity with funds in your IRA and if you use pretax money from an IRA or a 401 k to purchase the annuity then all payouts will be fully taxed If you use after tax dollars to Verkko Annuity withdrawals made before you reach age 59 189 are typically subject to a 10 early withdrawal penalty tax For early withdrawals from a pre tax qualified annuity the entire distribution amount may be subject to the penalty

How Much Tax Do You Pay On Your Bond Investments Mint

https://images.livemint.com/r/LiveMint/Period2/2018/05/23/Photos/Processed/FXUNXT6K.jpg

How Much Tax Do You Pay On Your Equity Investment Mint

https://images.livemint.com/img/2020/02/18/original/taxonEquityinvestment_1582044430244.png

https://smartasset.com/taxes/how-are-annuities-taxed

Verkko 25 huhtik 2022 nbsp 0183 32 Dividing the basis 90 000 by the expected return 120 000 gives you 75 Then by multiplying 75 by the amount of each payment you ll see how much of the payment will not incur taxes So if your 120 000 annuity assumes your life expectancy is 20 years your monthly payments would be 400

https://www.annuity.org/annuities/taxation

Verkko 31 lokak 2023 nbsp 0183 32 How much tax do you pay on annuity withdrawals The amount of tax you ll owe on an annuity withdrawal depends on the type of annuity you have A withdrawal from a qualified annuity will be taxed as normal income at your current tax rate while non qualified annuity withdrawals are only partially taxable

How Much Tax Do You Pay On Bond Investments Mint

How Much Tax Do You Pay On Your Bond Investments Mint

Best Tax Breaks 12 Most Overlooked Tax Breaks Deductions 2021

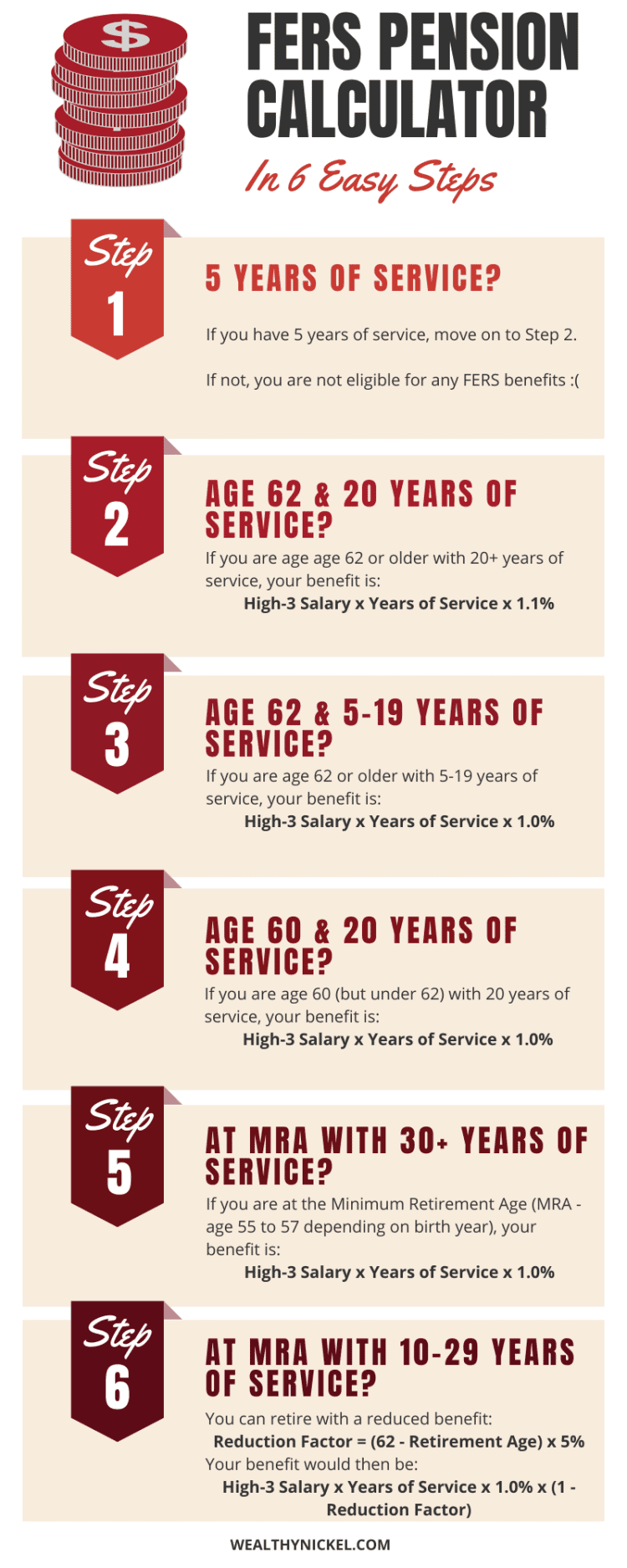

FERS Retirement Calculator 6 Steps To Estimate Your Federal Pension

How Much Tax Do You Pay When You Sell A Rental Property

FERS Retirement Calculator Financial Advisor Christy Capital

FERS Retirement Calculator Financial Advisor Christy Capital

How Federal Retirement Benefits Are Taxed Part II

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

How Federal Retirement Benefits Are Taxed Part II

How Much Tax Do You Pay On A Retirement Annuity - Verkko 4 huhtik 2017 nbsp 0183 32 Example John s deferred annuity has a current cash value of 110 000 to which a surrender charge of 10 000 applies His investment in the contract is 100 000 The position described above