How To Account For A Corporation Tax Refund Corporation Tax paid or refunded is recorded against code 500 Corporate tax expense during the year Then at the end of the year you journal a transfer from 500 to 830

If the company is taxed as a corporation you can record the refund as a deposit and would use the taxed paid or expense account as the source account on the deposit If the How to record journal entries for corporate tax expense tax refunds and tax installments

How To Account For A Corporation Tax Refund

How To Account For A Corporation Tax Refund

https://barnesroffe.com/wp-content/uploads/2020/08/business-2.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

In the 30 April 2021 accounts a journal for the amount of tax being claimed back debits a corporation tax debtor so as to be in the balance sheet assets at 30 April 2021 and Normally a tax refund would be set up on the books as part of the year end adjusting journal entries from the year the refund was triggered It would likely be debited to the Corporate

Hi we were due a refund from HMRC in respect of Corporation tax so posted the following journal in anticipation DR CL Corporation tax R P L Corporation tax charge We Use your Company Tax Return to tell HMRC if you think you re due a Corporation Tax refund known as a repayment and how you want it paid If you include your bank details account

Download How To Account For A Corporation Tax Refund

More picture related to How To Account For A Corporation Tax Refund

R D Claim Explained Blackwell Tax Solutions HMRC R D Tax Credits

https://www.blackwelltax.co.uk/wp-content/uploads/2022/09/Blackwell_Tax_RD_Tax_Claims_R__D_Explained-img1b.jpg

How Do Companies Advertise Their Services News Blogged

https://www.newsblogged.com/wp-content/uploads/2022/11/c-5.jpg

Monthly Accountants Tech Talk NPOs CIBA Academy

https://saiba.academy/wp-content/uploads/2022/08/NPO-07.jpg

If your business is a C corporation or is taxed as one and you overpay business income taxes throughout the year the government issues your business a refund check Document the income tax refund you receive in your Once you receive your income tax refund you would book the following entry to clear your payable account Dr increase Cash in Bank a current asset on your balance sheet Cr increase Corporate Income Tax

The issue is that you need to account for corporation tax due to or refund due from HMRC in your P L for the accounting year to which it pertains but the actual payment or How do I apply for a tax refund Tax refunds are typically processed automatically when you file your tax return no separate application is needed What documents are needed

R D Tax Credits

https://media.licdn.com/dms/image/C5612AQFMJXSg2Z6Btw/article-cover_image-shrink_720_1280/0/1520135708399?e=2147483647&v=beta&t=Lh4nXlnggjLcgxkobb1hX13jhdIUAsSEPy7mTUQ3dQc

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

https://images.squarespace-cdn.com/content/v1/57a4b7ec15d5db04f2470371/1518372319375-0E9ZOUL6050B3ZJEFN3N/new.jpg

https://central.xero.com › question

Corporation Tax paid or refunded is recorded against code 500 Corporate tax expense during the year Then at the end of the year you journal a transfer from 500 to 830

https://quickbooks.intuit.com › learn-support › en-uk › ...

If the company is taxed as a corporation you can record the refund as a deposit and would use the taxed paid or expense account as the source account on the deposit If the

Tax Refund Check Wow The US Treasury Opened Up It s Vice Flickr

R D Tax Credits

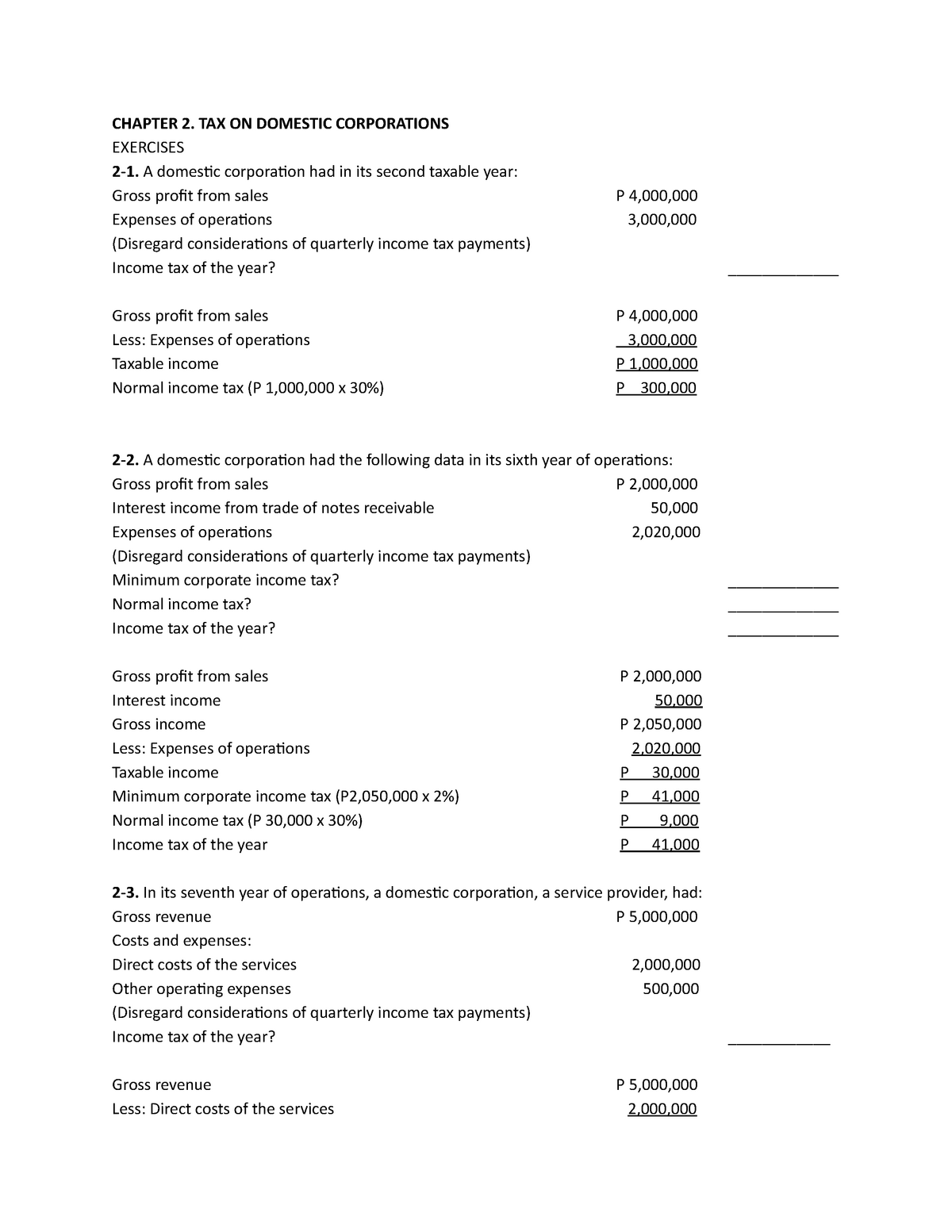

Tax 1 Day 1 Lesson CHAPTER 2 TAX ON DOMESTIC CORPORATIONS EXERCISES

What To Do If Your Tax Refund Is Wrong

How To Account For Government Payments Farm Online Farmonline

Deferred Tax And Temporary Differences The Footnotes Analyst

Deferred Tax And Temporary Differences The Footnotes Analyst

How To Explain A Corporation Tax Payment To HMRC FreeAgent

Donation Accounting Associate NATURAL DIVIDENDS INC VolunteerMatch

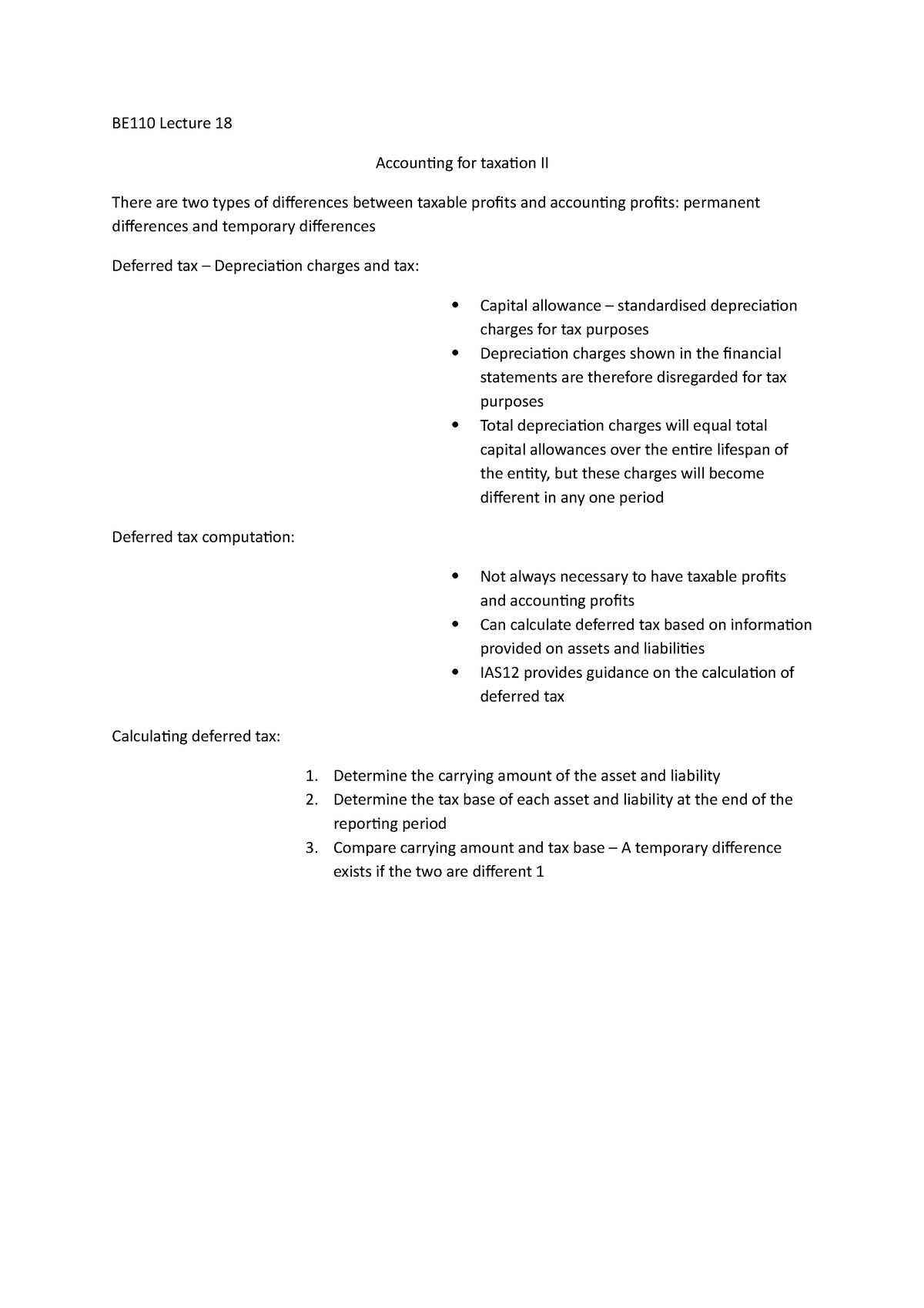

Accounting For Taxation Studocu

How To Account For A Corporation Tax Refund - In the 30 April 2021 accounts a journal for the amount of tax being claimed back debits a corporation tax debtor so as to be in the balance sheet assets at 30 April 2021 and