How To Calculate Mileage Rate 2023 Web 9 Jan 2023 nbsp 0183 32 We can create a formula using the IRS rates as an example Mileage reimbursement Miles driven x IRS mileage rate To illustrate if you have an employee who has recorded 150 miles for the week and the regular IRS rate you can calculate the reimbursement 150 miles x 0 625 93 75

Web Guidance Travel mileage and fuel rates and allowances Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per Web 26 Sept 2023 nbsp 0183 32 Table of Contents What is mileage allowance and why is it important What qualifies as business mileage How is mileage allowance calculated Mileage tracking methods Who pays mileage reimbursements What are official mileage allowance rates Mileage allowance in the UK Mileage allowance in Austria Mileage allowance in

How To Calculate Mileage Rate 2023

How To Calculate Mileage Rate 2023

https://companymileage.com/wp-content/uploads/2022/12/IRS-Mileage-Rate-2023-scaled.jpg

Business Math Calculating Mileage When Using A Personal Vehicle

https://blog.timesheets.com/wp-content/uploads/2019/04/Milage-TS-colors.png

What Are The IRS Mileage Rate Amounts Updated For 2023

https://falconexpenses.com/blog/wp-content/uploads/2021/11/what-is-the-irs-mileage-rate.png

Web 29 Dez 2022 nbsp 0183 32 Page Last Reviewed or Updated 05 Dec 2023 IR 2022 234 December 29 2022 The Internal Revenue Service today issued the 2023 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes Web 26 Dez 2023 nbsp 0183 32 2023 amp 2023 mileage reimbursement calculator is based on the newly announced standard mileage reimbursement rates for 2024 effective 1st January 2024 The new standard mileage rates for 2024 and 2023 are given below Table of Contents 2023 Mileage Reimbursement Calculator What is mileage reimbursement IRS rules on

Web Calculate Reimbursement Multiply the total number of kilometers driven for business purposes by the reimbursement rate per kilometer specified in the tax mileage rate The result of this calculation will provide you with the total mileage expenses to be reimbursed Who Can Benefit from Mileage Expenses Web 14 Dez 2023 nbsp 0183 32 Table of Contents IRS mileage rates for 2023 IRS issues mileage rates for 2024 IRS standard mileage rate for business Calculating standard mileage vs actual expenses for business

Download How To Calculate Mileage Rate 2023

More picture related to How To Calculate Mileage Rate 2023

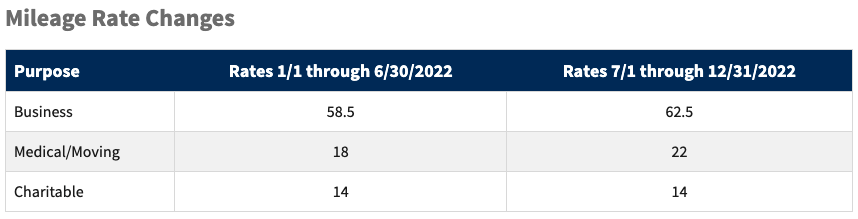

Deductible Mileage Rate For Business Driving Increases For 2022 Sol

https://www.ssacpa.com/wp-content/uploads/2021/12/aaaa-graphic-12-21.jpg

Calculator how To Calculate calculation count calculating Machine

https://storage.needpix.com/rsynced_images/calculator-2478633_1280.png

How To Calculate Milage The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/How-to-Calculate-Mileage-in-Excel-3.png

Web 22 Dez 2017 nbsp 0183 32 business standard mileage rate treated as depreciation is 26 cents per mile for 2019 27 cents per mile for 2020 26 cents per mile for 2021 26 cents per mile for 2022 and 28 cents per mile for 2023 See section 4 04 of Rev Proc 2019 46 SECTION 5 Web 9 Jan 2023 nbsp 0183 32 Employee Mileage Reimbursement In 2023 Rules Rates amp Tools In this guide we cover everything you need to know about employee mileage reimbursement including the rules the current IRS rates in 2023 tax benefits and the practical tools you can use to effectively manage mileage reimbursements for all of your employees 7 min read

Web How do you calculate a mileage deduction Fortunately it s easy to compute using the HMRC mileage allowance rates Below we ll detail the standard rates you can use to claim reimbursement for any business trips you take in 2023 What is the HMRC mileage rate for 2023 The HMRC mileage rates have remained unchanged since the 2011 2012 tax year Web The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest IRS standard mileage rate of 67 162 as of January 1 2024 You can also use this tool to calculate the number of frequent flyer miles you will earn for an upcoming flight or check the distance from where you are now to

How To Calculate Mileage For Taxes 8 Steps with Pictures

https://www.wikihow.com/images/6/60/Calculate-Mileage-for-Taxes-Step-10.jpg

Mileage Rate Change For 2023 CPA Nerds

https://www.cpanerds.com/app/uploads/2022/06/Mileage-Rate-Changes.png

https://www.workyard.com/blog/how-to-calculate-mileage-reimbursement

Web 9 Jan 2023 nbsp 0183 32 We can create a formula using the IRS rates as an example Mileage reimbursement Miles driven x IRS mileage rate To illustrate if you have an employee who has recorded 150 miles for the week and the regular IRS rate you can calculate the reimbursement 150 miles x 0 625 93 75

https://www.gov.uk/.../travel-mileage-and-fuel-rates-and-allowances

Web Guidance Travel mileage and fuel rates and allowances Updated 5 April 2023 Approved mileage rates from tax year 2011 to 2012 to present date Passenger payments cars and vans 5p per

How To Calculate Mileage For Tax Deduction TlwaStoria

How To Calculate Mileage For Taxes 8 Steps with Pictures

2023 Standard Mileage Rates

Gas Mileage Calculator Taxes LeighannBelle

How To Calculate Mileage Of Bike Easy Accurate Method Test N Drive

How To Calculate Mileage Claim In Malaysia Karen Rutherford

How To Calculate Mileage Claim In Malaysia Karen Rutherford

How To Calculate Gas Mileage Easy MPG Calculator Towing Home

Standard Mileage Rate Method Archives

Business Mileage Deduction 101 How To Calculate For Taxes

How To Calculate Mileage Rate 2023 - Web 14 Dez 2023 nbsp 0183 32 Table of Contents IRS mileage rates for 2023 IRS issues mileage rates for 2024 IRS standard mileage rate for business Calculating standard mileage vs actual expenses for business