How To Calculate Mileage Reimbursement California You can calculate mileage reimbursement in three simple steps Select your tax year Input the number of miles driven for business charitable medical and or moving

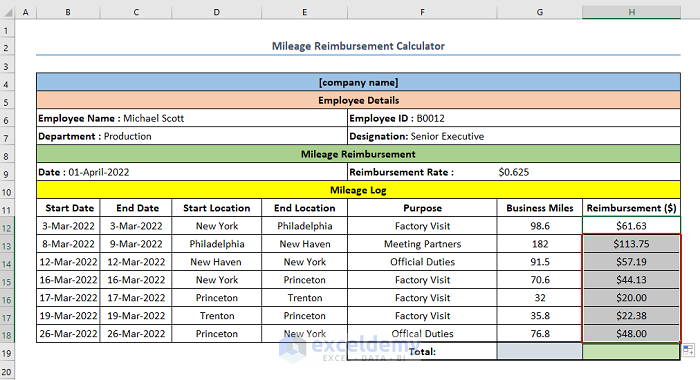

In California employers are required to fully reimburse you when you use your personal vehicles for business purposes In total there are 4 ways to calculate your To compute your mileage reimbursement multiply the applicable mileage rate by the number of miles driven For instance if you drove 15 miles 15 miles x

How To Calculate Mileage Reimbursement California

How To Calculate Mileage Reimbursement California

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-mileage-reimbursement-in-excel-4.png

How To Calculate Mileage Reimbursement For Taxes

https://media.freshbooks.com/wp-content/uploads/2021/10/calculate-mileage.jpg

Gas Mileage Calculator 2023 AyreneHailey

https://www.ssacpa.com/wp-content/uploads/2021/12/aaaa-graphic-12-21.jpg

To calculate mileage reimbursement in California multiply the total number of business miles driven by the IRS standard mileage rate for the year For How to calculate mileage reimbursement California To calculate your mileage reimbursement simply multiply your business miles by the mileage rate

How do you calculate mileage reimbursement in California To calculate reimbursement multiply the miles driven for business purposes by the applicable mileage rate For Now you can quickly calculate how much your employees can get back with our easy to use mileage reimbursement calculator for California Try our calculator now

Download How To Calculate Mileage Reimbursement California

More picture related to How To Calculate Mileage Reimbursement California

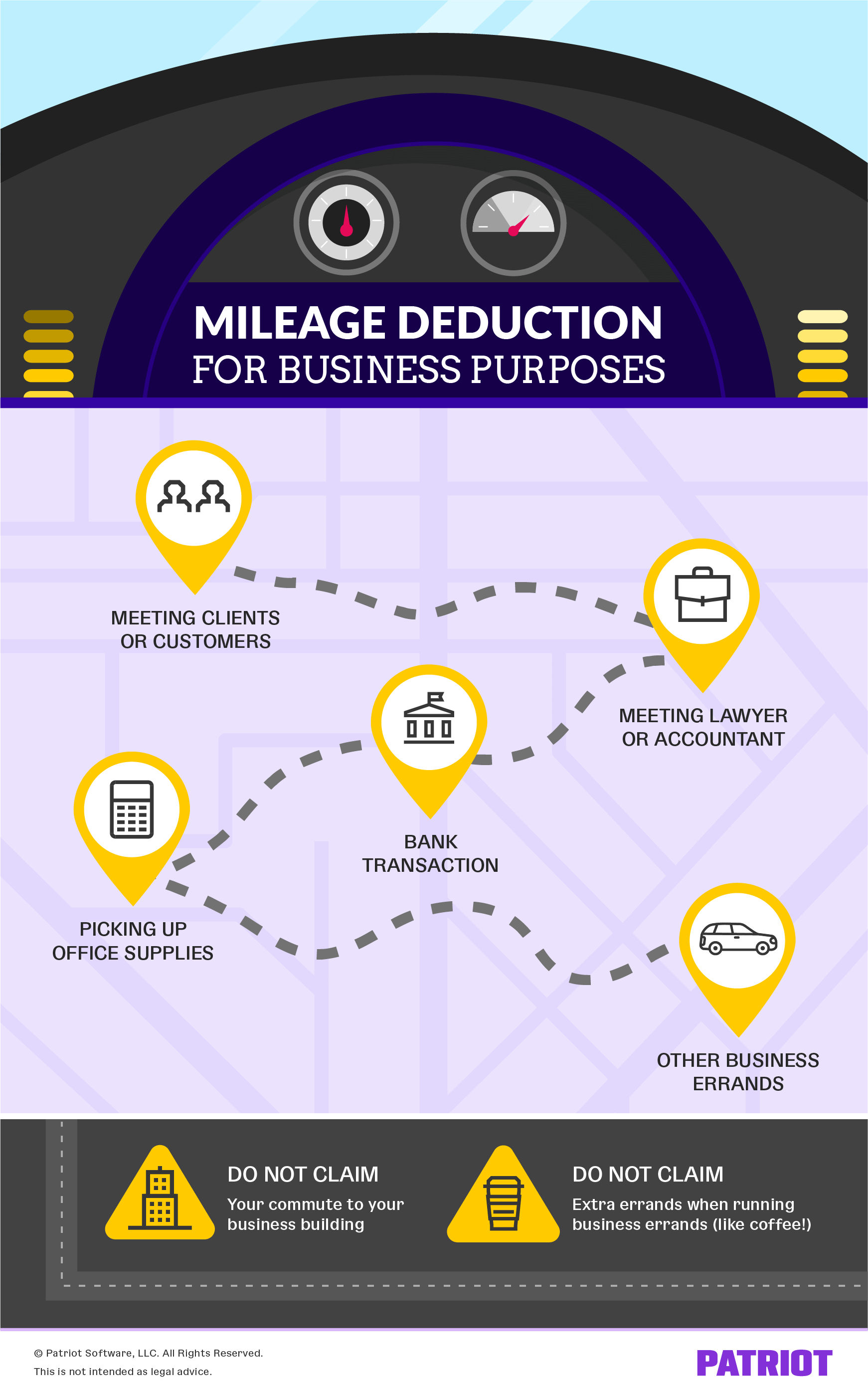

How To Calculate Mileage Reimbursement Guide To Deductions

https://www.freshbooks.com/wp-content/uploads/2021/08/how-to-calculate-mileage-reimbursement-1.jpg

Mileage Reimbursement In California Expert Tips For Tax Purposes

https://www.gofar.co/wp-content/uploads/2020/01/gofar-calculate-mileage-reimbursement.jpg

Business Mileage Deduction 101 How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

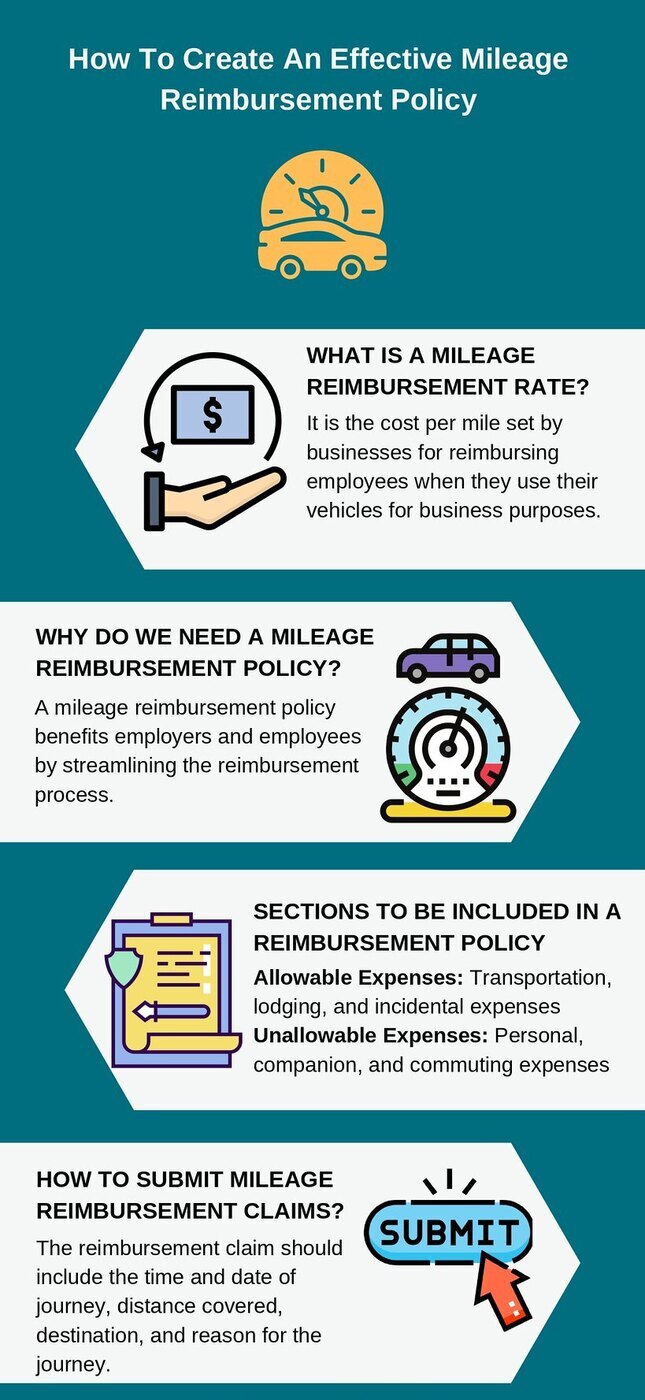

When it comes to employee travel reimbursements employers have a few options for how to do it including the CPM method actual expenses method lump How to Offer Mileage Reimbursement the Right Way in California Calculating California mileage reimbursement takes a combination of current IRS laws and financial

Mileage Reimbursement Under California Law What Do You Need to Know With different provisions about mileage reimbursement it can be difficult to Reimbursing employees for work mileage in California can be a complex endeavor The simplest method to meet this requirement is using the IRS mileage rate

Auto Tracking Track Trips From Your Pocket YouTube

https://i.ytimg.com/vi/h1c1_mSK_LU/maxresdefault.jpg

Fillable Online How To Calculate Mileage Reimbursement Microsoft Fax

https://www.pdffiller.com/preview/486/806/486806038/large.png

https://goodcalculators.com/mileage-reimbursement-calculator

You can calculate mileage reimbursement in three simple steps Select your tax year Input the number of miles driven for business charitable medical and or moving

https://www.shouselaw.com/ca/blog/california-mileage-reimbursement

In California employers are required to fully reimburse you when you use your personal vehicles for business purposes In total there are 4 ways to calculate your

This Mileage Reimbursement Form Can Be Used To Calculate Your Mileage

Auto Tracking Track Trips From Your Pocket YouTube

How To Calculate Mileage Reimbursement The Tech Edvocate

Vehicle Mileage Log With Reimbursement Form Word Excel Templates

Example Mileage Reimbursement Form Printable Form Templates And Letter

Free Mileage Log Template IRS Compliant Excel PDF

Free Mileage Log Template IRS Compliant Excel PDF

How Do You Calculate Mileage Reimbursement

Complete Guide On Mileage Reimbursement Policy ITILITE

Vehicle Programs Calculating Mileage Reimbursement Motus Motus

How To Calculate Mileage Reimbursement California - How do you calculate mileage reimbursement in California To calculate reimbursement multiply the miles driven for business purposes by the applicable mileage rate For