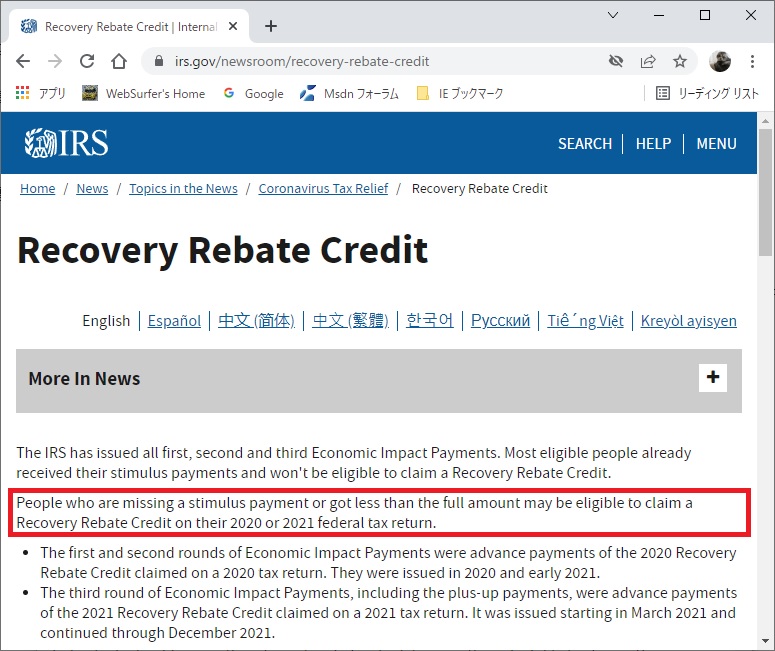

How To Calculate Recovery Rebate Credit On 2021 Tax Return How to claim the recovery rebate credit As a credit the Recovery Rebate Credit can be claimed when you file your income tax return However since the stimulus payments were made in 2020 and 2021 the Recovery Rebate Credit must be claimed on your tax returns for those two years

If you are missing all or part of your third stimulus payment you can claim the amount as a Recovery Rebate Credit on your 2021 income tax return How is the 2021 Recovery Rebate Credit different from 2020 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

How To Calculate Recovery Rebate Credit On 2021 Tax Return

How To Calculate Recovery Rebate Credit On 2021 Tax Return

https://cbnc.com/wp-content/uploads/2020/12/067-cash-money-dollars-bills-stimulus-check-congress-pass-mail-banking-finance-desperate-poverty-us-treasury.jpg

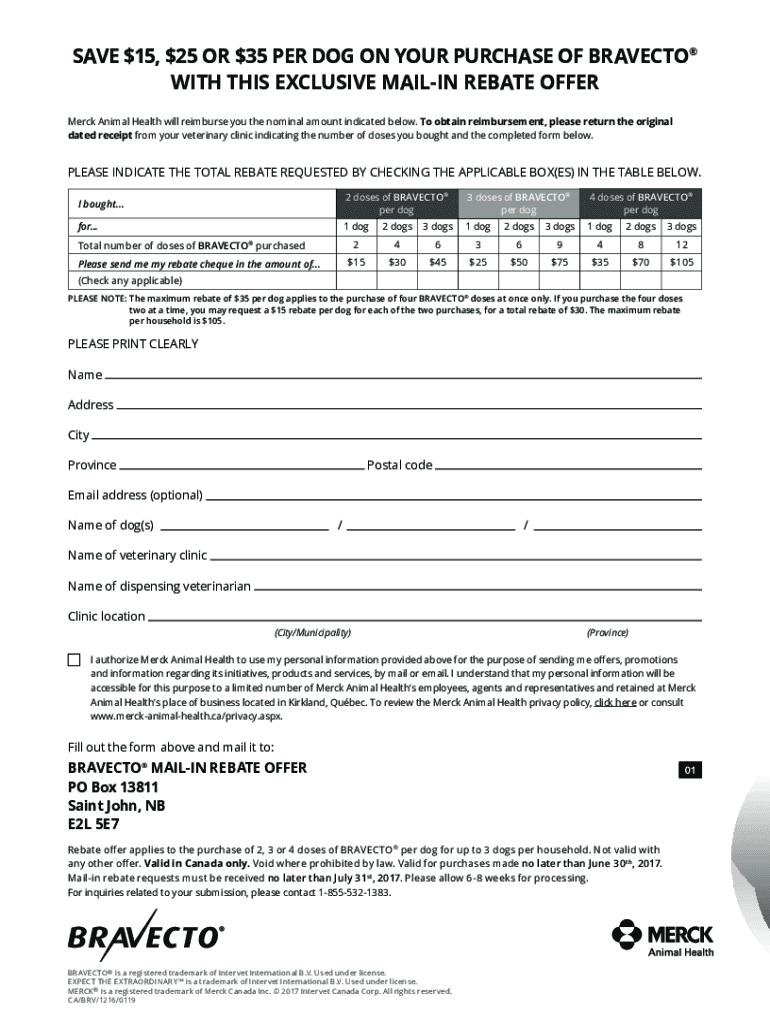

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments Two EIPs EIP1 and EIP2 were issued to eligible taxpayers during 2020 and early 2021 These EIPs were advanced payments of the Recovery Rebate Credit RRC a refundable credit claimed on the 2020 Individual Tax Return How do I get these EIPs if I didn t receive them or got an incorrect amount

The Recovery Rebate Credit is a tax credit that is calculated based on any 2021 1 400 stimulus checks economic impact payments you were entitled to receive but didn t receive in If a client was eligible but did not receive the third payment they were owed you may need to claim the 2021 Recovery Rebate Credit for the correct amount Here s what you need to know about the Recovery Rebate Credit for returns filed in 2022

Download How To Calculate Recovery Rebate Credit On 2021 Tax Return

More picture related to How To Calculate Recovery Rebate Credit On 2021 Tax Return

Recovery Rebate Credit 2020 Calculator KwameDawson

https://msofficegeek.com/wp-content/uploads/2022/03/Adoption-Tax-Credit-2021-Calculator.png

If The Income On The Return Is Over The Applicable Phase out

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The IRS on Thursday issued a fact sheet FS 2022 04 of frequently asked questions FAQs intended to help taxpayers and their return preparers calculate the recovery rebate credit for 2021 tax returns

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The IRS urges taxpayers to file electroni cally and allow tax software to figure the 2021 Recovery Rebate Credit Individuals will need the amount of any third payments they received to accurately calculate their 2021 Recovery Rebate Credit

Recovery Rebate Credit 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/recovery-rebate-credit-2023.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

https://apnews.com/buyline-personal-finance/...

How to claim the recovery rebate credit As a credit the Recovery Rebate Credit can be claimed when you file your income tax return However since the stimulus payments were made in 2020 and 2021 the Recovery Rebate Credit must be claimed on your tax returns for those two years

https://blog.taxact.com/10-faqs-about-claiming-the...

If you are missing all or part of your third stimulus payment you can claim the amount as a Recovery Rebate Credit on your 2021 income tax return How is the 2021 Recovery Rebate Credit different from 2020

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit 2023 Rebate2022

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

The Recovery Rebate Credit Calculator MollieAilie

IRS 2

Recovery Rebate Credit For 2022 Recovery Rebate

Recovery Rebate Credit For 2022 Recovery Rebate

Everything You Need To Know About The Recovery Rebate Credit SaverLife

How To Calculate Recovery For The DSTWU If Mole Fraction Of Top And

Recovery Rebate Credit Calculator EireneIgnacy

How To Calculate Recovery Rebate Credit On 2021 Tax Return - If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference