How To Carry Back Eis Relief On Tax Return Web 15 Aug 2017 nbsp 0183 32 When you invest in an EIS eligible opportunity EIS relief carry back enables you to claim tax relief on income tax that you paid in the previous financial year Even if your EIS eligible investments are

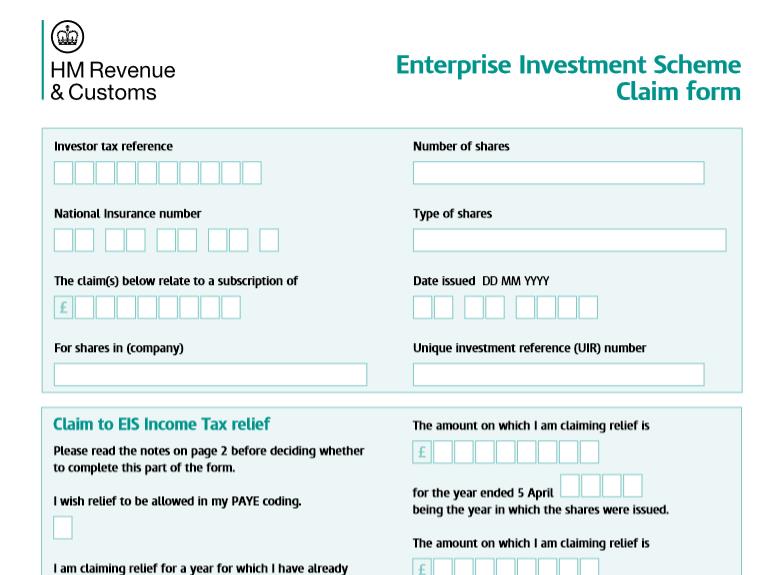

Web Details This guide explains how to claim Income Tax relief under the Enterprise Investment Scheme Published 4 July 2014 Last updated 6 April 2023 show all Web The information below is current as per the 2022 23 tax year How to claim EIS tax relief on your paper tax return How to claim EIS tax relief in your online self assessment form

How To Carry Back Eis Relief On Tax Return

How To Carry Back Eis Relief On Tax Return

https://www.infocomm.ky/wp-content/uploads/2022/10/1666731063.jpeg

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

EIS Carry Back Relief Explained EMV Capital

https://emvcapital.com/wp-content/uploads/2022/09/Blog-Banner-6-1024x576.png

Web 28 Feb 2023 nbsp 0183 32 One way to enjoy relief is by investing in new shares or by offering loans to social enterprises You re also free to invest in other Web 1 Mai 2018 nbsp 0183 32 If you wish to carry back tax relief on shares that have already been issued this current tax year and you have an EIS3 form you can include this on your tax return for the previous year and state that

Web 22 Mai 2018 nbsp 0183 32 EIS loss relief is calculated by multiplying your effective loss the value you originally invested minus the return you realised and value of income tax relief you claimed by either your marginal rate of income Web 30 Sept 2020 nbsp 0183 32 The investor is able to claim 30 of the amount invested back in income tax relief for the tax year that the investment is made or choose to carry it back to a previous year if they wish

Download How To Carry Back Eis Relief On Tax Return

More picture related to How To Carry Back Eis Relief On Tax Return

What Is SEIS And EIS Tax Relief Schemes In The UK Startups Investment

https://images.squarespace-cdn.com/content/v1/5ce3f8b34c89640001311321/1630575034607-C6NI0Y4YKVY72J9RJLOS/SEIS+and+EIS+Tax+Relief+Schemes-01.jpg

Tax Cuts Fiscal Drag And Why EIS Income Tax Relief Is More Desirable

https://www.syndicateroom.com/images/banners/articles-banners-eis-income-tax-relief.png

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

https://i.ytimg.com/vi/lyoFqOGn3IQ/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBAgZShcMA8=&rs=AOn4CLApAaacW7suH6PMwMxswgY32yZsZg

Web 30 Juni 2023 nbsp 0183 32 How to qualify for EIS tax relief What EIS rules do investors have to follow What companies can you invest in with EIS How to claim EIS tax relief How do EIS funds work SeedLegals for Web 10 Aug 2020 nbsp 0183 32 Carry back income tax relief Although you cannot carry forwards any income tax relief you can apply the tax relief to a previous year so long as you have

Web 27 M 228 rz 2021 nbsp 0183 32 By Thea Graves Updated March 27 2021 Published 24 2 2020 The Enterprise Investment Scheme EIS was launched in 1994 by the UK government as a way to encourage investment in small UK Web 9 Dez 2020 nbsp 0183 32 If you complete a self assessment tax return you can claim EIS losses against either Income Tax or CGT by completing the Capital Gains Summary SA108 form

What Is EIS Carry Back Enterprise Investment Scheme EMVC

https://emvcapital.com/wp-content/uploads/2023/05/What-is-EIS-carryback-1024x576.png

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

https://i.ytimg.com/vi/PIGFFRjObhE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLA4P7eTp6FaUSpi8zlhB318GucWIg

https://www.growthcapitalventures.co.uk/insig…

Web 15 Aug 2017 nbsp 0183 32 When you invest in an EIS eligible opportunity EIS relief carry back enables you to claim tax relief on income tax that you paid in the previous financial year Even if your EIS eligible investments are

https://www.gov.uk/government/publications/enterprise-investment...

Web Details This guide explains how to claim Income Tax relief under the Enterprise Investment Scheme Published 4 July 2014 Last updated 6 April 2023 show all

How To Execute The Perfect Fireman Carry Modded

What Is EIS Carry Back Enterprise Investment Scheme EMVC

Here s How To Claim EIS Tax Reliefs This Tax Year

What Is EIS Tax Relief EIS Tax Relief Explained EMV Capital

EIS Tax Relief 2023 The Ultimate Guide

.jpg)

EIS Tax Relief EIS Scheme Explained

.jpg)

EIS Tax Relief EIS Scheme Explained

Microneedling Arubia Training

How To Claim EIS Tax Relief WIS Accountancy

Q A Eligibility For EIS And SEIS Tax Relief

How To Carry Back Eis Relief On Tax Return - Web 1 Mai 2018 nbsp 0183 32 If you wish to carry back tax relief on shares that have already been issued this current tax year and you have an EIS3 form you can include this on your tax return for the previous year and state that