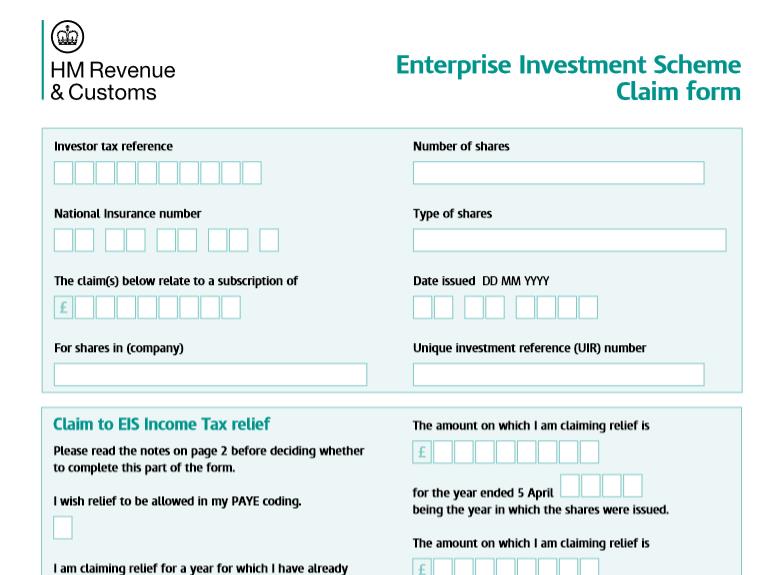

Can You Carry Back Eis Income Tax Relief This guide explains how to claim Income Tax relief under the Enterprise Investment Scheme The helpsheet for tax year 2023 to 2024 has been added and the version for tax

One of the key features of this scheme is the ability to carry back income tax relief which can be an important tax saving strategy for investors Let s focus on EIS income In relation to the income tax relief on an EIS investment I understand that the relief can only result in your overall tax liability to reduce to nil i e no refund due This brings

Can You Carry Back Eis Income Tax Relief

Can You Carry Back Eis Income Tax Relief

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/11/Claiming-EIS-Income-Tax-Relief-Step-by-Step-Guide.jpg

Claiming EIS Tax Relief For Investors Sleek

https://sleek.com/uk/wp-content/uploads/sites/6/2023/01/how-to-claim-eis-tax-relief.png

Tax Cuts Fiscal Drag And Why EIS Income Tax Relief Is More Desirable

https://www.syndicateroom.com/images/banners/articles-banners-eis-income-tax-relief.png

You can claim up to 30 income tax relief on EIS investments of up to 1 million per tax year 1 This increases to 2 million per tax year provided at least 1 million is invested in Knowledge Intensive Companies KICs 2 Carry back You cannot carry forward unused Income Tax relief to future tax years If you invest in a Venture Capital Trust you can only claim tax relief in the tax year you invest

It is possible to carry back all or part of the investment to the preceding tax year as long as the limit for relief is not exceeded for that year An individual may carry back current year EIS investments to the previous year Investors in unapproved EIS funds can choose to treat an investment as if it was made in the previous tax year which can be useful for tax planning It also means that up to 2 million can be invested in a tax year i e 1 million in the current

Download Can You Carry Back Eis Income Tax Relief

More picture related to Can You Carry Back Eis Income Tax Relief

EIS Carry Back Relief Explained EMV Capital

https://emvcapital.com/wp-content/uploads/2022/09/Blog-Banner-6-1024x576.png

Budget 2023 Income Tax Relief Health Technology Big Takeaways

https://i.ytimg.com/vi/cDrpKOQVUN8/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYQiA-KH8wDw==&rs=AOn4CLAXNjB-XKfY6HwEZwiXCAsWZ5g2RA

EIS Tax Relief 2023 The Ultimate Guide

https://academy-cdn.seedrs.com/academy/wp-content/uploads/2023/04/11171501/DOWNLOAD.png

The Art of Time Shifted Tax Relief At its core carry back relief embodies sophisticated tax planning When an investor makes an EIS investment they gain the ability to When you invest in an EIS eligible opportunity EIS relief carry back enables you to claim tax relief on income tax that you paid in the previous financial year

Income tax relief must be claimed within five years from the 31 January following the tax year of investment Shares must be held for at least three years from the issue date or Utilizing Carry Back Provision The EIS allows investors to carry back their claim to the previous tax year which can be beneficial if you had a higher tax liability in that year This strategic use

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

https://i.ytimg.com/vi/PIGFFRjObhE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLA4P7eTp6FaUSpi8zlhB318GucWIg

How To Claim EIS Income Tax Relief Step by step Guide How To Claim

https://vivintsystems.com/bc2dd760/https/2fd63b/static-web-wealthclub.s3.amazonaws.com/images/Homepage_hero8-min.original.jpg

https://www.gov.uk › government › publications › ...

This guide explains how to claim Income Tax relief under the Enterprise Investment Scheme The helpsheet for tax year 2023 to 2024 has been added and the version for tax

https://www.protaxaccountant.co.uk › post › eis-income...

One of the key features of this scheme is the ability to carry back income tax relief which can be an important tax saving strategy for investors Let s focus on EIS income

How To Claim EIS Tax Relief WIS Accountancy

EIS Tax Relief Maximizing Savings And Minimizing Taxes YouTube

Income Tax Relief Expected In Interim Budget 2024 Deloitte s Tax

Here s How To Claim EIS Tax Reliefs This Tax Year

EIS Limits Maximum EIS Investment EMV Capital

EQUITY SHARES Ultra Investments

EQUITY SHARES Ultra Investments

EIS Income Tax Relief What Is It And How Does It Work GCV

How Do I Claim An EIS Loss Relief On My Taxes KBC

EIS And SEIS Tax Relief A Guide For Investors Connectd

Can You Carry Back Eis Income Tax Relief - Carry back relief allows you to apply your EIS tax relief to the previous tax year rather than the current year This can be particularly useful if you don t have enough tax liability in the current