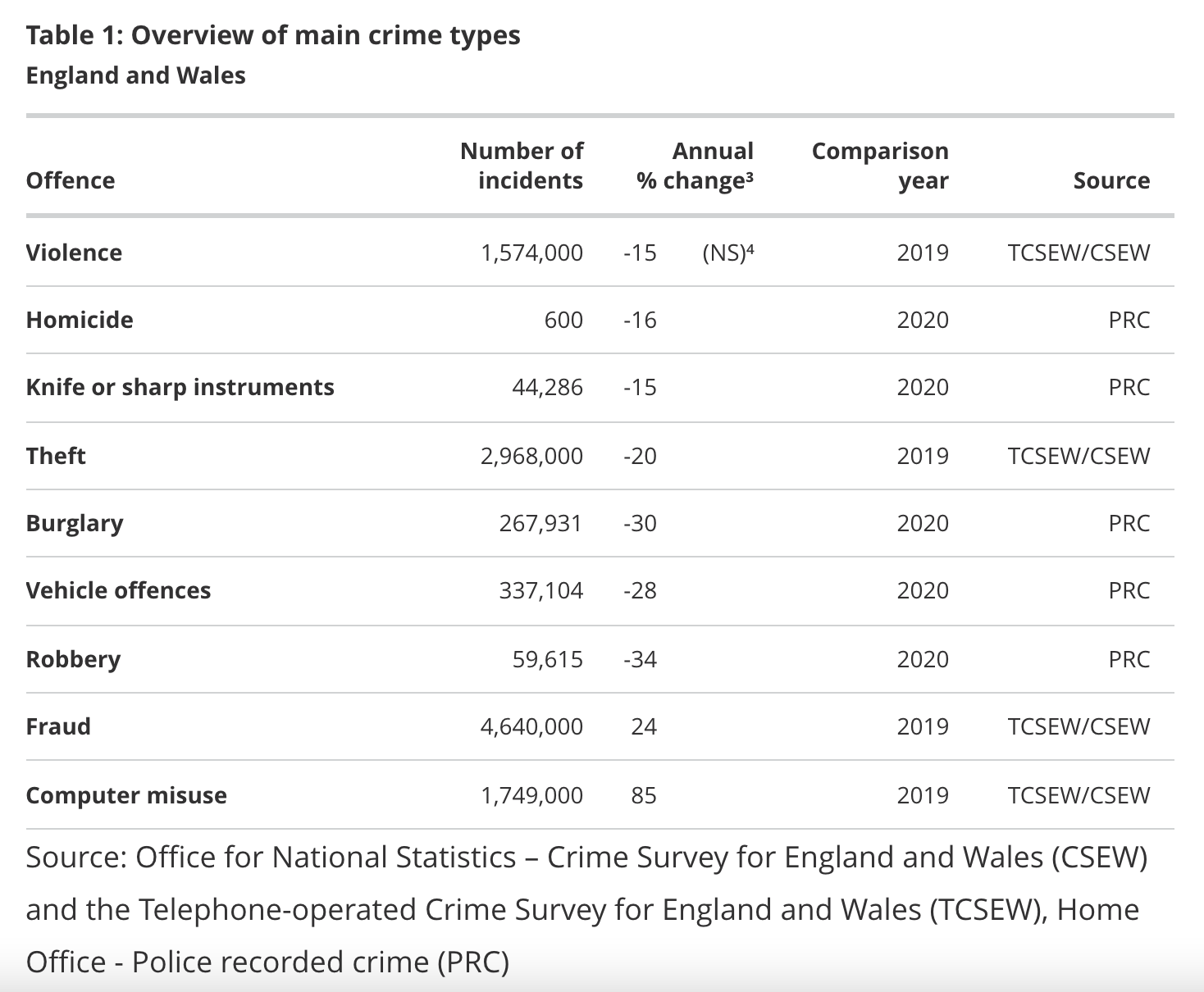

How To Claim Colorado Child Care Contribution Tax Credit Web To claim credit for a qualifying contribution you must obtain a completed DR 1317 form from the recipient and file it with your Colorado income tax return Note that the

Web You can claim the Federal Child Tax Credit by entering your qualifying children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a Web WHAT IS THE COLORADO CHILD CARE CONTRIBUTION TAX CREDIT Taxpayers may make a qualified monetary contribution to promote child care in Colorado and claim a

How To Claim Colorado Child Care Contribution Tax Credit

How To Claim Colorado Child Care Contribution Tax Credit

https://bgcmd.org/wp-content/uploads/2016/01/CCCC-header.png

Colorado Child Care Contribution Credit Denver Child Advocacy Center

https://www.denvercac.org/wp-content/uploads/2022/02/prevention-1.jpg

How To Claim Child Tax Credit A Step By Step Guide YouTube

https://i.ytimg.com/vi/Druuz8nrVzI/maxresdefault.jpg

Web The Colorado Child Care Contribution Tax Credit enables qualified child care providers and intermediary organizations to receive financial donations directly from individuals and businesses These funds Web Child Care Contribution Credit Any taxpayer who makes a qualifying contribution can claim the Child Care Contribution Credit Resident and nonresident individuals

Web The Child Care Contribution Credit provides an income tax credit for taxpayers making monetary contributions to support child care including but not limited to licensed Web How do I claim the Child Tax Credit The Colorado CTC is claimed on the 2022 Child Tax Credit Form DR 0104CN and the DR 0104CR The DR 0104CN and the DR

Download How To Claim Colorado Child Care Contribution Tax Credit

More picture related to How To Claim Colorado Child Care Contribution Tax Credit

How To Claim SkillsFuture Credit ACAD Pte Ltd

https://acad.com.sg/web/image/8343/vlcsnap-2022-07-08-14h01m22s288.png

How The Colorado Child Care Contribution Credit Works YouTube

https://i.ytimg.com/vi/EuZzIN7IJJQ/maxresdefault.jpg

Colorado Child Care Contribution Tax Credit Blessing From Giving

https://149827780.v2.pressablecdn.com/wp-content/uploads/Depositphotos_318807946_DS-72DPI-1024x486.jpg

Web To be able to claim the Colorado credit for child care expenses you must file federal form 1040 1040SR 1040SP or 1040NR and you and or your spouse must have been a Web Donors who make a qualifying contribution to promote child care in Colorado may claim a state income tax credit of 50 of the total qualifying contribution The Denver

Web Claiming Colorado child care credits To claim either a child care expenses credit or a low income child care expenses credit a taxpayer must file a Colorado Individual Web Bill Summary For income tax years commencing prior to January 1 2025 a taxpayer who makes a monetary contribution to promote child care in the state is allowed an income

How To Claim Rent Exemption Without An HRA Component In Your Salary

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/10/How-to-Claim-Rent-Exemption-Without-an-HRA-Component-in-Your-Salary.jpg

How To Claim Uk Criminal Injuries Compensation

https://injurylawsuithelper.com/wp-content/uploads/2023/04/how-much-compensation-for-criminal-injuries-statistics-graph.png

https://tax.colorado.gov/sites/tax/files/documents/DR1317_2…

Web To claim credit for a qualifying contribution you must obtain a completed DR 1317 form from the recipient and file it with your Colorado income tax return Note that the

https://tax.colorado.gov/CTC-FAQ

Web You can claim the Federal Child Tax Credit by entering your qualifying children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a

Colorado Tax Credit Returns 50 Of Qualified Child Care Contribution To

How To Claim Rent Exemption Without An HRA Component In Your Salary

How To Claim Colorado s New Paid Family And Medical Leave Benefits

How To Claim Employee Retention Tax Credit Updates YouTube

Colorado Child Care Contribution Credit More Than Half Of Your

Colorado Child Care Contribution Tax Credit United Way Of Larimer County

Colorado Child Care Contribution Tax Credit United Way Of Larimer County

Can A Child Claim A Tax Deduction For A Personal Super Contribution

Colorado Disability Benefits Eligibility Application And Appeal

Colorado Office Of Early Childhood Oec families Family

How To Claim Colorado Child Care Contribution Tax Credit - Web The Child Care Contribution Credit provides an income tax credit for taxpayers making monetary contributions to support child care including but not limited to licensed