How To Claim Child Care Tax Credit If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for

You can only make a claim for Child Tax Credit if you already get Working Tax Credit To claim Child Tax Credit update your existing tax credit claim Update your claim by reporting a change Both of the following must apply If you have a child and you re already claiming Working Tax Credit you can also claim Child Tax Credit Contact HM Revenue and Customs HMRC to

How To Claim Child Care Tax Credit

How To Claim Child Care Tax Credit

https://i.etsystatic.com/23403566/r/il/69a95f/3736849799/il_1588xN.3736849799_qvr5.jpg

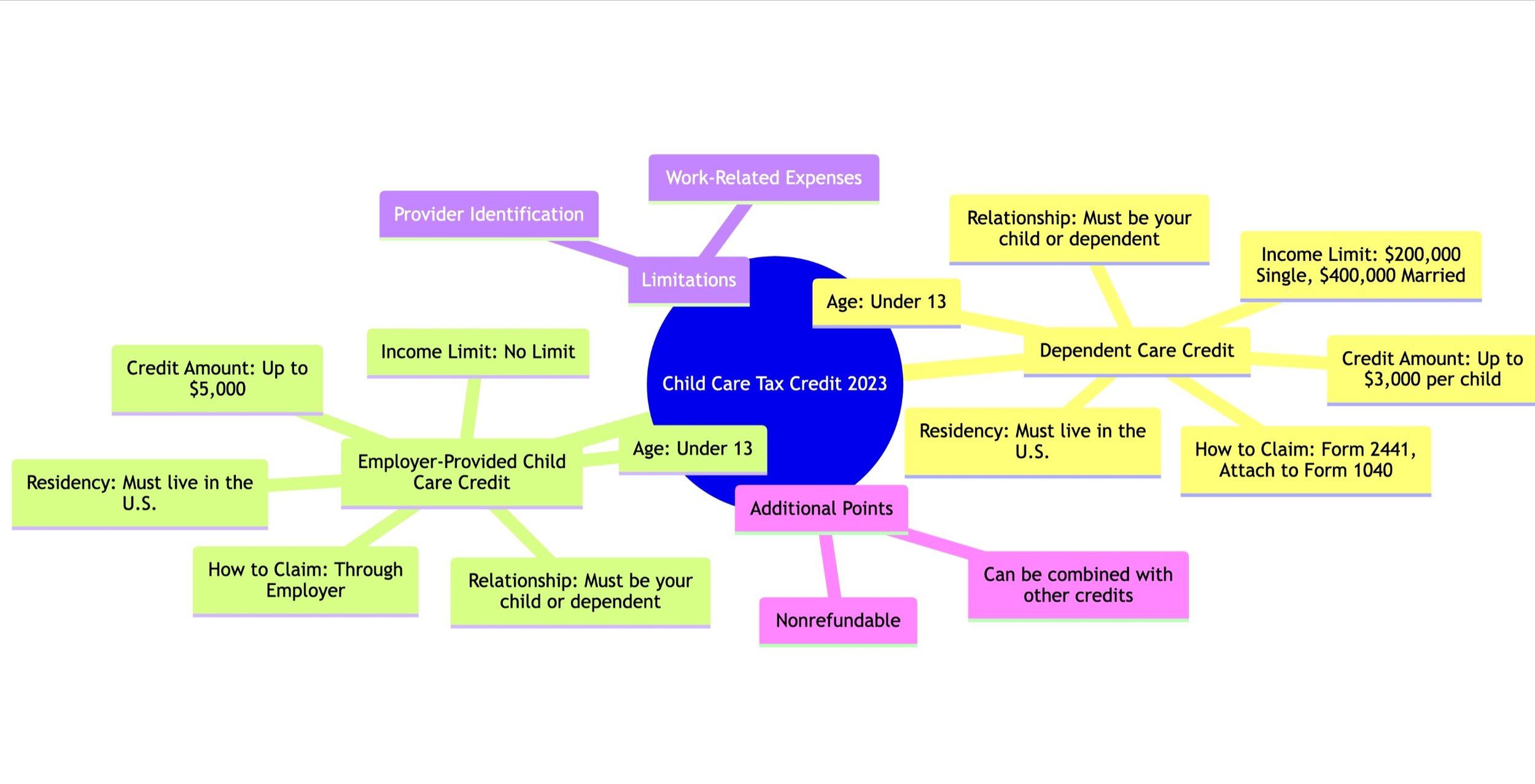

Understanding The 2023 Child Care Tax Credit Types Eligibility And

https://images.squarespace-cdn.com/content/v1/5d940768938dd828fc033675/77a228a5-aaee-47f8-a4be-e62a1c4783b2/Web+capture_25-10-2023_224527_showme.redstarplugin.com.jpeg

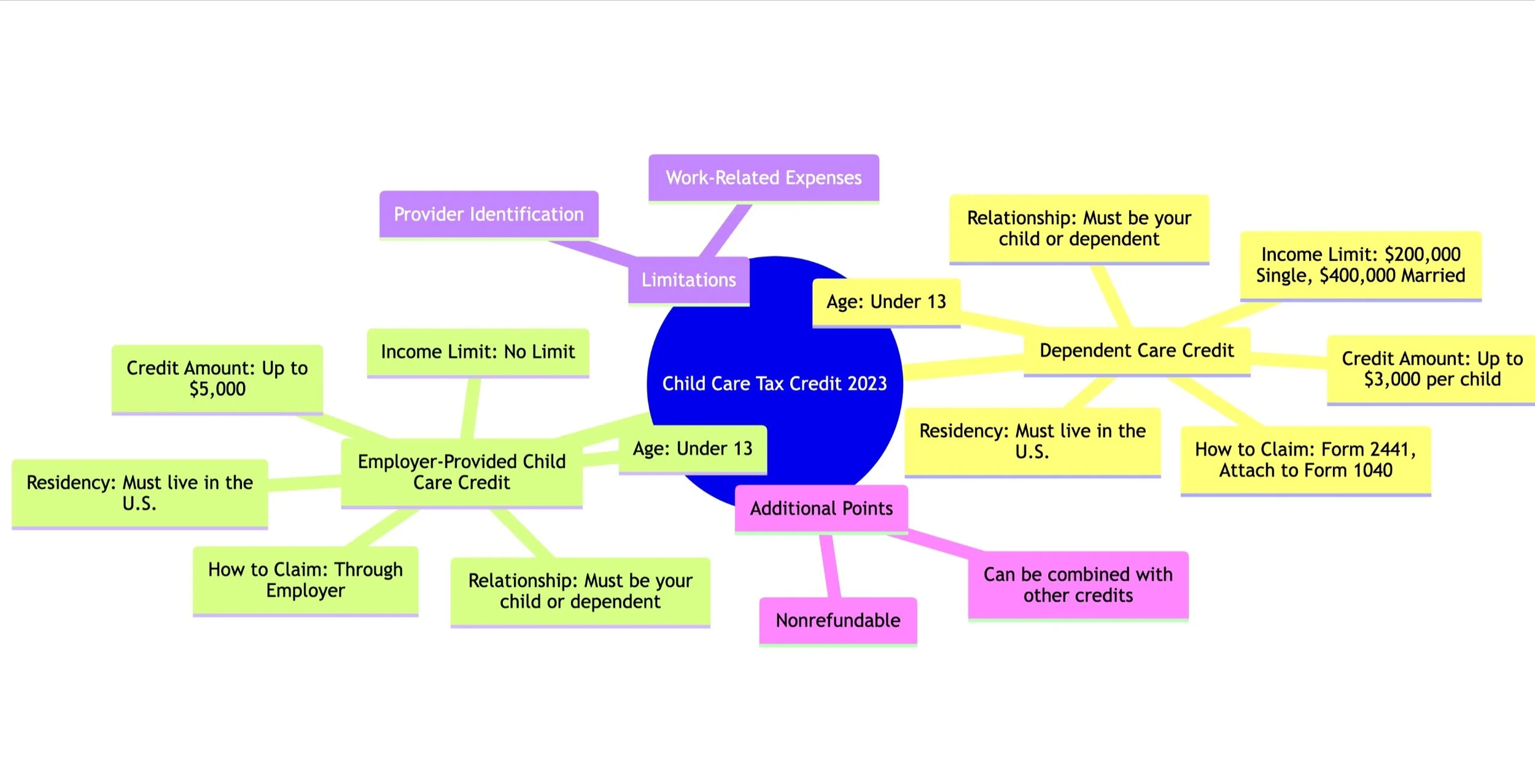

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

How to claim To claim the Ontario Child Care Tax Credit file your tax return and submit a completed Schedule ON479 A Ontario Childcare Access and Relief from Expenses CARE How do I claim the child care tax credit on my 2025 taxes You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the child and dependent care tax credit

See how the child care tax credit can boost your savings discover the essential details you can t afford to overlook Type Of Individual Seniors We can only claim the Child and Dependent Care Credit You can claim the 2024 child tax credit on the tax return you will file in 2025 You ll also need to fill out Schedule 8812

Download How To Claim Child Care Tax Credit

More picture related to How To Claim Child Care Tax Credit

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

EXPLAINER How To Claim Child Tax Credit On Your Taxes

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/ap22040072273992.jpg?crop=1.00xw:0.846xh;0,0.00240xh&resize=1200:*

To claim the child and dependent care credit a taxpayer must meet a variety of eligibility criteria The taxpayer must have qualifying expenses for a qualifying individual have To qualify for the child and dependent care credit families must have earned income during the tax year Read on for details on each requirement to qualify for the child and

How to claim the Child and Dependent Care Credit Luckily to claim this credit you only need to fill out one extra tax form when completing your tax return Complete Form 2441 Child and Learn more about this tax credit who qualifies for it and how much you can save on your tax bill If you paid someone to care for a child who was under age 13 when the care

Childcare Tax Statementchild Tax Statementdaycare Tax Etsy

https://i.etsystatic.com/22031907/r/il/c951c4/4432493562/il_fullxfull.4432493562_sh1f.jpg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

https://www.irs.gov › credits-deductions › individuals › ...

If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for

https://www.gov.uk › child-tax-credit › how-to-claim

You can only make a claim for Child Tax Credit if you already get Working Tax Credit To claim Child Tax Credit update your existing tax credit claim Update your claim by reporting a change

Child And Dependent Care Tax Credit What Is It How Does It Work

Childcare Tax Statementchild Tax Statementdaycare Tax Etsy

Minnesota Tax Credits For Workers And Families

Tax Statement Customize Child Care Business Daycare Parents Tuition

Child And Dependent Care Tax Credit Get Ahead Colorado

Child And Dependent Care Tax Credit Balancing Work And Family Needs

Child And Dependent Care Tax Credit Balancing Work And Family Needs

Child Tax Credit Payments Begin Arriving Today For Almost One Million

FSA Or Tax Credit Which Is Best To Save On Child Care

Tax Credit Or FSA For Child Care Expenses Which Is Better

How To Claim Child Care Tax Credit - You can claim the 2024 child tax credit on the tax return you will file in 2025 You ll also need to fill out Schedule 8812