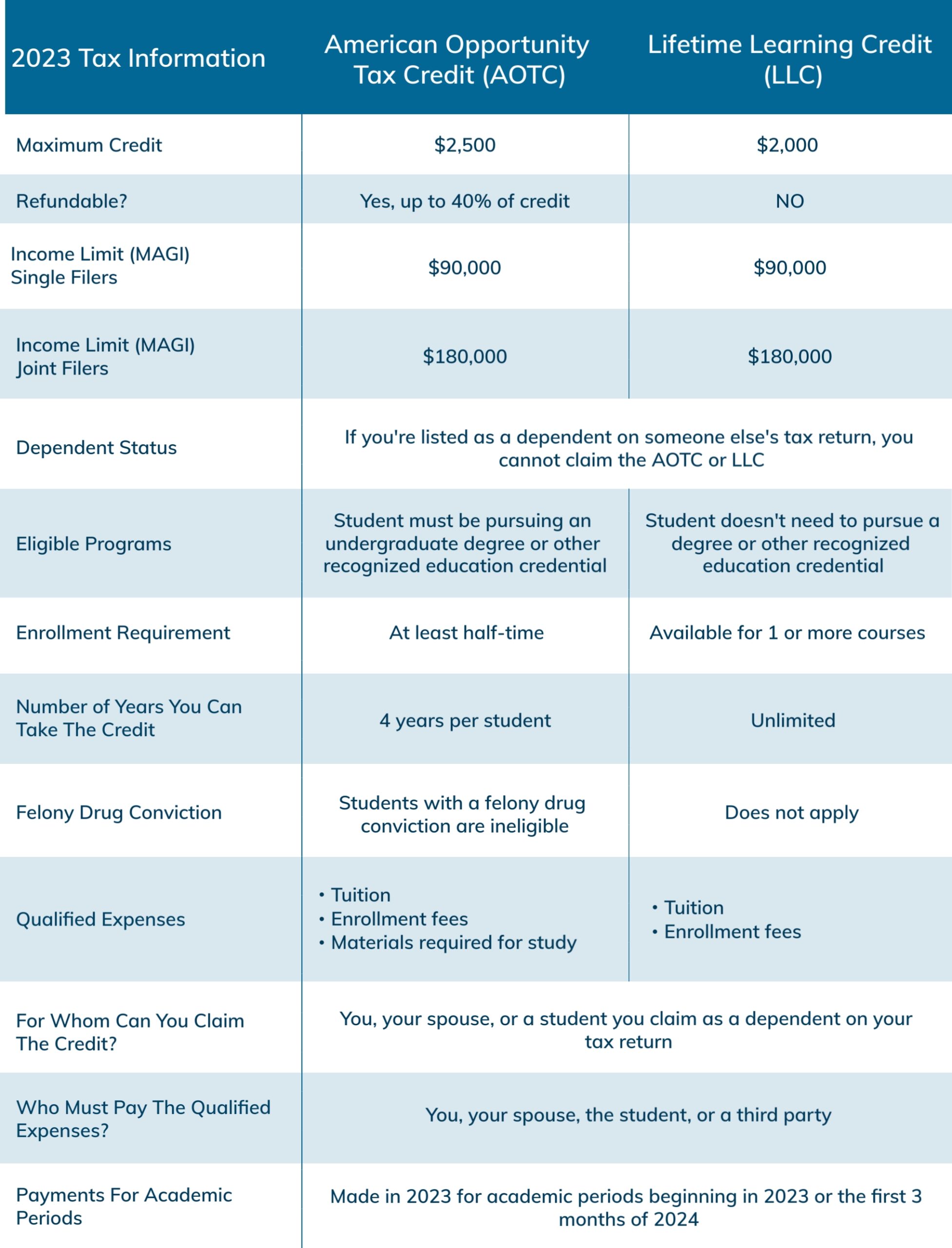

How To Claim Education Tax Credit For Dependents If you are eligible to claim an education credit on your tax return it could reduce the amount of tax that you owe by up to 2 500 per tax return The two education credits that are available are the American Opportunity

Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student This interview will help you determine if your education expenses qualify for a tax benefit Information you ll need Filing status Student s enrollment status Your adjusted gross income Who paid the expenses when the expenses were paid and for what academic period If any expenses were paid with tax exempt funds

How To Claim Education Tax Credit For Dependents

How To Claim Education Tax Credit For Dependents

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

How To Claim SkillsFuture Credit ACAD Pte Ltd

https://acad.com.sg/web/image/8343/vlcsnap-2022-07-08-14h01m22s288.png

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

To claim an education credit verify that the following are true for the taxpayers They cannot be claimed as a dependent on someone else s tax return They are not filing as Married Filing Separately Their adjusted gross income AGI is below the limitations for their filing status You can only claim one education credit for any student and their expense If you or your dependent qualifies for both credits you may want to figure which deduction would give you the best benefit If you receive tax free educational assistance such as a grant you need to subtract that amount from your qualified education expenses

Yes loved it Could be better Not sure if your dependent can claim an education credit Discover your options for filing or amending your return Get tax answers from H R Block If you file taxes in the U S and are paying for college you may be able to use two common types of tax credits the American Opportunity Tax Credit AOTC and Lifetime Learning Credit LLC as a form of compensation for what you spend on postsecondary education

Download How To Claim Education Tax Credit For Dependents

More picture related to How To Claim Education Tax Credit For Dependents

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Do You Get A Tax Credit For Dependents Over 17 Leia Aqui Does A Child

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

Approval Of Tax Credit For Union Built EVs Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

For tax years prior to 2018 every qualified dependent you claimed could reduce your taxable income by up to the exemption amount equal to 4 050 in 2017 In 2023 exemption deductions are replaced by An increased standard deduction A larger Child Tax Credit worth up to 2 000 per qualifying child If you or your dependent is pursuing a degree at a school you may qualify for the American Opportunity Tax Credit a partially refundable tax credit of up to 2 500 If you paid interest on qualifying student loans during the tax year you might be eligible to deduct up to 2 500 of that interest with the student loan interest deduction

[desc-10] [desc-11]

California Competes Tax Credit For Business Owners

https://capatacpa.com/wp-content/uploads/2019/02/taxtime.jpg

How To Claim Rent Exemption Without An HRA Component In Your Salary

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/10/How-to-Claim-Rent-Exemption-Without-an-HRA-Component-in-Your-Salary.jpg

https://savantwealth.com/savant-views-news/article/who-gets-the...

If you are eligible to claim an education credit on your tax return it could reduce the amount of tax that you owe by up to 2 500 per tax return The two education credits that are available are the American Opportunity

https://www.irs.gov/credits-deductions/individuals/qualified-ed...

Find out which education expenses qualify for claiming education credits or deductions Qualified education expenses are amounts paid for tuition fees and other related expenses for an eligible student

US Treasury Department Issues Guidelines Around A New Tax Credit For

California Competes Tax Credit For Business Owners

Who Can Claim The Education Tax Credit Commons credit portal

Georgia Tax Credits For Workers And Families

2023 Education Tax Credits Are You Eligible

How Much Is The Child Tax Credit For 2023 Here s What You Need To Know

How Much Is The Child Tax Credit For 2023 Here s What You Need To Know

Maximizing The Higher Education Tax Credits Journal Of Accountancy

IRS Announces New 2024 Tax Brackets How To Find Yours Weareiowa

Your First Look At 2023 Tax Brackets Deductions And Credits 3

How To Claim Education Tax Credit For Dependents - To claim an education credit verify that the following are true for the taxpayers They cannot be claimed as a dependent on someone else s tax return They are not filing as Married Filing Separately Their adjusted gross income AGI is below the limitations for their filing status