How To Claim Foreign Tax Credit In Income Tax Return Verkko 6 huhtik 2021 nbsp 0183 32 Guidance Relief for Foreign Tax Paid 2021 HS263 Updated 6 April 2023 If you ve paid foreign tax on income received or capital gains made that are

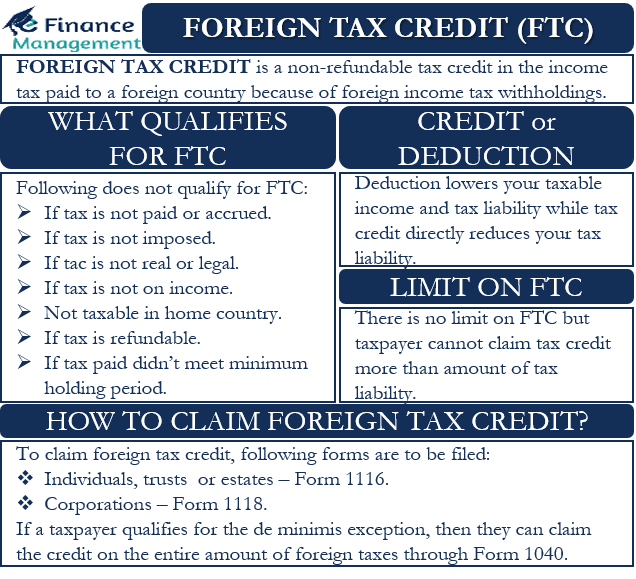

Verkko Generally the following four tests must be met for any foreign tax to qualify for the credit The tax must be imposed on you You must have paid or accrued the tax Verkko 14 jouluk 2023 nbsp 0183 32 After using the Foreign Tax Credit to erase your US tax bill you still have a 500 tax credit left over 16 000 15 500 500 That is your Foreign

How To Claim Foreign Tax Credit In Income Tax Return

How To Claim Foreign Tax Credit In Income Tax Return

https://brighttax.com/wp-content/uploads/2022/12/Taxable-income-section-of-Form-1116-1024x801.png

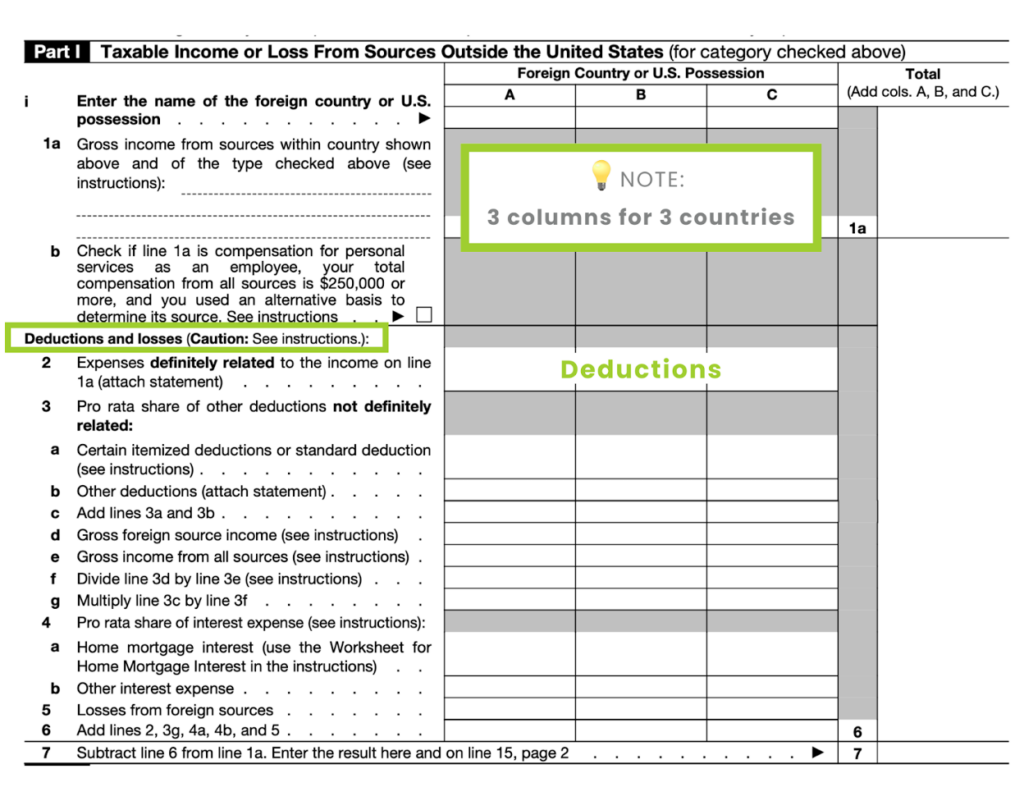

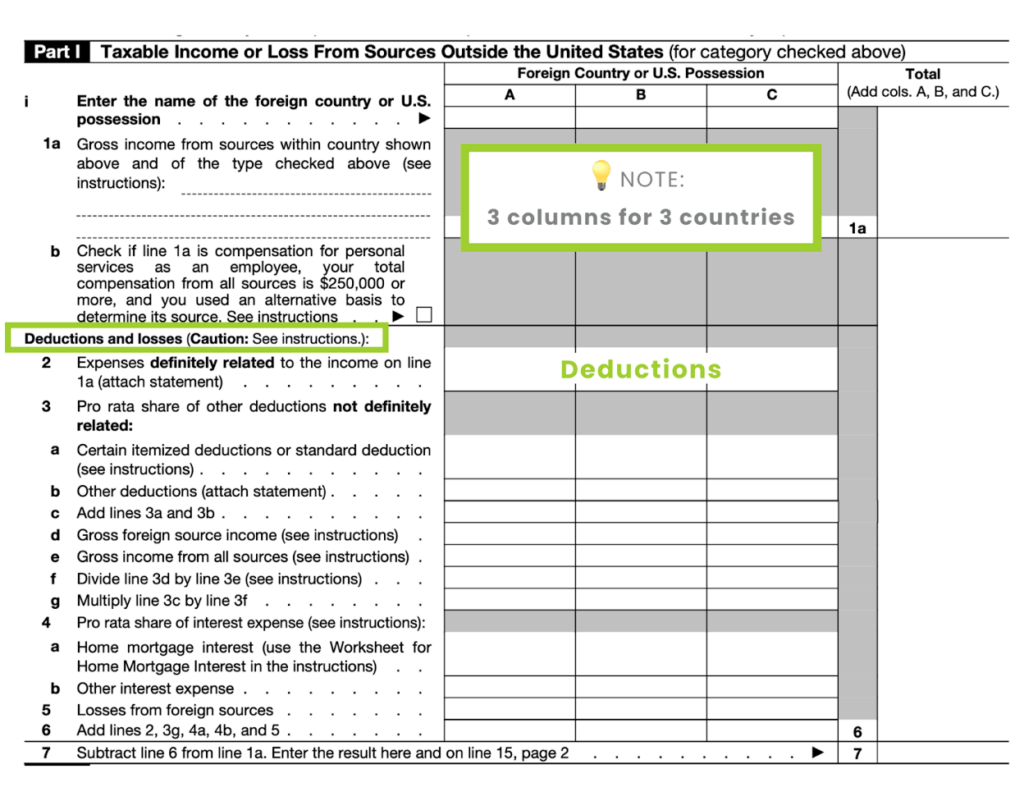

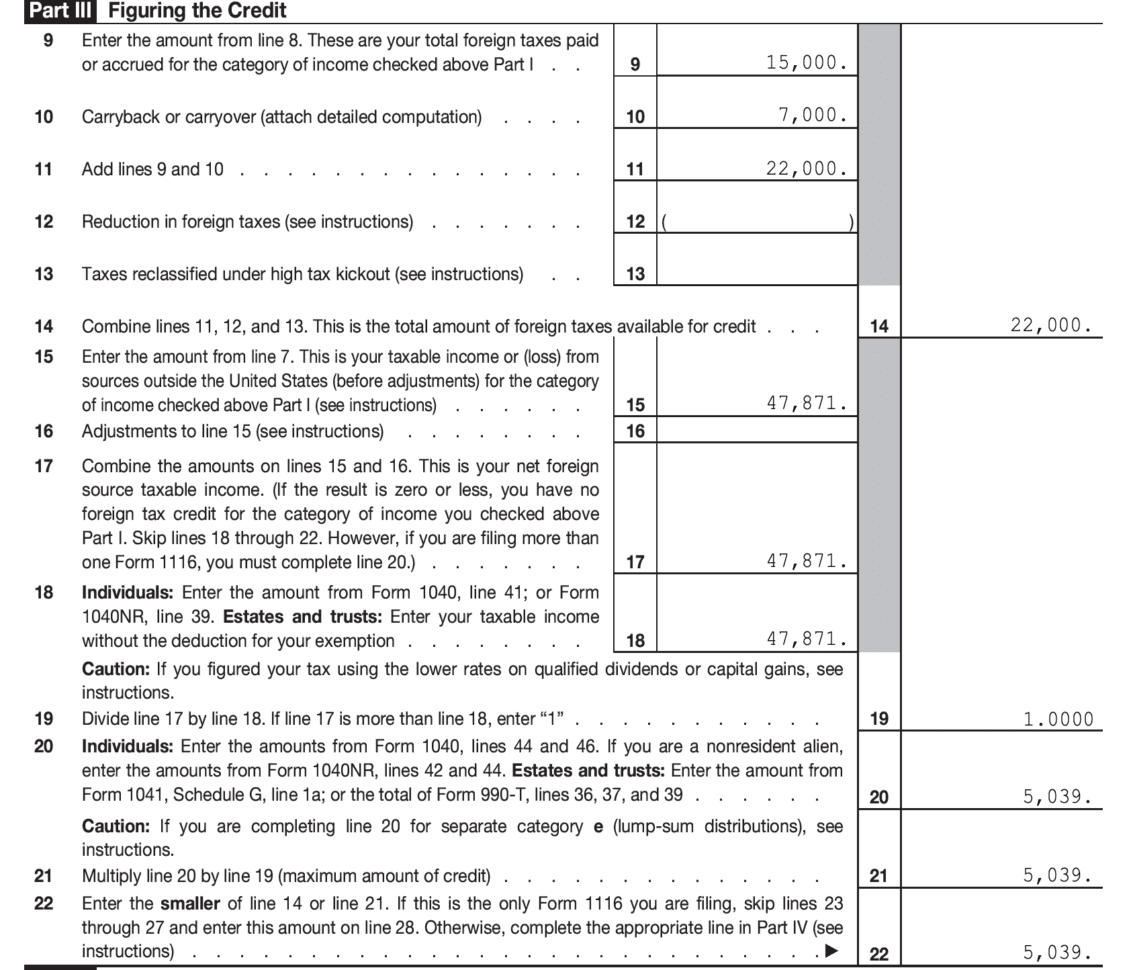

IRS Form 1116 Foreign Tax Credit With An Example

http://staging10.1040abroad.com/wp-content/uploads/2019/02/how-to-file-foreign-tax-credit-part-3-and-4.jpg

How Do I Claim Tax Credits Leia Aqui How Do Tax Credits Work On Taxes

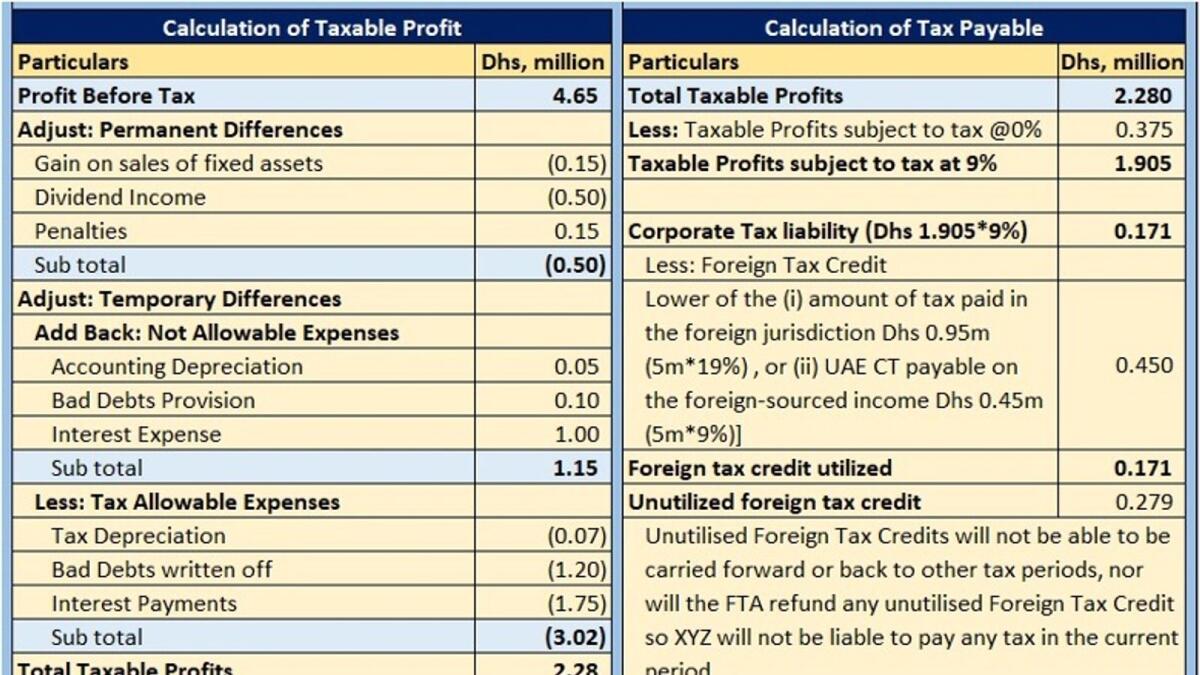

https://efinancemanagement.com/wp-content/uploads/2021/05/Foreign-Tax-Credit.png

Verkko 25 marrask 2023 nbsp 0183 32 If you opt for the tax credit you must complete Form 1116 and attach it to your U S tax return You must take a credit or a deduction for all qualified foreign taxes You can t take Verkko How to claim the foreign tax credit The IRS limits the foreign tax credit you can claim to the lesser of the amount of foreign taxes paid or the U S tax liability on the foreign income For example if you paid 350

Verkko You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double Verkko 13 lokak 2023 nbsp 0183 32 To claim the taxes as an itemized deduction use Schedule A Form 1040 Itemized Deductions Note Figure your tax both ways claiming the credit and

Download How To Claim Foreign Tax Credit In Income Tax Return

More picture related to How To Claim Foreign Tax Credit In Income Tax Return

What Is Foreign Tax Credit And How To Claim It Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/03/Foreign-tax-Credit.jpg

The Foreign Tax Credit International Tax Treaties Compliance

https://freemanlaw.com/wp-content/uploads/2022/01/Foreign-Tax-Credit-scaled-1.jpeg

All Details About New Foreign Tax Credit Rule With Benefits

https://blog.saginfotech.com/wp-content/uploads/2022/08/all-about-new-foreign-tax-credit-rule.jpg

Verkko 30 lokak 2023 nbsp 0183 32 If you claimed an itemized deduction for a given year for eligible foreign taxes you can choose instead to claim a foreign tax credit that ll result in a refund Verkko 4 tammik 2022 nbsp 0183 32 Accrual method of accounting You may have to post a bond Cash method of accounting Choosing to take credit in the year taxes accrue Credit based on taxes paid in earlier year Contesting

Verkko 2 lokak 2023 nbsp 0183 32 In most cases only foreign income taxes qualify for the foreign tax credit Other taxes such as foreign value added taxes sales taxes and property Verkko 1 helmik 2021 nbsp 0183 32 Sec 901 b 1 provides that a U S taxpayer may claim a credit for quot the amount of any income war profits and excess profits taxes paid or accrued

Foreign Tax Credit IRS Form 1116 Explained Greenback Expat Taxes

https://www.greenbacktaxservices.com/wp-content/uploads/2011/12/Screen-Shot-1.png

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

https://ebizfiling.com/wp-content/uploads/2022/08/tax-credit-2048x1072.png

https://www.gov.uk/government/publications/calculating-foreign-tax...

Verkko 6 huhtik 2021 nbsp 0183 32 Guidance Relief for Foreign Tax Paid 2021 HS263 Updated 6 April 2023 If you ve paid foreign tax on income received or capital gains made that are

https://www.irs.gov/.../foreign-taxes-that-qualify-for-the-foreign-tax-credit

Verkko Generally the following four tests must be met for any foreign tax to qualify for the credit The tax must be imposed on you You must have paid or accrued the tax

How To Claim Foreign Tax Credit On Form 1040 Asbakku

Foreign Tax Credit IRS Form 1116 Explained Greenback Expat Taxes

How To Calculate Income Tax Payable And Adjust Foreign Tax Credits

What Is The Foreign Tax Credit Expat US Tax

So How Do Foreign Tax Credits Work Let s Fix The Australia US Tax

How To Claim Foreign Tax Credit On Form 1040 Asbakku

How To Claim Foreign Tax Credit On Form 1040 Asbakku

How To Claim Foreign Tax Credit In India Foreign Tax Credit Foreign

How To Claim Foreign Tax Credit On Form 1040 Asbakku

Foreign Tax Credit Form 1116 Explained Greenback Db excel

How To Claim Foreign Tax Credit In Income Tax Return - Verkko You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double